If the final two years in monetary markets had been a film, they’d be a mixture of The Wolf of Wall Road (euphoria), Closing Vacation spot (impending doom), and Groundhog Day (charges are nonetheless excessive, however shares hold going up?!). Traders have loved substantial beneficial properties in shares, Bitcoin, and gold. But the worry and greed index says that buyers are “fearful.”

I consider rising Treasury yields, sticky inflation, and a cocktail of financial and political dangers make 2025 a yr when warning ought to be the default setting, and I am repositioning my portfolio accordingly.

Market Efficiency: The Good, the Unhealthy, and the Overpriced

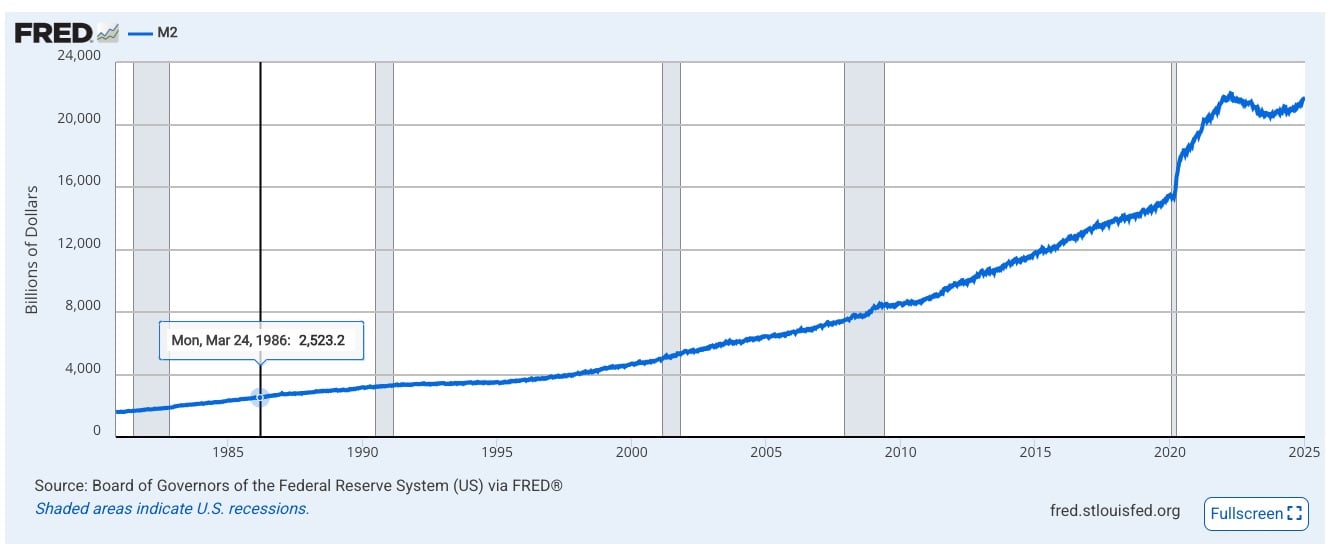

The cash provide: M2

Sure, it surged from 2019-2022, driving inflation and asset costs THEN.

Nevertheless, I believe it’s silly oversimplification (and certain unsuitable) to attribute asset worth development from 2023-2025 to a normal improve within the cash provide NOW.

- January 2023 M2: $21,187 ($ billions of {dollars})

- January 2025 M2: $21,533

- Change: +1.6%

M2 is a proxy for the cash provide that makes an attempt to measure most short-term liquidity positions, together with cash in financial institution accounts, forex, and different liquid deposits, like cash market accounts.

Opposite to the get together line of a big horde of fiat critics on the market, the cash provide shouldn’t be growing at a quicker price than asset values or inflation within the final two years.

There is no such thing as a doubt in my thoughts that the 39% improve within the cash provide from 2019 to 2022 was a significant driver of inflation and the surge in asset costs. I’m skeptical, nevertheless, that inflation since 2023, for each the CPI and asset values, has been primarily a results of a rise within the cash provide. From 2023 onwards, I consider that different elements have been at play—just like the long-term pattern of child boomers leaving the workforce, leading to wage development.

