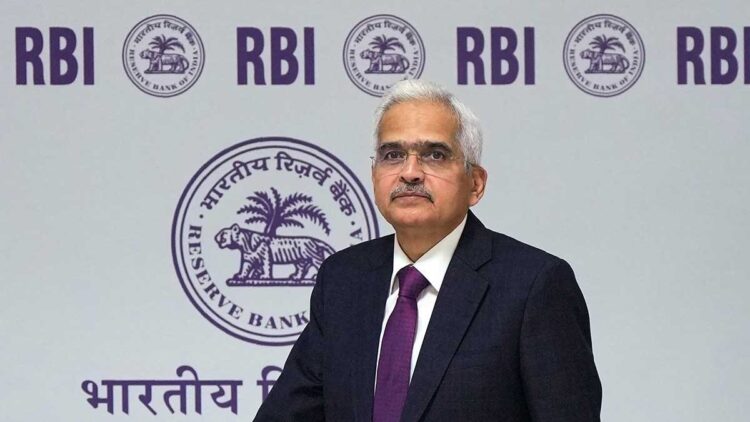

The Reserve Financial institution of India (RBI) on Wednesday determined to maintain the repo charge regular at 6.5%, with Governor Shaktikanta Das emphasizing the necessity for warning on inflation, regardless of latest indicators of moderation.

Whereas sustaining the retail inflation estimate for FY25 at 4.5%, Das warned, “We now have to be very cautious about opening the gate, because the inflation horse could bolt once more.”

The governor’s feedback replicate a fragile stability between managing inflation dangers and supporting financial progress. Though headline inflation has proven indicators of easing, Das identified the challenges in reaching the “final mile of disinflation” and the numerous dangers that stay. He famous that the evolving home value state of affairs suggests some moderation forward, however confused the necessity to carefully monitor situations for additional disinflationary impulses.

The RBI’s Financial Coverage Committee (MPC) additionally shifted its coverage stance from “withdrawal of lodging” to “impartial,” indicating a extra balanced strategy towards progress. The choice comes within the context of India’s regular financial progress, with actual GDP projected to develop by 7.2% in FY25, supported by Q2 progress at 7%, and seven.4% in Q3 and This fall.

Deepak Shenoy, founding father of Capitalmind, questioned the choice to carry charges. In a submit on X, he famous, “Charges unchanged, says RBI. Unusual—they quote climate, meals is okay, gasoline is fab, and many others. It’s ludicrous to have lower than 4% inflation with a 6.5% repo for this lengthy.” Shenoy additionally raised issues concerning the RBI’s function in doubtlessly fueling inflation by substantial USD purchases, signaling that the broader impression of those actions is but to be absolutely understood.

The RBI’s stance displays a cautious strategy, aiming to strike a stability between inflation management and sustaining progress. As Das put it, whereas the “inflation horse” could presently be within the secure, the central financial institution stays cautious of it breaking free, underscoring the significance of vigilance within the months forward.