Buyers are beginning to really feel a wholesome dose of cognitive dissonance—that grating feeling when two beliefs you maintain do not fairly line up.

On one hand, the U.S. market is hovering on the again of AI optimism and potential tax cuts.

And on the opposite, firms’ inventory costs, relative to their precise earnings, are beginning to loosely resemble the run-up to the Dotcom bubble of the late 90s.

So which perception will win out in 2025: growth or bust? Let’s parse this conflicted outlook by analyzing three questions particularly:

Are U.S. shares overvalued?

Round this time final 12 months, we stated the booming market on the time may maintain going if the Fed lowered rates of interest in response to cooling inflation.

Rates of interest did tick down, and boy, did markets take discover. By means of the tip of November 2024, a 90% inventory Betterment Core portfolio returned roughly 17.6% year-to-date.

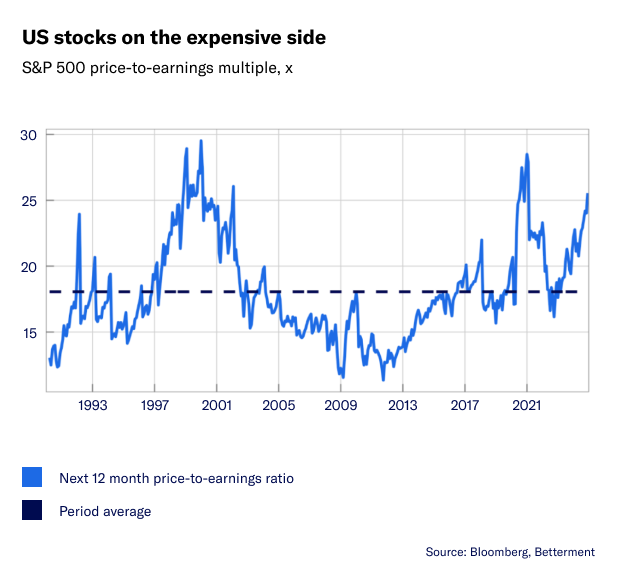

Such a run, nonetheless, begs hypothesis of one more reversal, a swing of the pendulum towards much less frothy valuations and a downside in portfolio returns. The S&P 500 presently prices about 25 instances greater than what these firms are anticipated to herald over the following 12 months. For comparability, this common “price-to-earnings” ratio during the last 35 years has been 18x.

Taking the angle of a long-term investor, nonetheless, these ratios matter lower than chances are you’ll suppose. As long as you keep invested for quite a lot of years, chances are high the market as a complete might “develop” into its valuation.

Keep in mind 2021 when a gaggle of tech-centric, dangerous shares have been darlings of the pandemic and shot to the moon? Analysts rightly known as foul—these sorts of valuations shouldn’t be sustainable.

However inside a couple of years the market was setting recent all-time highs. An investor who had bought or stayed on the sidelines would’ve missed out on all that development. So in the event you’re tempted to promote “excessive” proper now, keep in mind this:

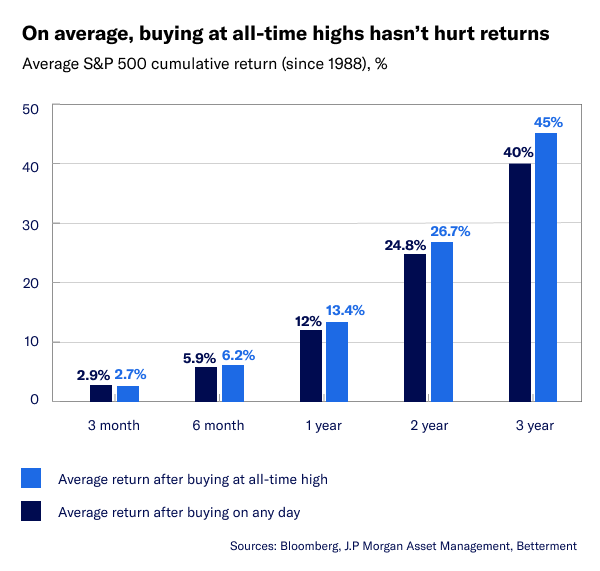

On common, investing at all-time highs hasn’t resulted in decrease future returns in comparison with investing on any given buying and selling day.