In 2025, I consider that the story will shift, a minimum of in Q1 and Q2. Costs are growing due to one thing aside from the cash provide proper now. Traders ought to take that critically.

“The federal government retains printing cash” is/was an incredible sound chew/prognosis for worth will increase if you end up the 900th touch upon a pro-Bitcoin Reddit thread. And it was an accurate statement and an actual motive to consider in main inflation from 2020 by means of 2022.

However that surge within the cash provide, I consider, has already been largely absorbed into the financial system and was mirrored within the costs of products, providers, many wages, actual property, and shares by the center of 2022.

I’d watch out as an investor—{dollars} in financial savings accounts could not degrade in actual worth over the subsequent 5 years at anyplace near the speed they did from 2019-2022.

S&P 500: U.S. shares are priced for a golden age, the place all the pieces goes completely based on plan for the largest firms on the earth.

- January 2023: 3,999

- January 2025: 6,040

- Change: +51%

The S&P is as costly as it’s ever been, relative to earnings, other than 1999/2000. With the Shiller P/E ratio at 38.5X, the one different time it’s been this costly relative to trailing 10-year earnings was in 1999. It’s risen 2.35X in six years, from 2,600 in January 2019.

This time is totally different, proper? Synthetic intelligence (AI), American hegemony, globalization, inflation, deregulation with a brand new “pro-business” administration, robust earnings development, and so on., will all drive an unprecedented wave of company earnings, proper?

If you happen to are invested within the S&P 500, that’s the guess. I don’t like that guess.

I consider that that is the riskiest inventory market since 1999, and lots of individuals who purchase into the “the inventory market at all times goes up in the long term” argument may very well be damage badly.

Subsequently, I’m reallocating away from shares to bonds and actual property.

Bitcoin: Similar price-to-earnings ratio, totally different worth

- January 2023: $17,000

- January 2025: $96,000

- Change: +465%

Bear in mind when Bitcoin was “lifeless” in 2022? Effectively, turns out it was simply taking an influence nap. BTC is again with a vengeance, largely fueled by institutional adoption, ETF approvals, and the continuing mistrust in conventional fiat currencies. That being mentioned, with this degree of parabolic development, any main shock (say, a regulatory crackdown) might result in an unpleasant unwind.

I consider that, per my statement in regards to the cash provide, Bitcoin’s worth surge from 2023 to 2025 shouldn’t be a results of the greenback shedding worth however somewhat the results of a surge in speculative demand.

I’m extraordinarily unpopular and seemingly practically alone with this take, however I fear that within the occasion of a recession or market crash that requires folks to start harvesting parts of their portfolios, Bitcoin can and can get hit first and hardest.

This is an “asset” that’s nonetheless, in my opinion, prone to whole loss at any time. Progress in worth shouldn’t be an indication of worldwide adoption, however of ever-increasing, geometrically compounding threat.

I personal no Bitcoin. To move off the Bitcoin individuals who will instantly chime in and inform me how I’m lacking out on an asset that will “make my bloodline” (precise remark from Bitcoin Bro) and what an costly place they suppose I maintain, here’s a rendering of me in 10 years, per ChatGPT, after lacking out on Bitcoin’s takeover:

Gold: Sluggish and regular, retailer of worth—besides it’s rising in worth nearly as quick because the S&P 500

- January 2023: $1,850/oz

- January 2025: $2,650/oz

- Change: +43%

In January 2019, gold traded at $1,285/ounce. That’s a 2.2X improve in opposition to a 40% improve within the cash provide. Gold’s rise in an period of excessive rates of interest is sort of a tortoise profitable the race—it’s gradual however inevitable. Or a minimum of, for this reason buyers, speculators, or the scared are likely to flee to gold.

However what’s gold when its worth accretes nearly as quick because the S&P 500 throughout a historic bull run? Is it actually a protected haven and hedge in opposition to inflation?

