It is usually cited in surveys because the #1 reason behind bankruptcies within the U.S. How prevalent do you suppose medical debt is for American adults?

Reply: 29%

Questions:

- Why would possibly individuals with medical insurance nonetheless find yourself with medical debt?

- How would possibly carrying medical debt affect somebody’s different selections like shopping for a automotive or persevering with their schooling?

- Do you suppose medical debt seem on credit score reviews?

Behind the numbers (The Commonwealth Fund):

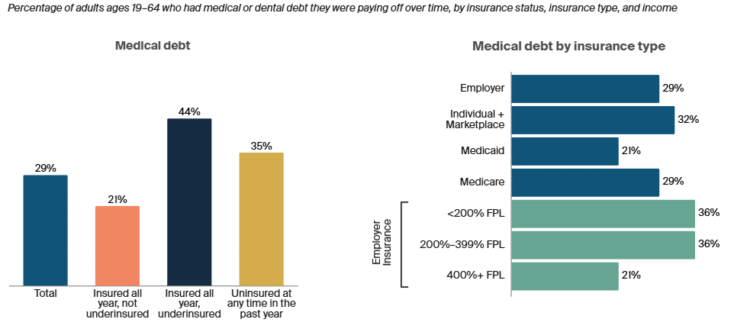

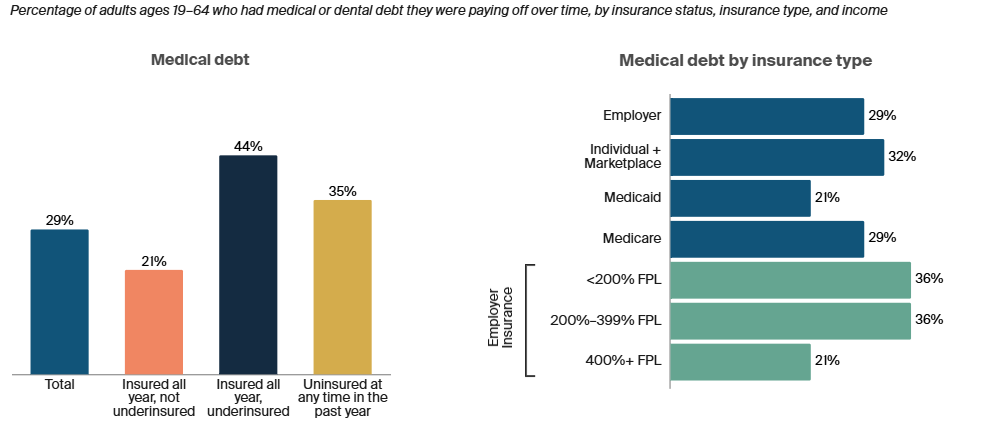

“Prices forestall many Individuals from searching for well being care, and people who do get care usually go away the hospital or physician’s workplace with payments they can’t pay. We requested individuals whether or not they had medical payments or debt of any type that they have been paying off over time, together with dental, dwelling well being, or long-term care. Three in 10 reported they have been paying off medical debt, with underinsured adults reporting this on the highest price.

Of survey respondents with employer protection, these with low and reasonable revenue reported paying off medical debt at larger charges than these with larger revenue. Folks in employer plans and the person market and marketplaces reported considerably larger charges of medical debt than individuals who had Medicaid.”

About

the Creator

Dave Martin

Dave joins NGPF with 15 years of instructing expertise in math and laptop science. After becoming a member of the New York Metropolis Educating Fellows program and incomes a Grasp’s diploma in Schooling from Tempo College, his instructing profession has taken him to New York, New Jersey and a summer time within the north of Ghana. Dave firmly believes that monetary literacy is significant to creating well-rounded college students which are ready for a fancy and extremely aggressive world. Throughout what free time two younger daughters will enable, Dave enjoys video video games, Dungeons & Dragons, cooking, gardening, and taking naps.