Supply: The School Investor

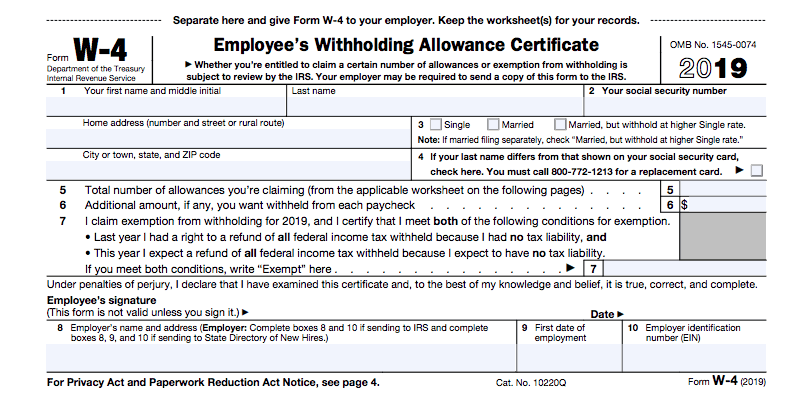

For those who’re seeking to fill out an IRS Type W-4 to alter your withholding, we break it down beneath. That is the shape you fill out whenever you’re first employed at a job, or if you wish to change the quantity of taxes taken out of your paycheck every month.

For those who’re beginning a job, or discovering your self getting an enormous tax refund annually – you possible wish to alter your W-4 withholding quantity with the intention to be precisely paid.

Right here’s what it’s good to know in regards to the kind, so you possibly can fill it out accurately.

What Is the Type W-4?

Everytime you begin a brand new job, you’ll be anticipated to fill out a Type W-4. This type tells your employer how a lot cash to withhold out of your paycheck. The withheld cash is distributed straight to the IRS and your state or native income division to pay your revenue taxes.

The IRS has discovered that it collects extra tax income when it collects cash all year long as a substitute of counting on folks to pay an enormous tax invoice on the finish of the yr.

It’s essential to notice that the Type W-4 solely applies to individuals who have an ordinary employer. For those who’re a contractor, freelancer, small enterprise proprietor, and many others., you’ll have to file and pay quarterly tax estimates by yourself.

After you fill out the W-4, your employer withholds a set quantity of taxes based mostly on a number of totally different variables. The variables you possibly can’t management embody the quantity you earn from that employer and whether or not you file as single, married submitting individually, or collectively. The variables you possibly can management embody the variety of allowances you choose (we’ll clarify this later, however extra allowances means fewer taxes are withheld) and whether or not you ask to have extra taxes withheld.

How Do I Fill Out the Type W-4?

Filling out the primary little bit of the Type W-4 is straightforward. Merely enter your identify, Social Safety standing, and your marital standing. Additionally, verify field 4 in case your identify differs from the identify in your Social Safety card.

Sadly, the straightforward bit is up, and the difficult bit begins whenever you get to field 5.

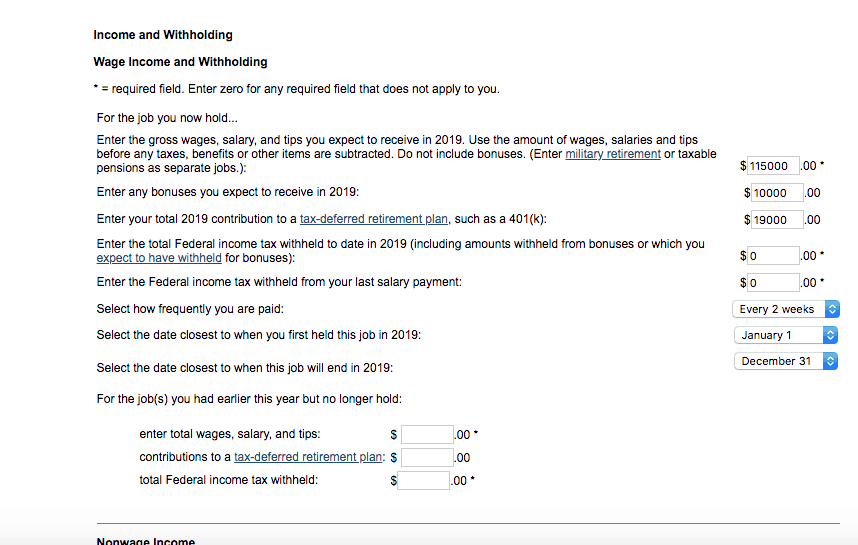

Earlier than you possibly can fill out field 5, you must go to the subsequent few pages that are “calculators.” I’ll clarify the calculations intimately, however I like to recommend utilizing the IRS Withholding Calculator to do the maths for you.

