(Bloomberg) — Merchants within the choices market are making ready for the pound to tumble as a lot as 8% extra as fiscal woes that prompted a painful selloff throughout UK markets final week weigh on the foreign money.

Most Learn from Bloomberg

There’s sizable demand for contracts that pay out beneath $1.20 — virtually 2% decrease than the place the foreign money was buying and selling on Friday — in response to information from the Depository Belief & Clearing Company. Some merchants are even betting on sterling falling beneath $1.12, the weakest stage in additional than two years.

Sterling proved probably the most fragile foreign money amongst developed-nation friends final week as concern about Donald Trump’s insurance policies, sticky inflation and excessive ranges of borrowing triggered a world retreat — with UK belongings on the epicenter of the turmoil. Traders say the market is underestimating the necessity for fee cuts to spur the economic system, one other supply of potential strain for the pound.

“The trail of least resistance is decrease at this juncture,” mentioned Jamie Niven, a fund supervisor at Candriam. “On one aspect, you’ve gotten very restricted pricing in of Financial institution of England cuts, whereas the fiscal considerations are additionally sterling damaging.”

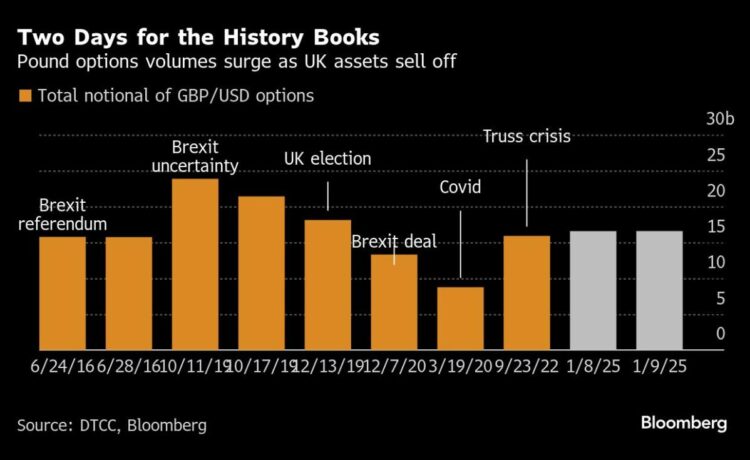

The pound slumped in tandem with different UK belongings final week as 10-and 30-year gilt yields jumped 1 / 4 proportion level and the FTSE 250 inventory index notched its worst drop since mid-2023. That prompted comparisons with the market meltdown after Liz Truss’s disastrous mini-budget in 2022, though the severity of the strikes was not matched.

Nonetheless, demand for pound choices final week surpassed ranges seen throughout that disaster — and even across the 2016 Brexit referendum.

In keeping with Mimi Rushton, Barclays’ world head of foreign money distribution, there was a 300% improve in commerce inquiries concerning sterling choices, as hedge funds flocked to wager on additional weak point. The unusually excessive volumes made some buying and selling situations “more difficult,” she mentioned.

Contracts on the pound that pay out if it strengthens in opposition to the greenback had been in favor in the beginning of the yr. However the spike in bond yields seen final week has prompted the sharpest shift in sentiment in additional than two years, the DTCC information present.

Demand for “longer-dated choices stays fairly elevated, suggesting that the market just isn’t but completed with this theme,” mentioned Tim Brooks, head of FX choices buying and selling at Optiver.