(Bloomberg) — Shares drifted close to all-time highs forward of the Federal Reserve resolution, with merchants cut up on the scale of an interest-rate reduce.

Most Learn from Bloomberg

The S&P 500 closed little modified after briefly crossing the edge of a file amid a rise in US retail gross sales. Economically delicate industries as soon as once more outperformed tech. Treasury yields edged up, with shorter maturities main the transfer. The market-implied odds the Fed declares a 50-basis-point discount on Wednesday had been round 55%.

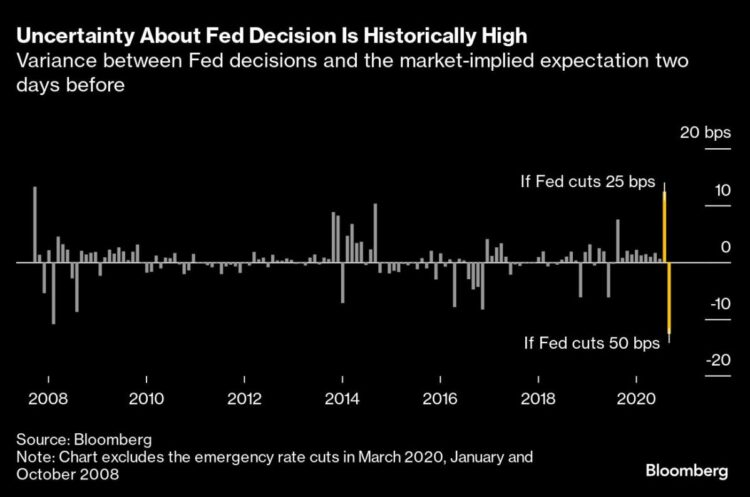

For a number of market observers, maybe the most-important side of what occurs stands out as the investor response. Might a 25 basis-point discount go away merchants frightened the Fed is behind the curve? Might a 50 basis-point transfer spook markets that the Fed should know the financial system is in dire form? Or will buyers be reassured that, regardless of the Fed does, Chair Jerome Powell is on high of the state of affairs?

“It’s uncommon below the Powell Fed for markets to be this ‘up within the air’ on what precisely the Fed will do with simply at some point to go earlier than the choice,” based on Bespoke Funding Group strategists. “Though possibly the Fed is pleased with the market being 100% certain that we’ll at the very least get a reduce.”

A survey performed by 22V Analysis confirmed buyers who anticipate a 25 basis-point discount are cut up on whether or not that reduce would ship a “risk-on” or “risk-off” response. Meantime, these betting on 50 foundation factors suppose a smaller Fed transfer could be “risk-off.”

The S&P 500 closed close to 5,635. The Nasdaq 100 and Dow Jones Industrial Common had been little modified. The Russell 2000 of small corporations added 0.7%. Treasury 10-year yields rose two foundation factors to three.64%. The greenback gained.

Whereas the market has usually accomplished effectively on Fed Days when charges have been reduce, efficiency within the week after the primary fee reduce of a brand new easing cycle has been fairly weak, based on Bespoke.

The S&P 500 has averaged a drop of 0.56% from the shut on the day earlier than the primary fee reduce by means of one week later, whereas eight of 10 sectors have averaged declines as effectively. Financials and well being care have seen essentially the most weak spot within the week after the primary fee reduce, whereas tech and communication companies have bucked the development and averaged positive aspects.

The Fed will both reduce 50 foundation factors or go for a 25 basis-point discount, however sign that they are going to be extra aggressive going ahead, based on Matt Maley at Miller Tabak.

Nonetheless, he says, that doesn’t assure that the inventory market and/or bond market will rally in a significant approach. Maley says the Fed will possible attempt to convey {that a} extra dovish stance isn’t seen as one thing meaning they’re all of a sudden frightened about an imminent recession.

“Due to this fact, on condition that the inventory market is approaching overbought territory, we may nonetheless get a ‘promote the information’ response to the Fed this week,” he added.

“If the Fed doesn’t provoke its easing cycle with 50 foundation factors, certainly a 25 basis-point transfer shall be enveloped by a dovish tone,” based on Quincy Krosby at LPL Monetary. Ryan Detrick at Carson Group stated “a bigger reduce out of the gate makes quite a lot of sense” on condition that now the large concern is the potential for a rapidly slowing labor market.

