The most effective place to open a 529 plan for many Individuals is their very own state.

529 plans include a number of nice advantages, however these advantages are ruled by their state tax guidelines. Opening a 529 plan in your state sometimes means that you can maximize your educations financial savings advantages.

Let’s break down the place to open a 529 plan!

Why A 529 Plan?

With the price of faculty continually on the rise, merely placing cash away in a financial savings account for a kid’s academic future is probably not sufficient. Establishing and contributing to a 529 plan — a tax-advantaged financial savings plan for academic prices — is likely one of the greatest methods to start out saving early and maximize these financial savings.

And you do not have to be a guardian to benefit from a 529 plan. Anybody — grandparents, aunts and uncles, godparents, and mates — can set up a 529 to put money into the academic future of a kid they care about.

There are two totally different sorts of 529s obtainable in the US: training financial savings plans and pay as you go tuition plans. Training financial savings plans are rather more frequent, and so they’re often what persons are referring to after they speak about 529s, however this piece will speak you thru every type.

Inside every type of plan, nonetheless, there are totally different funding choices, minimal contributions, charges, and restrictions on fund utilization. Making a call can really feel overwhelming, particularly when faculty is years away, however so long as you already know your monetary objectives and the choices that matter most to you, there are wonderful instruments obtainable that will help you evaluate plans and make the only option for you and the folks you care about.

Training Financial savings Plans vs. Pay as you go Tuition Plans

An training financial savings plan is an funding account sponsored by a state authorities that means that you can lower your expenses for a beneficiary’s future training. Its funds can be utilized to pay for any certified academic bills, together with tuition, charges, and room and board, and its earnings should not topic to federal tax.

More often than not, folks use these plans to avoid wasting and pay for post-secondary training in the US, however they can be utilized in a extra restricted style to pay for public, non-public, and non secular training on the elementary and secondary ranges. Since these are funding funds, they profit from having loads of time to develop.

Pay as you go tuition plans are a a lot much less frequent type of 529. Reasonably than rising contributions by way of funding, these plans will let you prepay tuition at some private and non-private schools and universities. With most plans, contributors buy credit or “Tuition Certificates” at present charges, and beneficiaries can then redeem them for equal credit or tuition sooner or later, irrespective of how a lot the price of tuition per credit score has gone up. Since these funds don’t want time to develop, and may solely be used at particular establishments, they will work nicely for beneficiaries who’re already nearing faculty.

Contributing to an Training Financial savings Plan

Training financial savings plans are very versatile investments. Most individuals take into consideration this type of 529 as an funding made by mother and father within the academic way forward for their little one. Whereas that’s the commonest configuration, anybody can arrange an training financial savings plan and designate anybody because the beneficiary — a niece or nephew, a pal’s little one, and even themselves — so long as the beneficiary is a U.S. citizen or resident alien.

You may contribute to a number of plans, and one beneficiary will be the recipient of funds from a number of contributors. Furthermore, although these plans are sponsored by state governments, you don’t often must be a resident to put money into a given state’s plans.

Every obtainable plan provides a variety of funding choices — often mutual funds and exchange-traded funds — with one in all two approaches.

The age-based method shifts the combination of property in order that it turns into much less dangerous because the beneficiary approaches faculty age, very like target-based funds do with retirement investments.

A static fund will preserve the identical profile all through the lifetime of the funding. Many state plans additionally provide cash market accounts and principal-protected financial institution merchandise.

Charges and Restrictions on Academic Financial savings Plans

These plans often have some restrictions on contributions. Most plans have minimums for preliminary and subsequent contributions, although these limits are sometimes fairly low.

Most plans even have a most contribution restrict, and that restrict shouldn’t be primarily based on how a lot a given contributor has put right into a plan, however on how a lot has been contributed to all plans with the identical designated beneficiary in that state. One answer is to open extra plans in different states.

