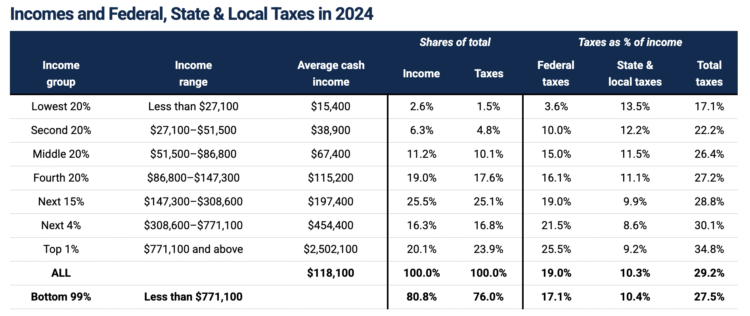

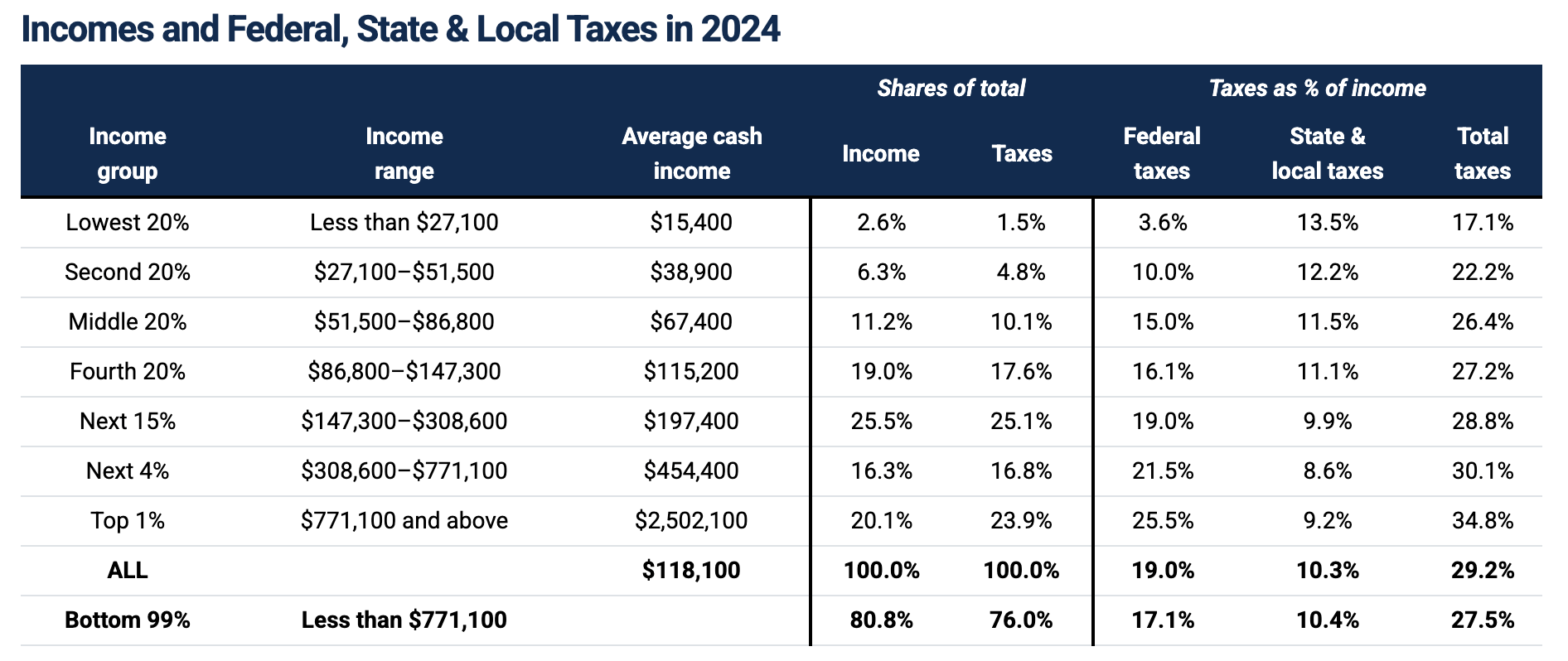

How a lot of your revenue actually goes in direction of taxes, while you add up federal, state, and native taxes?

Reply: 29%

Questions:

- What’s the common federal tax fee?

- What’s the relationship between revenue and common tax fee?

- Is the typical tax fee greater or decrease than you anticipated? Why?

- Do you assume the U.S. tax system is honest? Why or why not?

Click on right here for the ready-to-go slides for this Query of the Day that you should utilize in your classroom.

Behind the numbers (ITEP):

“America’s federal tax system general is comparatively progressive, that means it requires the wealthy to pay extra relative to their revenue than others, whereas state and native taxes in most states are regressive, that means they take a bigger share of revenue from the poor than from the wealthy. The progressive features of the federal tax system offset the regressive features of the state and native tax system in order that general, taxes for every revenue group are roughly proportional to revenue.

The federal private revenue tax is a progressive tax as a result of it applies at greater marginal charges to greater ranges of revenue and contains options such because the Earned Revenue Tax Credit score (EITC), which advantages low-income working individuals, and the refundable portion of the Youngster Tax Credit score (CTC), which is without doubt one of the few federal insurance policies that instantly addresses baby poverty…

The estimates supplied on this evaluation take note of all the numerous federal, state, and native taxes that People pay”

About

the Writer

Kathryn Dawson

Kathryn (she/her) is worked up to affix the NGPF workforce after 9 years of expertise in training as a mentor, tutor, and particular training instructor. She is a graduate of Cornell College with a level in coverage evaluation and administration and has a grasp’s diploma in training from Brooklyn School. Kathryn is trying ahead to bringing her ardour for accessibility and academic justice into curriculum design at NGPF. Throughout her free time, Kathryn loves embarking on cooking tasks, strolling round her Seattle neighborhood together with her canine, or lounging in a hammock with a e-book.