Nvidia (NVDA) mentioned Wednesday that its newest Blackwell AI chips have reached full-scale manufacturing, producing $11 billion in income throughout its fourth quarter.

“We delivered $11.0 billion of Blackwell structure income within the fourth quarter of fiscal 2025, the quickest product ramp in our firm’s historical past,” mentioned Nvidia CFO Colette Kress in feedback launched with the chipmaker’s earnings outcomes Wednesday after the bell.

Watch dwell: Nvidia earnings insights, name snippets, and in-depth evaluation

“Blackwell gross sales had been led by massive cloud service suppliers which represented roughly 50% of our Information Heart income.”

Nvidia’s fourth quarter earnings surpassed Wall Avenue’s excessive expectations.

The chipmaker reported income of $39.3 billion, beating Wall Avenue’s estimate of $38.2 billion, with knowledge heart income reaching $35.6 billion, forward of the $34.1 billion anticipated, in response to Bloomberg consensus estimates.

The AI chipmaker reported adjusted earnings per share of $0.89, greater than the $0.84 anticipated.

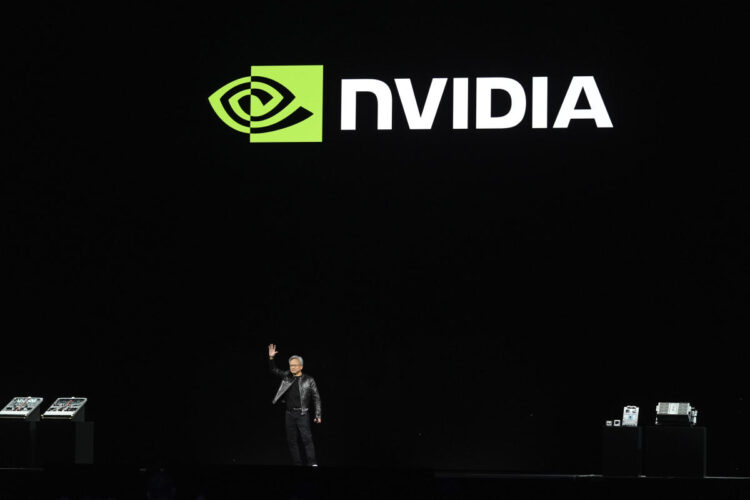

CEO Jensen Huang mentioned in a separate assertion, “We’ve efficiently ramped up the massive-scale manufacturing of Blackwell AI supercomputers, attaining billions of {dollars} in gross sales in its first quarter.”

The commentary dispelled fears of additional Blackwell delays.

Manufacturing of large server racks utilizing Nvidia’s newest AI chips had been pushed again amid stories of overheating points and glitches, which reportedly prompted Nvidia’s high clients — Microsoft (MSFT), Amazon (AMZN), Google (GOOG), and Meta (META) — to chop orders of Blackwell merchandise.

These 4 clients alone (often called “hyperscalers”) bought an estimated $44 billion value of Nvidia GPUs within the 2024 calendar 12 months, in response to a DA Davidson evaluation.

Evercore ISI analyst Mark Lipacis had instructed in a observe earlier this week that Blackwell manufacturing may very well be pushed again to the center of 2025. Nvidia’s commentary Wednesday addressed such considerations.

“Based mostly on the This fall numbers and the steering, it looks like demand for Blackwell … may be very, very sturdy, and one can assume is coming from the hyperscalers,” Ali Mogharabi, senior fairness analyst at WestEnd Capital Administration, instructed Yahoo Finance in an interview after the earnings report.

On the corporate’s earnings name, Kress added that gross sales to hyperscalers doubled 12 months over 12 months, including, “Giant CSPs [cloud service providers] had been among the many first to face up Blackwell, with Azure, GCP [Google Cloud Products], AWS, and OCI [Oracle Cloud Infrastructure] bringing 200 [Blackwell] techniques to cloud areas all over the world to satisfy surging buyer demand for AI.”