Embattled Federal Reserve Governor Lisa Cook dinner is going through accusations of mortgage fraud—particularly, owner-occupancy mortgage fraud. The declare is that she took out two mortgages in two states, inside two weeks, whereas designating each properties as her “main residence.”

If true, it’s a horrible search for somebody sitting on the Fed, the very establishment tasked with upholding the principles and integrity of our banking system. It’s just like the referee secretly betting on the sport. That mentioned, we’re all presumed harmless till confirmed responsible. It’s onerous to consider somebody so excessive up within the banking system, with so many eyes on them, would knowingly commit fraud. However stranger issues have occurred.

Since this website is all about saving, making, and investing more cash to realize monetary freedom, let’s use this newest controversy as a springboard to raised perceive mortgages. In spite of everything, most of us depend on them to purchase our dream properties. And the decrease the rate of interest, the extra wealth we get to maintain.

The Penalty For Mortgage Fraud Can Be Extreme

The penalties for owner-occupancy fraud, which falls below the broader umbrella of mortgage fraud, will be surprisingly harsh, even when enforcement is uncommon. Technically, mortgage fraud is a federal crime below 18 U.S.C. § 1344 (financial institution fraud), punishable by as much as 30 years in jail and fines of as much as $1 million. In apply, although, the utmost sentences are usually reserved for large-scale fraud rings, shady brokers, or lenders gaming the system.

Nonetheless, lenders have the proper to name the mortgage due instantly by way of an acceleration clause, which might require the borrower to repay your complete steadiness directly or danger foreclosures. They may additionally retroactively re-price the mortgage as an funding property mortgage, which means greater charges and charges, and reduce off entry to favorable refinancing or future loans.

Past the monetary hit, the reputational harm will be extreme. Whereas the common borrower in all probability flies below the radar, public figures, brokers, and actual property professionals danger having their credibility torched in the event that they’re caught.

However right here’s the fact: owner-occupancy fraud is probably going much more widespread than regulators would admit. The monetary incentives are apparent, enforcement is weak, and the soiled little secret is that loads of debtors have quietly bent the principles to save cash on their mortgages.

The Profit Of Claiming Two Major Residences For A Mortgage

The principle motive why somebody would declare a rental property or trip property as their main residence is as a result of lenders supply decrease mortgage charges for main residence debtors. Whether or not you might be refinancing your mortgage or shopping for a brand new property with a mortgage, the common mortgage charge is often round 50 foundation factors (0.5%) decrease for a main residence than for an funding property or trip property mortgage.

On 1,000,000 greenback mortgage, that quantities to $5,000 a yr in curiosity financial savings. Over a interval of 10 years, if the principal steadiness remained the identical resulting from an curiosity solely mortgage, that is $50,000.

