A poor millionaire seems like an oxymoron, however they undoubtedly exist. Roughly 6% of U.S. households are millionaires, but a lot of them nonetheless don’t really feel wealthy.

A poor millionaire is somebody value over $1 million however unable to entry a lot of their wealth. In different phrases, their internet value is very illiquid. A layoff, bear market, or job loss may rapidly put them in peril.

In distinction, a wealthy millionaire can be value over $1 million however can simply faucet into their wealth. They’re liquid and resilient to monetary shocks. Not solely are they wealthy financially, they’re richer mentally. The considered monetary destruction hardly ever crosses their minds.

The Key Liquidity Zapper for Millionaires

The primary wrongdoer behind illiquidity is the main residence. Proudly owning a pleasant house is superior, particularly if you happen to get to earn a living from home or are retired. You simply must watch out proudly owning an excessive amount of house.

If you wish to really feel comfy, purpose to maintain your main residence beneath 30% of your internet value. If you wish to really feel wealthy, preserve it beneath 20%. That approach, not less than 80% of your internet value might be in liquid or semi-liquid belongings.

In actuality, although, sustaining 70%–80% liquidity is hard, and in addition pointless. Millionaires usually put money into rental properties, personal actual property funds, enterprise capital, enterprise debt, and different illiquid alternate options. Decamillionaires and up normally have vital personal enterprise fairness as nicely, one other illiquid asset class.

That’s why having not less than 20% of your internet value in liquid belongings—like shares and bonds—is so worthwhile. You’ll sleep higher understanding you by no means must promote illiquid holdings at fire-sale costs and at all times have dry powder to purchase the dip when markets panic.

Advisable Revenue And Web Price Chart Earlier than Shopping for A House

Beneath is a useful home-buying chart I put collectively primarily based on revenue and internet value minimums. Ideally, it is best to have each the really useful revenue and really useful internet value related together with your goal house value. If not, you want not less than one of many following mixtures earlier than continuing:

- The really useful revenue + the minimal internet value, OR

- The really useful internet value + the minimal revenue

In any other case, you may probably really feel financially strained.

My Expertise With Liquidity After 26+ Years of Constructing Wealth

My suggestions come from real-life expertise, constructing wealth from nothing in 1999 to monetary independence as we speak.

With each house buy since 2003, I’ve tracked how each made me really feel. My newest house buy in 2023 was one other check of my 20%–30% rule. It was an all-cash deal equal to about 23% of my internet value.

The second I closed, I felt uncomfortable—home wealthy and money poor—hoping nothing dangerous would occur to our funds within the subsequent yr. It was a horrible feeling that I could not wait to eradicate.

I even wrote about residing paycheck to paycheck after that buy, which ruffled some feathers. However I used to be merely being trustworthy about how I felt. From that uncomfortable place, I made a decision to spice up liquidity by negotiating extra on-line enterprise offers and taking over a part-time consulting position at a seed-stage fintech startup. Too dangerous I may solely final 4 months as a result of I didn’t benefit from the micromanagement.

The expertise reaffirmed my perception: to really feel really wealthy and safe, preserve your main residence to not more than 20% of your internet value. Despite the fact that I survived the nervousness, I don’t wish to really feel that approach once more.

Because of a bull market and continued financial savings, my house now represents about 19% of my internet value, and I really feel nice – nearly like I bought a freebie. What amplified that feeling was promoting my outdated main residence in early 2025, after renting it out for a yr. Changing that illiquid property fairness into public shares, Treasuries, and an open-ended enterprise fund that provides quarterly liquidity felt superb.

As bullish as I’m on single-family properties with views on San Francisco’s west aspect, the peace of thoughts that comes with liquidity trumps all.

