For those who’re completely and completely disabled, you may qualify for scholar mortgage forgiveness.

When your scholar loans are discharged attributable to incapacity, it’s possible you’ll be restricted in whether or not you may work or go to high school for a time frame. In any other case, your scholar loans could also be reinstated.

This may be an particularly tough situation to navigate in case your loans are discharged when you’re attending college, or plan to. And it may possibly occur even when you by no means deliberate on asking for a incapacity discharge.

Here is what to find out about incapacity discharge, and the right way to navigate your selections in case your loans are mechanically forgiven.

Whole and Everlasting Incapacity Discharge

Federal scholar loans could also be discharged if the borrower has a Whole and Everlasting Incapacity (TPD).

Eligible loans embrace:

- All loans within the William D. Ford Federal Direct Mortgage Program (Direct Loans)

- Federal Household Schooling Mortgage Program (FFELP)

- Federal Perkins Mortgage Program

- Federal Stafford Loans

- Federal Mum or dad PLUS Loans

- Federal Grad PLUS Loans

- Federal Consolidation Loans

- A TEACH Grant service obligation can be eligible for a TPD discharge.

There are three strategies of qualifying for a TPD discharge:

If the TPD discharge is authorized, funds made on or after the incapacity date will probably be returned to the borrower. The incapacity date is the date of the VA’s incapacity willpower, the date the U.S. Division of Schooling acquired documentation of the SSA discover of award or the date of the physician’s certification.

About half of personal scholar loans have a incapacity discharge that’s just like the TPD discharge for federal training loans, albeit with out automated discharge primarily based on a VA or SSA willpower.

Computerized Incapacity Discharge

The TPD discharge by way of a VA or SSA willpower is automated by way of a quarterly information match between the U.S. Division of Schooling and these federal companies. Debtors who qualify for a TPD discharge by way of an information match don’t have to submit a TPD discharge utility or present documentation of their incapacity willpower.

Debtors can decide out of the automated discharge. If a borrower opts out, they’ll apply for a TPD discharge later. Generally a borrower will delay the TPD discharge utility to make sure that all of their federal training loans are discharged or as a result of they’re involved about state revenue tax legal responsibility.

Incapacity Discharge by Software

If the borrower doesn’t obtain a incapacity discharge by way of the automated course of, they’ll additionally qualify by submitting the TPD discharge utility together with documentation of a VA or SSA willpower. For the SSA, documentation can embrace:

- A duplicate of the SSA discover of award for SSDI

- SSI advantages

- Advantages Planning Question (BPQY type 2459) indicating the following incapacity overview will probably be in 5-7 years from the date of the latest SSA incapacity willpower.

The way to submit an utility

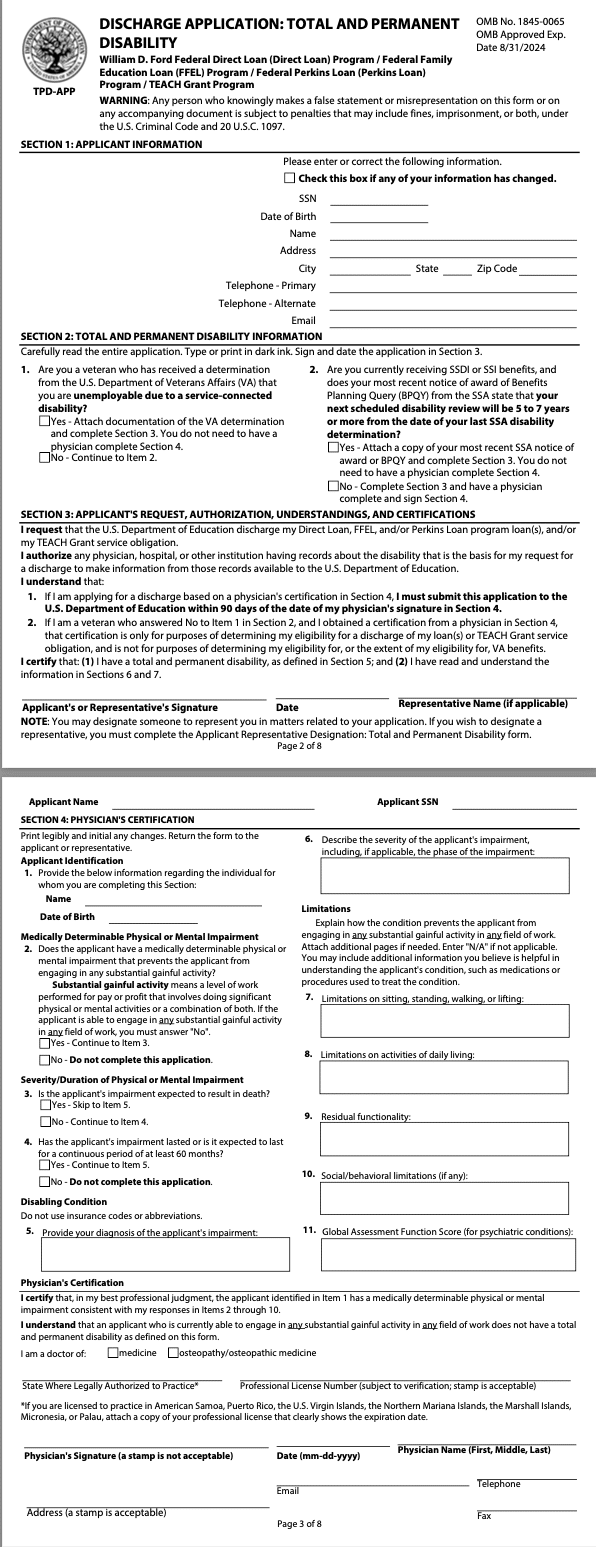

To obtain a TPD discharge by way of a physician’s certification, the borrower should submit an utility with the physician’s certification in part 4.

