Losses within the Chinese language yuan and the euro have picked up in current months, and that’s worsening the outlook for emerging-market currencies in Asia and Europe.

Article content material

(Bloomberg) — Losses within the Chinese language yuan and the euro have picked up in current months, and that’s worsening the outlook for emerging-market currencies in Asia and Europe.

Article content material

Article content material

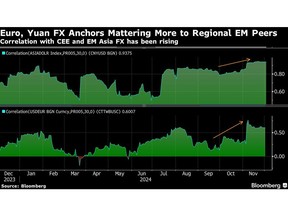

That’s as a result of the yuan and euro play a task as “forex anchors” for his or her smaller friends, serving to to both help them or drag them down relying on the prevailing market circumstances. Their anchor position has turn out to be even stronger in current months, a research of correlations reveals.

Commercial 2

Article content material

A surging greenback and the specter of larger US tariffs have dragged down the yuan and euro because the finish of September. The yuan additionally weakened as merchants grew dissatisfied over China’s stimulus measures, whereas the euro was pummeled as merchants boosted bets on European Central Financial institution interest-rate cuts.

“Anytime China is both coming beneath strain from a forex perspective or extra an financial perspective, that’s going to spill over and there’s going to be contagion results for the remainder of Asia,” stated Brendan McKenna, an emerging-markets economist and foreign-exchange strategist at Wells Fargo Securities LLC in New York.

“If the euro’s coming beneath strain, a number of the jap European currencies are in all probability going to weaken as nicely,” he stated.

The 30-day correlation between the yuan and the Bloomberg Asia Greenback Index, which tracks a basket of rising currencies within the area, climbed to 0.95 this month, the very best stage in 5 years. An equal correlation between the euro and a Bloomberg index for central and jap European currencies rose to 0.6, from round 0.2 on the finish of September. A studying of 1 would imply the 2 transfer in lockstep.

Article content material

Commercial 3

Article content material

A significant cause behind the shut correlations is the robust commerce linkages. Exports to the euro zone make up a minimum of 50% of whole shipments from the CEE international locations of Hungary, Poland and the Czech Republic. In rising Asia, a minimum of 20% of exports from South Korea, Indonesia and Malaysia go to China.

A weakening of the yuan or euro places downward strain on the currencies of their export-dependent neighbors, and will be typically be welcomed because it helps preserve their items aggressive.

If the yuan depreciates previous 7.50 per greenback, the Reserve Financial institution of India might let the rupee weaken as nicely, in order to maintain the yuan-rupee cross secure, stated Wim Vandenhoeck, a senior portfolio supervisor at Invesco Ltd. in New York.

The prospect of upper US tariffs is about to additional weigh on the yuan and euro and their emerging-market counterparts. Since his election victory in November, President-elect Donald Trump has threatened to slap 25% tariffs on imports from Mexico and Canada, and an extra 10% duties on China.

“Hypothesis round Trump’s insurance policies and the tariff threats imply the CEE-4 currencies do have a goal painted on them,” stated Anders Faergemann, co-head of rising markets world mounted earnings at Pinebridge Investments in London, referring to the principle currencies of central and jap Europe.

Commercial 4

Article content material

“We’ve already seen some weak point within the Hungarian forint and it’s at all times seen as a proxy to the area,” Faergemann stated. “But when we do see extra tariffs, we are able to see the Czech koruna bearing the brunt of the euro’s weak point.”

Stronger Greenback

The greenback is prone to stay “stronger for longer” too, which is able to put additional strain on the euro and yuan, and by extension, the currencies of rising Asia and Europe, in accordance with Goldman Sachs Group Inc.

“The euro space is especially negatively impacted by commerce uncertainty and this presents a difficult atmosphere for the CEE economies and currencies,” stated Kamakshya Trivedi, head of world foreign-exchange and rates of interest on the financial institution in London.

As well as, “we expect will probably be onerous for Asia low-yielder currencies to keep away from spillovers from the Chinese language yuan weak point that we count on,” he stated.

What to Watch

- China’s high leaders will meet Wednesday and Thursday in a excessive—profile conclave, and traders will scrutinize potential commentary for any clues on stimulus plans for 2025

- Numerous international locations will announce inflation information this week together with India, China, Mexico, Hungary, Czech Republic, Poland and South Africa

- Brazil’s central financial institution is forecast to boost rates of interest on Wednesday, whereas their Peruvian friends will announce their price resolution on Thursday

—With help from Liau Y-Sing.

Article content material