Key Factors

- The White Home is signaling that not all furloughed employees could obtain again pay, creating new monetary dangers through the shutdown.

- Till employees obtain discover they don’t seem to be exempted and really cease receiving paychecks, they can not modify their loans.

- If paychecks do cease, and employees aren’t paid, re-certifying your pupil mortgage income-driven reimbursement plan with a $0 revenue can decrease funds and defend PSLF eligibility.

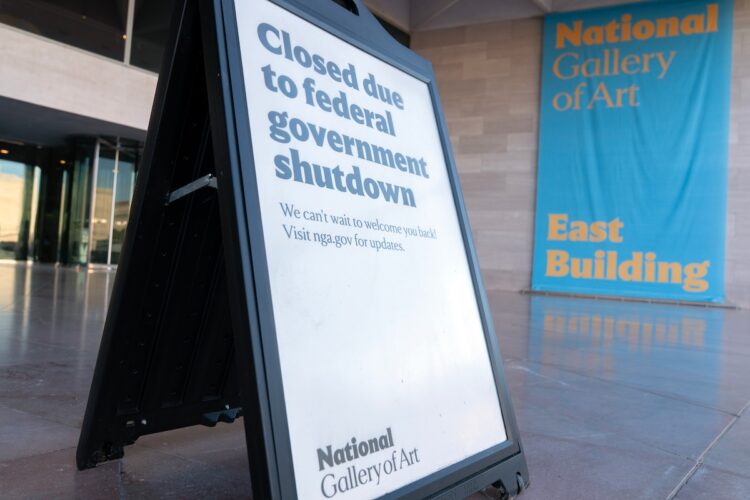

The October 2025 authorities shutdown has entered its second week, sidelining greater than 620,000 federal workers and disrupting key authorities features. The IRS alone has furloughed 46% of its workforce this week, whereas massive parts of the State Division, Division of the Inside, and Justice Division stay partially shuttered.

Tomorrow, October 10, goes to be the primary paycheck Federal workers will see that is lower than regular (because it consists of the interval of the primary days of the shutdown).

However the monetary stress deepened after President Trump prompt that some furloughed employees may not obtain again pay as soon as the shutdown ends, regardless of a 2019 regulation that was designed to ensure it.

The Authorities Worker Honest Remedy Act of 2019 (PDF), handed after the document 35-day shutdown in 2018-2019, added language to the Antideficiency Act requiring that each one furloughed and excepted workers obtain again pay robotically “on the earliest date doable” as soon as appropriations resume.

Nevertheless, the brand new White Home draft memo interprets that clause in another way, arguing that Congress should nonetheless cross appropriations earlier than any again pay may be issued.

An earlier Workplace of Administration and Finances memo from September 30 reaffirmed the 2019 regulation’s assure of again pay. However that reference was eliminated in an October 3 replace, signaling an inner debate inside the administration about whether or not the regulation is self-executing.

For furloughed employees with federal pupil loans, the implications are particularly critical. Missed or delayed pay can shortly translate into missed mortgage funds and potential delays to Public Service Mortgage Forgiveness (PSLF) progress.

Would you want to avoid wasting this?

Defending PSLF Eligibility If Paychecks Cease

For many authorities employees, the purpose is straightforward: keep away from lacking funds and hold PSLF progress intact.

Below PSLF, federal workers can have their pupil mortgage steadiness forgiven after 120 qualifying month-to-month funds whereas working full-time for a authorities or nonprofit employer. Funds made below an income-driven reimbursement (IDR) plan depend and months in forbearance normally don’t.

Which means the most secure approach to deal with a missed paycheck is to replace your IDR plan instantly to replicate your present revenue, which, throughout a furlough, may very well be $0.

This retains your mortgage in good standing, preserves forgiveness progress, and protects your credit score, all whereas permitting you to make an reasonably priced cost.

It is vital to notice that receiving backpay is totally different than not receiving pay. For those who obtain backpay, your revenue did not drop to $0. You had been simply delayed in being paid. Wherein case, you’ll be able to’t lie about your revenue. A forbearance stands out as the solely selection if you cannot afford your cost.

Nevertheless, should you really do not receives a commission for this time, your revenue is $0. Then, you are eligible to vary your reimbursement plan quantity based mostly in your present revenue. The nuance issues.

