Scholar debt is including up, however who’s developing brief on funds?

Reply: 24%, practically 1 out of each 4 debtors

Questions:

- Why do you assume so many individuals battle to pay again their scholar loans even after graduating?

- Do you assume having scholar loans adjustments the alternatives younger folks make, like what jobs they take or after they purchase a home?

- If you happen to have been in cost, how would you stability the price of school between college students, households, and the federal government?

Behind the numbers (NY Fed):

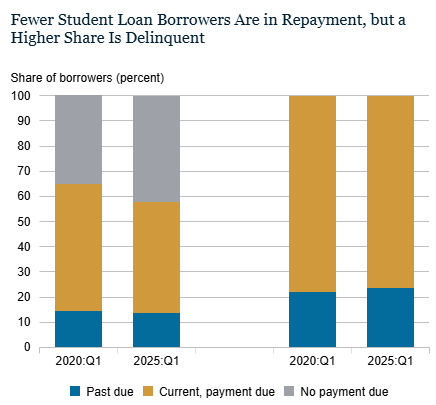

“On the finish of the primary quarter, greater than twenty million federal debtors weren’t in compensation and 5 million federal debtors had a zero greenback month-to-month fee. Within the subsequent set of bars, we present the borrower delinquency charge after eradicating debtors and not using a fee due (henceforth, the conditional borrower delinquency charge). Amongst debtors who have been required to make funds, practically one in 4 scholar mortgage debtors (23.7 %) have been behind on their scholar loans within the first quarter of 2025.”

About

the Creator

Dave Martin

Dave joins NGPF with 15 years of instructing expertise in math and laptop science. After becoming a member of the New York Metropolis Instructing Fellows program and incomes a Grasp’s diploma in Schooling from Tempo College, his instructing profession has taken him to New York, New Jersey and a summer season within the north of Ghana. Dave firmly believes that monetary literacy is significant to creating well-rounded college students which are ready for a fancy and extremely aggressive world. Throughout what free time two younger daughters will enable, Dave enjoys video video games, Dungeons & Dragons, cooking, gardening, and taking naps.