Key Factors

- Debtors with federal loans issued after July 1, 2026, will select between the brand new Customary Plan or a brand new income-based choice known as the Compensation Help Plan (RAP).

- Current debtors should transition by July 1, 2028, from plans like SAVE or PAYE into both RAP or Revenue-Primarily based Compensation (IBR).

- Dad or mum PLUS debtors stay excluded from RAP and amended IBR, locking many into the Customary Plan with out income-based choices.

The ultimate model of the One Large Stunning Invoice goes to reshape the way forward for scholar mortgage reimbursement.

Beginning July 1, 2026, all new federal scholar mortgage debtors will solely have two choices: the revised Customary Plan or the newly launched Compensation Help Plan (RAP). For present debtors, the transition comes between 2026 and 2028, when legacy plans like SAVE, PAYE, and ICR can be phased out and debtors can be compelled to maneuver into both the RAP plan, or the IBR plan.

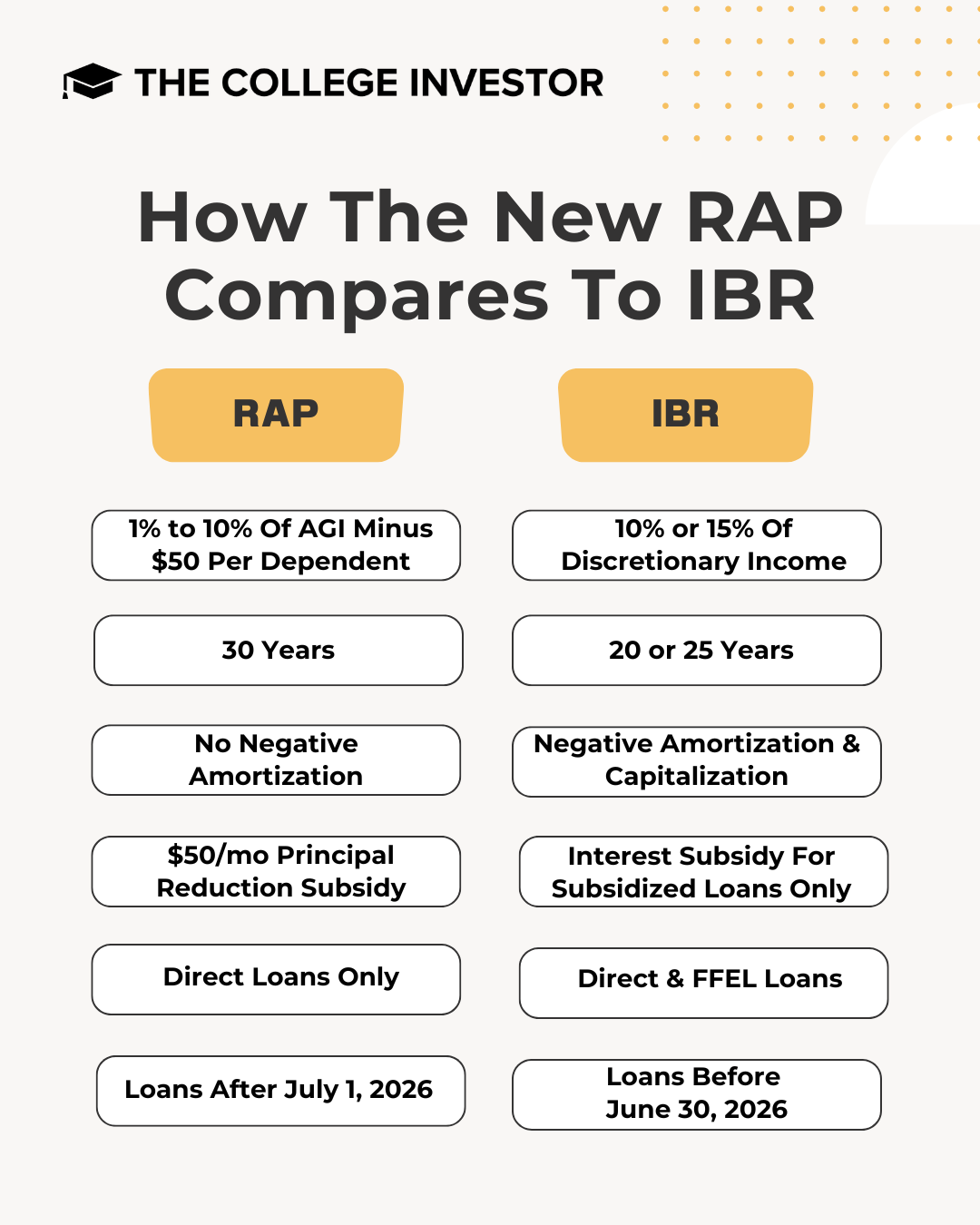

The RAP plan calculates month-to-month funds on a sliding scale, starting from 1% to 10% of adjusted gross earnings. A key function is that unpaid curiosity is forgiven, and a $50 month-to-month principal match helps chip away on the steadiness. Loans are forgiven after 30 years of funds.

