It is no secret that semiconductor shares have been significantly massive winners amid the bogus intelligence (AI) revolution. With share costs skyrocketing, a number of high-profile chip corporations have opted for inventory splits this 12 months. Some AI chip stock-split shares you may acknowledge embrace Nvidia (NASDAQ: NVDA), Tremendous Micro Pc (NASDAQ: SMCI), and Broadcom (NASDAQ: AVGO).

Certainly, every of those shares has accomplished wonders for a lot of portfolios over the past couple of years. Nevertheless, I see one in all these chip shares because the superior alternative over its friends.

Let’s break down the total image at Nvidia, Supermicro, and Broadcom and decide which AI chip stock-split inventory may very well be the perfect buy-and-hold alternative for long-term traders.

1. Nvidia

For the final two years, Nvidia has not solely been the most important title within the chip house but additionally basically emerged as the last word gauge of AI demand at giant. The corporate makes a speciality of designing subtle chips, often known as graphics processing models (GPUs), and knowledge middle companies. Furthermore, Nvidia’s compute unified system structure (CUDA) offers a software program part that may used along with its GPUs, offering the corporate with an enviable and profitable end-to-end AI ecosystem.

Whereas all that appears nice, traders can not afford to be starry-eyed as a consequence of Nvidia’s current dominance. The desk beneath breaks down Nvidia’s income and free-cash-flow development developments over the past a number of quarters.

|

Class |

Q2 2023 |

Q3 2023 |

This fall 2023 |

Q1 2024 |

Q2 2024 |

|---|---|---|---|---|---|

|

Income |

101% |

206% |

265% |

262% |

122% |

|

Free money movement |

634% |

Not materials |

553% |

473% |

125% |

Information supply: Nvidia Investor Relations.

Admittedly, it is arduous to throw shade on an organization that’s constantly delivering triple-digit income and revenue development. My concern with Nvidia is just not associated to the extent of its development however fairly its tempo.

For the corporate’s second quarter of fiscal 2025 (ended July 28), Nvidia’s income and free money movement rose 122% and 125% 12 months over 12 months, respectively. It is a notable slowdown from the final a number of quarters. It is honest to level out that the semiconductor business is cyclical, and an element like that would affect development in any given quarter. Sadly, I feel there’s extra beneath the floor with Nvidia.

Specifically, Nvidia faces rising competitors from direct business forces, resembling Superior Micro Gadgets, and tangential threats from its prospects — particularly, Tesla, Meta, and Amazon. In concept, as competitors within the chip house rises, prospects may have extra choices.

This leaves Nvidia with much less leverage, which can seemingly diminish a few of its pricing energy. In the long term, this might take a hefty toll on Nvidia’s income and revenue development. For these causes, traders may need to contemplate some options to Nvidia.

2. Tremendous Micro Pc

Supermicro is an IT structure firm specializing in designing server racks and different infrastructure for knowledge facilities. In recent times, hovering demand for semiconductor chips and knowledge middle companies has served as a bellwether for Supermicro. Furthermore, the corporate’s shut alliance with Nvidia has proved significantly helpful.

That stated, I’ve some issues with Supermicro. As an infrastructure enterprise, the corporate depends closely on different corporations’ capital expenditure wants. This makes Supermicro’s development vulnerable to exterior variables, resembling demand for knowledge middle companies, chips, server racks, and extra. Moreover, Supermicro is much from the one IT structure specialist out there.

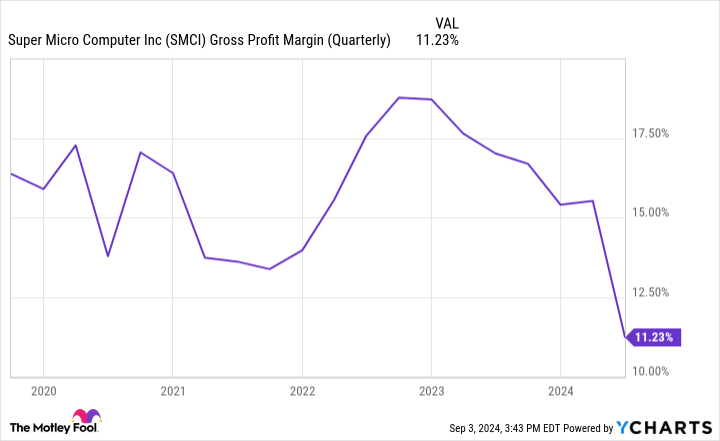

Competitors from Dell, Hewlett Packard, and Lenovo (simply to call just a few) convey their very own ranges of experience to {the marketplace}. On account of competing in such a commoditized environment, Supermicro may be pressured to compete on worth — which takes a toll on revenue era.