Liquidity by Stage of Millionaire

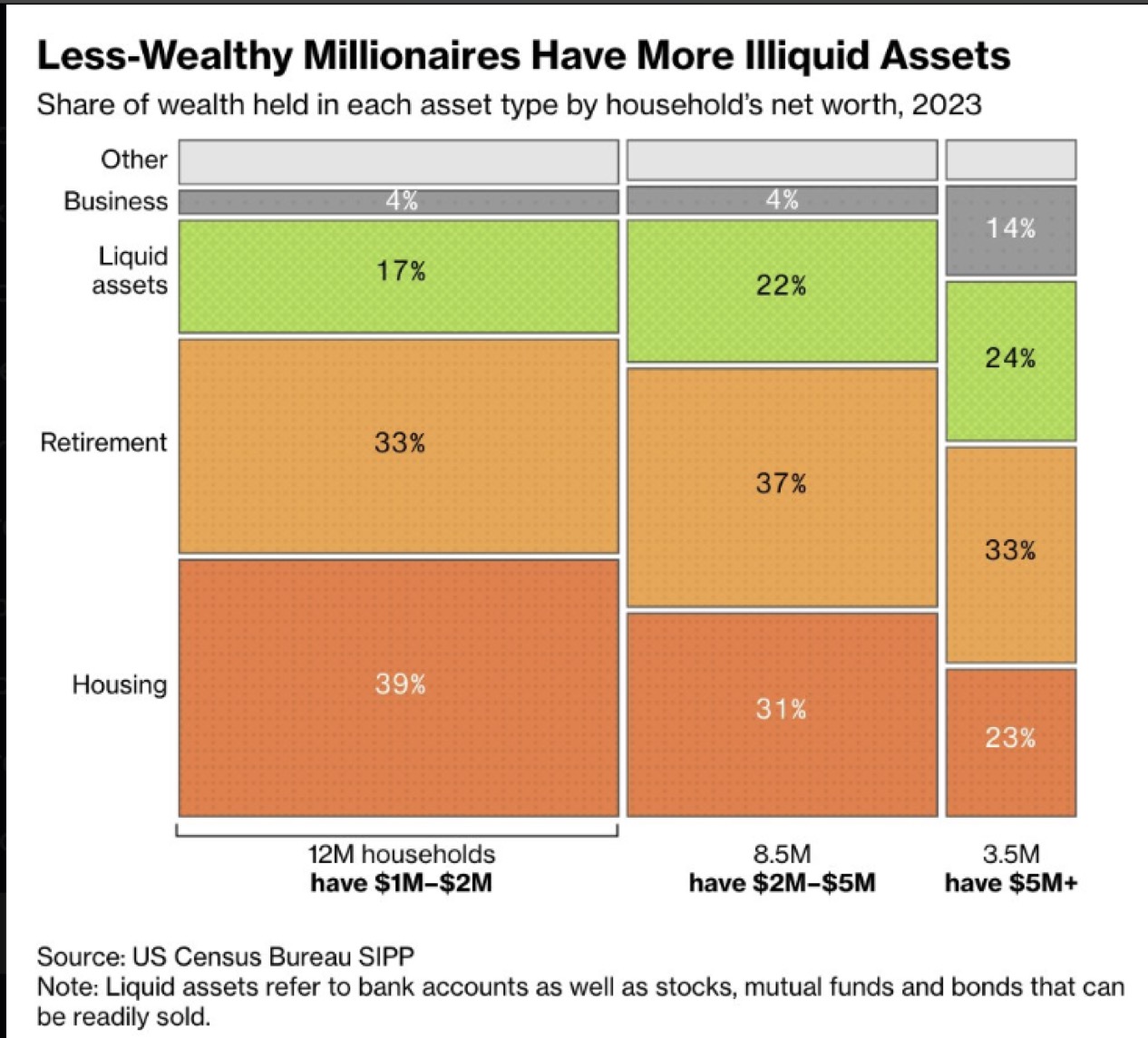

In line with the newest U.S. Census Bureau knowledge, millionaire liquidity varies extensively.

For the ~12 million households with a $1M–$2M internet value, an aggressive 39% of wealth is tied up in housing. It’s no surprise so many of those “poor millionaires” say they don’t really feel wealthy or really feel like they’re simply operating in place. Because of inflation, a millionaire as we speak wants over $3 million to match the buying energy of a Nineteen Nineties millionaire.

In the meantime, for the ~3.5 million households with a internet value above $5M, solely 23% is of their main residence. Roughly 33% comes from retirement accounts, 24% from liquid belongings, 14% from enterprise pursuits, and the remaining from miscellaneous belongings. Significantly better.

Primarily based on a Monetary Samurai survey, $5 million is the very best internet value for retirement with $10 million an in depth second. As soon as you are feeling wealthy sufficient, you’re keen to behave, usually by leaving a suboptimal job to pursue one thing extra fulfilling.

I’m happy to see that the 23% determine for housing amongst these “wealthy millionaires” aligns with my 20% guideline. I’m assured that for households value over $10 million, housing as a share of internet value would fall even decrease—probably underneath 20%.