The applying could also be obtained within the following methods:

- Telephone: 1-888-303-7818

- E mail: disabilityinformation@nelnet.internet

- On-line

The applying may be submitted by the borrower’s consultant, however debtors should submit an Applicant Consultant Designation Kind first. An influence of lawyer will not be sufficient.

The federal authorities requires disabled debtors, who could also be unable to finish a type attributable to their incapacity, to submit a type so another person can full the shape on their behalf.

Whereas the TPD discharge utility is being processed and verified, the borrower’s loans will probably be positioned in a forbearance for as much as 120 days.

The precise incapacity discharge for less than requires 2 pages to be accomplished:

Tax Legal responsibility from the Cancellation of Pupil Mortgage Debt

The One Massive Stunning Invoice Act made scholar mortgage forgiveness attributable to incapacity tax-free completely.

Incapacity discharges can also be topic to state revenue tax in some states.

Put up-Discharge Monitoring Interval

If the borrower receives a TPD discharge due to a SSA willpower or a physician’s certification, the borrower will probably be topic to a three-year post-discharge monitoring interval beginning on the date the discharge is authorized. Debtors who qualify for a TPD discharge due to a VA willpower are usually not topic to the three-year post-discharge monitoring interval.

Efficient July 1, 2023, the monitoring interval not displays revenue, however moderately new monetary support.

The reimbursement obligation will probably be reinstated if the borrower receives a brand new federal training mortgage or TEACH Grant through the post-discharge monitoring interval. If the borrower receives a disbursement of a earlier federal training mortgage or TEACH Grant through the post-discharge monitoring interval and doesn’t return it inside 120 days of the disbursement date, the reimbursement obligation will probably be reinstated.

It is vital to notice how the monitoring interval impacts the efficient discharge date. For those who acquired VA incapacity discharge, there is no such thing as a monitoring interval, so the efficient date of discharge of your scholar loans is the date you obtain it.

Nonetheless, when you’re topic to the monitoring interval (SSA and Physician Dedication), the efficient date of incapacity discharge is when the monitoring interval is over.

Going Again to Faculty

As famous above, debtors who receive a brand new federal training mortgage or TEACH Grant through the three-year post-discharge monitoring interval could have their reimbursement obligation reinstated.

Debtors can proceed their faculty enrollment or return to high school through the three-year post-discharge monitoring interval. Nonetheless, in the event that they don’t want their reimbursement obligation to be reinstated, they can’t request a brand new federal training mortgage or TEACH Grant through the post-discharge monitoring interval.

After the three years are over, the borrower can receive a brand new federal training mortgage or TEACH Grant with out having the reimbursement obligation reinstated. Debtors who certified for a TPD discharge attributable to a VA willpower may receive new federal training loans instantly and TEACH Grants with out having the reimbursement obligation reinstated, since loans discharged due to a VA willpower are usually not topic to the post-discharge monitoring interval.

Nonetheless, to acquire a brand new federal training mortgage or TEACH Grant, the borrower should receive a certification from a physician that they can interact in substantial gainful exercise, even when there was no post-discharge monitoring interval.

The borrower should additionally acknowledge that the brand new federal training mortgage or TEACH Grant service obligation can’t be discharged on the idea of the borrower’s present incapacity until the borrower’s situation deteriorates sufficient for whole and everlasting incapacity.

Notice that the identical guidelines apply to father or mother debtors of a Mum or dad PLUS Loans, if the father or mother borrower beforehand had federal training loans qualifying for a TPD discharge. Solely the borrower of a Mum or dad PLUS Mortgage can have the mortgage discharged due to the borrower’s incapacity. If the coed on whose behalf the Mum or dad PLUS Mortgage was borrowed turns into disabled, the Mum or dad PLUS Mortgage is not going to be discharged.

Sometimes, a disabled scholar will wait till they graduate or drop out of school to use for a TPD Discharge.

Impression of Incapacity Discharge on Eligibility for Pupil Monetary Help

The TPD discharge doesn’t have an effect on the coed’s eligibility for different federal scholar support, such because the Federal Pell Grant or Federal Supplemental Instructional Alternative Grant (FSEOG).

Vocational rehabilitation help doesn’t have an effect on eligibility for federal scholar support.

If the vocational rehabilitation help doesn’t absolutely cowl the coed’s disability-related bills, the faculty monetary support administrator can embrace these bills within the scholar’s price of attendance. This transfer can yield a rise within the scholar’s demonstrated monetary want.

ABLE accounts are usually not reported as an asset on the Free Software for Federal Pupil Help (FAFSA).

References

The principles regarding a Whole and Everlasting Incapacity Discharge seem within the laws as follows:

- Federal Perkins Mortgage Program. 34 CFR 674.61(b) and (c)

- Federal Household Schooling Mortgage Program. 34 CFR 682.402(c)

- Federal Direct Mortgage Program. 34 CFR 685.213

- TEACH Grants. 34 CFR 686.42(b)

These laws are primarily based on the statutory language at 20 USC 1087 and 20 USC 1087dd(c)(1)(F).

Editor: Robert Farrington

The submit Pupil Mortgage Forgiveness Due To Incapacity: What To Know appeared first on The Faculty Investor.