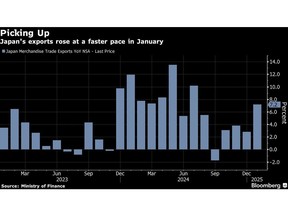

Japan’s exports rose at a quicker clip in January as companies ramped up orders simply as US President Donald Trump unleashed a barrage of protectionist insurance policies anticipated to take impact in coming months.

Article content material

(Bloomberg) — Japan’s exports rose at a quicker clip in January as companies ramped up orders simply as US President Donald Trump unleashed a barrage of protectionist insurance policies anticipated to take impact in coming months.

Article content material

Article content material

Exports measured by worth elevated 7.2% from a yr earlier led by shipments of automobiles and ships, the Ministry of Finance reported Wednesday. Exports rose broadly in step with expectations. Imports surged 16.7% led by communication equipment and computer systems, and beat the median estimate. Japan’s commerce steadiness swung again into the pink, with a deficit of ¥2.76 trillion ($18.2 billion), the most important in two years.

Commercial 2

Article content material

By area, shipments to the US rose 8.1%, whereas these to China fell 6.2%. Exports to Europe declined 15.1%.

The worldwide commerce outlook is more and more unsure. Trump stated Tuesday he would probably impose tariffs on car, semiconductor and pharmaceutical imports of round 25%, with an announcement coming as quickly as April 2. For medicine and chips, Trump advised that the levies will turn out to be considerably increased than 25% over the course of a yr.

“I believe there was a rush of demand for exports. Shipments clearly grew within the first half of the month earlier than the Trump administration started,” stated Takeshi Minami, economist at Norinchukin Analysis Institute. “I don’t assume this type of development matches demand within the US, so it’s fairly attainable that exports will decline down the street.”

Trump’s contemporary tariffs towards China already prompted retaliatory levies from Beijing, and the president has additionally threatened a variety of measures towards different nations, together with 25% levies on metal and aluminum imports that may take impact in March and reciprocal tariffs on quite a few buying and selling companions.

Article content material

Commercial 3

Article content material

Japan, whose two largest buying and selling companions are the US and China, is bracing for the potential impression and making an attempt to reduce fallout. Tokyo has requested Trump to exclude it from the metal and aluminum steps in addition to the reciprocal duties whereas it additionally seeks particulars concerning his different levy plans.

Exports to China declined for a second month because the lunar new yr holidays got here in January this yr, versus final yr after they had been in February. Going ahead, the renewed commerce struggle between Beijing and Washington is prone to affect Japan’s commerce as effectively.

Japan’s longstanding commerce surplus with the US continues to danger the ire of Trump, who favors utilizing levies to shut commerce gaps with different nations. Japan’s commerce surplus with the US was ¥477 billion in January. Auto exports to the US surged 21.8% within the month.

Automotive exports are a key part for Japan’s financial system, particularly at a time when inflation appears to be maintaining a lid on home consumption. Japan may endure each from the direct hit of tariffs on its shipments in addition to an oblique hit from duties rising on imports originating in Mexico and Canada, which each host factories owned by Japanese carmakers.

Commercial 4

Article content material

The tariff threats proceed to mount even after Prime Minister Shigeru Ishiba promised throughout his first summit with Trump earlier this month that Japanese corporations would increase funding into the US. Information from the Japan Vehicle Producers Affiliation present that in 2023, Japanese carmakers made 3.3 million automobiles within the US, greater than twice the 1.5 million automobiles they exported to the nation.

The yen averaged 157.20 per greenback in January, 9.2% weaker than a yr earlier, the Finance Ministry stated. Prior to now, Trump criticized the weaker yen for fueling the US commerce deficit with Japan. Because the begin of his second time period in late January, the president hasn’t raised the problem — even when he met Ishiba head to head in Washington.

A budget yen is an issue for Japanese shoppers and companies because it raises the prices of imported vitality and meals. Japan’s foreign money has stayed weak even because the Financial institution of Japan has rolled again straightforward financial settings over the past yr with a sequence of gradual rate of interest hikes. The federal government has added money assist for low-income households to assist them deal with the cost-of-living crunch.

“If the US actually imposes 25% tariffs on cars on April 2, I believe the impression on the Japanese financial system can be important,” stated Norinchukin’s Minami. “The Trump administration is asking for extra factories to be constructed within the US, which may trigger Japan’s manufacturing bases to lower.”

(Updates with economist feedback, extra background.)

Article content material