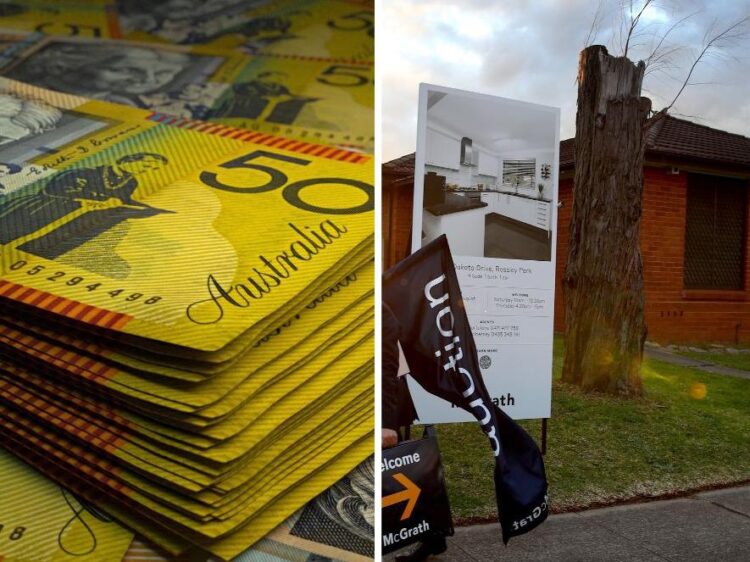

Competitors at public sale started to average late final yr, however demand is anticipated to stay sturdy over 2026. Image: Jeremy Piper

Sydney households might want to earn almost $305,000 by the tip of 2026 to afford a median metropolis home and $165,000 a yr for a unit if anticipated rates of interest and worth rises eventuate, new information reveals.

The evaluation of PropTrack worth modelling and fee predictions from two of the nation’s massive 4 banks confirmed a window of higher housing affordability could quickly be closing.

Each ANZ and Westpac are actually forecasting no additional rate of interest cuts in 2026 as a result of cussed excessive inflation, with each banks anticipating the money fee to stay on maintain till the tip of the yr.

This sustained charges local weather would coincide with continued rises in costs over the yr that, though slower than in 2025, would imply patrons needing a lot bigger budgets to have the ability to sustain.

PropTrack modelling has forecast continued rises in costs over 2026, with Sydney values tipped to rise about 5 per cent over the yr, down from almost 7 per cent in 2025.

The analysis group famous these rises could be pushed by migration-fuelled inhabitants progress, housing shortages and authorities purchaser help such because the First Residence Assure Scheme.

This Citadel Hill residence lately offered for $2.68m.

MORE: Usman Khawaja’s $9m plan for retirement

These forces could be a “tailwind” that may mitigate a number of the market impression of a altering rate of interest setting, PropTrack economist Angus Moore advised The Every day Telegraph in December.

Continued worth rises would even be pushed by sturdy demand for essentially the most reasonably priced properties – slightly than demand for properties throughout the highest finish of the market.

A house purchaser wanting to buy a median priced Sydney home ($1.62m) with a 20 per cent deposit presently wants an earnings of about $291,000 to afford it and never go into mortgage stress.

Avoiding mortgage stress meant the client could be spending not more than a 3rd of their earnings on housing prices.

Residence patrons presently want an earnings of $157,000 a yr to have the ability to afford a median priced unit with a 20 per cent deposit and a median mortgage fee.

MORE: Iconic Hollywood actor faces eviction over $90k hire debt

Actual Property Patrons Agent Assocation president Melinda Jennison mentioned rates of interest would play a decisive function out there.

One other 5 per cent rise in costs would change this requirement.

With a median home now costing almost $1.7m, a home purchaser would wish about $305,000 to afford the acquisition.

Unit patrons would wish to earn $165,000 by the tip of 2026 to nonetheless be capable to afford a median priced house.

Actual Property Patrons Brokers Affiliation of Australia president Melinda Jennison mentioned housing shortages would drive costs up over 2026.

“We’re effectively behind Housing Accord targets and, with no materials easing in immigration, demand to each purchase and hire will proceed to outpace provide in lots of cities,” she mentioned.

“ I anticipate continued depth within the extra reasonably priced home and townhouse markets, as higher-income households are pushed out of premium suburbs and into the middle-ring and outer areas.”

MORE: Aus’ worst main suburb to dwell in revealed

Hotspotting founder and property analyst Terry Ryder.

Terry Ryder, director of analysis group Hotspotting, mentioned in a word to buyers that the majority markets throughout Australia would carry out fairly effectively in 2026.

“Demand is being fuelled by an unprecedented excessive stage of infrastructure funding (and) excessive inhabitants progress,” he mentioned.

“On the similar time … we proceed to construct far too few new dwellings, listings of properties on the market are extraordinarily low in all places and vacancies proceed to hover round traditionally low ranges.”

Mr Ryder added that $900 billion in main infrastructure initiatives would make it tougher for brand spanking new building to meet up with demand.

“It’s creating heightened financial exercise and jobs – and due to this fact demand for actual property,” he mentioned.

“And it’s exacerbating the scarcity of recent dwellings as a result of tradespeople are engaged on the big-ticket authorities initiatives slightly than constructing new homes and models.”

This Greystanes residence lately offered for $1.625m.

MORE: Sydney landlord’s gorgeous $210k demand

Intuitive Finance director Andrew Mirams mentioned first-home patrons could be a key driver for the 2026 market due to authorities help permitting them to purchase with 5 per cent deposits.

“The federal government incentives and 5 per cent deposit scheme, whereas additionally elevating the shopping for limits and eradicating the earnings assessments, imply this market will doubtlessly growth into 2026 and past,” he mentioned.

A possible wrecking ball to present forecasts for additional worth progress over 2026 could be rate of interest hikes – the expectation of CBA and NAB.

CBA predicts a single money fee hike for 2026 to return in February. NAB has forecast two 2026 fee hikes, one in February and one other in Might. Most different forecasters are ruling out fee hikes at this stage.

Mr Mirams mentioned fee hikes may impression market sentiment and make patrons extra hesitant, however sluggish building at a time of sturdy inhabitants progress could mitigate a lot of the impression.

“We nonetheless have a power constructing undersupply, so if the federal government doesn’t deal with migration, then we’re going to frequently have an absence of provide to satisfy demand.”