Canada’s excessive

is eroding the boldness of its residents on the subject of their

Two-thirds of Canadians say inflation has made it tough to avoid wasting for retirement, whereas 74 per cent mentioned excessive costs have added to the issues that their retirement nest egg might not be sufficient, in line with a

by Financial institution of Montreal.

Canada’s

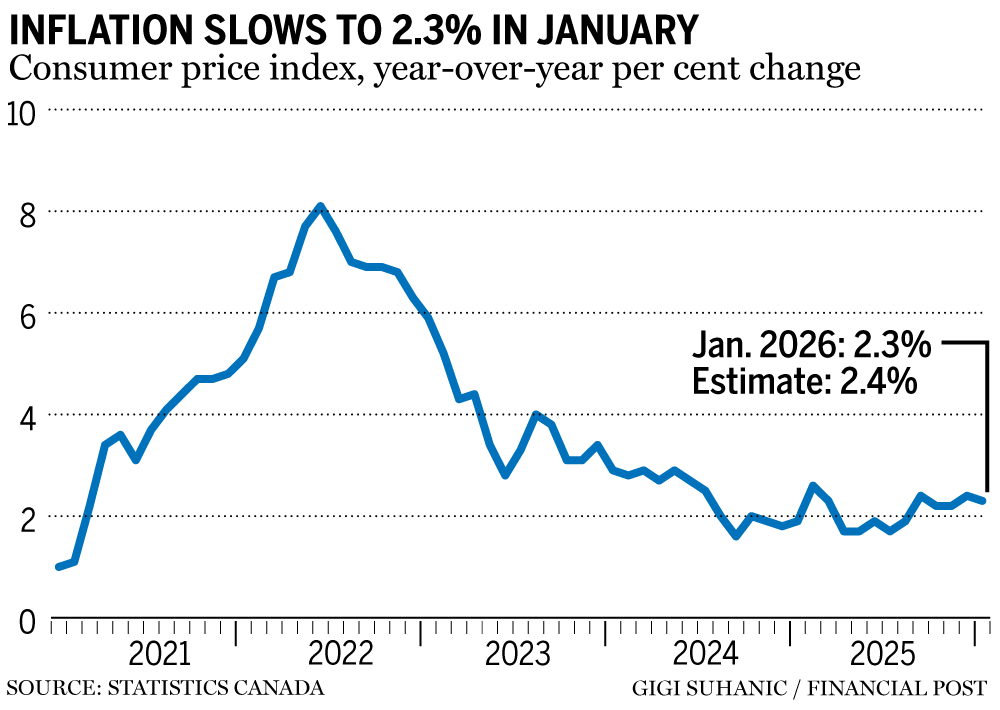

inflation price inched decrease to 2.3 per cent

in January, however a 16.7 per cent drop in gasoline costs was the primary issue behind the dip. With out gasoline costs, inflation was three per cent, proper on the higher restrict of the Financial institution of Canada’s goal vary.

Amongst those that mentioned inflation is hurting their financial savings prospects, about half mentioned they’re paying between $100 and $300 extra monthly for requirements, whereas a 3rd mentioned it’s costing them greater than $300 additional.

Canadians try to make up the distinction, with 31 per cent saying they’re contributing much less to retirement, 27 per cent are slicing again on spending and 17 per cent are pausing retirement financial savings altogether.

Consequently, they could be falling behind on retirement financial savings. Canadians are earmarking about 3.74 per cent of their disposable earnings for retirement, amounting to about $3,570 per yr, in line with a

report by Constancy Investments Canada ULC

.

Constancy mentioned Canadians underneath the age of 35 have median family financial savings of $159,100, which grows to $738,900 for these 65 years of age or older.

However BMO mentioned Canadians are frightened about their cash lasting. Whereas 30 per cent mentioned they don’t understand how lengthy their financial savings would possibly final, 22 per cent mentioned they’d final between 10 and 20 years and simply 13 per cent imagine they’ll final greater than 30 years.

BMO recommends retirement savers begin planning early, keep financial savings plans as a part of their common bills and search skilled recommendation to advocate new saving methods.

“The hot button is to remain invested and take a proactive method,” Brent Joyce, chief funding strategist at BMO Personal Wealth, mentioned in a launch. “By incorporating inflation assumptions into complete monetary plans, we assist Canadians perceive how their portfolios can carry out over many years — not simply years. With disciplined investing and skilled steerage, shoppers can guarantee their cash grows quicker than inflation and helps the approach to life they’ve envisioned.”

Enroll right here to get Posthaste delivered straight to your inbox.

Canada’s inflation price slowed to 2.3 per cent year-over-year in January, as a steep drop in gasoline costs moved the general price down.

In complete, gasoline costs dropped 16.7 per cent within the month, which means inflation with out gasoline really ticked as much as three per cent.

The GST/HST vacation in early 2025 meant that restaurant costs climbed 12.3 per cent final month, whereas different merchandise coated underneath this system, together with toys, clothes and alcohol, additionally rose.

The figures have some economists suggesting that the door could also be opening for the

Financial institution of Canada

to chop rates of interest as soon as once more.

- 2:00 p.m.: U.S. Federal Open Market Committee minutes

- As we speak’s Information: Canada current dwelling gross sales and MLS dwelling value index for December, U.S. housing begins for November and December

- Earnings: HSBC Holdings Plc, Rin Tonto Plc, DoorDash Inc., Kinross Gold Corp., Nutrien Ltd., Molson Coors Beverage Co.

- Cooler inflation provides Financial institution of Canada a gap to chop charges if financial system falters, say economists

- Taxing unrealized features is a foolish concept that Canada ought to ignore

- Canada’s inflation price cools to 2.3% as gasoline costs fall

- Ontario designates Kinross Gold’s Nice Bear challenge for fast allow approval

- Emmanuelle Gattuso has a radical concept: take names off buildings when the value is correct

For these afraid of working out of cash in retirement, a fast evaluation from a monetary planner can go an extended approach to encourage confidence or ensure you are heading in the right direction. These conferences may assist with understanding all of your investments and the place to go from there.

Considering power? The subscriber-only FP West: Vitality Insider e-newsletter brings you unique reporting and in-depth evaluation on one of many nation’s most necessary sectors.

McLister on mortgages

Need to be taught extra about mortgages? Mortgage strategist Robert McLister’s

may also help navigate the advanced sector, from the newest tendencies to financing alternatives you received’t wish to miss. Plus examine his

for Canada’s lowest nationwide mortgage charges, up to date each day.

Monetary Publish on YouTube

Go to the Monetary Publish’s

for interviews with Canada’s main consultants in enterprise, economics, housing, the power sector and extra.

As we speak’s Posthaste was written by Ben Cousins with extra reporting from Monetary Publish employees, The Canadian Press and Bloomberg.

Have a narrative concept, pitch, embargoed report, or a suggestion for this text? E-mail us at

.

Bookmark our web site and assist our journalism: Don’t miss the enterprise information it’s essential know — add financialpost.com to your bookmarks and join our newsletters right here