Supply: The Faculty Investor

Are you attempting to determine what scholar mortgage compensation plan is smart for you?

The myriad of choices might be complicated, however determining the appropriate choice is crucial to your monetary well being. There are over 150 totally different choices in your scholar loans – from Federal loans, non-public loans, mortgage forgiveness plans, and extra.

It is vital to recollect the perfect scholar mortgage compensation plan is the one which you can afford to pay every month, on time, with out lacking funds. Absolutely the worst factor you are able to do is go into default in your scholar loans.

Under we define assets and choices that can assist you work out what is smart for you.

The place To Begin

If you do not know the place to even begin, listed below are some useful assets. It’s also possible to use our Scholar Mortgage Calculator to run some fundamental numbers.

Your Mortgage Servicer

Mortgage servicers aren’t recognized for the perfect customer support. Nonetheless, a mortgage servicer can offer you details about your present loans together with your present compensation plan.

That is their job, and you will have to work with them ultimately. Do not be shy to offer them a name or use their on-line instruments.

Chipper

Chipper is a instrument that may enable you perceive your mortgage compensation choices. It has a database of mortgage compensation choices, and it helps you optimize primarily based in your private circumstances. Not like numerous instruments, it doesn’t robotically push customers to refinance loans.

This instrument is very helpful for folks simply getting began with debt compensation, and those that might qualify for Public Service Mortgage Forgiveness.

Refinancing Marketplaces

Are you able to simply afford your mortgage fee on a 10-year compensation plan? In that case, refinancing your debt may make sense. Use a market like Credible to search out scholar mortgage refinancing choices.

It’s also possible to have a look at our checklist of the perfect scholar mortgage refinance lenders right here.

