In some unspecified time in the future in your investing journey, you could take a look at your returns and surprise in the event that they could possibly be higher.

And in case you’re a Betterment buyer? Somebody who’s been invested in one in all our globally-diversified portfolios? Be ready for one query specifically to creep into your thoughts:

“Wait, why isn’t my Core portfolio maintaining with the S&P 500?”

The query comes up now and again — and the reply largely lies in somewhat factor known as residence bias. To higher perceive it, let’s first take a fast tour by means of the magical world of markets.

Whats up, world. We’re right here to take a position.

We speak so much in regards to the “market” at Betterment, however in actuality there is no such thing as a one, single market. As a substitute, a bunch of interconnected markets are unfold out internationally. And broadly talking, from our perspective right here within the States, you possibly can place them into one in all three buckets:

- The U.S. market

- Worldwide developed markets (Japan, a lot of Europe, and so on.)

- Worldwide rising markets (Brazil, India, and so on.)

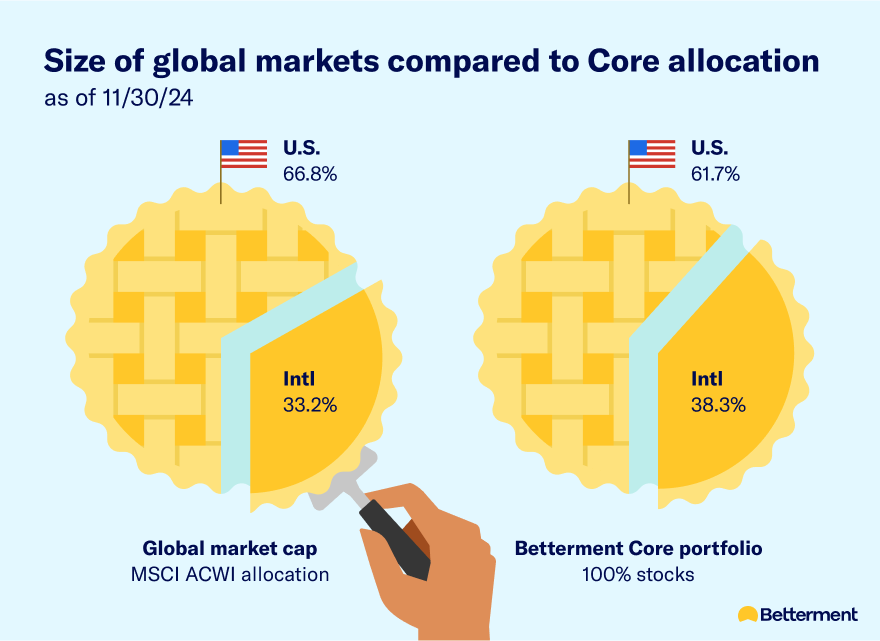

The U.S. market is large, but it surely’s removed from being the one participant within the sport. There are nonetheless trillions of {dollars} of belongings buying and selling arms in worldwide markets. It is why our Core portfolio, constructed partly on the concept extra diversification equals much less danger, roughly mirrors the relative weights of those gamers.

The U.S. market has been on a tear since 2010. However that is not more likely to final perpetually. So let’s change gears to efficiency, and the way to take a look at latest traits by means of a extra historic lens.

Whats up, residence bias (“U-S-A! U-S-A!”)

American exceptionalism is in our blood; we won’t assist it. It additionally reveals up in our investing by means of residence bias, or the tendency for American traders to favor American markets. And is it any shock proper now? The U.S. financial system has recovered from the pandemic far quicker, and to a a lot bigger extent, than different international locations.

The S&P 500, although it doesn’t characterize the full U.S. inventory market, consists of the largest American corporations, title manufacturers like Apple and Ford, so it is change into shorthand for investing’s Group America. And whereas it’s been surging this decade, worldwide markets cleaned up within the 2000s. Traditionally-speaking, we take turns within the lead each 5 to 10 years.

So what’s an investor to do?

