Housing safety is one thing I hope everybody will someday get hold of. As soon as you’re home safe, you’ll be able to extra simply focus in your profession, household formation, and different stuff you care about. Nevertheless, if you happen to lease for all times, you could face housing insecurity, which may really feel particularly uncomfortable whenever you’re older or not keen or capable of work.

In fact, I perceive why some individuals argue towards homeownership. They are saying it’s a poor funding, a problem, and ties you down. As a house owner and a landlord since 2003, I get it.

However lots of those that are anti-homeownership have additionally missed out on great property worth appreciation over time. Most have been renters their total lives, whereas I’ve been each a renter and a house owner. I’ve additionally made and misplaced cash from actual property. Nonetheless, I imagine homeownership is the trail to constructing wealth for most individuals.

Actual property FOMO is highly effective. However as you campaign towards homeownership, attempt to keep in mind the common individual – somebody who values stability, could need to begin a household, and isn’t some guru making a fortune promoting get wealthy programs or constructing a web-based empire.

As a savvy investor, you need to put money into property that outpace inflation over time. Housing is a kind of property. School, childcare, and healthcare are the three others.

Repair Your Residing Prices Sooner, Reasonably Than Later

That will help you construct extra wealth, your objective needs to be to repair your dwelling prices as a lot as attainable as a result of inflation is simply too highly effective of a pressure to beat. And if you happen to ultimately turn out to be a landlord, the mixture of rising rents and property costs will seemingly construct you an amazing quantity of wealth over time.

Conversely, as a renter, you’re successfully brief the housing market. The one means you really profit is that if rents and property costs decline. Whereas they do drop throughout each cycle, the long-term development is undeniably up because of the power undersupply of housing and a rising inhabitants.

Simply because it’s unwise to brief the S&P 500 over the long term, it’s additionally unwise to brief the true property market indefinitely by renting. Time and inflation are likely to work in favor of the proprietor, not the renter.

The federal government additionally offers a number of tax incentives for homeownership — from the mortgage curiosity deduction to depreciation to the $250,000/$500,000 in tax-free capital positive aspects if you happen to promote. By way of constant compelled financial savings, you’ll progressively construct fairness and release money circulate to put money into different danger property like shares, if you want.

A Tough State of affairs With Rising Rents in NYC

Let me share a state of affairs that reinforces why I don’t advocate renting indefinitely. It’s based mostly on my expertise serving to a relative handle her funds – one thing I did at no cost and, in hindsight, carried emotional prices of its personal.

I’m witnessing the results of housing insecurity firsthand, even for somebody with a seven-figure funding portfolio, partially due to a long time spent renting.

For privateness, I’ve modified the entire particulars. Nevertheless, the ratios are the identical.

12 months-Finish Monetary Evaluation Time

Every time I conduct a monetary evaluation, I don’t simply take a look at investments. That’s just one a part of the equation. To actually assist somebody, it’s a must to perceive their goals, bills, retirement timeline, and life plans. You may’t set monetary objectives with out understanding what’s going out the door every month.

My relative has lived in New York Metropolis for about 32 years. However she’s been feeling great cost-of-living strain as a result of her $3,800-a-month two-bedroom condominium has turn out to be unaffordable given she solely earns about $30,000-a-year as an alternative trainer and different part-time jobs. The one means she will cowl lease is by drawing down from her investments.

Originally of the 12 months, she requested whether or not she ought to transfer to a smaller condominium in a much less fascinating space to avoid wasting. Usually, I might have mentioned sure. However as a result of she had round $1.6 million in varied investments (IRA, Roth, Taxable), $800,000 of which was taxable, I advised her to remain put for now. At 55, she deserved some stability after a number of strikes, together with leaving Manhattan to Queens to economize.

Based mostly on my comparatively constructive market at the start of the 12 months, I felt her 60/40 portfolio, which I constructed with low-cost ETFs, may maintain her life-style for some time longer. Fortunately, 2025 turned out to be one other sturdy 12 months for the markets.

Now the Landlord Is Aggressively Raised the Lease

Sadly, she simply obtained discover her landlord will hike her lease subsequent 12 months from $3,800 to $5,200 a month. That enhance pushes her annual bills from roughly $80,000 to about $100,000, factoring in inflation throughout different classes as properly.

On the floor, spending $80,000 a 12 months when your revenue is barely $30,000 gross is extreme. Nevertheless, she’s been working, saving, and investing diligently for greater than 30 years to construct her $1+ million funding portfolio. And as we age, most of us need to keep and even enhance our lifestyle, not in the reduction of.

Based mostly on her internet value and my market outlook at the start of the 12 months, I believed sustaining her life-style was cheap for yet another 12 months. To be frank, I additionally did not have the center to inform her to downshift her life-style at her age. She has the online value at her age.

Nonetheless, the maths tells a more durable story.

To sustainably assist ~$100,000 in annual spending, you typically want between $2 million and $2.5 million invested, assuming a 4%–5% withdrawal price. She’s shut, at ~$1.75 million whole with $880,000 in a taxable portfolio to attract from, however not fairly there.