Particular person yearly contributions over $14,000 might set off the present tax, although it’s unlikely to be an issue for many buyers.

Training financial savings plans even have a lot of one-time and recurring charges which differ from plan to plan, simply as funding choices and contribution limits do. Normally, plans will cost a payment for the preliminary enrollment, in addition to ongoing or annual charges for account upkeep, asset administration, and program administration.

Utilizing the Funds in an Training Financial savings Plan

The funds from an training financial savings plan will be withdrawn at any time. There aren’t any limits for yearly withdrawals to pay for post-secondary training, although you may solely withdraw $10,000 per 12 months for elementary or secondary training.

There may be additionally no requirement that beneficiaries start withdrawal of funds by a sure age, so there isn’t a want to fret in case your designated beneficiary chooses to attend some time earlier than heading to school.

So long as the funds from these plans are used to pay for certified academic bills, they aren’t topic to federal tax. Certified academic bills embody tuition, obligatory charges, books, provides, and tools, plus room and board for college kids attending half-time or extra. Because of this even when a beneficiary receives vital scholarships, the training financial savings plan can be utilized to pay for a lot of issues that scholarships typically don’t cowl.

Furthermore, leftover funds will be rolled into the plans of new beneficiaries, similar to youthful siblings, and even right into a 529 ABLE account, a financial savings plan for Individuals with disabilities. These are necessary choices to recollect, as any funds withdrawn that aren’t used on certified academic bills are topic to taxes on the plan’s earnings and a further 10% penalty.

Deciding on and Setting Up a 529 Plan

As you may see, training financial savings plans and pay as you go tuition plans are very totally different, so you need to take into account your wants, and the wants and objectives of your beneficiary, when selecting which method to take.

Past this most elementary alternative, nonetheless, there are a lot of choices, particularly since there are hardly ever residency restrictions for state-based plans. Because of this, it is actually value it to check plans. A very powerful issues to think about are the funding approaches supplied, the charges and bills required, and the minimal preliminary and recurring contributions. Some plans will even waive or scale back charges in the event you enroll in an computerized contribution plan — together with one which deducts instantly out of your paycheck — or preserve a excessive steadiness, so it helps to buy round.

Furthermore, whereas residency is probably not required to hitch most state-based plans, many will exempt residents from state taxes on earnings, waive some charges for residents, or will let you deduct a portion of your contributions out of your state revenue tax.

Some states provide matching grants to lower- and middle-income residents, and Rhode Island even offers seed cash for a 529 to each child born within the state. All that being mentioned, the recurring charges in your state’s plan could also be so excessive they wipe out any residency advantages, so it is very important evaluate fastidiously.

The place to Begin:

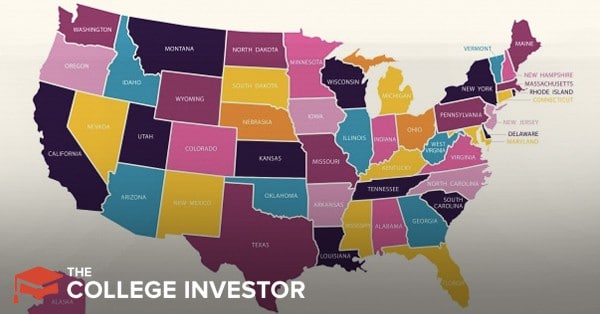

Fortunately there are a number of instruments that will help you make an knowledgeable resolution. Try this map under and see the place to start out:

If you’ve chosen your plan, there’s one remaining query: how do you set it up? 529s will be bought instantly from the state or group that sponsors the plan or arrange by way of a dealer. Buying by way of a dealer will incur extra charges, nonetheless, so generally, it is smart to arrange your plan instantly.

With all of those choices — and some good instruments that will help you type by way of them — there’s certain to be a 529 plan that works for you. And bear in mind: simply because it’s by no means too early to start out investing in a baby’s training, it’s by no means too late both!