The cautionary story of choosing shares applies right here, as a result of we do not advise choosing markets both. For those who’re investing for the long run, the percentages are good the U.S. market will hit a tough patch in some unspecified time in the future. And in that state of affairs, a globally-hedged portfolio will very seemingly clean out your returns from 12 months to 12 months, making your investing journey really feel much less like a hair-raising curler coaster.

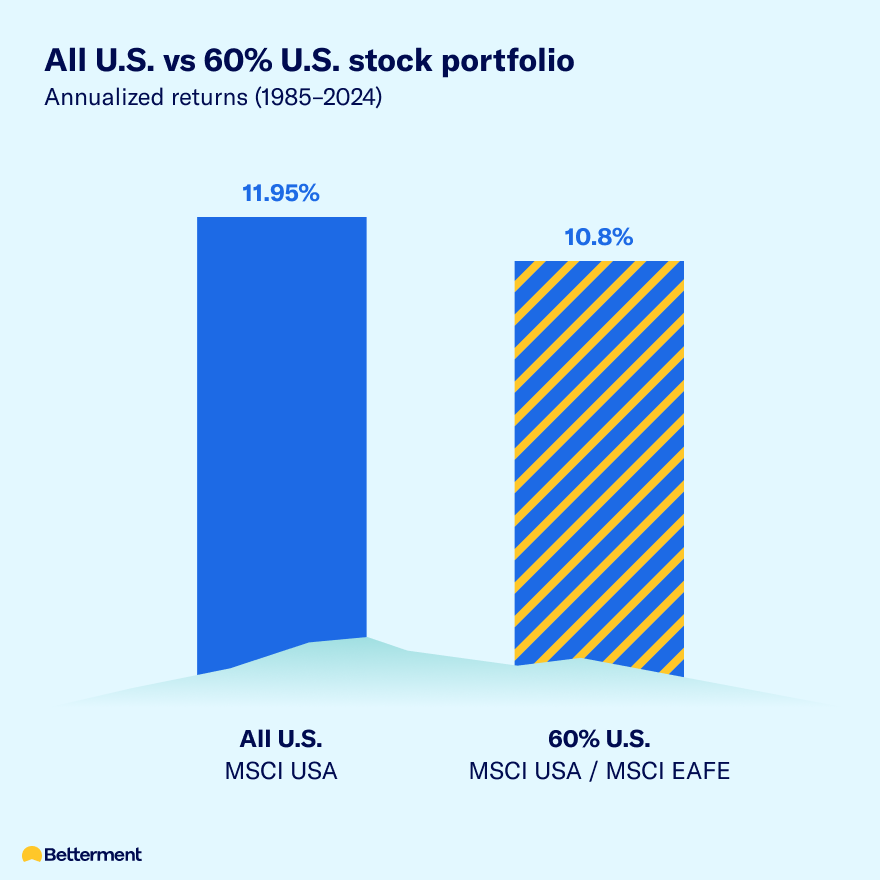

That being stated, diversification is a sliding scale. There is no such thing as a cross/fail, no dangerous or good. And typically, adequate is nice sufficient. Think about you’ve got been saving for retirement the final 40 years. The distinction in annualized returns for an all-U.S. inventory portfolio vs. a globally-diversified one (e.g. 60% U.S.) over that point span would have been (drumroll, please): 1.15%.

And whereas 1% makes a distinction over time (it’s why we harp on taxes and costs a lot), in case you’ve been saving steadily over that point, you are seemingly in fine condition both method.

So here is one more probability to breathe straightforward. Each choices—All-American and Largely-American—have been dependable roads to long-term wealth up to now 40 years.

The numbers, whereas purely hypothetical and academic in nature, drive residence that time. They don’t replicate the efficiency of Betterment clients, however somewhat two alternative ways of setting up a portfolio.

We provide a number of globally-diversified portfolios, every one made up principally of U.S. equities, and two extra methods to maintain your investing even nearer to residence:

- Put money into our Versatile Portfolio and reallocate your worldwide publicity to U.S. asset courses.

- Join Betterment Premium and get entry to unique investing choices like a U.S.-only portfolio.

Both method, it’ll be residence candy residence (bias).