Steve Sosnick at Interactive Brokers nonetheless believes the Fed ought to lean to 25 foundation factors, however notes that years of buying and selling expertise have taught him to respect the message of the market.

“And that message has been saying 50,” he stated.

Sosnick famous there’ll possible be widespread disappointment if the Fed opts for 25 foundation factors. He says fairness markets at all times crave extra liquidity, and on the identical time, bond markets have all however priced in an aggressive fee slicing path for future conferences. So the smaller reduce would bias in opposition to each.

Kristina Hooper at Invesco expects the Fed to chop by 25 foundation factors as a much bigger discount would elevate alarm bells in regards to the state of the US financial system.

“Recall that the Fed began a quick easing cycle with a 50 foundation level reduce in March 2020 with the worldwide pandemic upon us; it could be very exhausting to argue that the state of affairs is so dire now,” she famous.

What Powell says in his press convention in regards to the state of the US financial system may assist construct confidence for these frightened a few recession within the close to time period, Hooper added.

“As well as, will probably be beneficial to listen to Powell’s ideas on the anticipated path of fee cuts — particularly, what circumstances may set off a change in fact, both a moderation or acceleration in easing,” she famous. “These are simply issues you may’t glean from the dot plot, so the press convention is ‘should see TV’ in my opinion.”

Company Highlights:

-

Microsoft Corp. raised its quarterly dividend 10% and unveiled a brand new $60 billion stock-buyback program, matching the scale of a repurchase plan three years in the past.

-

Intel Corp. made a raft of bulletins, spurring optimism that the chipmaker’s turnaround plan is beginning to bear fruit.

-

Salesforce Inc. is unveiling a pivot in its synthetic intelligence technique this week at its annual Dreamforce convention, now saying that its AI instruments can deal with duties with out human supervision and altering the best way it expenses for software program.

-

Newmont Corp., the world’s largest gold miner, stated it’s on monitor to boost $2 billion — if no more — from promoting smaller mines and improvement tasks.

-

JPMorgan Chase & Co. is in discussions with Apple Inc. about taking on a bank card portfolio that rival Goldman Sachs Group Inc. has been attempting to ditch.

-

Snap Inc. Chief Government Officer Evan Spiegel unveiled a brand new model of the corporate’s Spectacles sensible glasses, revitalizing an effort to construct a sophisticated augmented actuality product that will at some point exchange or rival the smartphone.

-

Ozempic, the blockbuster diabetes shot made by Novo Nordisk A/S, is “very possible” to be one of many subsequent medication focused for a value reduce in bargaining with the US authorities’s Medicare program, an organization govt stated.

Key occasions this week:

-

Eurozone CPI, Wednesday

-

Fed fee resolution, Wednesday

-

UK fee resolution, Thursday

-

US US Conf. Board main index, preliminary jobless claims, US current dwelling gross sales, Thursday

-

FedEx earnings, Thursday

-

Japan fee resolution, Friday

-

Eurozone client confidence, Friday

A few of the fundamental strikes in markets:

Shares

-

The S&P 500 was little modified as of 4 p.m. New York time

-

The Nasdaq 100 was little modified

-

The Dow Jones Industrial Common was little modified

-

The MSCI World Index was little modified

-

S&P 500 Equal Weighted Index rose 0.2%

-

Bloomberg Magnificent 7 Complete Return Index rose 0.4%

-

The Russell 2000 Index rose 0.7%

Currencies

-

The Bloomberg Greenback Spot Index rose 0.2%

-

The euro fell 0.1% to $1.1117

-

The British pound fell 0.4% to $1.3163

-

The Japanese yen fell 1.1% to 142.22 per greenback

Cryptocurrencies

-

Bitcoin rose 4% to $59,953.71

-

Ether rose 3.4% to $2,352.4

Bonds

-

The yield on 10-year Treasuries superior two foundation factors to three.64%

-

Germany’s 10-year yield superior two foundation factors to 2.14%

-

Britain’s 10-year yield superior one foundation level to three.77%

Commodities

-

West Texas Intermediate crude rose 1.8% to $71.34 a barrel

-

Spot gold fell 0.5% to $2,568.94 an oz

This story was produced with the help of Bloomberg Automation.

Most Learn from Bloomberg Businessweek

©2024 Bloomberg L.P.