IBR, the opposite remaining choice for present debtors, retains a lot of the options of Previous and New IBR, relying on mortgage origination date. These with loans from earlier than July 1, 2014, pay 15% of discretionary earnings and obtain forgiveness after 25 years. Debtors with loans after July 1, 2014 can pay 10% of discretionary earnings, with forgiveness at 20 years. Discretionary earnings is outlined as earnings above 150% of the federal poverty stage.

Would you want to save lots of this?

What Debtors Ought to Know

Debtors with present loans have time to guage which choice makes extra sense. Nevertheless, between July 1, 2026 and July 1, 2028, everybody on legacy income-driven plans might want to transition to both RAP or IBR.

The legislation requires that each one loans eligible for income-based reimbursement be paid underneath the identical plan, although exceptions stay for loans like Dad or mum PLUS.

RAP can supply extra flexibility on month-to-month cost quantities, particularly for debtors with kids. IBR stays extra acquainted to present debtors and gives barely quicker forgiveness for a lot of, particularly these with average incomes.

You may see our Compensation Help Plan Calculator right here. You may see your IBR cost on our common Pupil Mortgage Calculator right here.

Pattern Eventualities: IBR vs. RAP

To raised perceive the variations between RAP and IBR, think about three typical borrower profiles.We’re assuming the debtors all have $40,000 in scholar loans and reside within the decrease 48 states.

1. Single borrower, $50,000 earnings, no kids

- IBR: $228/month

- RAP: $167/month

On this situation, the RAP plan gives a decrease month-to-month cost.

2. Married borrower, $100,000 earnings, two kids

- IBR: $443/month

- RAP: $650/month

On this situation, the IBR plan could be a greater choice.

3. Single borrower, $80,000 earnings, one youngster

- IBR: $411/month

- RAP: $417/month

On this situation, the month-to-month funds are almost equivalent, however IBR is barely decrease (and since it might additionally supply 20 yr forgiveness, versus 30, it is a greater choice).

Different Eventualities

We ran another eventualities as nicely, and you’ll see that RAP usually has a decrease month-to-month cost for debtors incomes lower than $80,000 per yr. Nevertheless, when you cross about $90,000 in AGI, IBR begins to usually turn into the bottom month-to-month cost plan.

However each state of affairs is completely different: marriage standing, dependents, earnings. It is advisable to run the RAP calculator and see your cost to know for certain.

Dad or mum PLUS Loans Left Out

Whereas the invoice rewrites reimbursement choices for many debtors, Dad or mum PLUS loans stay excluded. New Dad or mum PLUS debtors after July 1, 2026, will solely be eligible for the Customary Plan. Current Dad or mum PLUS debtors have slender pathways to ICR/IBR through scholar mortgage consolidation.

If a borrower consolidates a Dad or mum PLUS mortgage earlier than June 30, 2026, they turn into eligible for ICR and later transition to IBR. Those that have already double-consolidated can transfer to IBR earlier than the July 1, 2028, deadline.

Nevertheless, these methods are complicated have strict timelines.

Closing Ideas

It is irritating to must navigate new scholar mortgage reimbursement plan choices. Nevertheless, the brand new Compensation Help Plan (RAP) could also be higher for some debtors than the present IBR choices obtainable.

For brand spanking new debtors, the choice on reimbursement plans can be simpler – much less plans means much less confusion.

However for present debtors, having emigrate and determine on a brand new reimbursement plan choice can be complicated. It is important that you just run the numbers and see which plan may go finest for you relying in your monetary state of affairs.

Widespread Questions

What’s the Compensation Help Plan (RAP)?

The Compensation Help Plan(RAP) is the brand new income-driven reimbursement plan that can be obtainable for brand spanking new debtors after July 1, 2026.

How does RAP differ from the revised Revenue-Primarily based Compensation (IBR)?

RAP bases month-to-month funds as a proportion of AGI, with a $10 minimal. It additionally has a principal and curiosity subsidy. IBR bases month-to-month funds on discretionary earnings, with a minimal cost of $0 per thirty days. It doesn’t have any subsidies.

Who should transition to RAP or amended IBR?

Any borrow present in ICR, PAYE, or SAVE should transition to amended IBR or RAP after July 1, 2026.

Are Dad or mum PLUS loans eligible for RAP or amended IBR?

Dad or mum PLUS Loans are NOT eligible for RAP. Dad or mum PLUS loans could be eligible for IBR, if the mortgage is consolidated on being repaid underneath an earnings pushed reimbursement plan by June 30, 2026.

Do not Miss These Different Tales:

Editor: Colin Graves

The publish RAP vs. IBR: What Pupil Mortgage Debtors Want To Know appeared first on The Faculty Investor.