The world’s high commodity retailers are grappling with a harder setting for buying and selling oil as seismic market occasions of the previous few years begin to lose their influence.

Article content material

(Bloomberg) — The world’s high commodity retailers are grappling with a harder setting for buying and selling oil as seismic market occasions of the previous few years begin to lose their influence.

The slowdown is being felt in all places, from the likes of Glencore Plc and Gunvor Group — the place earnings are down — to hedge fund boss Pierre Andurand, who ditched oil trades for bets on copper and cocoa. Whereas trade titans are nonetheless worthwhile, these are now not the blockbuster figures banked since 2020.

Commercial 2

Article content material

Again then, oil costs briefly flicked into detrimental territory when Covid-19 trashed demand at a time when Saudi Arabia-led OPEC was sustaining excessive ranges of provide. Just below two years later, Russia invaded Ukraine bringing wealthy pickings as futures surged and diesel spreads boomed. Now, the volatility that’s the lifeblood of buying and selling has been depressed as a result of the market has absorbed these points.

“The markets over the previous a number of years have been trending markets,” stated Kurt Chapman, the previous head of crude oil at Mercuria Power Group, who now heads up the oil division at Levmet UK Ltd. “Whether or not they have been massively bearish due to Covid and bodily merchants might retailer barrels, or going the opposite approach with Ukraine. This yr has been a difficult yr as a result of there hasn’t been apparent bodily buying and selling alternatives.”

Thus far in 2024, value swings have been considerably extra muted than in years previous, even within the face of crude’s latest hunch towards $70. Brent futures are — for now — heading for the smallest annual value vary since 2004 whereas a gauge of market volatility touched its lowest in virtually a decade earlier this yr.

Article content material

Commercial 3

Article content material

That’s fueling a shift away from browsing massive bets on derivatives. The merchants are as a substitute hiring extra individuals who specialise in successful new enterprise. There’s additionally a contemporary push into buying belongings like refineries and tankers that can provide retailers an edge.

As oil merchants descend on Singapore this week to strike offers throughout one of many largest weeks within the trade calender, the robust buying and selling setting is a key dialog subject. One other, although, is the change to grease flows around the globe because of world conflicts.

G-7 sanctions on Russia in response to the struggle have minimize the quantity of barrels that the massive merchants have been prepared to purchase and promote. Nonetheless, those self same barrels — which as soon as would have gone to refineries in Europe — are nonetheless discovering their approach to clients in Asia, typically at knock-down costs that the merchants should compete with.

Retailers are additionally having to deal with competitors from more and more subtle rivals. China has seen a rise in so-called time period provides from Saudi Arabia into the likes of Rongsheng Petrochemical, wherein Saudi Aramco lately took a stake. The dominion has additionally taken shares in different Chinese language refining belongings, giving it a toe-hold in a key demand heart.

Commercial 4

Article content material

“Loads of the organizations which have traditionally relied on merchants to produce or offtake their oil have been increase commercially,” stated Roland Rechtsteiner who heads up McKinsey & Firm’s commodity buying and selling and threat follow. “Whereas that provides liquidity and extra counterparties, it’s definitely making the flexibility for service provider merchants to entry new flows harder.”

Decrease Earnings

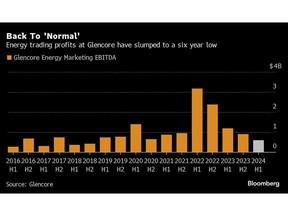

The harder market setting can already be seen in printed earnings.

The power division at Glencore notched its lowest half yearly earnings since 2018 attributable to decrease margins buying and selling oil and coal. In the meantime at Torbjörn Törnqvist’s Gunvor – the agency’s transport and freight division was an even bigger contributor to earnings.

“It’s slightly little bit of a difficult setting,” Törnqvist stated in an interview in Singapore, discussing the broader oil market.

The agency is buying and selling extra partly in an effort to counteract the robust market. Gunvor’s newest monetary outcomes present it has elevated the volumes of crude and oil merchandise it trades to document ranges within the first half of the yr.

A Swiss oil buying and selling pod of Freepoint Commodities LLC noticed important drawdowns earlier this yr earlier than merchants departed, in accordance with an individual accustomed to the matter. Freepoint declined to remark.

Commercial 5

Article content material

Trafigura Group, one other main service provider, noticed its revenue decline 73% in six months by March, though it doesn’t break up out how its oil enterprise carried out. Ben Luckock, the agency’s head of oil, stated that the shortage of a development, and rangebound crude, imply it hasn’t been “significantly simple to commerce.”

Vitol Group, the biggest impartial oil dealer, doesn’t publicly report half yearly earnings. Nonetheless, Chief Government Officer Russell Hardy stated in an interview in Singapore that volatility has diminished.

“Volatility has reverted again a lot nearer to the imply,” Vitol’s Hardy stated. “Alternative inside buying and selling corporations has some proportionality to that.”

—With help from Alex Longley and Jack Wittels.

Article content material