Supply: The Faculty Investor

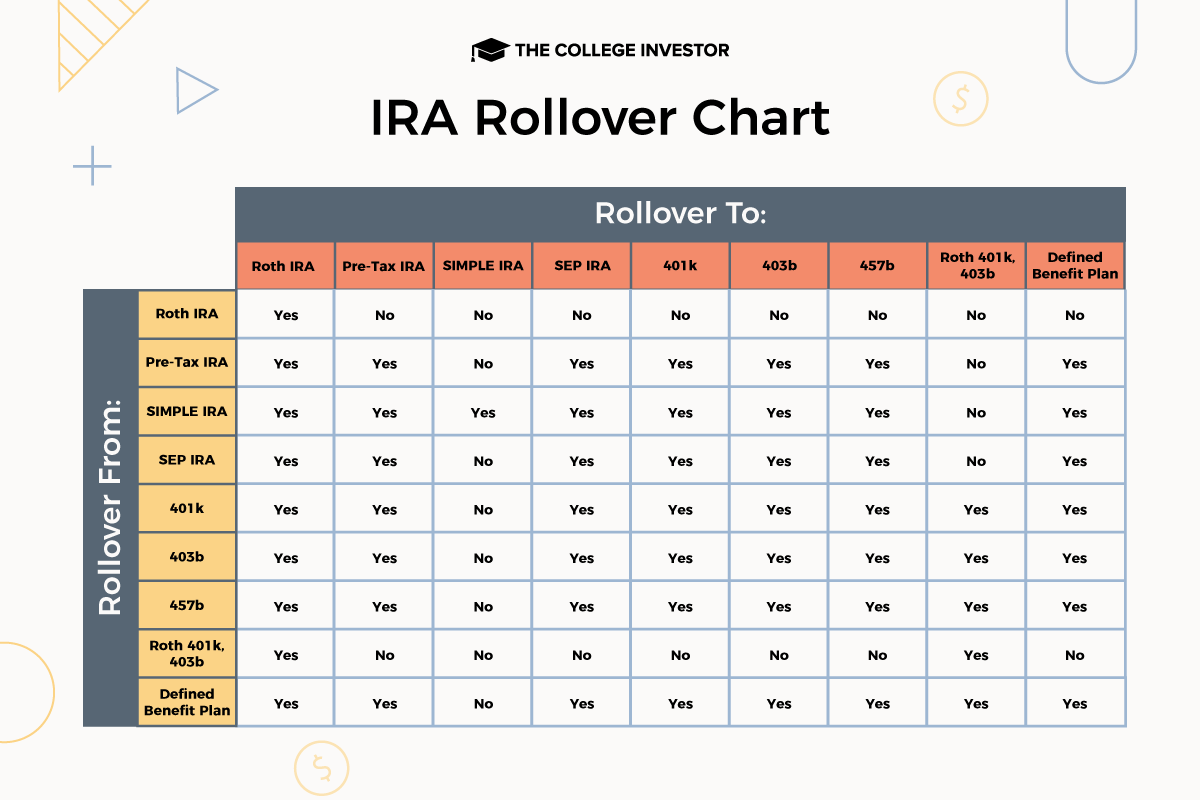

It is necessary that you just perceive the place you possibly can rollover your IRA or 401k. However it may be sophisticated! So we created this IRA Rollover Chart that can assist you know the place you possibly can transfer totally different accounts.

In comparison with the mid-twentieth century, workers not keep at a job their complete life. The place a pension and one firm was widespread, now switching jobs yearly or so is the norm. Such job-hopping creates a extra dynamic scenario in your retirement.

Pensions have light away and been changed by self-managed retirement. When workers swap jobs, they’ve a couple of choices of what they’ll do with their retirement. Rolling it over into one other account is one choice accessible to them.

On this article, we’ll speak about the place you possibly can roll your retirement to once you go away your job. Plus, we now have a useful IRA rollover chart that lays all of it out for you.

Why Rollovers Are Essential

One of the widespread causes for rolling over a retirement account is to maneuver it out of a former employer’s plan. In that case, a 401(ok) is rolled into an IRA at one other brokerage of your selecting. There are a couple of advantages to doing this:

- Extra diversification: Employer retirement plans usually have only a few funds accessible, which interprets into inadequate diversification. Possibly there may be an all-world index, an S&P 500 fund, and a few bond funds. There could also be a handful or so of such choices. Wish to put money into oil, actual property, rising markets, a selected nation, excessive tech, and many others.? You’ll typically be out of luck.