The calculator makes it straightforward to find out what number of allowances (field 5) and what number of extra withholdings you must elect.

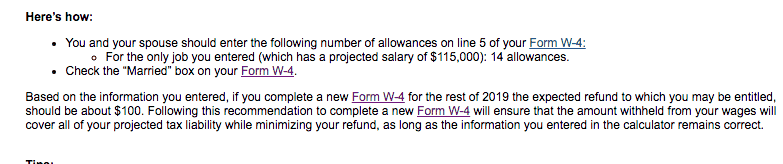

Simply make sure you verify your numbers rigorously. I by chance added an additional zero to the Federal taxes withheld ($15,000 as a substitute of $1,500) and the calculator instructed me to pick out 14 allowances. After I reran, I used to be directed to pick out 2 as a substitute.

How Ought to I Fill Out Strains 5 and 6?

For those who favor to do issues the laborious means, you possibly can fill out the Type W-4 calculator by hand. The calculator has three sections.

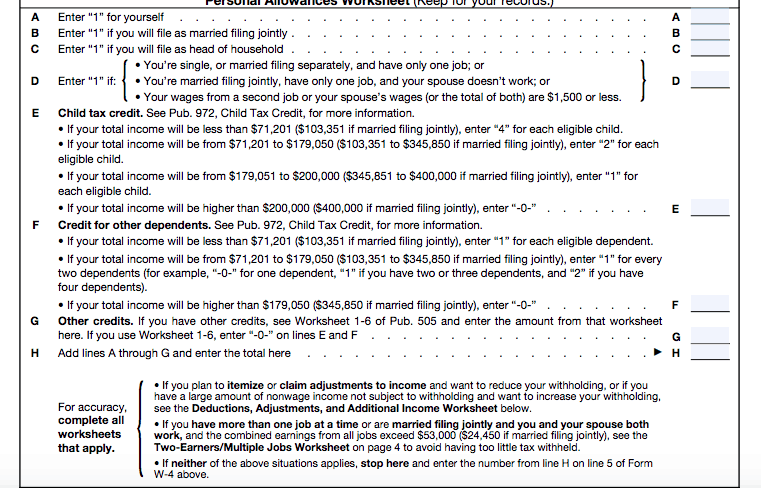

Private Allowances Worksheet

Beginning with the primary part, you’ll add up the variety of allowances you wish to choose based mostly in your private revenue. Line A is all the time 1. For those who’re married submitting collectively, you’ll enter 1 on line B.

Part D, E, and F cowl widespread household situations. In my case, each my husband and I work, so we chosen 0 for line D. We’ve 3 kids, and we count on to earn between $103,351 and $345,580, so we chosen 6 for line E.

For those who count on to earn different tax credit, such because the little one and dependent care tax credit score (particularly in the event you don’t have a daycare FSA and/or the Saver’s credit score — lots of faculty college students who aren’t claimed as dependents might be eligible for this). Truthfully, except you’re a tax geek, you most likely don’t know what credit you’re eligible to obtain. You would select to do your analysis on this through the use of particular person credit on the IRS web site.

Not eager about doing tax homework? I’ll refer you once more to the Withholding Calculator on the IRS web site.

Subsequent, you’ll have to regulate your withholdings. For those who’re single, and also you solely count on to have one job this yr, and also you gained’t itemize your taxes, you’re finished. Enter the quantity from line H into field 5 on the primary sheet. Signal the W-4 and name it a day.

Nonetheless, in the event you plan to itemize, it’s good to transfer to the subsequent a part of the worksheet.