I’ve written earlier than about how you may really feel reaching varied millionaire milestones – $1M, $5M, $10M, and $20M+. And I’ll confidently say: after getting over $10M and your house makes up 20%, you’ll unequivocally really feel wealthy, even in costly cities like San Francisco or New York.

For instance, to illustrate you owned a $2 million house with a mortgage, however had $4 million in a taxable brokerage account, $1 million in Treasury bonds, $2.5 million in a IRA, and $500,000 in money. There isn’t any doubt in my thoughts you’ll really feel wealthy.

This will sound apparent to you, however I can’t let you know what number of costly metropolis residents have requested me what that magic quantity and ratio is in order that they will lastly get off the treadmill grind.

Housing Builds Foundational Wealth, Every little thing Else Will get You Richer

The Census Bureau knowledge reinforces one key reality: housing is the muse of wealth-building.

Because of persistent undersupply, inhabitants progress, inflation, leverage, compelled financial savings, and authorities incentives, proudly owning your main residence is mostly a smart monetary transfer. You won’t construct wealth on the quickest tempo, however after a decade of homeownership, you’ll probably see substantial fairness positive aspects.

The mixture of paying down your mortgage and having fun with long-term appreciation is a strong power. After all, there shall be extra opportune time than others to purchase your main residence. Nonetheless, long-term, you wish to get impartial housing so inflation doesn’t bludgeon you to despair.

Renting Quickly Is High quality, However Not Lengthy Time period (7+ Years)

Some renters say they’ll “save and make investments the distinction,” however a minority truly do constantly. Self-discipline over many years is tough. In a approach, proudly owning a house with a mortgage protects you from your self, forcing you to save lots of and construct wealth robotically.

If everybody had good self-discipline, we’d all be in peak monetary form with four-pack abs. But over 60% of People are chubby regardless of understanding the well being dangers.

I’m serving to handle certainly one of my relative’s investments free of charge. She’s in her 50s and has rented in New York Metropolis for over 30 years. Sadly, she’s now underneath strain to maneuver as a result of her revenue hasn’t saved tempo with the town’s relentless hire will increase.

I’m feeling the uncomfortable monetary strain by way of her and it really stinks. If solely she had purchased a spot 10 or 20 years in the past, as an illustrator, her life can be a lot simpler as we speak.

The Cycle Repeats As soon as Housing Will get To Be a Small Sufficient Share

When you personal your main residence, reaching “impartial” actual property publicity, you’ll be able to make investments aggressively in different asset courses. Your basis is about. From there different asset courses can all assist develop your wealth. Over time, as these different investments develop, your main residence will naturally turn out to be a smaller proportion of your complete internet value.

Sarcastically, as soon as your house drops beneath 10% of your internet value, you may really feel too frugal. At that time, you’re probably incomes way over you’ll be able to spend from passive and lively revenue.

So don’t be afraid to improve your way of life. Purchase a house value as much as 20% of your internet value, possibly even 30% once more if you want. Benefit from the fruits of your self-discipline, then work that ratio again all the way down to really feel one other nice sense of feat.

Housing builds your basis, however liquidity builds your freedom. The wealthy millionaire doesn’t simply personal wealth, they will use it when it issues most.

So, readers, are you a wealthy millionaire or a poor millionaire? How a lot of your internet value is tied up in illiquid belongings versus simply accessible money or investments? And in your view, what’s the best stage of liquidity to really really feel rich and free?

Make investments In Actual Property With out Draining Liquidity

For those who’re enthusiastic about investing in actual property with out taking over a mortgage, take into account trying out Fundrise. The platform manages over $3 billion in belongings, with a deal with residential and business actual property within the Sunbelt.

With rates of interest progressively declining and restricted new building since 2022, I anticipate upward strain on rents within the coming years, an surroundings that might help stronger passive revenue.

I’ve personally invested over $500,000 in Fundrise funds, they usually’ve been a long-time sponsor of Monetary Samurai as our funding philosophies are aligned.

If You Need To Be A Millionaire

Choose up a replica of my USA TODAY nationwide bestseller, Millionaire Milestones: Easy Steps to Seven Figures. I’ve distilled over 30 years of economic expertise that will help you construct extra wealth and break away sooner. Amazon is having an important sale proper now.

For extra nuanced private finance content material, be part of 60,000+ others and join the free Monetary Samurai e-newsletter and posts by way of e-mail. My objective is that will help you obtain monetary freedom sooner.