Infrastructure companies don’t carry the identical margin profile as software program corporations, as an example. On condition that the corporate’s gross margins are pretty low and in decline, traders should be cautious. Whereas Supermicro’s administration tried to guarantee traders that the margin deterioration is the results of some logjams within the provide chain, more moderen information may sign that gross margin is the least of the corporate’s issues.

Supermicro was not too long ago the goal of a brief report revealed by Hindenburg Analysis. Hindenburg alleges that Supermicro’s accounting practices have some flaws. Following the quick report, Supermicro responded in a press launch outlining that the corporate is delaying its annual submitting for fiscal 12 months 2024.

Given the unpredictability of demand prospects, a fluctuating margin and revenue dynamic, and the allegations surrounding its accounting practices, I feel traders now have higher choices within the chip house.

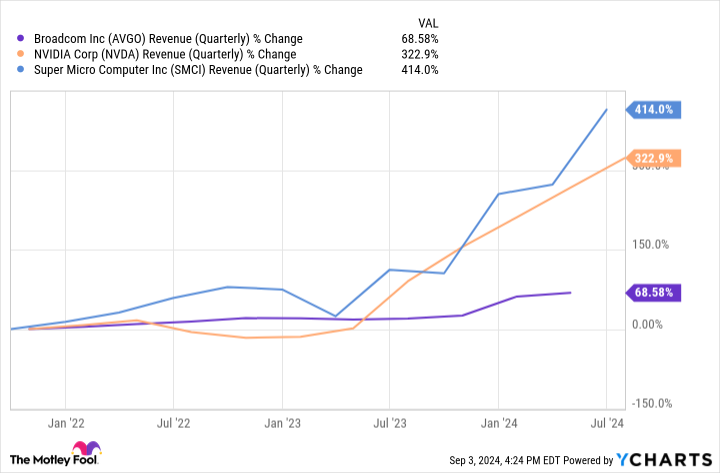

3. Broadcom

By means of elimination, it is clear that Broadcom is my prime buy-and-hold alternative amongst chip shares proper now. This isn’t as a result of Broadcom’s returns this 12 months have lagged its counterparts, although. The underlying causes Broadcom’s shares have paled in comparison with different chip shares may shine some mild on why I feel its greatest days are forward.

I see Broadcom as a extra diversified enterprise than Nvidia and Supermicro. The corporate operates throughout a bunch of development markets, together with semiconductors and infrastructure software program. Grand View Analysis estimates that the overall addressable market for methods infrastructure within the U.S. was valued at $136 billion again in 2021 and was set to develop at a compound annual development charge of 8.4% between 2022 and 2030.

Techniques infrastructure contains alternatives in knowledge facilities, communications, cloud computing, and extra. Contemplating firms of all sizes are more and more counting on digital infrastructure to make data-driven choices, I see the position Broadcom performs in community safety and connectivity as a significant alternative and suppose its latest acquisition of VMware is especially savvy and can assist unlock new development potential.

When you have a look at the expansion developments within the chart above, it is apparent that Broadcom is just not experiencing the identical stage of demand as Nvidia and Supermicro proper now. I feel it is because Broadcom’s place within the broader AI realm is but to expertise commensurate development in comparison with shopping for chips and storage options in droves.

Whereas I am not saying Nvidia or Supermicro are poor selections, I feel their futures look cloudier than Broadcom’s proper now. I consider Broadcom is within the very early levels of a brand new development frontier that includes many alternative themes (with AI being simply one in all them). For these causes, I see Broadcom as the most suitable choice explored on this piece and suppose long-term traders have a profitable alternative to scoop up shares and maintain on tight.

Do you have to make investments $1,000 in Broadcom proper now?

Before you purchase inventory in Broadcom, contemplate this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they consider are the 10 greatest shares for traders to purchase now… and Broadcom wasn’t one in all them. The ten shares that made the lower may produce monster returns within the coming years.

Contemplate when Nvidia made this record on April 15, 2005… when you invested $1,000 on the time of our suggestion, you’d have $630,099!*

Inventory Advisor offers traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 3, 2024

John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Randi Zuckerberg, a former director of market growth and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Adam Spatacco has positions in Amazon, Meta Platforms, Nvidia, and Tesla. The Motley Idiot has positions in and recommends Superior Micro Gadgets, Amazon, Meta Platforms, Nvidia, and Tesla. The Motley Idiot recommends Broadcom. The Motley Idiot has a disclosure coverage.

Nvidia, Tremendous Micro, or Broadcom? Meet the Synthetic Intelligence (AI) Inventory-Break up Inventory I Suppose Is the Finest Purchase and Maintain Over the Subsequent 10 Years. was initially revealed by The Motley Idiot