Given gold’s worth run-up, I ponder if persons are paying for safety or simply FOMO. I personal no gold.

Residential actual property: The forgotten stepchild

- January 2023 Case-Shiller Nationwide House Worth Index: 298

- January 2025: 314

- Change: +5.3%

Not like shares and Bitcoin, actual property has been the designated driver at this monetary get together. Excessive mortgage charges have saved housing costs from surging, and whereas single-family houses have held up higher, business actual property (CRE) has been a special story.

Again in January 2019, the Case-Shiller index traded at 204. Or put in another way, housing costs have risen 53% in six years. With out leverage, this asset class has been one of many worst performers of the final 5 to seven years, and housing—single-family houses, particularly—has been the best-performing a part of the actual property ecosystem, with asset values getting crushed from 2022 to the current in lots of business actual property sectors.

Residential actual property has seen worth and hire development solely marginally outpace development within the cash provide in the previous few years. I consider it is at a a lot decrease threat than different asset courses in 2025. Subsequently, I’m conservatively shopping for actual property with funds reallocated from inventory holdings.

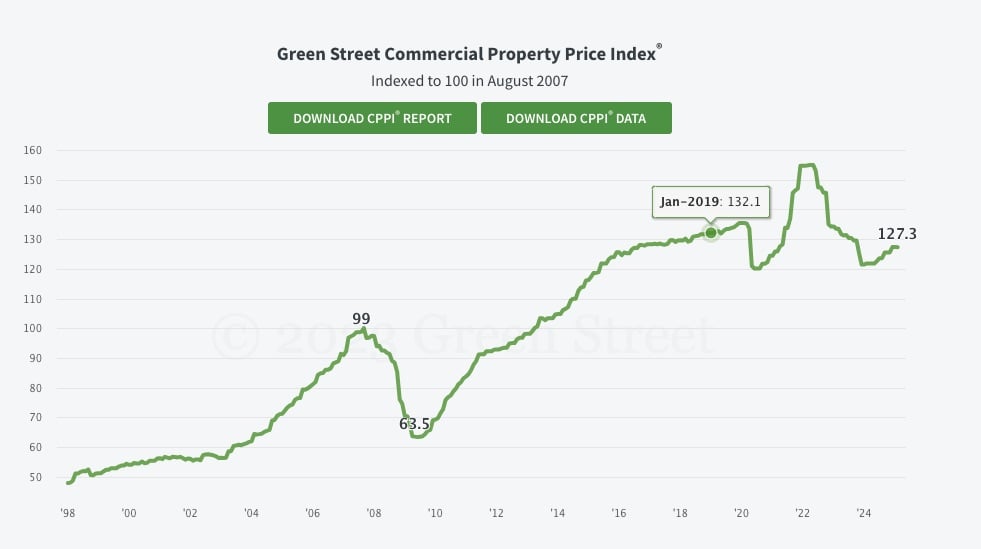

Industrial actual property: Deep, soul-crushing, generational wealth-destroying, and probably career-ending ache for buyers over the previous six years

- January 2023 Inexperienced Road Industrial Property Worth Index: 154

- January 2025: 127

- Change: -18%

This is ugly. And it’s not like CRE buyers who bought in at 2019 worth ranges loved a excessive sufficient run-up to nonetheless be sitting fairly on massive beneficial properties in 2025. In six years, business actual property has misplaced 4% of its worth, led by deep ache within the workplace sector from 2019 to the current and deep ache in multifamily from 2022 to the current.

Once we contemplate how business actual property is likely one of the most extremely leveraged asset courses on the market, an 18% decline can imply fairness losses of 40% to 60% for buyers.

2025 is shaping as much as be the yr the chickens come house to roost in multifamily: The availability onslaught continues, there appears to be no finish in sight to falling rates of interest, demand shouldn’t be excessive sufficient to drive significant hire development, working bills proceed to rise, and a cloth proportion of the debt backing these property matures, forcing horrible refinance or sale selections.

I’ve been speaking about the dangers in multifamily particularly for years, with nice element on the dangers for 2023 and 2024 spelled out right here and right here.