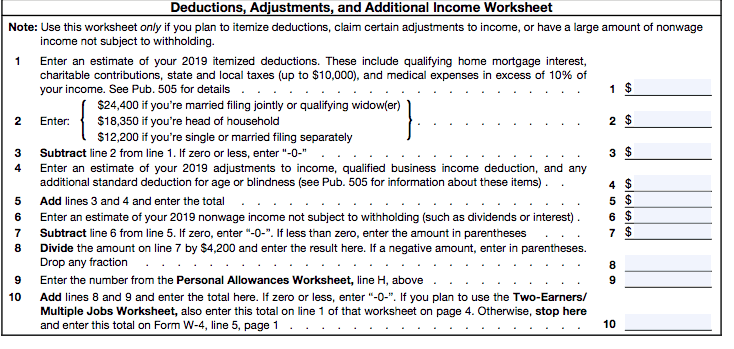

Deductions, Changes, and Extra Revenue

This worksheet is especially for individuals who itemize their taxes, nevertheless it’s price calling out line 6. That is the place you enter any revenue that isn’t topic to withholdings. For instance, in the event you earn dividends, curiosity, capital good points (from the sale of inventory or home flipping), or rental revenue, enter that revenue right here.

In my case, rental property revenue yields a −2 on line 6 for us. In fact, the precise data you fill in relies on your private circumstances.

The IRS tells you so as to add line H from the primary worksheet to line 8 from this worksheet. In my case that was 8 + (−2) = 6.

If I had been the one earner in my household, I’d enter 6 in field 5 on the primary sheet, signal my W-4, and be finished.

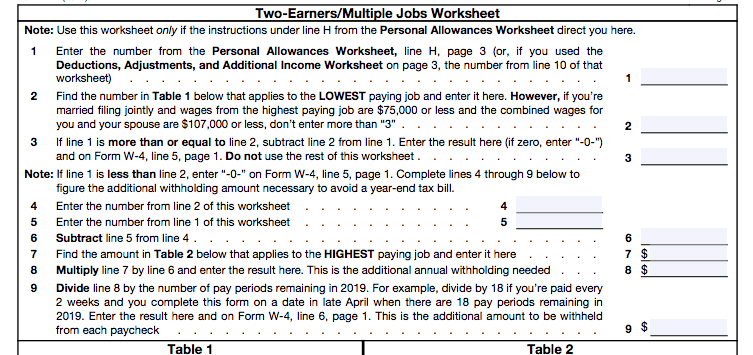

Two-Earners/A number of Jobs Worksheet

Nonetheless, I’m in a dual-earning couple, so I needed to transfer on to the ultimate sheet. For those who’re in a dual-earning marriage, or you will have a number of jobs, fill out the ultimate sheet.

This one is price going by way of line by line because it applies to many individuals.

On line 1, you’ll enter your complete allowances thus far. For most individuals, that’s line H from the Private Allowances Worksheet. For those who’re somebody who itemizes deductions or you will have additional revenue (akin to rental revenue), you’ll want to make use of line 10 from the second worksheet.

Subsequent, you must decide the place you earn the lesser amount of cash. Let’s say your partner earns $50,000 per yr and is the decrease earner. You’ll enter 6 on line quantity 2. For those who’re treating this as a second job, and also you earn $20,000 per yr at your second job, you’d enter 2 on line 2.

Learn the instructions rigorously, and make sure that you’re doing this for the decrease quantity.

Line 3 is a possible stopping level. Subtract line 2 from line 1. In my case I had 6 private allowances (line 1) and 6 for line 2. This meant my complete allowance calculation was 0. The IRS instructed me to enter 0 withholdings and be finished.

In case your quantity is optimistic or 0 you get to cease. However when you’ve got a damaging quantity, the IRS needs you to account for extra withholdings.

The precise quantity of extra withholdings is calculated utilizing the formulation in steps 4 by way of 9. Crucial factor to notice is that in line 7, it’s good to take into consideration your highest paying job. You additionally want to make use of the desk on the fitting to find out your extra withholdings.

What About State Tax Withholdings?

If in case you have a state revenue tax, and you’ve got taxes withheld out of your paycheck, you may also alter your withholding. Every kind is barely totally different based mostly on the state you are in, however the rules are the identical.

Most states additionally can help you add additional “flat” greenback quantity withholdings if that is simpler.

Backside Line

Filling out the W-4 accurately will assist you keep away from over- or under-withholding. Personally, I feel utilizing the IRS calculator is the best way to go. It streamlines the method. That stated, filling out the W-4 by hand might offer you a number of good concepts on how one can cut back your tax burden, so you will have extra money to avoid wasting and make investments.