Faculty graduates want a plan to pay again any cash they selected to borrow. Let’s have a look at how a lot that’s, on common.

Reply: $35,639

Questions:

- What components would an individual have to contemplate when deciding if it is price it to graduate with tens of hundreds of {dollars} in debt?

- Are you involved about pupil mortgage debt? Clarify why or why not.

- What can an individual do to attenuate their debt after they graduate?

Click on right here for the ready-to-go slides for this Query of the Day that you should use in your classroom.

Behind the numbers (Training Information Initiative):

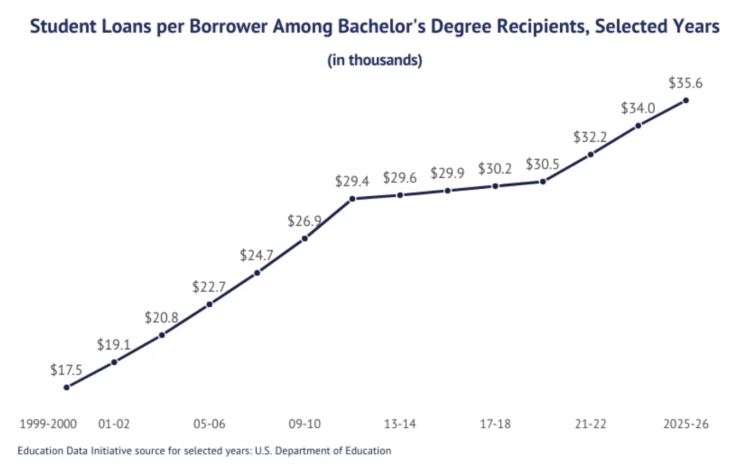

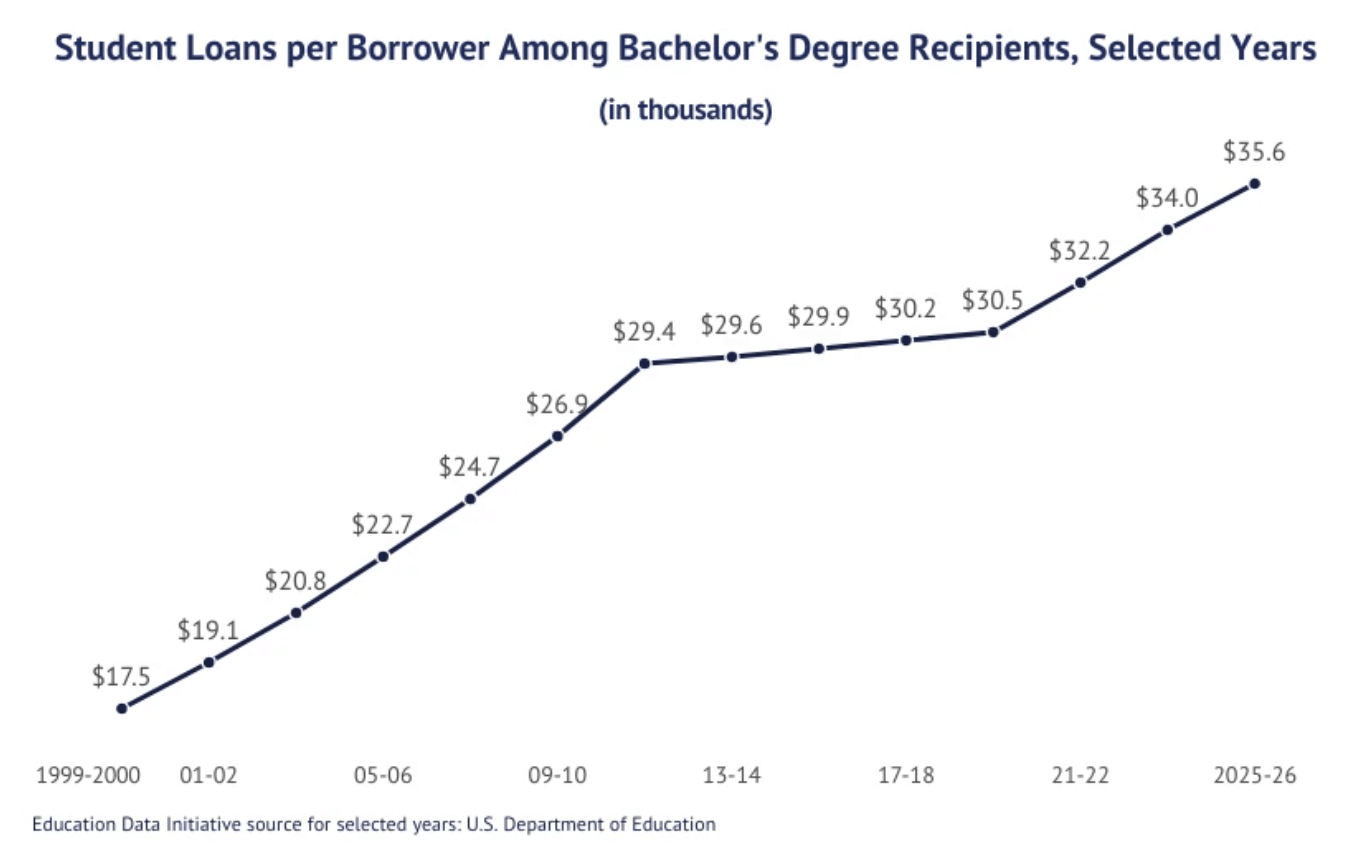

“College students who borrowed to pursue their bachelor’s diploma in 2025 took out a mean of $35,639 in schooling loans.

- 61.0% of current bachelor’s diploma graduates borrowed pupil loans.

- 47% of pupil debtors with bachelor’s levels have a debt stability over $25,000.

- 20.7% of American households have pupil mortgage debt; amongst them, the typical whole pupil debt stability is $52,138.”

————–

Performed by over 1,000,000 individuals, the sport PAYBACK develops pupil decision-making expertise required to get to and thru school.

————–

Attend NGPF Skilled Developments and earn Academy Credit by yourself time! Take a look at NGPF On-Demand modules!

About

the Writer

Kathryn Dawson

Kathryn (she/her) is happy to affix the NGPF workforce after 9 years of expertise in schooling as a mentor, tutor, and particular schooling instructor. She is a graduate of Cornell College with a level in coverage evaluation and administration and has a grasp’s diploma in schooling from Brooklyn Faculty. Kathryn is wanting ahead to bringing her ardour for accessibility and academic justice into curriculum design at NGPF. Throughout her free time, Kathryn loves embarking on cooking initiatives, strolling round her Seattle neighborhood along with her canine, or lounging in a hammock with a guide.