- Decrease charges: Most employer plan funds even have excessive charges. Whereas fund charges have come down enormously lately, rolling your 401(ok) into an IRA will typically prevent a couple of tenths of a share level in fund charges. Fund charges aren’t the one charges to think about. There are additionally employer plan administrative charges as properly. Most IRA plans solely have fund charges.

- Extra management: Not solely do you’ve extra diversification in an IRA, you management when cash goes into the account and the way. There can be some advantages when it comes time to tug cash out throughout retirement, relying on what you roll into.

Along with leaving an employer, there are different causes to roll over. You might need two or extra retirement plans at your earlier employer. A rollover provides the prospect to consolidate them into one plan, which can present simpler administration of these funds.

Lastly, you won’t have any motive to roll funds over into one other account. In case your earlier employer’s plan provides nice diversification and low charges, it is perhaps troublesome to compete with that. You would even do an IRA to 401k reverse rollover.

Rolling Your Retirement

Let’s reply the query of the place you possibly can roll your retirement account to. Relying on the account sort, you possibly can roll into numerous retirement account varieties. The IRS has very particular rollover tips.

Probably the most restrictive rollovers are the Roth IRA, which may solely be rolled into one other Roth IRA, and the designated Roth account, which may solely roll into one other designated Roth account and a Roth IRA.

Observe that every plan listed beneath will be rolled to the identical plan at a unique brokerage. For instance, a Roth IRA will be rolled into one other Roth IRA.

- Roth IRA: Can’t be rolled into some other account sort.

- Conventional IRA: Might be rolled to Roth IRA, SEP-IRA, 457(b), pre-tax certified plan, and pre-tax 403(b).

- SIMPLE IRA: Might be rolled to the next after two years: Roth IRA, conventional IRA, SEP-IRA, 457(b), pre-tax certified plan, and pre-tax 403(b). The 2-year wait doesn’t apply if rolling into one other SIMPLE IRA.

- SEP-IRA: Might be rolled to Roth IRA, conventional IRA, 457(b), pre-tax certified plan, and pre-tax 403(b).

- 457(b): Might be rolled to Roth IRA, conventional IRA, SEP-IRA, pre-tax certified plan, pre-tax 403(b), and a delegated Roth account.

- Pre-tax certified plan: Might be rolled to Roth IRA, conventional IRA, SEP-IRA, 457(b), pre-tax 403(b), and a delegated Roth account.

- Pre-tax 403(b): Might be rolled to Roth IRA, conventional IRA, SEP-IRA, 457(b), pre-tax certified plan, and a delegated Roth account.

- Designated Roth account: Can solely be rolled to Roth IRA.

Observe, rolling from a pre-tax account to a Roth account could have tax implications. Additionally, to roll into some plans (reminiscent of a 401k or outlined profit plan, the plan should enable it).

IRA Rollover Chart

This is a useful IRA rollover chart that would assist make issues clear:

IRA Rollover Chart. Supply: The Faculty Investor

Restrictions to Be Conscious of When Rolling Over

As soon as the rollover course of begins, you’ll have 60 days to finish it. In any other case, the cash is taken into account a withdrawal and topic to revenue taxes. Additionally, in case you are below 59.5 years of age, these funds will incur a ten% early withdrawal penalty.

Have any test made out to the brand new plan and never you. Ship the test on to the brand new plan. Don’t neglect to report the rollover in your revenue taxes as a non-taxable distribution.

Which Brokerages to Open Your Account At

When you aren’t positive which brokerage to roll your new plan to, we’ve recognized the highest brokerages in our article, The Finest Conventional and Roth IRA Accounts. A number of the names listed you’ll already be acquainted with, reminiscent of Vanguard, Constancy, Schwab, and Betterment. Some names chances are you’ll not have heard of. You actually can’t go mistaken with any of them.

Rolling over a retirement plan isn’t troublesome or time-consuming. Simply observe each plan directors’ directions and you must have a hassle-free rollover expertise.

The publish IRA Rollover Chart: The place Can You Transfer Your Account? appeared first on The Faculty Investor.