And whereas the numbers would possibly counsel she may make it work, the emotional actuality could be very totally different. It’s extremely exhausting to withdraw $5,000 – $6,000 a month out of your portfolio after a lifetime of saving. One 10% correction and such a withdrawal quantity would really feel unattainable.

Get a Greater Paying Job or Downgrade Your Life-style

The rational resolution is obvious: reduce bills and enhance revenue. Sadly, discovering a higher-paying job at age 55 in a aggressive, age-sensitive job market is tough. She had been out of the workforce for years as a keep at residence mother.

A minimum of, for yet another 12 months, she managed to take pleasure in a way of life that her funds didn’t absolutely justify, due to a roughly 10% portfolio acquire. It was a danger we took at the start of 2025, that has paid off. However the grace interval is over. With a 35% lease enhance looming and the S&P 500 buying and selling at 23X ahead earnings, it’s time to downgrade.

Simply the truth that now we have to take dangers merely to take care of our present life-style shouldn’t be taking place as we attain our 60s and strategy conventional retirement age. By that stage, we must always really feel safe about our funds, not anxious about whether or not our landlord will hike our lease or ask us to go away. Do you actually need to face this indignity and insecurity at this age?

And let’s not overlook the almost 20 p.c drop in shares in March and April of 2025. That was the one time my relative contacted me about her investments, and in a panic. It was a reminder of how fragile that sense of stability will be when the whole lot is determined by market efficiency. We may simply appropriate one other 10 p.c plus once more.

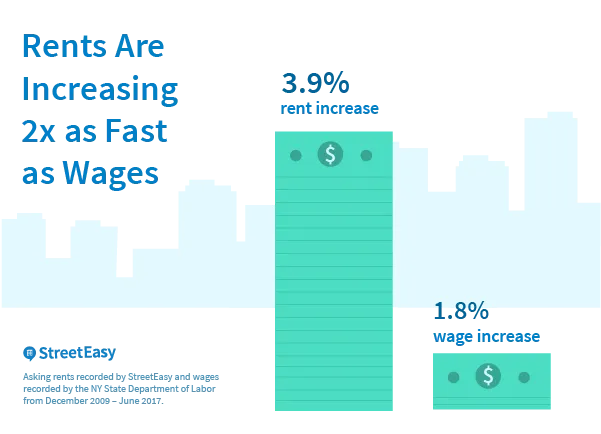

That is the unhappy actuality of lifelong renting. Over time, rents are likely to rise quicker than wages and inflation. Ultimately, you get squeezed exhausting sufficient that it’s a must to transfer – typically far-off from the neighborhood you’ve constructed.

Larger Peace of Thoughts with Homeownership

Once you personal your house, you repair roughly 85% – 90% of your dwelling bills for so long as you personal it. You’re not on the mercy of your landlord elevating lease or promoting the property. You could have housing safety – a type of peace that turns into more and more beneficial as you age and your profession vitality wanes.

As a result of let’s be trustworthy: as you grow old, your want and means to grind for revenue decline. Should you take day out of the workforce – for parenting, caregiving, or just burnout – it may be exhausting to seek out one other well-paying job in a while.

Proudly owning your house eliminates that uncertainty. It’s a monetary and emotional anchor.

Under is a tragic but fascinating chart displaying the rising median age of U.S. homebuyers. For first-time patrons, the median age is now 40.

You would argue this displays worsening housing affordability as renters are being compelled to avoid wasting longer earlier than they’ll purchase. However you may simply as simply argue that this development underscores the worth of homeownership, given how a lot housing has appreciated over time.

After greater than 45 years of the median homebuyer age steadily growing, do we actually suppose this development will reverse anytime quickly? Unlikely. Demand continues to outpace provide, and extra international actual property patrons are scooping up what nonetheless seems to be like cheap U.S. actual property in comparison with their residence markets.

Simply take a look at what has occurred in Canada, the place the federal government overtly allowed international patrons to buy actual property, typically with illicit funds, for many years. In consequence, foreigners helped drive costs to ranges that turned unaffordable for a lot of native residents.

When there are large monetary incentives at play, it’s exhausting for some politicians to do the precise factor. Ultimately, if you happen to don’t see the worth in proudly owning U.S. property, another person will. Don’t depend on power-hungry attempt politicians that can assist you.

Please Don’t Lease Without end If You Don’t Have To

My relative may have purchased a two-bedroom condominium 8–10 years in the past. I want we might have had a monetary session again then, however I had no thought about her funds then. She selected the flexibleness of renting as a substitute.

Had she bought again then, her month-to-month housing prices would now be comparatively mounted, and her condominium would seemingly be value 20%–40% extra. Not a improbable return in comparison with the S&P 500, however an incredible trade-off for stability plus appreciation on a big asset.

If you already know the place you need to dwell for no less than 5 years — ideally 10 — purchase as a substitute of lease. Inflation is just too highly effective to fight indefinitely, and lease will increase don’t cease for anybody. Additional, the return on lease is at all times unfavorable 100%. You’ll by no means have the choice to generate income from the lease you pay.

