Key Factors

- The Grad PLUS program ends July 1, 2026, changed with new federal borrowing caps for graduate {and professional} college students.

- Mother or father PLUS loans can be capped at $20,000 per 12 months and $65,000 complete per youngster, shifting extra households towards personal loans.

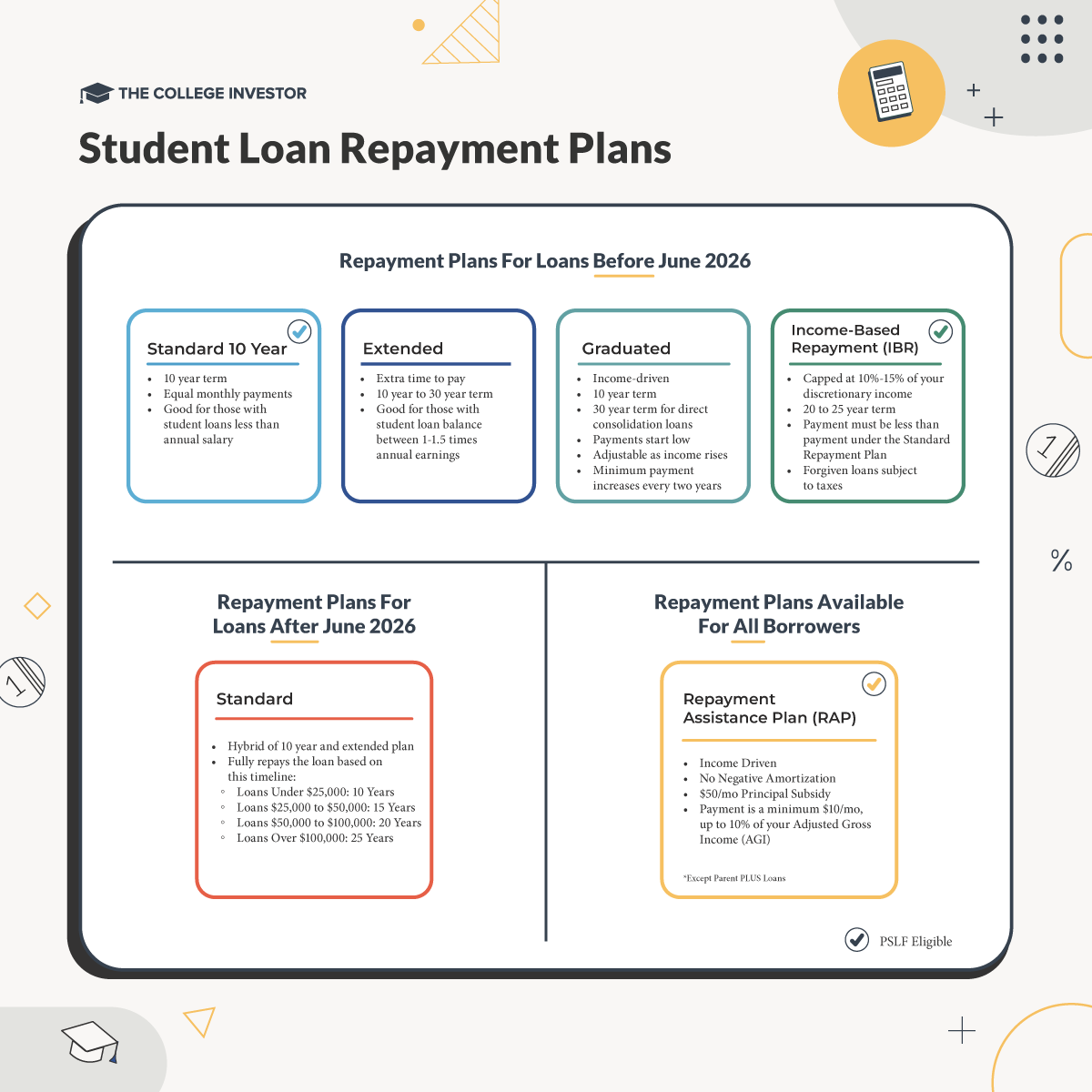

- New compensation choices will shrink to 2 plans for brand new debtors – Normal or Reimbursement Help Plan (RAP).