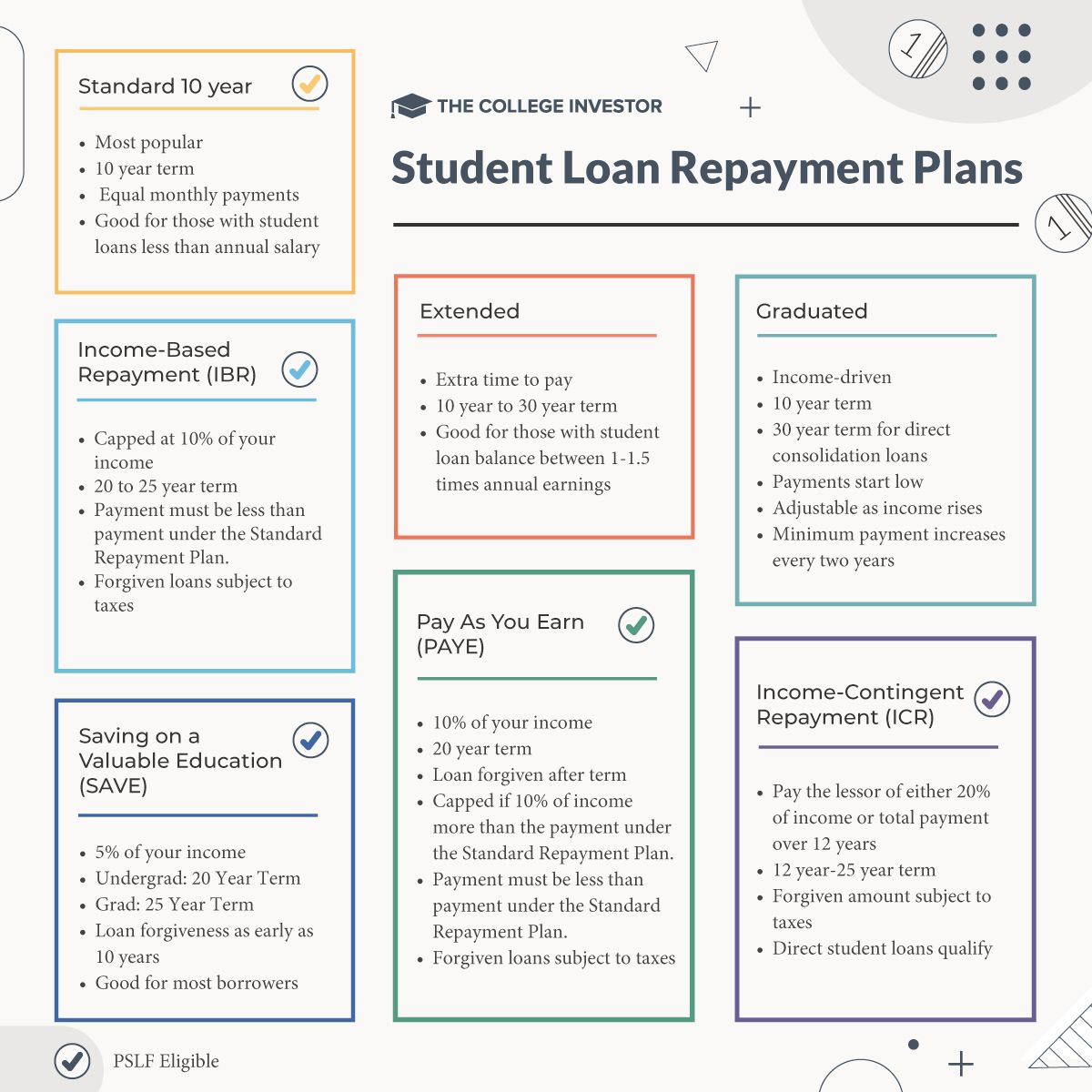

Customary Compensation Plan

Once you take out Federal scholar loans, your mortgage servicer will robotically decide you into the Customary Compensation Plan. Underneath this plan, you’ll make equal month-to-month funds for 10 years, after which your loans will probably be paid off!

The Customary Compensation Plan is the preferred scholar mortgage compensation plan, though that’s most likely as a result of it’s a default compensation plan.

Generally, in case your annual wage is greater than you owe in scholar loans, the Customary Compensation Plan is smart for you. For instance, for those who earn $47,000 per yr, and also you owe $33,000 in scholar loans, typically, you’ll be able to afford to repay the loans.

Should you owe extra in scholar loans than you earn every year, you’ll wish to keep away from this plan (at the least for now).

Prolonged Compensation Choice

Once you do a direct consolidation of Federal scholar loans, you’ll be able to decide into the prolonged compensation choice.

Technically, there are two variations of this program. In case your mortgage compensation began between October 7, 1998 and July 1, 2006, you’ll have 25 years to repay your loans. The funds will probably be stage month-to-month funds over the 25 years, and also you’ll have a minimal of a $50 month-to-month fee.

For many who began mortgage compensation after July 1, 2006, the compensation time period is dependent upon the mortgage stability. Compensation phrases vary from 10 to 30 years.

Should you don’t plan to use for Public Service Mortgage Forgiveness, and also you want some additional time to pay again your loans, this plan may make sense. It may be significantly useful in case your whole mortgage stability is between 1 and 1.5 occasions your annual earnings. For instance, for those who earn $200,000 per yr, and also you owe $250,000 in scholar loans, this might make sense for you.

Graduated Compensation Choice

A graduated compensation plan is a fee program that permits debtors to repay loans over a 10-year interval. Should you’ve taken a Direct Consolidation Mortgage, the compensation interval might last as long as 30 years relying on the stability.

Underneath the Graduated Compensation Plan, funds begin low. However your minimal fee will increase each two years. Ostensibly, this provides debtors the power to regulate their funds as their earnings rises.

Nonetheless, this can be a plan that looks as if the worst of all potential worlds. In lots of instances, funds underneath this plan triple over the course of 10 years. Plus, a ton of your fee goes in direction of servicing curiosity within the early years, so that you’re unlikely to see actual progress till your previous couple of years.

Generally, for those who can’t afford your funds proper now, an income-driven compensation plan makes essentially the most sense.

Earnings-Pushed Compensation Plans

Should you’re pursuing Public Service Mortgage Forgiveness, you undoubtedly wish to be on one of many income-driven compensation plans. Nonetheless, there are 4 choices, and it isn’t at all times apparent which one makes essentially the most sense.

SAVE (REPAYE)

The REPAYE Plan was just lately rebranded as SAVE (Saving on a Useful Schooling) Plan. The Biden Administration principally revised the principles on the REPAYE Plan to assist extra debtors.

This plan replace occurs in two phases. Some options can be found proper now, others roll out in 2024.

Proper now, this plan presents the next:

- The change within the earnings threshold from 150% of the poverty line to 225% of the poverty line. Try our up to date discretionary earnings calculator to see how this modifications.

- The waiver of curiosity past the required fee may also be carried out.

