A unit of billionaire Mukesh Ambani-led Reliance Industries Ltd. dangers being penalized after failing to arrange a battery cell plant that shaped a part of Indian Prime Minister Narendra Modi’s push to chop import dependence, in line with individuals acquainted with the matter.

Article content

(Bloomberg) — Follow Bloomberg India on WhatsApp for exclusive content and analysis on what billionaires, businesses and markets are doing. Sign up here.

Article content

Article content

A unit of billionaire Mukesh Ambani-led Reliance Industries Ltd. risks being penalized after failing to set up a battery cell plant that formed part of Indian Prime Minister Narendra Modi’s push to cut import dependence, according to people familiar with the matter.

Advertisement 2

Article content material

Reliance New Power Ltd., amongst corporations that received a bid for battery cell manufacturing in 2022 below an Indian authorities plan to reward native manufacturing, is liable to pay fines of as a lot as 1.25 billion rupees ($14.3 million) for lacking a deadline, mentioned the individuals who requested to not be recognized as a result of the deliberations are personal.

Rajesh Exports Ltd., which additionally utilized below this authorities initiative to make battery cells, can also be on the hook for stalling the advanced-chemistry cell program and could possibly be levied related sized penalties, they mentioned.

The small financial fines are a mere rap on the knuckle, particularly for Asia’s richest particular person and his Reliance conglomerate. However the failure to succeed in state-directed manufacturing targets displays the technological challenges and shifting market dynamics that may stymie Modi’s ‘Make in India’ imaginative and prescient to rival China because the world’s manufacturing unit.

Modi has sought to spice up manufacturing to 25% of gross home product however the share has slipped to 13% in 2023 from 15% in 2014.

Representatives for Reliance Industries, Rajesh Exports and India’s Heavy Industries Ministry, which abroad this initiative, didn’t reply to emails looking for feedback.

Article content material

Commercial 3

Article content material

Patchy Success

Whereas subsidies to producers below the so-called Manufacturing-Linked Incentives, or PLI, have labored properly to spice up native meeting of smartphones, the success hasn’t been uniform throughout sectors.

Reliance New Power, Rajesh Exports and the unit of Ola Electrical Mobility Ltd. had received bids in 2022 to construct the battery cell crops — a part of the nation’s push to cut back dependence on imports for electrical automobiles — below the PLI program.

Producers had been eligible for 181 billion rupees price of subsidies on assembly milestones for the undertaking that sought to create a cumulative 30 gigawatt-hour capability of superior chemistry cell battery storage.

The corporations had been required to attain a minimal ‘dedicated capability,’ together with native worth addition of 25% inside two years of the settlement, and 50% inside 5 years, the individuals mentioned.

The third participant within the combine, nonetheless, billionaire Bhavish Aggarwal’s Ola Cell Applied sciences Pvt. has made progress on its commitments below this PLI program.

The Ola unit began trial manufacturing in March final yr and plans to start out industrial manufacturing of lithium-ion cells within the April to June quarter, a spokesperson for Ola Electrical mentioned in an emailed response. “We’re properly on monitor to fulfill the set timelines,” he mentioned.

Commercial 4

Article content material

‘Dangerous to Make investments’

The Reliance unit, in the meantime, has turned its focus to inexperienced hydrogen, a gasoline seen as key to a carbon-free future, as a part of a shift within the firm’s priorities, the individuals mentioned. The businesses are additionally but to agency up the know-how wanted to fabricate lithium-ion cells regionally.

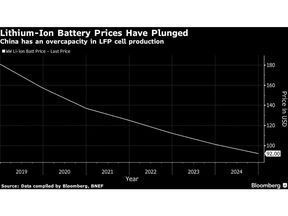

“It was fairly dangerous to put money into cell manufacturing final yr – an excessive amount of uncertainty with plenty of world overcapacity and unsure commerce setting,” Jiayan Shi, a BloombergNEF analyst, mentioned.

Additionally, the capital funding wanted for constructing lithium-ion battery crops could be very excessive, starting from $60 to $80 million per gigawatt-hour, she added.

Furthermore, world lithium-ion phosphate, or LFP, battery costs have been on the decline. This has made imports of cells cheaper than ever, creating uncertainty round home demand and slowing the tempo of investments in India.

Though Reliance New Power did purchase sodium-ion cell maker Faradion in 2021 and Netherlands-based Lithium Werks, together with its manufacturing amenities in China, in 2022, they represented small investments.

Article content material