Beginning July 1, 2026, the federal pupil mortgage system will enter a brand new period.

A sweeping set of federal coverage adjustments will reshape how households and graduate college students borrow for faculty beginning in 2026. The laws, handed this summer time, eliminates some long-standing mortgage packages and replaces them with new caps and compensation plans.

Whereas the reforms intention to include debt development and enhance accountability for faculties, additionally they mark a transparent shift away from the versatile borrowing mannequin that has outlined federal pupil help for years.

The Consequence: fewer borrowing choices, stricter limits, and new tradeoffs for each college students and fogeys.

Would you want to save lots of this?

What Modifications For Debtors

For debtors taking out new loans after July 1, 2026, federal lending guidelines will look very completely different. Whereas undergraduate mortgage limits stay the identical (together with getting access to sponsored and unsubsidized loans), dad and mom will face new limits.

Dad and mom: For households, probably the most dramatic change can be to Mother or father PLUS loans, which is able to now carry a $20,000 annual and $65,000 lifetime restrict per dependent youngster. The restrict is fastened per pupil – paying off loans or qualifying for forgiveness won’t restore eligibility. A three-year grace interval permits dad and mom who borrowed earlier than June 30, 2026, to proceed beneath the previous guidelines by means of 2029.

Mother or father PLUS debtors can even now not have entry to income-driven compensation, which can make compensation tougher and truthfully makes them a worse selection than personal pupil loans.

Graduate College students: The Grad PLUS mortgage program is eradicated, ending open-ended borrowing for graduate college. As a substitute, graduate college students can be restricted to $20,500 per 12 months and $100,000 in complete beneath new unsubsidized Direct Stafford loans. Skilled college college students (together with these pursuing regulation or drugs) could have greater limits: $50,000 per 12 months and $200,000 complete.

College students already enrolled in a program and who acquired not less than one mortgage earlier than June 30, 2026, can be allowed to proceed borrowing beneath the previous guidelines for the rest of their program or as much as three years, whichever is shorter.

New Reimbursement Plan Modifications

Debtors taking out new loans after July 1, 2026, could have simply two compensation choices: the Normal Reimbursement Plan and the brand new Reimbursement Help Plan (RAP).

Normal Reimbursement Plan:

Funds are fastened based mostly on the borrower’s mortgage stability.

- Beneath $25,000: 10-year time period

- $25,000–$50,000: 15-year time period

- $50,000–$100,000: 20-year time period

- Over $100,000: 25-year time period

This construction replaces a number of older compensation choices and resembles the “prolonged compensation” plans beforehand used for bigger balances.

Reimbursement Help Plan (RAP):

RAP bases funds on adjusted gross earnings (AGI), beginning at simply $10 per 30 days for debtors incomes beneath $10,000 yearly. Cost charges improve with earnings (from 1% of AGI for these incomes $10,001–$20,000 as much as 10% for incomes above $100,000).

Debtors obtain a $50-per-dependent deduction from their month-to-month cost, although funds can not fall under $10. Any unpaid curiosity can be waived, stopping stability development. After 30 years of funds, any remaining stability can be forgiven.

Mother or father PLUS debtors should not eligible for RAP. Their solely choice would be the Normal Reimbursement Plan.

Present debtors will nonetheless preserve entry to their “previous” normal plans and IBR, however may choose into RAP.

How These Modifications Will Influence Debtors

For households, the 2026 adjustments might shift how households pay for faculty. With decrease federal borrowing limits, some college students (notably in high-cost graduate or skilled packages) might flip to personal pupil loans, which regularly require qualifying credit score scores and lack federal protections.

Dad and mom who borrow by means of the PLUS program might have to regulate borrowing expectations, and take a look at personal loans vs. Mother or father PLUS loans.

In the meantime, the simplified compensation system may cut back confusion however prolong compensation timelines. The RAP plan’s 30-year time period presents smaller month-to-month funds however might have greater complete prices over time. In comparison with current plans, RAP could also be cheaper than IBR for decrease earnings debtors, however is probably going costlier for households incomes over $100,000 per 12 months.

Do not Miss These Different Tales:

Editor: Colin Graves

The put up What’s Altering For Pupil Loans In 2026? appeared first on The School Investor.