How To Setup Your Pupil Mortgage Cost Based mostly On $0 Earnings

Right here’s the step-by-step course of for furloughed employees who will not be getting paid:

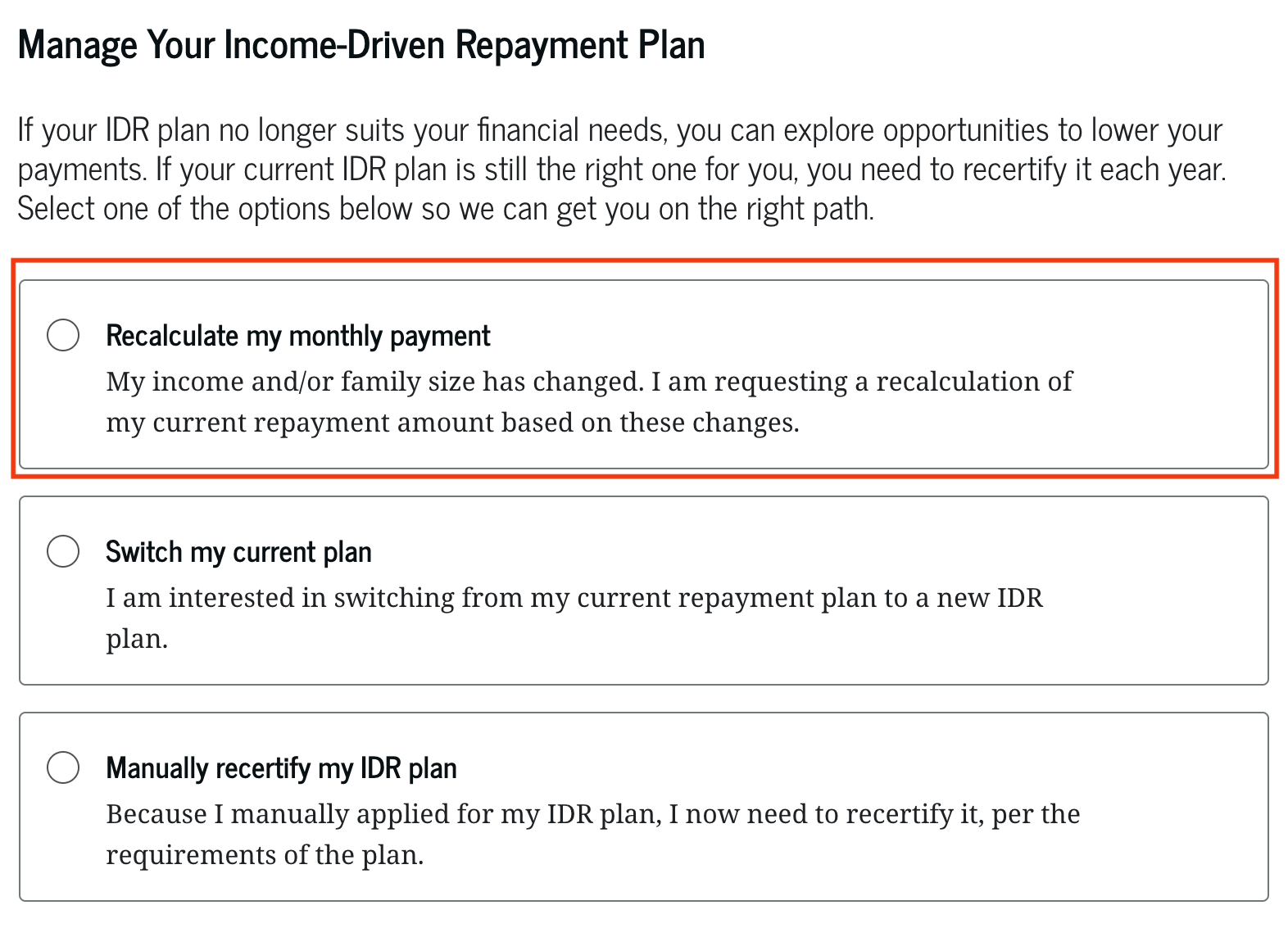

1. Log in at StudentAid.gov and select “Earnings-Pushed Reimbursement Plan.”

2. Choose “Recertify or Change Your Earnings-Pushed Reimbursement Plan.“

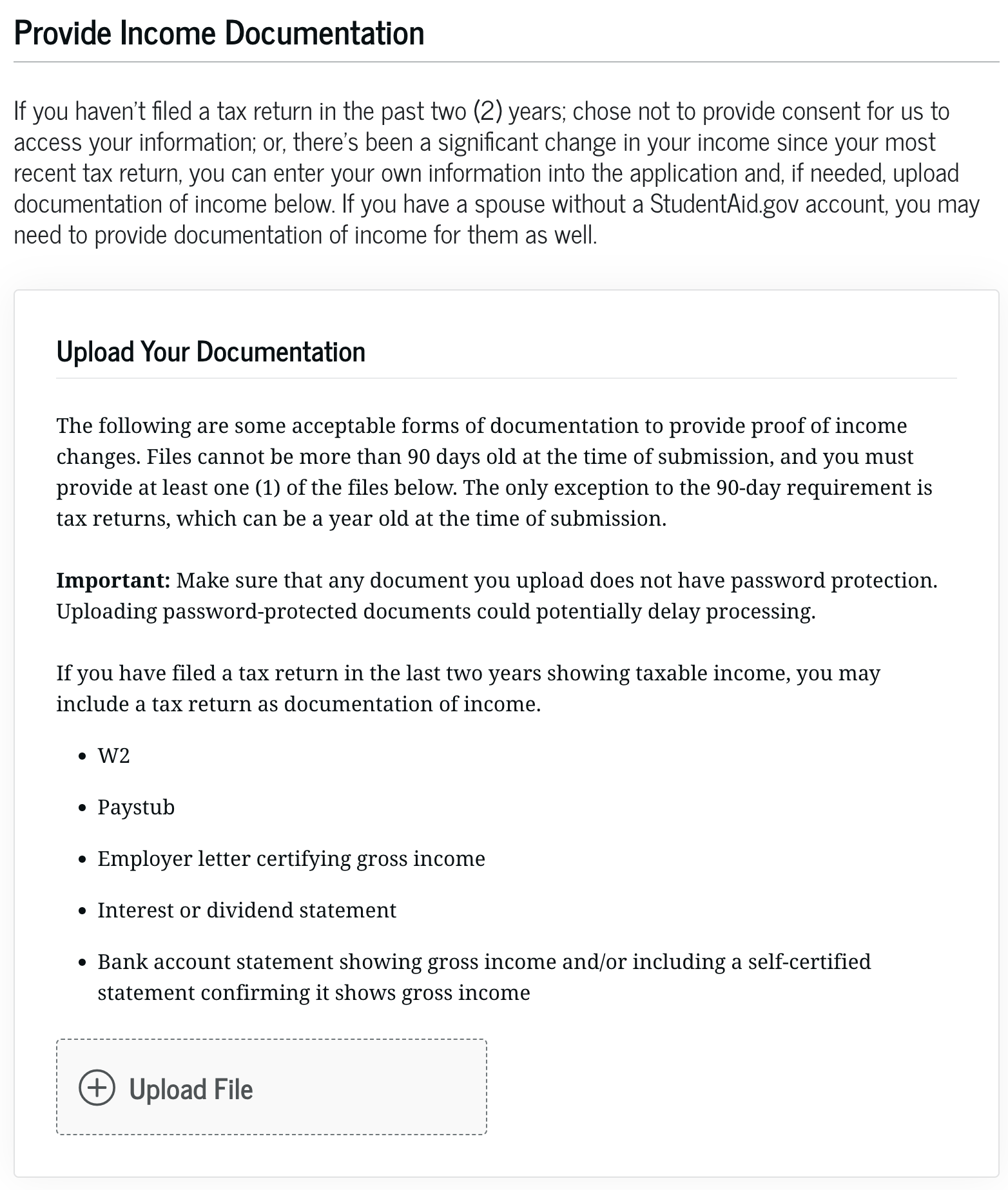

3. Enter your present revenue as $0 should you’re not receiving pay through the shutdown (however understand you could have different revenue).

4. Add documentation, reminiscent of your furlough letter, or write a short assertion explaining your lack of revenue.

5. Submit your utility and monitor your account for affirmation that your cost has been recalculated.

Below IDR guidelines, funds are tied to discretionary revenue. In case your revenue falls to zero, your month-to-month cost can too—and these $0 funds nonetheless depend towards PSLF so long as your employment stays energetic.

