(Bloomberg) — US inflation in all probability moved sideways at greatest in October, highlighting the uneven path of easing value pressures within the house stretch towards the Federal Reserve’s goal.

The core shopper value index due on Wednesday, which excludes meals and vitality, doubtless rose on the identical tempo on each a month-to-month and annual foundation in comparison with September’s readings.

The general CPI in all probability elevated 0.2% for a fourth month, whereas the year-over-year measure is projected to have accelerated for the primary time since March.

“The October CPI report will doubtless assist the notion that the final mile of inflation’s journey again to focus on would be the hardest,” Wells Fargo & Co. economists Sarah Home and Aubrey Woessner wrote in a report. “Excluding the extra risky vitality and meals elements, the unwinding of pandemic-era value distortions has confirmed to be frustratingly gradual.”

They added that costs of core items in all probability rose once more in October, due partly to greater demand for automobiles and auto components after Hurricanes Helene and Milton. Evacuation orders from the storms additionally pressured extra folks to remain in motels, persevering with what’s been a “glacial slowing” in providers costs.

“We count on each CPI and PPI to return in sizzling, pushing long-end charges even greater — and additional restraining the economic system over the following couple months. We count on control-group retail gross sales to gradual and the unemployment charge to proceed to climb, reaching 4.5% by yr finish,”

—Anna Wong, Stuart Paul, Eliza Winger, Estelle Ou & Chris G. Collins. For full evaluation, click on right here

Even so, “the story could be very constant, with inflation persevering with to return down on a bumpy path,” and one or two unhealthy experiences received’t change that sample, Fed Chair Jerome Powell stated Thursday after the central financial institution reduce rates of interest by 1 / 4 level.

The US authorities can even launch wholesale inflation figures within the coming week, which in all probability picked up after stalling in September. Meantime, earnings development that continues to outpace inflation doubtless contributed to a different respectable acquire in retail gross sales, in information due Friday.

On Tuesday, Fed Governor Christopher Waller is because of communicate at a banking convention earlier than the central financial institution releases its newest Senior Mortgage Officer Opinion Survey. Powell is scheduled for an occasion later within the week, whereas New York Fed President John Williams and Dallas Fed President Lorie Logan are additionally on the calendar.

In Canada, in the meantime, house gross sales information for October will reveal whether or not the central financial institution’s charge cuts are beginning to jolt the sluggish housing market.

A packed week for information elsewhere features a vary of financial numbers from China, wage and development statistics within the UK, and a number of inflation readings, from India to Argentina. New European Union forecasts can even be revealed.

Click on right here for what occurred prior to now week, and beneath is our wrap of what’s arising within the world economic system.

Asia

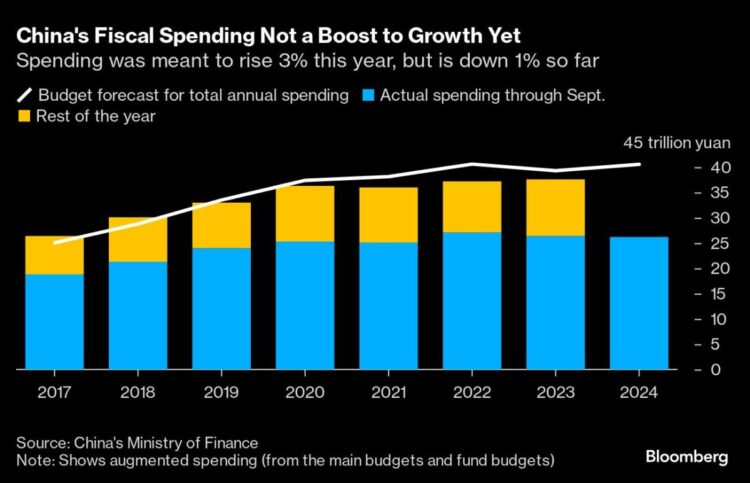

A knowledge blast from China could present the economic system’s efficiency improved marginally in October, with industrial output, fastened asset funding and retail gross sales all seen choosing up a bit because the downturn in property funding moderates.

Even so, the info will underscore the need of the broad stimulus steps undertaken since late September as President Xi Jinping seeks to realize his development targets.

China’s slew of figures comes on the finish of the week, on the identical day that Japan is anticipated to report that its financial development slowed to an annualized 0.6% quarter on quarter within the three months by means of September.

India’s inflation is projected to have picked as much as 5.72% in October, whereas industrial output is seen rebounding in September in figures due on Tuesday.

Australia will get shopper and enterprise confidence surveys on Tuesday earlier than releasing quite a few labor-market statistics later within the week.

The wage value index for the third quarter comes on Wednesday, and different employment statistics for October can be revealed a day later. Indonesia experiences commerce information on Friday.