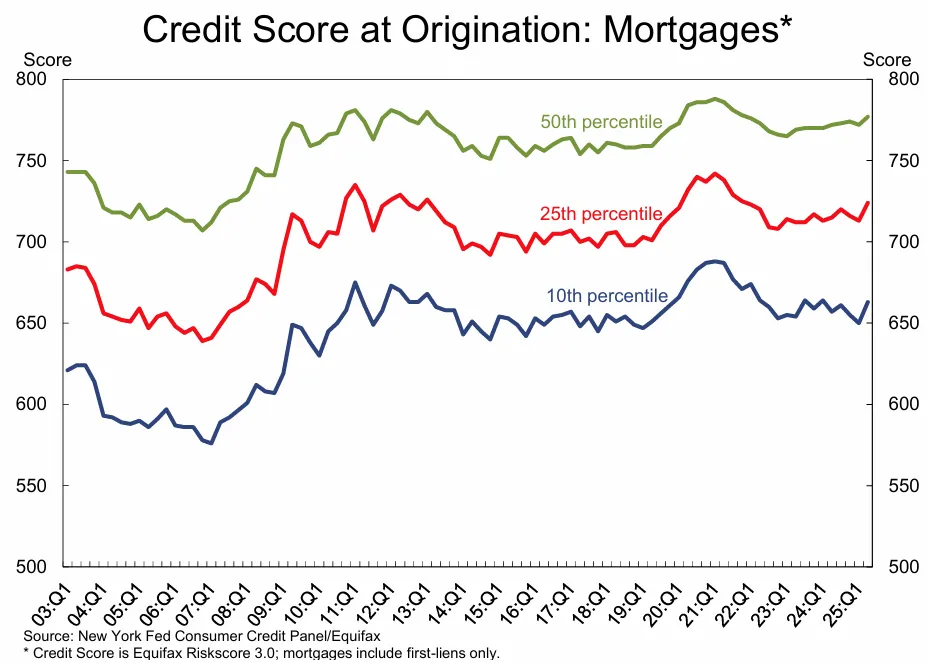

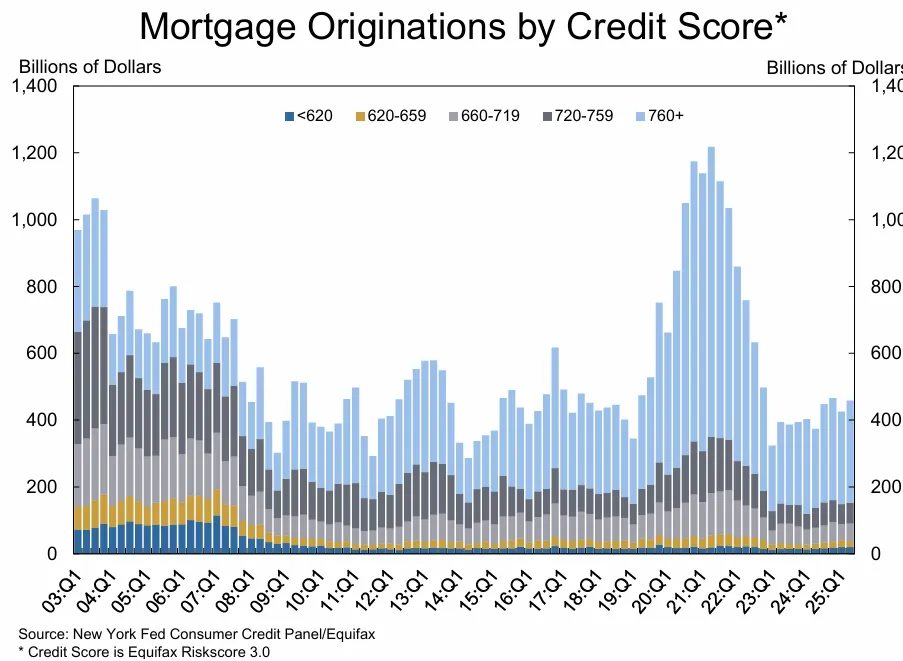

To the lender’s credit score, because the 2009 world monetary disaster, they’ve been making mortgage candidates undergo the wringer to show their earnings, wealth, and credit-worthiness. Lenders have been far stricter since 2009, and do not need to be left with big losses once more. It might usually take me two or three months to get a brand new mortgage.

Lenders will make you signal a doc stating you might be refinancing or taking out a brand new mortgage for a main residence. You may additionally should share a utility invoice maybe, however that is simple to maintain in your identify.

Nevertheless, not as soon as, in my greater than 15 mortgage purposes, has the mortgage officer ever personally come out to confirm that I used to be taking out a main residence mortgage. And even when they did, how may they show I wasn’t if I confirmed as much as my empty or not empty rental property? They cannot, except they rent a personal detective to observe my each transfer for months.

Clearly, the mortgage trade doesn’t have the assets—or the inducement—to crack down onerous on owner-occupancy fraud. Mortgage officers are targeted on incomes their commissions, whereas banks are wanting to e book income and transfer on to the subsequent borrower.

Why Major Residence Mortgages Are Cheaper

From a borrower’s perspective, paying a 0.5% premium for a trip residence or rental property mortgage feels pointless. If you happen to’re rich—or reckless—sufficient to purchase a trip property you solely use a couple of weeks a yr, you clearly have money movement. Why ought to the financial institution tack on the next charge?

And with an funding property, you’ve bought each your earnings and rental earnings from a tenant to cowl the mortgage. Shouldn’t that make the mortgage charge the identical, and even decrease, than a main residence mortgage? You are much less dangerous given you might have an further supply of earnings.

Sadly, borrower logic isn’t lender logic.

- Trip properties: From the financial institution’s perspective, these are luxuries, not requirements. When the economic system sours, trip properties are the primary to hit foreclosures—as we noticed within the 2008–2009 monetary disaster. Individuals ditch the lake home earlier than their essential roof over their heads. Banks hate holding foreclosed properties, in order that they pad charges to guard in opposition to losses. Foreclosing on and promoting off a main residence is less complicated as a result of the pool of patrons is bigger.

- Rental properties: Lenders assume you want tenant earnings to afford the mortgage. However turnover, vacancies, and late funds make rental earnings unstable. That’s why banks usually low cost reported rental earnings by ~30% when calculating what you’ll be able to borrow. What seems to be like bonus money to you seems to be like unreliable earnings to them.

In the meantime, a gentle W-2 paycheck used to qualify for a main residence is taken into account a lot safer. That’s why main residence loans get one of the best pricing.

In brief, banks view second properties and leases as “needs” somewhat than “wants,” which makes them riskier, and riskier loans at all times include the next value.

The Authorized Workaround to Getting a Major Residence Fee on a Rental

The cleanest solution to get a main residence mortgage charge on a rental property is easy: observe the legislation. Take out or refinance the mortgage as a main residence, then really reside within the property for no less than one yr. After that, you’re free to lease it out, and also you’ll nonetheless be having fun with the cheaper charge.

This is likely one of the massive benefits of the U.S. mortgage system. You’ll be able to lock in a low mounted charge for many years. As an illustration:

- A 10/1 ARM provides you 10 years of mounted funds. Reside there for one yr, then lease it out whereas protecting 9 extra years on the main residence charge.