Why Forbearance Ought to Be A Final Resort

If you’ll obtain backpay and easily want a brief reprieve till you receives a commission, then a brief forbearance for a month or two could make sense. Since you may finally be paid in your time working.

Whereas forbearance gives a fast cost pause, it normally comes with hidden prices:

- Curiosity continues accruing, rising your whole steadiness.

- PSLF progress stops, since most forbearance intervals don’t depend towards qualifying funds.

- Restarting funds after forbearance can take time and require extra paperwork.

For those who’re eligible for a decrease cost since you’re not getting paid however you’ll be able to’t get your IDR request processed in time, ask your servicer for a short-term forbearance (30–90 days) to keep away from delinquency when you wait.

Are Furloughed Employees Nonetheless “Employed” For PSLF?

Sure, you are still employed when furloughed. Even should you’re unpaid throughout a shutdown, you’re nonetheless thought of employed by your federal company.

Nevertheless, after that it might get tough. Most authorities shutdowns solely final a number of days to every week. In these conditions, your “full-time 30+ hours per week” requirement probably will not be impacted because you’d nonetheless have a number of full time weeks through the month.

If this authorities shutdown lasts over a month, it is doable that the Division of Schooling may say this whole month wouldn’t qualify for PSLF, because you did not work full time. Whether or not they may get into the main points (or have the staffing to take action) stays to be seen.

However, assuming you stay on the payroll and haven’t resigned, you must take into account your self eligible for PSLF through the interval.

To guard your document:

- Save your furlough discover and HR emails.

- Proceed submitting your PSLF Employment Certification Kind as normal.

- Ask your HR workplace to confirm your employment dates as soon as the federal government reopens.

This documentation ensures your PSLF progress isn’t interrupted later by confusion over furlough standing.

What About Authorities Employees Who Are Working With No Paycheck?

Whereas practically half of the federal authorities is furloughed, one other half are working with out pay. What are one of the best choices for them?

It is a comparable state of affairs: since you’re working full time, and you’ll obtain again pay (because you’re working, not furloughed), your time will stay PSLF-eligible. And so long as you proceed your funds, they may depend as qualifying funds.

The problem comes with making that cost if you cannot afford it as a consequence of not receiving a paycheck.

On this state of affairs, you are confronted with an unappealing selection: forbearance. It is unappealing as a result of which means your time working will not depend for PSLF. However should you actually cannot afford your cost as a result of you have to save money for necessities like housing and meals, then you’ll be able to’t fear about your pupil mortgage cost.

Is IDR Processing Delayed?

If you wish to change your reimbursement plan as a consequence of a change of revenue, will not it take perpetually? Not likely.

We’re seeing most IDR functions processed inside 3-7 days, since most of this work is dealt with by third-party contractors like pupil mortgage servicers.

For those who do begin lacking paychecks and might’t get your IDR utility processed, you’ll be able to ask for a processing forbearance throughout that point in order that no funds will likely be due whereas the IDR utility is being processed.

Dealing With A Cloud Of Uncertainty

With the administration questioning whether or not again pay is assured, furloughed employees ought to plan for the chance that paychecks misplaced throughout the federal government shutdown is probably not reimbursed for time spent not working.

Sensible steps embody:

- Prioritize important bills like housing, utilities, and meals.

- Pause nonessential spending and automated transfers the place doable.

- Faucet emergency financial savings if obtainable, moderately than high-interest credit score.

- Selecting a financial institution that gives shutdown help like Navy Federal Credit score Union, which is providing shutdown help to impacted members.

For households relying on again pay to catch up, this uncertainty underscores the significance of decreasing fastened obligations now, together with pupil loans.

Takeaways for Federal Employees

- Plan for delayed paychecks: again pay just isn’t assured, so handle bills conservatively.

- If you’re not going to be paid: Recertify your IDR plan now if eligible to replicate your $0 revenue earlier than lacking a cost.

- Hold PSLF progress intact by avoiding forbearance besides as a final resort.

- Monitor official updates from the Division of Schooling, Workplace of Personnel Administration, and StudentAid.gov.

- Hold information of your employment, communications, and functions to guard your eligibility later.

Do not Miss These Different Tales:

Editor: Colin Graves

The publish Pupil Loans And Furloughs: What to Do Now appeared first on The Faculty Investor.