The housing market has proven indicators of slowing down, besides, 73% of metros areas nonetheless noticed constructive worth beneficial properties within the final quarter of 2025.

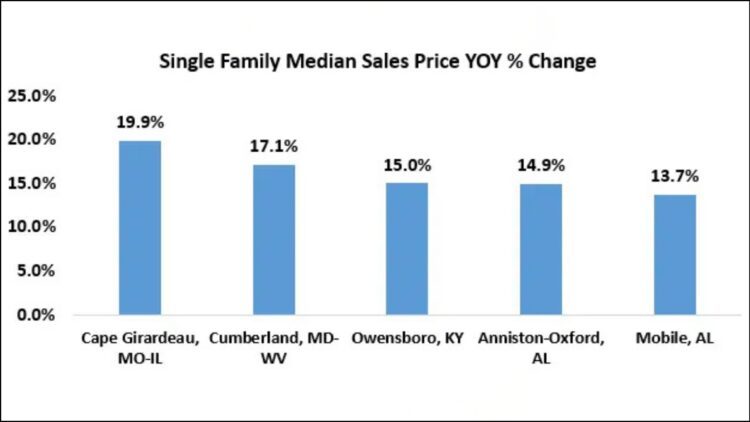

Yr-over-year costs grew the quickest in Cape Girardeau in southern Missouri (19.9%), the place the median dwelling worth is $275,000, in accordance with new information from the Nationwide Affiliation of Realtors®.

This was adopted by Cumberland, MD (17.1%), the place the median dwelling worth is $174,900 after which Owensboro, KY (15%), the place the median worth is $264,000.

Within the final quarter of 2025, the nationwide median worth rose rose 1.2% to $414,900, at the same time as month-to-month mortgage funds on a single-family dwelling decreased 5.7% to $2,057, NAR information reveals.

These areas fall far under the nationwide median, making them extra reasonably priced for the typical homebuyer.

“With a view to meet the 30% threshold to afford a typical dwelling within the three markets, an annual family earnings of $53,320 (Cape Girardeau MO-IL), $33,920 (Cumberland, MD-WV) and $51,360 (Owensboro, KY) is required,” says Jiayi Xu, Realtor.com economist.

The calculation relies on 20% down fee for a first-time purchaser at a mean 30-year mortgage charge of 6.1%, and excludes tax and insurance coverage.

Costs declined probably the most in Elmira, NY (-7.2%), Farmington, NM (-7%), and Boulder, CO (-6.7%).

Dwelling worth development has been stalling in lots of areas, and inflation is falling. That provides patrons leverage, however they nonetheless want to return to the market ready.

“Understanding mortgage charges and qualifying earnings necessities for down funds will assist potential householders decide which metro areas are reasonably priced for them,” Michael Hyman writes for NAR.

Value strain: gradual, not sudden

Xu says some sidelined patrons is likely to be coming again into the market. However home-owner fairness stays elevated, which retains costs regular. Many components of the nation have additionally seen earnings development at a quicker charge than dwelling worth development.

“With stock nonetheless comparatively constrained, these elements collectively have contributed to continued worth resilience throughout a lot of the market regardless of slower total gross sales exercise,” says Xu.

So will wannabe homebuyers see any reduction within the development in costs? It would begin to look that approach. However Xu stated to anticipate affordability beneficial properties to return at a sluggish tempo.

“Barely decrease mortgage charges and modest enhancements in affordability have introduced some sidelined patrons again into the market,” says Xu.

“Nonetheless, significant, longer-term reduction for brand new patrons is probably going tied to rising housing provide, notably in starter-home segments.

“With stock remaining tight in lots of markets, upward strain on costs is anticipated to persist at the same time as rates of interest ease.”