I consider that business actual property is at, or nearing, the underside of a traditionally unhealthy cycle.

I’m watching the CRE market extraordinarily intently, and consider there’s an actual chance of “no-brainers in 2H 2025.” My “residential” funding was truly a quadplex, which is in between a “business” and “residential” property.

As I examine the market extra, I believe there’s a affordable chance that I purchase lots of CRE within the subsequent two years.

The Two Areas of Industrial Actual Property I’m Most Curious About

1. Multifamily is probably going at or near the underside in lots of areas

If it’s not already “purchase time” in multifamily/residences, it is going to be by 2H 2025, or definitely 1H 2026.

No matter now we have been ready for by way of a shopping for alternative in multifamily is prone to be right here proper now or months, not years, away. I’ve by no means seen a bid/ask unfold as excessive in my profession, and I believe that lots of influencers-turned-syndicators who purchased on the peak from 2021-2022 will be pressured to understand large losses this yr and subsequent.

Their ache is the conservative investor’s achieve. I believe that in 5 years, few who purchase in 1H 2025 will really feel like they purchased anyplace near the highest, and it’s very potential that proper now’s the underside for this asset class. I’m beginning to purchase now, conservatively, with gentle or no leverage, and can possible proceed to purchase, including leverage if issues worsen and worse.

I like Denver and suppose the stress on sellers may be very actual right here proper now, however I suppose that markets like Austin, Texas, and most main Florida markets are prone to be a few of the finest values within the nation.

2. Workplace house: Is it at present priced for the apocalypse?

I lately talked to an investor who purchased a 12-cap workplace constructing with a present occupancy of 72%, seller-financed at 70% LTV for 5 years with interest-only debt, at a 40% decrease valuation than its final sale in 2013. Both he exits that factor at an eight-cap in 5 years, with 90%+ occupancy, or South Denver dies as we all know it.

Is workplace so beaten-down and depressed as an asset class that purchasing an workplace constructing has develop into an “Both folks come again to work right here within the subsequent three to seven years, or this a part of the town will decay and switch to mud” guess?

You may guess I’ll develop into a scholar of the workplace market in 2025, in the identical method, that I’ve tried to develop into a scholar of single-family and multifamily these previous 10 years. I’m at present a novice in understanding workplace actual property, so I merely pose the query of whether or not that is the appropriate time.

10-12 months Treasury Yield: Rising Like a Persistent Villain

- January 2023: 3.5%

- January 2025: 4.9%

- Change: +40%

Bond yields have continued their regular climb, leaving anybody hoping for a Fed pivot sorely disenchanted. Larger yields imply borrowing prices stay elevated, which ought to put downward stress on all the pieces from shares to house costs.

Once more, increased Treasury yields ought to put downward stress on all the pieces from shares to house costs. They haven’t had this impact within the final two years, outdoors residential actual property, which has seen little to no development within the final two years, and business actual property, which has crashed.

