Supply: The Faculty Investor

There is a staggering lack of economic literacy in the case of how pupil loans work when paying for faculty.

Each school monetary support workplace says “simply apply for pupil loans”, however no one tells you the way pupil loans work!

More and more, tuition continues to rise, saddling thousands and thousands of scholars with massive quantities of pupil mortgage debt. In truth, the common pupil is graduating with nearly $30,000 in pupil loans. That’s barely greater than a Tesla Mannequin 3 or perhaps a marriage ceremony. With out college students loans, many individuals wouldn’t even have the ability to attend school.

For many anybody heading to school, pupil loans will grow to be a reality of life. However the place do pupil loans come from, how a lot are you able to borrow, and what’s the true value? On this article, you’ll be taught all about how pupil loans work.

The Ins and Outs of Pupil Loans

Pupil loans can be found for undergraduate and graduate college students alike. They’re based mostly on want, of which earnings is just one part. College students loans are issued by the federal government (therefore the time period Direct Mortgage – straight from the federal government). Though, non-public pupil loans are additionally out there. The quantity issued to a pupil will depend upon the coed’s monetary state of affairs. The ultimate choice is as much as the varsity.

Monetary support packages are step one in receiving a pupil mortgage. The monetary support bundle is made up of present support (resembling grants and scholarships), loans, and work-study packages.

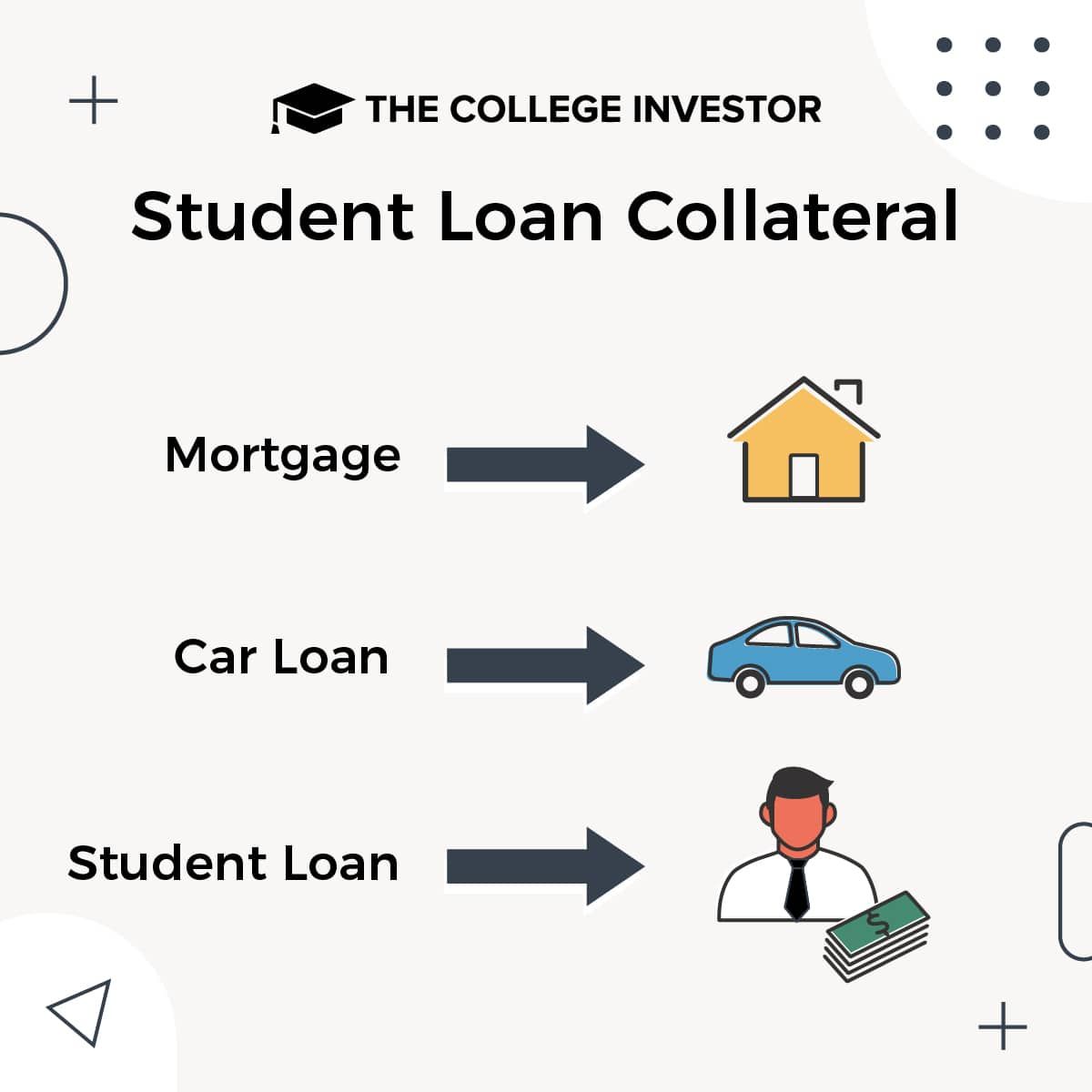

What’s the collateral for a pupil mortgage? It is necessary to keep in mind that the collateral for a pupil mortgage is your future earnings. If you purchase a automotive and get a automotive mortgage, the collateral for the automotive mortgage is the automotive. So in case you do not pay the automotive observe, the financial institution can repossess your automotive. With pupil loans, it is necessary to keep in mind that the collateral is your future earnings. Should you do not repay a pupil mortgage, the federal government can garnish your wages, take your tax returns, and extra. All the time preserve this in thoughts when borrowing.

