Guess the share who count on their funds to: a) get higher, b) worsen, or c) keep the identical.

Reply:

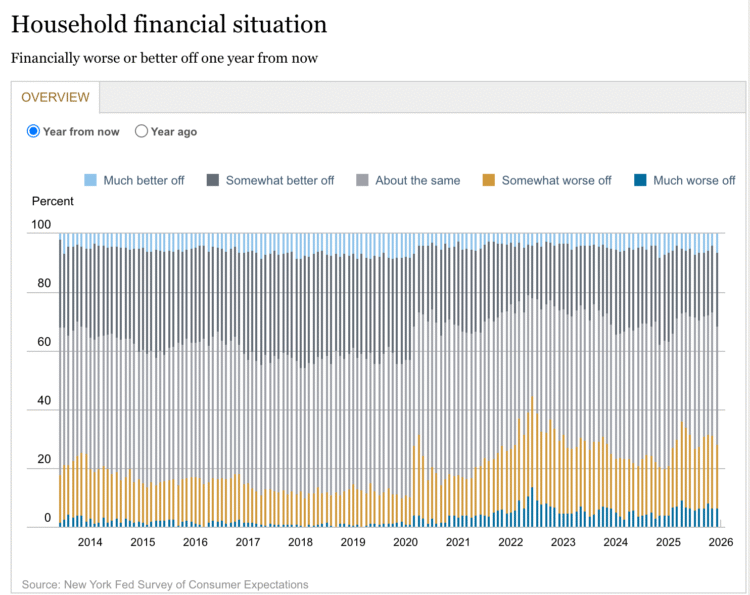

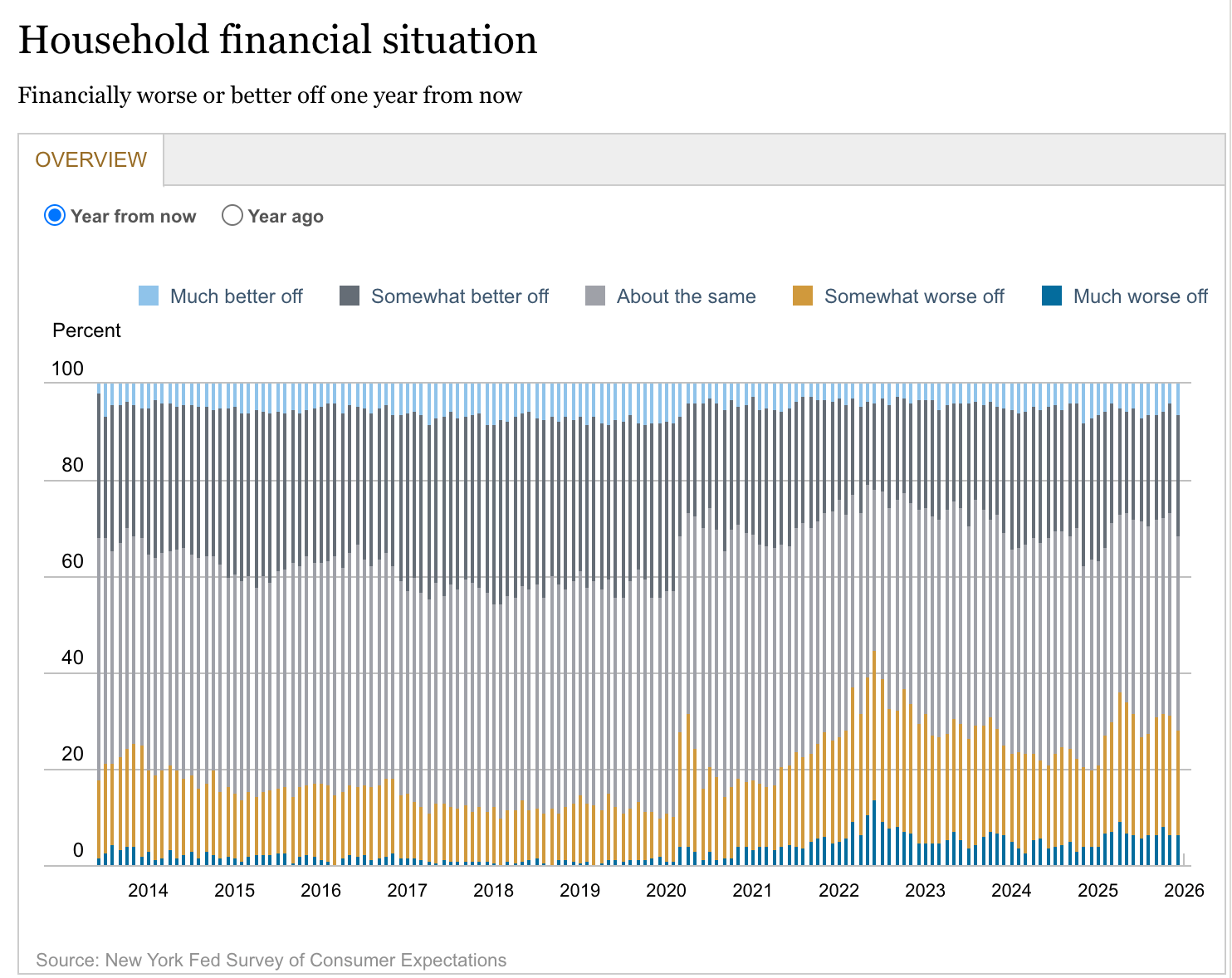

Family monetary predictions for the following 12 months:

- Get higher: 31%

- Keep the identical: 41%

- Worsen: 28%

Questions:

- Take into consideration the upcoming 12 months. What are you anticipating or hoping your 12 months will seem like?

- Had been you stunned by the information? Why or why not?

- Do you assume private elements (ie. job modifications) or societal elements (ie. inflation) have a bigger impression on folks’s predictions for the following 12 months? Why?

Click on right here for the ready-to-go slides for this Query of the Day you should use in your classroom.

Behind the numbers (NY Federal Reserve):

“The Federal Reserve Financial institution of New York’s Middle for Microeconomic Information immediately launched the December 2025 Survey of Shopper Expectations, which exhibits that households’ inflation expectations elevated on the short-term horizon and remained unchanged on the medium- and longer-term horizons. Job discovering expectations declined to a collection low—the second collection low for the measure in six months—whereas job loss expectations additionally worsened. Spending and family earnings progress expectations remained largely unchanged. Delinquency expectations deteriorated to the very best degree because the onset of the pandemic, however respondents had been extra optimistic about their future family monetary conditions.”

“Perceptions about households’ present monetary conditions in comparison with a 12 months in the past improved, with a smaller share of households reporting a worse monetary state of affairs and a bigger share of households reporting a greater monetary state of affairs. 12 months-ahead expectations about households’ monetary conditions additionally improved, with a smaller share of households anticipating a worse monetary state of affairs and a bigger share of households anticipating a greater monetary state of affairs (the very best since February 2025) in a single 12 months from now.”

About

the Writer

Kathryn Dawson

Kathryn (she/her) is happy to affix the NGPF staff after 9 years of expertise in schooling as a mentor, tutor, and particular schooling trainer. She is a graduate of Cornell College with a level in coverage evaluation and administration and has a grasp’s diploma in schooling from Brooklyn School. Kathryn is wanting ahead to bringing her ardour for accessibility and academic justice into curriculum design at NGPF. Throughout her free time, Kathryn loves embarking on cooking initiatives, strolling round her Seattle neighborhood together with her canine, or lounging in a hammock with a guide.