Bonds: No Respect From a Era of Traders Who Haven’t Skilled a Downturn

- January 2023 Vanguard Complete Bond Market ETF (VBTLX) Worth: $9.66

- January 2025 VBTLX Worth: $9.55

- Change: -1%

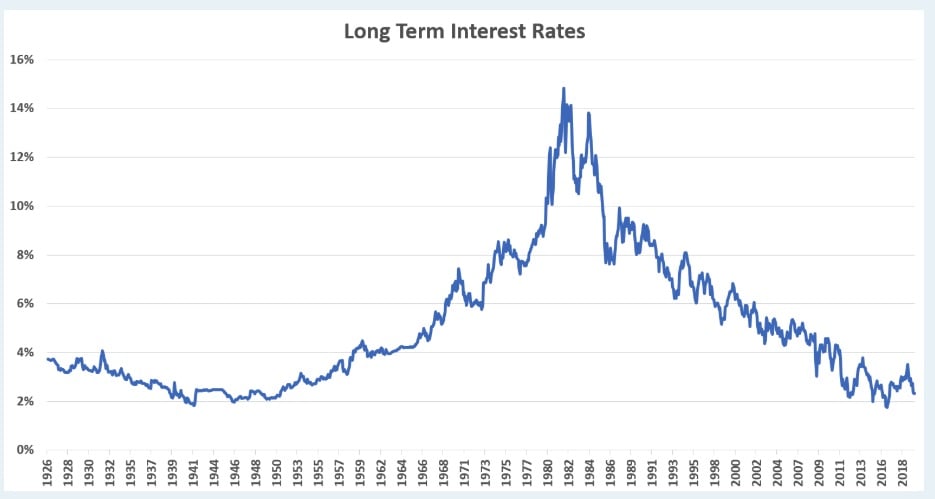

As rates of interest rise, bond fairness values fall. Rates of interest fell practically constantly from 1982 to 2022:

Bonds do very nicely in that form of atmosphere and, higher, additionally serve their supposed goal as a hedge in opposition to a market downturn—within the occasion the market crashes or there’s a deep recession or melancholy, buyers can anticipate the Federal Reserve to decrease rates of interest, which props up bond fairness values for buyers.

Lately, many buyers, a minimum of those that frequent BiggerPockets, appear to be exiting bonds. It is smart on the floor. Bond yields are nonetheless too low (VBTLX at present gives a measly 4.6% yield to maturity and even much less in revenue—a good shopper can get 3.8% to 4.2% on a good financial savings or cash market account with a decrease threat of principal loss and extraordinarily excessive liquidity) to actually make sense.

However good instances make buyers overlook that these bonds are what can save a portfolio, together with a standard or early retirement, within the occasion of a extreme downturn. Falling charges lead to fairness beneficial properties for bonds, and a downturn is very prone to coincide with fast price drops from the Fed.

I’m contemplating, however haven’t but finished so, shifting my retirement account positions to be within the 60/40 or 50/50 shares/bonds allocation.

What Am I Doing in Response to All This?

In an atmosphere the place markets are frothy, threat is excessive, and uncertainty is in all places, I consider the logical investor response consists of:

Trimming inventory publicity + rebalancing/reallocating

With shares at near-all-time excessive price-to-earnings ratios, I felt that the prudent transfer was to reset my portfolio. I rebalanced and moved a big portion of my inventory portfolio to frivolously levered actual property in Q1 2025.

Holding additional cash

A hefty money place offers dry powder for when the inevitable pullback arrives. I at all times preserve a larger-than-usual money place as a result of I really feel it could be extremely embarrassing to declare private chapter after writing a ebook known as Set for Life. So, no actual change right here.

Investing in debt + bonds

With Treasury yields approaching 5%, bonds and actual estate-backed loans supply compelling risk-adjusted returns. Along with probably rebalancing a few of my portfolio to a 60/40 or 50/50 shares/bonds place, I’ll possible add a tough cash mortgage or two again to my portfolio this yr if I don’t purchase extra actual property outright. As a semiprofessional actual property investor, I really feel that my means to foreclose on actual property enormously reduces my threat on non-public loans within the class.

Shopping for residential actual property

Calmly levered, or utterly paid off: Excessive charges imply borrowing is dear. If you happen to’re shopping for actual property, paying money (or a minimum of limiting leverage) might help mitigate threat. The cap price on my most up-to-date buy is extraordinarily shut, after tax, to the yield I can get on a short-duration onerous cash word. If I can yield ~10% (7% cap price + 3% appreciation on common) on an asset that ought to see worth and hire development, maintain tempo with or develop in worth quicker than inflation with out utilizing any debt in any respect, why hassle overthinking it?)

Learning and coaching myself to identify “no-brainers” in business actual property, particularly multifamily and workplace

I believe there’s a affordable chance that an unbelievable purchaser’s market is right here, proper now, in workplace, and simply across the nook, in multifamily. I don’t know what I’m doing in workplace. That can change. I intend to check, preserve entry to liquidity, and be able to enter this house with a significant a part of my portfolio within the subsequent 18 months.