Amongst central banks, the Financial institution of Japan releases a abstract of opinions from its October assembly, when it held charges regular, and Reserve Financial institution of Australia Governor Michele Bullock seems on a panel on Thursday, with policymaking colleague Brad Jones doing the identical a day later.

Europe, Center East, Africa

The UK can be in focus following Thursday’s Financial institution of England charge reduce, which got here with a warning of the inflationary influence of the current funds. Governor Andrew Bailey is scheduled to make a speech on Thursday.

Wage numbers on Tuesday could present mildly slowing pay development, providing restricted reassurance to policymakers. A launch on Friday will in all probability reveal financial development to have weakened within the third quarter to 0.2% from 0.5% within the prior three months, in accordance with economists.

Different international locations with preliminary GDP numbers for a similar interval embody Poland on Thursday and Switzerland on Friday.

Turning to the euro zone, Tuesday’s German ZEW index will supply a glimpse of investor sentiment at a time when Europe’s largest economic system continues to be struggling to shake off industrial malaise, and now faces the prospect of early elections as properly.

Euro-zone industrial manufacturing on Wednesday will reveal the state of producing on the finish of the third quarter, and a second estimate of GDP will arrive concurrently. The European Fee in Brussels will launch new financial forecasts for the area on the finish of the week.

The European Central Financial institution on Thursday will publish an account of its October assembly, presumably containing hints on officers’ pondering for his or her December choice. Vice President Luis de Guindos, talking in Madrid the identical day, is amongst a number of officers scheduled to make appearances.

In Sweden, minutes of the Riksbank’s choice to ramp up easing with a half-point charge reduce are due on Wednesday, adopted by its monetary stability report a day later.

In Russia on Wednesday, information will in all probability present the economic system contracted within the third quarter — for the primary time since war-related fiscal stimulus started boosting exercise again in late 2022. Bloomberg Economics forecasts GDP to have fallen 0.3% to 0.5% within the three months by means of September.

Russia is amongst quite a few international locations releasing inflation information. Right here’s an outline:

-

Norway on Monday could present a notable slowdown in inflation, to 2.4%. However with krone weak spot preoccupying officers, the central financial institution saved borrowing prices unchanged on Thursday, signaling no imminent plans for any discount.

-

With Russia’s launch for October due on Wednesday, policymakers will watch to see if a 200 basis-point charge improve final month will assist decelerate value development towards its 4% goal. In September it was at 8.6%.

-

On Friday, Nigeria’s inflation numbers are anticipated to indicate quickening to 33.4% from 32.7% after gasoline prices spiked due to the scaling again of subsidies, in accordance with Bloomberg Economics.

-

The identical day in Israel, information will doubtless reveal value development stayed above 3%, the higher finish of the official goal. It’s been above goal for 3 straight months because the conflicts in Gaza and Lebanon trigger authorities spending on protection to soar and worsen supply-side constraints.

In the meantime, Egyptian inflation information revealed Sunday showe the gauge barely quickened for a 3rd month, pushed by a pointy rise in gas costs.

Amongst central banks, financial policymakers in Zambia are anticipated to go away their charge unchanged at 13.5% to assist the drought-battered economic system. That ordeal has prompted the Worldwide Financial Fund to virtually halve its 2024 development projections, to 1.2%.

Latin America

Argentina President Javier Milei is prone to get some welcome information with the October shopper costs report. Month-to-month inflation could have slowed to a three-year low of just below 3% with the annual studying coming in underneath 200%, down from April’s 289.4% peak.

Analysts count on a hawkish tone to the minutes of the Brazilian central financial institution’s Nov. 6 choice to hike to 11.25%. On the identical time, ahead steering could also be briefly provide provided that Brazil’s authorities had but to decide to spending cuts, and all of the wild playing cards inherent following the US election.

Economists count on a hike of at the very least the identical magnitude on the BCB’s December assembly, and plenty of have marked up their terminal charge projections to 13% or extra.

Uruguay’s central financial institution has held its key charge at 8.5% since April and is prone to preserve it there for a fifth straight assembly.

In Peru, Lima labor market figures and September GDP-proxy information are on faucet, each underscoring the economic system’s rebound from final yr’s recession.

Banco de Mexico’s case for a third-straight charge reduce on Nov. 14 seemed fairly simple a month in the past, however yet one more bout of quicker inflation makes it a barely harder name.

Nonetheless, the mixture of slower development and 21 straight months of slowing core inflation will doubtless see Governor Victoria Rodriguez and colleagues go forward with the discount to 10.25%.

–With help from Brian Fowler, Laura Dhillon Kane, Monique Vanek, Robert Jameson, Paul Wallace and Piotr Skolimowski.

Most Learn from Bloomberg Businessweek

©2024 Bloomberg L.P.