Suppose you’ll be able to outsmart the market? Spoiler alert: even the professionals hardly ever do.

Reply: 8%

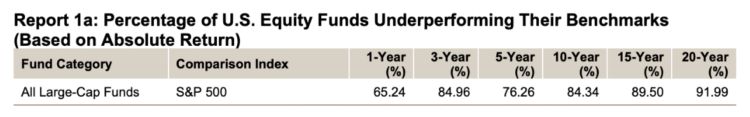

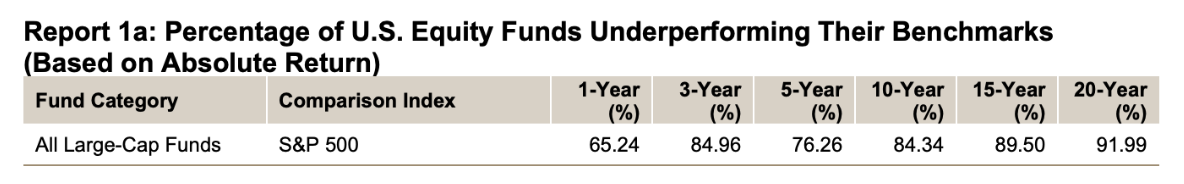

Solely 8% of fairness funds investing in giant firms beat the market.

Rationalization: 92% of fund managers underperformed the S&P 500. The remaining 8% met or beat the S&P 500.

Questions:

- Why do you suppose investing professionals battle to “beat the market?”

- Why do you suppose buyers nonetheless make investments their cash with professionals regardless of their document?

- Your pal says “you’re higher off investing with professionals as a substitute of shopping for a easy index fund (e.g., S&P 500) that matches the market return.” Do you agree or disagree?

Listed here are the ready-to-go slides for this Query of the Day you should use along with your college students.

Behind the numbers (SPIVA):

In an surroundings characterised by large-cap dominance, it was not stunning to see {that a} majority of actively managed fairness funds underperformed their assigned benchmarks in 2024. Fastened earnings managers had a blended yr, with pockets of excessive outperformance. In our largest and most carefully watched comparability, 65% of all lively large-cap U.S. fairness funds underperformed the S&P 500®, worse than the 60% fee noticed in 2023 and barely above the 64% common annual fee reported over the 24-year historical past of our SPIVA Scorecards.

Throughout asset lessons, underperformance charges usually rose as time horizons lengthened. On the one-year horizon, 7 of twenty-two fairness classes and 11 of 16 mounted earnings classes noticed majority outperformance. Over the 15-year interval ending December 2024, there have been no classes through which a majority of lively managers outperformed.

—————–

Train college students about index funds with the most well-liked sport within the NGPF Arcade, STAX.

About

the Creator

Kathryn Dawson

Kathryn (she/her) is worked up to hitch the NGPF workforce after 9 years of expertise in schooling as a mentor, tutor, and particular schooling instructor. She is a graduate of Cornell College with a level in coverage evaluation and administration and has a grasp’s diploma in schooling from Brooklyn Faculty. Kathryn is wanting ahead to bringing her ardour for accessibility and academic justice into curriculum design at NGPF. Throughout her free time, Kathryn loves embarking on cooking initiatives, strolling round her Seattle neighborhood together with her canine, or lounging in a hammock with a ebook.