On Taxes and the Realization of Features

I incessantly hear buyers argue that making strikes like these I record is extremely tax-inefficient—or a minimum of they observe that I’ll pay taxes. A main portfolio reallocation can completely create tax drag.

I’ve a singular perspective on taxes that I believe is value mentioning, because it informs my decision-making.

First, I optimize for post-tax web value, usable in my life as we speak, proper now, not pre-tax web value at conventional retirement age or time of loss of life.

I’m 34 years outdated. Maximizing the worth of my property to go on incrementally extra wealth to my heirs some 50 years down the highway is meaningless. Except I do one thing extraordinarily dangerous, and blow all the pieces, there ought to be loads for my heirs later in life.

My two-year-old daughter shouldn’t be serious about an additional million {dollars} when she is 55. She is considering taking part in hide-and-seek with me as we speak. The chance value of conventional tax minimization recommendation that might result in me not having money circulation or liquidity to optimize time together with her proper now will value me rather more than even a a number of hundred-thousand-dollar tax hit.

My wealth, my true wealth, is the after-tax liquidity my portfolio can generate for me as we speak. Not a quantity with eight figures on it 30 years from now in my spreadsheet.

Second, I’m prepared to guess that capital beneficial properties taxes will go up sooner or later. Whereas it’s extra environment friendly to merely permit wealth to compound in perpetuity tax effectively, by no means harvesting beneficial properties, there’s each probability that the marginal tax charges for capital beneficial properties will improve sooner or later. The truth is, I’ll (and in some methods, already am) guess(ting) on it. This lessens the wealth penalties of paying taxes on beneficial properties now.

There may be additionally the actual, although distant, risk that tax brackets for capital beneficial properties improve a lot over my lifetime that I’m truly forward by paying taxes at as we speak’s charges somewhat than these of the 2055s.

Third, I solely notice beneficial properties when I’ve private use for the proceeds or I’m reallocating {dollars}.

If I consider that I will incur much less threat or have a shot at higher returns, the tax penalties are a lot decrease. I consider that the strikes I make, after I make them sometimes and notice beneficial properties, are possible to supply rather more upside, or a lot much less threat, than maintaining property in place; in any other case, I received’t make them.

If I’m proper, the tax drag is a nonfactor. If I’m unsuitable, I’ll see a double hit (tax drag AND worse returns, in comparison with leaving issues be), however I’ll a minimum of sleep higher at evening.

Fourth, particular to 2025, actual property gives severe tax benefits. For some people, actual property losses can offset beneficial properties in different asset courses. This is usually a big boon. I can entry these losses with a selected sort of funding (itemizing a property as a short-term rental) that I’m contemplating for 2H 2025.

Closing Ideas

2025 is shaping as much as be a yr when buyers have to tread rigorously. The market’s relentless optimism within the face of excessive charges and geopolitical uncertainty is regarding to me. Whether or not it’s an overvalued inventory market, a speculative Bitcoin rally, or nonetheless actual considerations in business actual property, regardless of my hypothesis that we’re nearing a backside, dangers are in all places.

They are saying buyers have two feelings: worry and greed. My evaluation screams “worry,” and that’s precisely what I really feel, by and huge, as we head into 2025.

Please disagree, chortle at me, get offended with me, or do the digital equal of giving me a “you must know higher than to try to investigate the market” within the feedback. After which, make an instance of me over the subsequent few years.

I’m certain to be unsuitable, categorically, on a number of factors, or probably each level, now that I’ve dedicated my ideas to writing, printed them, and acted on them.

I deserve the scorn of any pundit, the chance value of my actions, and the tax penalties. However, I can’t assist however share my evaluation, ideas, and fears with this group. It’s what I believe. It’s what I really feel. It’s what I’m doing.

Please do push again on any a part of this evaluation that you disagree with—beginning with my observations in regards to the cash provide (M2), which are certain to ruffle some feathers.

I’d love hyperlinks to different datasets that problem my viewpoints or understanding of the cash provide extra broadly. This appears to be a central level the place many buyers and the market have a special view than I do.