Quite the opposite, shopping for when the market has by no means been larger results in barely larger common returns in the long term. You possibly can by no means ensure precisely when a development cycle will finish.

Will AI pan out?

A giant driver of this bull market has been optimism surrounding synthetic intelligence and the massive tech firms powering it, like Amazon, Google, and the pc chip-maker Nvidia. They’ve rallied big-time during the last 12 months, and consequently, they make up an more and more massive share of the U.S. and international inventory market.

A debate, nonetheless, surrounds their outperformance and the hoopla round AI on the whole. Some analysts argue {that a} good quantity of AI funding gained’t in the end show fruitful, whereas others foresee vital boosts to productiveness and earnings.

There’s that grating feeling once more—the potential of revolutionary upside sitting proper subsequent to worries that it’s largely hype. Within the face of uncertainty, all one can do to decrease their threat is hedge their bets and diversify. Our portfolios’ inventory allocations take this to coronary heart, providing vital publicity to Large Tech, whereas additionally investing in European, Japanese, and rising markets. It’s these cheaper equities that present a possible buffer within the occasion AI’s ambitions fall quick.

There’s that grating feeling once more—the potential of revolutionary upside sitting proper subsequent to worries that it’s largely hype. Within the face of uncertainty, all one can do to decrease their threat is hedge their bets and diversify. Our portfolios’ inventory allocations take this to coronary heart, providing vital publicity to Large Tech, whereas additionally investing in European, Japanese, and rising markets. It’s these cheaper equities that present a possible buffer within the occasion AI’s ambitions fall quick.

Do markets care who’s within the White Home?

Proper now, markets aren’t certain precisely what to make of President-elect Trump’s proposed financial agenda. Guarantees of company tax cuts, whereas fueling the latest surge in shares, may in follow enhance inflation. Similar goes for tariffs and mass deportation. And rising inflation may in flip pause or reverse the latest development in rate of interest cuts. However till extra particulars emerge, or the insurance policies themselves are literally put into follow, we gained’t know their full impact.

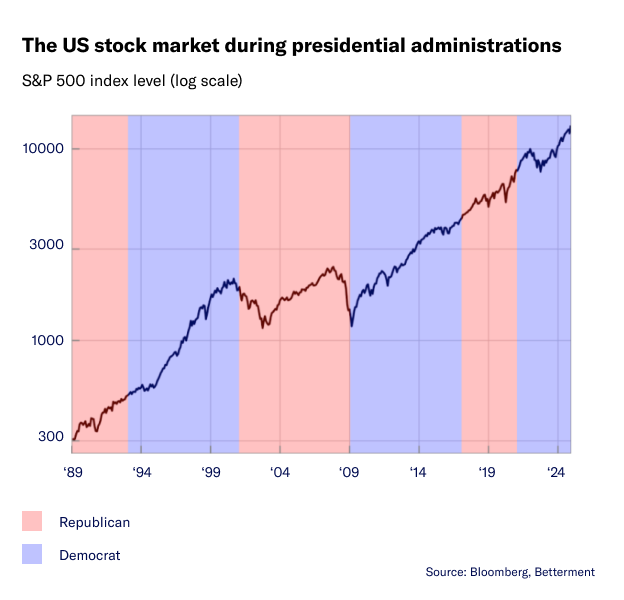

As a substitute of sitting again and anxiously ready, we recommend having a look on the chart under. It reveals that markets are inclined to rise over time no matter which social gathering holds the presidency. Sustaining a constant, diversified funding method is one of the simplest ways to navigate political and financial cycles. That, and perhaps cooling it a bit in your information consumption.

So what now?

As at all times, it’s not possible to know precisely how lengthy every development cycle will final, so take into account erring on the facet of staying invested. If you end up sitting on an excessive amount of money, now is likely to be the time to place it to work out there. You possibly can make investments it as a lump sum, which analysis reveals might provide larger potential returns. Or you possibly can sprinkle it right into a portfolio over time. Most significantly, nonetheless the market performs in 2025, we recommend zooming out and reminding your self you’re in it for the lengthy haul.