-

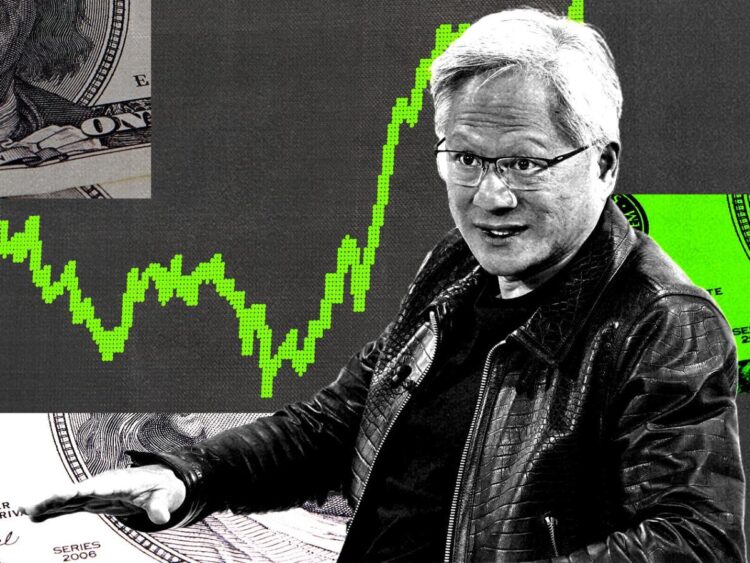

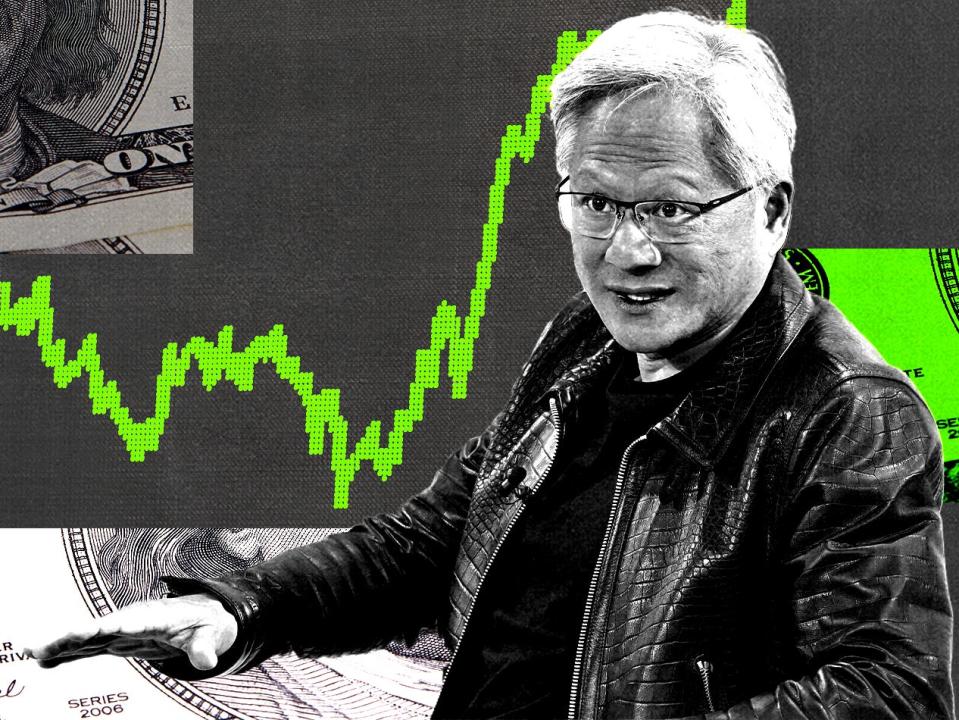

Nvidia inventory is about for extra features as demand for its GPU chips surges, Morgan Stanley says.

-

Nvidia’s Blackwell GPU is on schedule and is offered out for the subsequent 12 months, the corporate mentioned.

-

Inference computing development boosts the long-term demand potential for Nvidia’s AI GPU chips.

Nvidia inventory is poised for extra features as its GPU chip enterprise continues to see surging demand.

That is in keeping with Morgan Stanley, which hosted conferences with Nvidia CEO Jensen Huang, CFO Colette Kress, and different members of the chip maker’s administration workforce for 3 days in New York Metropolis this week.

The important thing takeaway is that “each indication from administration is that we’re nonetheless early in a long run AI funding cycle,” Morgan Stanley analyst Joseph Moore mentioned.

The financial institution reiterated its “Obese” and “High Decide” rankings and $150 worth goal, representing potential upside of 12% from present ranges.

Moore mentioned Nvidia’s manufacturing ramp of its next-generation Blackwell GPU chip is “progressing on schedule,” including that the product is offered out for the subsequent 12 months.

“Any new Blackwell orders now that are not already in queue will probably be shipped late subsequent 12 months, as they’re booked out 12 months, which continues to drive robust quick time period demand for Hopper which can nonetheless be a significant component via the 12 months,” Moore defined.

Hopper is Nvidia’s earlier era of AI-enabled GPU chips, that are being offered in clusters to cloud “hyperscalers” like Amazon, Microsoft, and Meta Platforms.

And Nvidia has a brand new “factor” to its story, in keeping with Moore, which is the view that inference computing “is beginning to remedy rather more advanced issues which would require a a lot richer mixture of {hardware}.”

That must be a boon for Nvidia’s GPU chip product set, in keeping with the notice.

“The long run imaginative and prescient is that deep pondering will enable each firm on this planet to rent giant numbers of “digital AI staff” that may execute difficult duties,” Moore mentioned.

He added: “The notion {that a} extra considerate, activity oriented inference would trigger an exponential leap in inference complexity strikes us an essential new avenue for development, and one other clear space the place NVIDIA’s full stack method to fixing these issues provides to the corporate’s appreciable lead.”

Nvidia CEO Jensen Huang made it clear to Morgan Stanley that the corporate expects to see significant development in 2025 that spills over into 2026, “although he didn’t quantify,” Moore mentioned.

Nvidia’s shares have elevated for the reason that begin of October, rising about 10%. Nvidia inventory is up 172% for the reason that begin of this 12 months.

Learn the unique article on Enterprise Insider