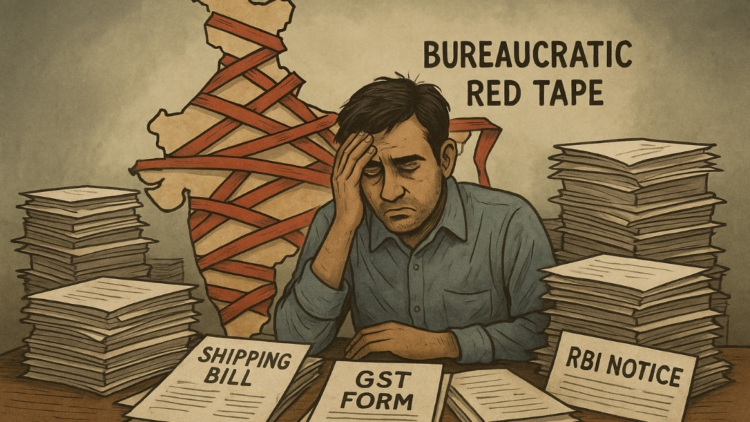

The Indian authorities continuously touts enhancements within the “ease of doing enterprise,” however a annoyed entrepreneur’s latest Reddit submit sharply challenged this narrative, highlighting the crippling paperwork concerned in exporting on to worldwide prospects (B2C exports).

Ease of doing enterprise vs actuality

In a submit titled “Why you shouldn’t attempt exporting from India Vent & Rant,” Reddit consumer Limp-Query-4778 detailed his four-year ordeal, declaring, “All of the discuss of ease of doing enterprise is simply discuss and no stroll. You might be higher off transferring to Dubai and exporting from there than from India.”

The entrepreneur, from a small Indian village, initially discovered success domestically, dealing with between 300-400 each day orders. His troubles started when worldwide prospects confirmed curiosity in 2022. The difficult necessities he confronted included acquiring an IEC Certificates, registering on ICEGATE, securing an AD code from the financial institution, and necessary transport by licensed couriers—procedures he described as “nonsensical for a $30 export.”

Punished by GST twice for a rejected cargo

The state of affairs worsened when a buyer rejected a cargo, prompting the Indian authorities to levy GST costs twice—as soon as for the outgoing cargo and once more for its return. “We needed to pay GST TWICE on a cargo on which we didn’t earn a penny,” he wrote, highlighting how punitive guidelines burden small companies.

Additional issues arose from a doc referred to as CSB 5, a compulsory transport invoice exporters should retain. On account of poor integration between Customs, GST, and RBI programs, in 2024 he found roughly ₹50 lakh value of “open” transport payments. Closing every incurred a charge of ₹400, totaling ₹8 lakh—roughly 16% of his turnover. Unable to fulfill the tight deadline, RBI marked his account non-compliant, freezing it and successfully ending his export operations.

Silence from the authorities regardless of repeated appeals

Frustratingly, repeated makes an attempt for help from regulatory our bodies went unanswered. The entrepreneur wrote quite a few instances to RBI and even offered detailed diagrams explaining his state of affairs to Commerce Minister Piyush Goyal’s workplace—solely to obtain silence in return.

ITC claims set off bureaucratic nightmares

Small companies continuously keep away from claiming Enter Tax Credit score (ITC) as a consequence of fears of triggering a GST audit and harassment. Because the entrepreneur bitterly famous, “We truthfully haven’t got the funds, folks or stamina to take care of yet another bureaucratic nightmare.”

India vs. UK: a stark comparability

Highlighting India’s bureaucratic absurdities, he contrasted his expertise establishing a UK-based enterprise remotely: “I can arrange a UK-based firm & checking account in 2 days… sitting in India, I am unable to arrange an organization in 2 months regardless of bribes.”

He lamented the misplaced employment alternatives for over 50 rural ladies whose lives had improved by his enterprise. Pressured closure as a consequence of bureaucratic hurdles meant these staff returned to their earlier hardships.