Supply: The Faculty Investor

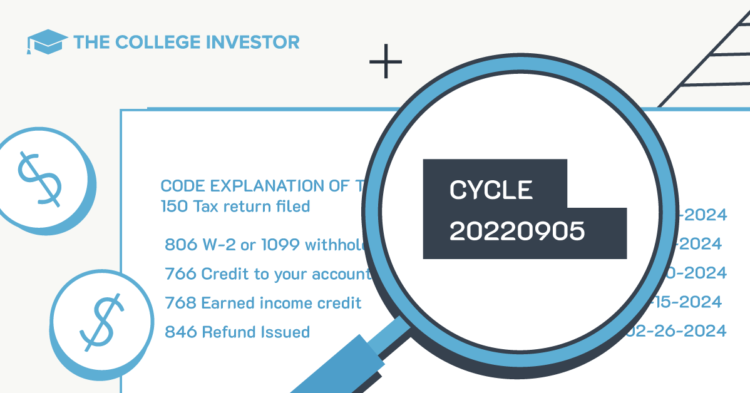

An IRS cycle code is an 8-digit code in your IRS tax transcript that signifies the day your return was posted to the IRS Grasp File.

Understanding this quantity may also help you identify when your tax refund is more likely to be processed and deposited. It might additionally assist you determine the date that pending holds and different points are more likely to be resolved.

Right here’s every part you want to learn about understanding and discovering your IRS cycle code.

What Is An IRS Cycle Code?

An IRS cycle code is an 8-digit quantity discovered in your IRS tax transcript, representing when a sure tax exercise is enter into the IRS Grasp File.This may very well be your refund date, but additionally may very well be the discharge of a maintain or different objects.

The code is damaged into three elements: the tax processing 12 months, the week of the 12 months, and the day of the week. These numbers may also help you estimate when the IRS obtained and processed your return, which may give you a greater concept of while you would possibly obtain your tax refund.

For instance, the code “20240604” would break down like this:

• 2024: The tax 12 months

• 06: The sixth week of the 12 months

• 04: Wednesday (the day your return was processed)

When you translate that right into a “actual” date, that may be: Wednesday, February 7, 2024.

Understanding this data helps you observe the place your return is within the course of and offers you a clue as to when your refund is perhaps deposited.

The place To Discover IRS Cycle Code

To find your IRS cycle code, you’ll want entry to your IRS tax transcript. You’ll be able to simply receive this by the IRS’s “Get Transcript” instrument, which lets you view or obtain your transcript free of charge.

After getting your transcript, look underneath the “Transactions” part, the place you’ll see the heading “Cycle” adopted by the 8-digit code. This quantity is your cycle code and offers you a snapshot of when your return was posted to the IRS Grasp File for processing.

Here is an instance:

IRS Tax Transcript with Cycle Code Highlighted. Supply: The Faculty Investor

How To Learn Your Cycle Code

Studying your IRS cycle code is easy when you perceive the format. The primary 4 digits seek advice from the tax 12 months. The fifth and sixth digits symbolize the week of the 12 months, and the final two digits let you know which day of the week your return was processed.

Right here’s a step-by-step information to decoding your cycle code:

- Yr: The primary 4 digits correspond to the tax processing 12 months. For instance, in “20240604,” the 12 months is 2024.

- Week of Yr: The fifth and sixth digits symbolize the week of the tax 12 months. On this instance, “06” means the return was processed in the course of the sixth week of the 12 months, which might fall in early February.

- Day of the Week: The seventh and eighth digits let you know the day of the week that your return was processed.

The IRS makes use of a numbering system for the times, the place:

- 01 = Friday

- 02 = Monday

- 03 = Tuesday

- 04 = Wednesday

- 05 = Thursday (reserved for weekly processing)

So, “20240604” means the return was processed on a Wednesday in the course of the sixth week of 2024. When you take that to a calendar, you will see that really interprets to Wednesday, February 7, 2024.

Different Key Issues To Know

Listed below are another key issues to know:

IRS Code 846: Refund Issued

Whereas the cycle code is beneficial in understanding when your return was processed, a very powerful code to search for is IRS Code 846. This code signifies that your refund has been permitted and a direct deposit date has been set. When you see this code in your transcript, you possibly can anticipate your refund to be deposited quickly, typically the day after your cycle code’s day.

For instance, in case your transcript exhibits Code 846 and a cycle code of “20240604,” it means your refund will doubtless be deposited on Thursday, the day after the processing.

What The IRS Cycle Codes Do not Inform You

Whereas IRS cycle codes are useful for understanding when your return was processed, they aren’t a foolproof methodology for predicting your refund date. Numerous elements, equivalent to IRS delays, backlog, or further assessment of your return, can push your refund timeline past what the cycle code signifies. Moreover, statutory limitations just like the PATH Act, which delays refunds for taxpayers claiming the Earned Earnings Tax Credit score (EITC) or Further Little one Tax Credit score (ACTC), can additional complicate predictions.

How To Test Your Refund Standing?

The best option to verify your refund standing is through the use of the IRS’s “The place’s My Refund?” instrument. You’ll want your Social Safety quantity, submitting standing, and the precise quantity of your anticipated refund. Whereas this instrument updates every day, chances are you’ll not see any adjustments till your return has been processed, which may take time relying on the amount of returns the IRS is dealing with.