Pupil Mortgage Collateral. Supply: The Faculty Investor

How To Apply For A Pupil Mortgage

The FAFSA, or Free Utility for Federal Pupil Help, should be stuffed out annually to obtain monetary support. FAFSA deadlines change annually. You possibly can test the deadlines right here. Make certain your FAFSA is submitted on time. In any other case, a late FAFSA will definitely complicate your monetary state of affairs and depart you scrambling to pay for college.

To get an thought of how a lot monetary support you could be awarded, test the Federal Help Estimator web site.

Upon being “awarded” monetary support, you’ll obtain quantities for present support and loans. There also needs to be a breakdown of your faculty’s value. Colleges show value data in several methods and the true value could be off by a large margin. Relying on what’s proven, it’s possible you’ll must ask the varsity for value on:

- Tuition

- Housing

- Meals

- Journey

- Charges (labs, and so forth.)

- Books

Add in another identified value. It’s higher to overestimate relatively than underestimate. Many college students discover that they’re brief on cash, even after receiving their monetary support. This is because of many prices that aren’t accounted for.

Observe: The primary 12 months can also be often the least costly 12 months of faculty. Your school prices will usually rise annually you attend a university.

Truly Making use of For Pupil Loans

Now that you’ve your monetary support award, you will see a number of “awards” of loans (discover the parenthesis – it is horrible they name this an award). These loans are topic to the annual pupil mortgage limits, that are very low – solely $5,500 in 12 months 1.

First, you will be provided a Direct Pupil Mortgage. That is your kid’s mortgage. It may very well be backed or unsubsidized. With backed loans, the federal government pays your curiosity whereas in class. With unsubsidized loans, your curiosity grows your mortgage steadiness when you’re in class. That is the one actual distinction. Learn our full information to backed vs. unsubsidized loans right here.

Second, it’s possible you’ll be provided Guardian PLUS Loans. These loans are the father or mother’s mortgage. Your little one has no obligation for this mortgage. You possibly can borrow, as a father or mother, on your kid’s training. We hate seeing father or mother’s borrow for his or her youngsters’s school, however we additionally know that some mother and father won’t have deliberate or wish to have robust conversations. In consequence, loads of over-borrowing can occur. See our full information to Guardian Pupil Loans right here.

Lastly, you possibly can have a look at utilizing non-public loans. Many households go for non-public loans in-lieu of Guardian PLUS Loans. Personal loans are taken out in your kid’s title, however the father or mother is the cosigner. This makes each of you accountable. For fogeys with nice credit score and earnings, non-public loans could provide decrease rates of interest. However they do not include any kind of mortgage forgiveness choices, and infrequently are the charges really significantly better. Borrow at your personal threat. You possibly can see our information to one of the best non-public loans right here.

How A lot Ought to You Borrow?

After getting an annual value for college, subtract out present support and any cash your mother and father could have saved up for faculty. If in case you have saved up cash for faculty, subtract it out as nicely. The quantity you’re left with just isn’t solely direct faculty value (tuition & housing) however value wanted to reside when you’re in class. If in case you have a job, think about how a lot of the above value it can cowl. It’s best to have a last quantity on value at this level.

That last quantity is the quantity wanted for college loans. The much less cash in class loans you need to take, the higher. As you possibly can see, the quantity of loans isn’t nearly tuition and books. It ought to think about all prices which can be related to being a pupil.

One caveat about pupil loans: college students will typically take the total awarded quantity, even when it isn’t wanted. Should you don’t want the total quantity, you possibly can take solely what is required. Taking extra mortgage cash than what is required will value extra in curiosity and enhance your month-to-month mortgage funds.

Key Rule Of Thumb: Our key rule of thumb for the way a lot it’s best to borrow is solely to NEVER borrow greater than you count on to earn in your first 12 months after commencement. It will assist be sure that you by no means borrow an excessive amount of and might’t afford to repay it.

