Earlier than the buying and selling day begins we convey you a digest of the important thing information and occasions which are prone to transfer markets. Right now we have a look at:

Article content

(Bloomberg) — Before the trading day starts we bring you a digest of the key news and events that are likely to move markets. Today we look at:

Article content

Article content

- Bharti Musk handshake

- Domestic money flow

- Macro recovery on cards

Good morning, this is Chiranjivi Chakraborty, an equities reporter in Mumbai. US markets extended losses and Asian markets are mixed this morning as investors worldover grapple with US President Donald Trump’s tariff flipflops. While Nifty futures point to a flat start, much of the action could be in mid and small-cap shares, where news flow has been largely negative in recent weeks.

Advertisement 2

Article content material

Airtel-SpaceX deal to compound Reliance’s woes

Bharti Airtel’s shock cope with SpaceX to convey Elon Musk’s satellite tv for pc Web providers to the nation may put additional strain on Reliance Industries’ inventory. The partnership marks the tip of a months-long battle over Starlink’s entry into the nation’s telecom sector, a battle that after noticed rivals Bharti and Reliance briefly be part of forces. Now, with Airtel switching sides and rolling out the pink carpet for Musk, the telecom vertical of billionaire Mukesh Ambani’s $193 billion empire may face investor skepticism, following current deratings of its retail and vitality companies.

Foreigners monitor native flows for market indicators

Home cash has been a key pillar of help for Indian equities and stays resilient at the same time as share costs decline. Native establishments, primarily mutual funds, have plowed a internet $20 billion into native shares, serving to take up the $15 billion of promoting by world funds this yr. Whereas overseas fund selloff has abated in current periods, world buyers are carefully looking forward to any indicators of weak spot in native flows, significantly in month-to-month recurring funding plans, in accordance with Macquarie. The mutual fund trade’s knowledge launch on Wednesday may provide insights into native buyers’ sentiment amid shrinking returns.

Commercial 3

Article content material

Morgan Stanley sees India demand rebounding

Whereas acknowledging the potential draw back dangers from commerce tensions, Morgan Stanley is assured {that a} restoration in home demand is taking form and can assist maintain development momentum. This could place India because the area’s development driver once more, says the financial institution’s Chief Asia Economist Chetan Ahya. He attributes the restoration to elevated authorities spending on infrastructure, easing financial coverage, and moderating meals inflation — the latter two anticipated to elevate actual family incomes.

Analysts actions:

- Infosys Lower to Equal-Weight at Morgan Stanley

- IndusInd Financial institution Lower to Maintain at BOB Capital Markets; PT 870 rupees

- Affle India Rated New Purchase at Equirus Securities Pvt Ltd

Three nice reads from Bloomberg in the present day:

- Trump Walks Again 50% Canada Tariff Risk, Downplays Recession

- Goldman Sachs Says US Credit score Spreads Will Get a Lot Wider

- Massive Take: China Piles the Stress on India in Its Personal Yard

And, lastly..

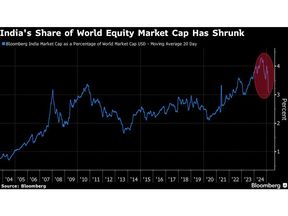

India’s fairness market rout has wiped off greater than $1 trillion in worth over the previous 4 months, additionally shrinking the nation’s share of the worldwide market capitalization. On a 20-day common, India’s share of worldwide fairness market worth is near hitting the three% mark, down from a peak of greater than 4% final yr.

To learn India Markets Buzz on daily basis, observe Bloomberg India on WhatsApp. Enroll right here.

—With help from Chiranjivi Chakraborty and Kartik Goyal.

Article content material