- Debtors who file federal earnings tax returns as married submitting individually can have their mortgage funds calculated primarily based on simply their very own earnings. Spouses will not must cosign the SAVE compensation plan software.

Beginning in 2024, this plan may also have:

- The change within the share of discretionary earnings, from 10% to five%.

- The forgiveness of the remaining debt after 10 years for debtors with low preliminary mortgage balances.

- Consolidation will not reset the qualifying fee depend for forgiveness. Extra deferments and forbearances will depend towards forgiveness.

- The automated use of tax info to calculate the month-to-month fee underneath the SAVE plan. Computerized recertification of earnings and household dimension.

- Debtors who’re 75 days late will probably be robotically enrolled in an income-driven compensation plan.

When the SAVE plan is totally carried out, debtors will see the bottom month-to-month scholar mortgage fee of any particular person compensation plan.

⚠︎ SAVE is At present Paused Due To Pending Litigation

The SAVE compensation plan is at present on pause as a result of pending litigation. Debtors who had been enrolled within the SAVE plan earlier than the lawsuit are at present on an administrative forbearance. Different debtors who want to enroll might even see their loans find yourself in a processing forbearance.

Earnings-Based mostly Compensation (IBR)

Should you began borrowing after July 1, 2014, your fee is capped at 10% of your earnings, and you’ll make funds for 20 years. Should you borrowed earlier than July 1, 2014, your time period will probably be 25 years. After 20 or 25 years, your loans will probably be forgiven, however you’ll want to be careful for the tax bomb the yr the loans are forgiven.

To qualify for IBR, your fee underneath IBR have to be lower than the fee underneath the Customary Compensation Plan.

Debtors can mix IBR with Public Service Mortgage Forgiveness. Once you do that, you’ll make certified funds for 10 years, then the mortgage will probably be forgiven.

Pay As You Earn (PAYE)

Underneath PAYE plans, your fee is 10% of your earnings, and your compensation time period is 20 years. If 10% of your earnings is greater than the fee underneath a regular compensation plan, then your fee is capped. After 20 years of funds, your mortgage is forgiven, however it’s a must to be careful for the tax bomb.

To qualify for IBR, your fee underneath IBR have to be lower than the fee underneath the Customary Compensation Plan.

You could use PAYE along with Public Service Mortgage Forgiveness.

Associated: IBR vs. PAYE

Earnings-Contingent Compensation (ICR)

Anybody with Direct scholar loans can go for an Earnings-Contingent Compensation Plan.

On an ICR plan, you pay the lesser of both 20% of your discretionary earnings or what you’ll pay with a hard and fast plan over 12 years.

Once you use the 20% choice, your funds can stretch out as much as 25 years. After a most of 25 years, your loans will both be paid off or they are going to be forgiven. The forgiven quantity is topic to earnings taxes.

You could use PAYE along with Public Service Mortgage Forgiveness.

Non-public Mortgage Compensation Choices

Non-public scholar loans haven’t got the identical compensation plan choices which might be provided by the Division of Schooling. Moderately, the mortgage phrases are set by your lender if you take out the mortgage.

Non-public loans have phrases starting from 1 yr to twenty years, and the rate of interest might be fastened or variable. We break down the perfect non-public loans right here so you’ll be able to see how yours compares.

Most lenders supply some or the entire following sorts of plans:

- Rapid Compensation – That is the place you begin making month-to-month funds instantly

- Deferment In College – That is the place your fee is deferred whilst you’re at school, and sometimes for six months after you graduate

- Set Month-to-month Cost In College – That is the place you could have a small, set month-to-month fee (equivalent to $25) whereas at school

- Curiosity Solely In College – That is the place you pay solely your accrued curiosity every month whereas at school

If you have already got non-public loans, the standard method to change your compensation plan is to easily refinance your scholar mortgage into one other scholar mortgage with higher charges or phrases. Yow will discover our information to Scholar Mortgage Refinancing right here.

Associated: Non-public Scholar Mortgage Forgiveness Choices

Last Ideas

As soon as once more, the perfect scholar mortgage compensation plan is the one which you can afford to make each month. Should you fail to make your month-to-month funds, not solely will your credit score be harm, however you’ll be able to see your wages garnished and extra. Plus, going into default will see your mortgage stability robotically rise by about 25% as a result of accrued curiosity and assortment prices.

The underside line is to be sure you get in the perfect compensation plan that works for you!