Associated: How To Calculate The ROI Of Faculty

Paying Again Your Pupil Loans

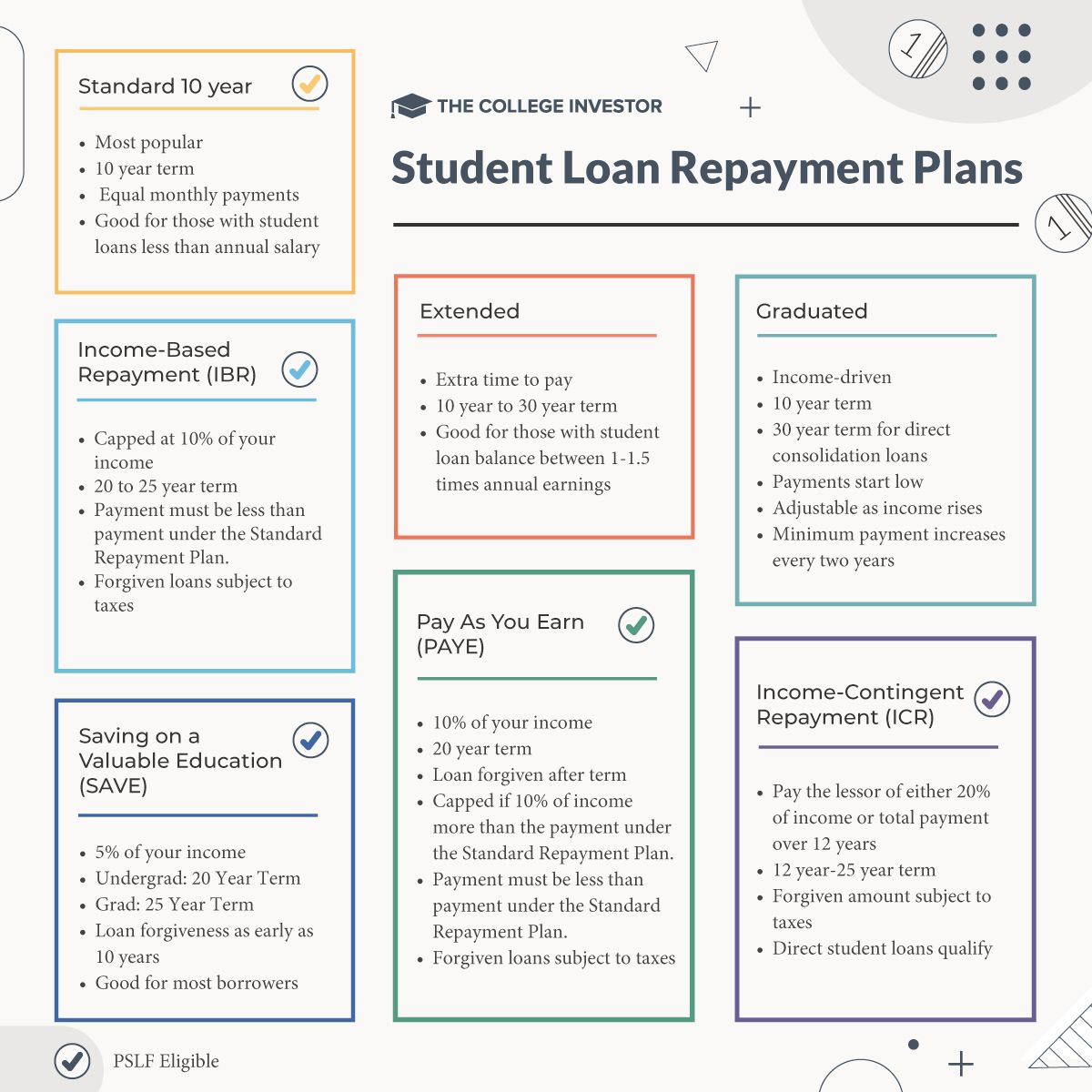

If in case you have Federal pupil loans, there are a number of reimbursement plans, resembling income-driven reimbursement plans, that may make it easier to pay again your pupil loans in an inexpensive approach.

It’s best to choose the reimbursement plan that you could afford to make the fee on each month. If you do not know the place to start out, have a look at utilizing a software like Pupil Mortgage Planner that can assist you.

The federal government presents a variety of mortgage options that aren’t out there with non-government loans. These embody:

- Forbearance: You don’t have to start out paying on pupil loans till after you graduate.

- Hardship: Whereas in reimbursement, you possibly can push again funds till your funds enhance.

- Low curiosity: Most loans could have rates of interest within the single digits.

- Low origination charges: Charges for disbursed loans are ~1% of the mortgage worth.

- Mortgage Forgiveness Packages: There are a number of mortgage forgiveness packages that federal loans are eligible for.

If you’re enrolled at the least half-time, you don’t have to start making funds on authorities loans till six months after graduating. Moreover, curiosity won’t accrue till after commencement for backed loans, however begins accruing instantly for unsubsidized loans.

Based on the Federal Reserve, the typical month-to-month fee is $393, with a median month-to-month fee of $222. How a lot you pay will depend upon the reimbursement plan and rate of interest. Observe that graduate loans will often have increased rates of interest than undergraduate loans.

Personal loans have no choices for mortgage forgiveness, and the deferment guidelines are strict. You primarily need to make these funds it doesn’t matter what, similar to a mortgage or automotive mortgage.

Supply: The Faculty Investor

A Necessity for Most College students

With tuition persevering with to skyrocket, pupil loans have grow to be a necessity for nearly any pupil eager to attend school. Whereas pupil loans could be a massive supply of financing for faculty, planning for value and taking solely the quantity wanted will assist to keep away from being overly saddled with unneeded debt.