Maybe if housing prices proceed to soar, new political management will step in with simpler options. However I wouldn’t rely on it. Relying on the federal government to avoid wasting you is an unstable technique. Relying on your self, then again, is the muse of economic freedom.

In the long run, proudly owning your house isn’t nearly cash. It’s about peace, dignity, and management of your life. And if you happen to can safe that for your self, your loved ones, and your future, why wouldn’t you?

Construct Your Fort Whereas You Can

Life is unpredictable, and all of us face totally different monetary and private challenges. However the one factor we are able to management is how a lot we rely on others for our primary wants. Shelter is foundational. When you safe it, the whole lot else—profession, household, objective—turns into simpler to handle.

Whether or not you select to lease or purchase, the hot button is to make a acutely aware, numbers-based choice. Simply know that, mockingly, the longer you lease, the more durable it turns into to interrupt free.

Listed here are 5 actionable steps to maneuver nearer to housing safety:

1) Run your lease vs. purchase numbers yearly.

Don’t depend on outdated assumptions. Plug your lease, revenue, and native residence costs right into a calculator to see the place the crossover level lies. When lease inflation is factored in, possession typically wins before anticipated.

2) Assume in a long time, not months.

Should you plan to remain put for no less than 5 years, shopping for often is sensible. Actual property rewards time and endurance, not market timing.

3) Save aggressively for a down cost.

Deal with your down cost fund like an funding in freedom. Even if you happen to don’t purchase immediately, that financial savings cushion builds optionality and self-discipline.

4) Purchase what you’ll be able to comfortably afford.

You don’t want your dream residence proper out of the gate. A modest, well-located property that retains your month-to-month bills steady is commonly the perfect wealth builder. Please comply with my 30/30/3 rule for residence shopping for.

5) Don’t depend on luck, politicians, or anybody else.

Markets shift. Insurance policies change. Guarantees fade as politicians promise the world to get into energy. However proudly owning your house offers you management over one in every of life’s largest variables – your price of dwelling. It’s a private hedge towards uncertainty.

Should you depend on politicians to feed and home you, those self same politicians can simply as simply take that assist away. Look no additional than the latest authorities shutdown, which created meals insecurity for the roughly 42 million individuals who rely upon SNAP advantages.

Backside line: If you should buy and maintain for the long run, do it. Renters should always adapt to the market, whereas owners ultimately let the market adapt round them.

Construct your fort whilst you can, as a result of when you do, you’ll have the muse to dwell the life you really need.

Readers, what are your ideas on renting for all times? Should you’ve been a lifelong renter, do you imagine you’ve constructed extra wealth than if you happen to had bought a major residence? Have you ever ever been compelled to maneuver as a result of your landlord imposed an aggressive lease hike? And why do you suppose some individuals who’ve by no means owned a house are so strongly towards homeownership when there’s a lot knowledge displaying the median internet value of a house owner is much better?

Make investments In Actual Property Passively

Should you can’t purchase a house but, don’t sit on the sidelines whereas housing costs and rents maintain rising. You may nonetheless take part in the true property market and construct wealth over time — with no need to give you an enormous down cost.

That’s why I’ve invested with Fundrise, a platform that permits on a regular basis buyers to achieve publicity to residential and industrial properties nationwide. With over $3 billion in property beneath administration and 350,000+ buyers, Fundrise makes it simple to personal a chunk of the true property market that continues to compound in worth.

Actual property has traditionally been among the finest methods to hedge towards inflation and develop wealth passively. And with a minimal funding of solely $10, anybody can begin investing at the moment.

Fundrise has been a long-time sponsor of Monetary Samurai as a result of our philosophies align — constant, disciplined investing in tangible property to construct monetary freedom.

Get a Customized Monetary Evaluation Earlier than the 12 months Ends

Should you’ve ever puzzled whether or not you’re really on observe towards housing safety and monetary independence, it helps to get a second set of eyes in your plan. I’ve been writing about private finance since 2009, however a few of the most rewarding work I’ve achieved helps readers one-on-one — from optimizing portfolios to mapping out home-buying timelines and passive revenue objectives.

Whether or not you’re a lifelong renter debating when to purchase, or a house owner deciding whether or not to improve or downsize, I may help you suppose by the numbers and the feelings behind every choice.

To shut out the 12 months, I’m opening seven consulting spots for readers who desire a customized evaluation earlier than 2026. You’ll additionally obtain copies of my USA TODAY bestselling e-book, Millionaire Milestones that can assist you proceed constructing wealth and confidence by yourself.

Take a look at my private finance consulting web page if you happen to’re . I sit up for assembly a few of you!

To expedite your journey to monetary freedom, be part of over 60,000 others and subscribe to the free Monetary Samurai publication. You can too get my posts in your e-mail inbox as quickly as they arrive out by signing up right here. Monetary Samurai is among the many largest independently-owned private finance web sites, established in 2009. Every little thing is written based mostly on firsthand expertise and experience.