- A 30-year mounted works the identical method—reside there for a yr, then lease it out with 29 years of cheaper debt nonetheless in place.

This dovetails with one among my favourite actual property wealth-building methods: purchase a main residence, reside in it for 2 years, then both promote tax-free (as much as $250,000 in beneficial properties if single, $500,000 if married) or maintain it as a rental. Do that a couple of instances over your life and you’ll comfortably construct 3–6 properties that fund retirement—all whereas staying 100% compliant with the principles.

That’s very completely different from making use of for two “main residence” mortgages in two states inside two weeks. One is strategic, affected person, and authorized. The opposite seems to be calculated and fraudulent. Sure, timing purposes shut collectively in numerous states makes it tougher for lenders to catch, however that is dangerous in case you’re in a excessive profile seat.

The Lender Can’t Management Your Life After Closing

Right here’s the factor about owner-occupancy fraud: generally it’s not fraud in any respect, it’s simply life. You might signal a doc promising to reside within the property for a yr, however circumstances change. Perhaps you lose your job three months later. As an alternative of bleeding money you don’t have, you progress right into a buddy’s basement and lease out the property to remain afloat.

Is that fraud? I don’t assume so. You tried to honor the settlement, however the economic system handed you a crap sandwich and you probably did what you needed to do. And let’s be frank, no lender is sending somebody to knock in your door and verify in case you’re nonetheless dwelling there. They’re too busy attempting to shut their subsequent mortgage.

Or image this: you purchase a house in San Francisco and reside there for six months. Then a dream job supply lands in New York Metropolis—double the pay and a promotion. You propose to return to San Francisco sometime, so that you lease out the property at market charges whilst you’re gone. What financial institution has the proper to inform you to depart it empty, or worse, decline the chance? No financial institution.

Life is unpredictable. Which is why there are in all probability hundreds of instances every year that seem like owner-occupancy fraud on paper however are actually simply individuals adapting to altering circumstances. The actual distinction is intent: did the borrower intentionally misrepresent themselves, or did life power their hand?

You’ll be able to’t actually blame a borrower for considering forward both. Many individuals need to climb the property ladder each time their funds or circumstances permit. And if the perfect residence to lift a household comes alongside, the temptation is to grab it.

The Backside Line

There’s an enormous distinction between working the system inside the legislation and outright mendacity to lenders. One is strategic. The opposite is fraud.

If the allegations in opposition to Lisa Cook dinner are true, it’s not solely embarrassing for her but additionally for the Fed. On the similar time, the case highlights a actuality few focus on: owner-occupancy fraud is much extra widespread than individuals assume. The incentives are robust, and the enforcement is weak.

Sure, many debtors who lie are merely attempting to save cash. But when too many unqualified patrons tackle mortgages they will’t comfortably afford, the danger extends past the person. It places the housing and lending trade on shakier floor when the subsequent downturn arrives.

Readers, what are your ideas on owner-occupancy fraud as a solution to safe a decrease main mortgage charge? Ought to lenders tack on a 50-basis-point (or greater) premium for rental and trip properties? And do you consider the Fed governor knowingly dedicated mortgage fraud simply to save cash?

Make investments In Actual Property With out Needing A Mortgage

If you wish to diversify into actual property with out taking over a mortgage, think about Fundrise—a platform that permits you to make investments 100% passively in built-to-rent residential and industrial properties. With about $3 billion in non-public actual property belongings below administration, Fundrise primarily targets the Sunbelt area, the place valuations are decrease and yields are typically greater.

Because the Federal Reserve embarks on one other multi-year rate of interest reduce cycle, actual property demand is prone to rebound. The sharp rise in mortgage charges from 2022–2025 has dramatically slowed new building, which may result in better lease stress in 2026 and past. That’s why it could make sense to take a position right now earlier than lease inflation probably accelerates.

I’ve personally invested over $500,000 in a few Fundrise funds, and so they’ve been each a trusted associate and long-time sponsor of Monetary Samurai. With only a $10 minimal, diversifying your portfolio into actual property has by no means been simpler.

Subscribe To Monetary Samurai

Decide up a duplicate of my USA TODAY nationwide bestseller, Millionaire Milestones: Easy Steps to Seven Figures. I’ve distilled over 30 years of monetary expertise that will help you construct extra wealth than 94% of the inhabitants and break away sooner. A core a part of changing into a millionaire is investing in actual property.

Pay attention and subscribe to The Monetary Samurai podcast on Apple or Spotify. I interview specialists of their respective fields and focus on a few of the most fascinating subjects on this website. Your shares, scores, and opinions are appreciated.

To expedite your journey to monetary freedom, be a part of over 60,000 others and subscribe to the free Monetary Samurai e-newsletter. You can too get my posts in your e-mail inbox as quickly as they arrive out by signing up right here. Monetary Samurai is among the many largest independently-owned private finance web sites, established in 2009. The whole lot is written based mostly on firsthand expertise and experience.