Key Factors

- The School Investor’s “How A lot Pupil Mortgage Debt Can You Afford” calculator permits college students and oldsters to see the ultimate price of their pupil mortgage borrowing.

- Households can toggle between Federal, Guardian PLUS, and personal mortgage choices to grasp long-term reimbursement prices.

- The software highlights the impact of curiosity, reimbursement phrases, and in-school funds on month-to-month funds after commencement.

Paying for faculty usually means borrowing pupil loans, however households hardly ever get a transparent image of how a lot debt is affordable earlier than committing. The School Investor’s new interactive calculator, the How A lot Pupil Mortgage Debt Can You Afford Calculator, goals to shut that hole.

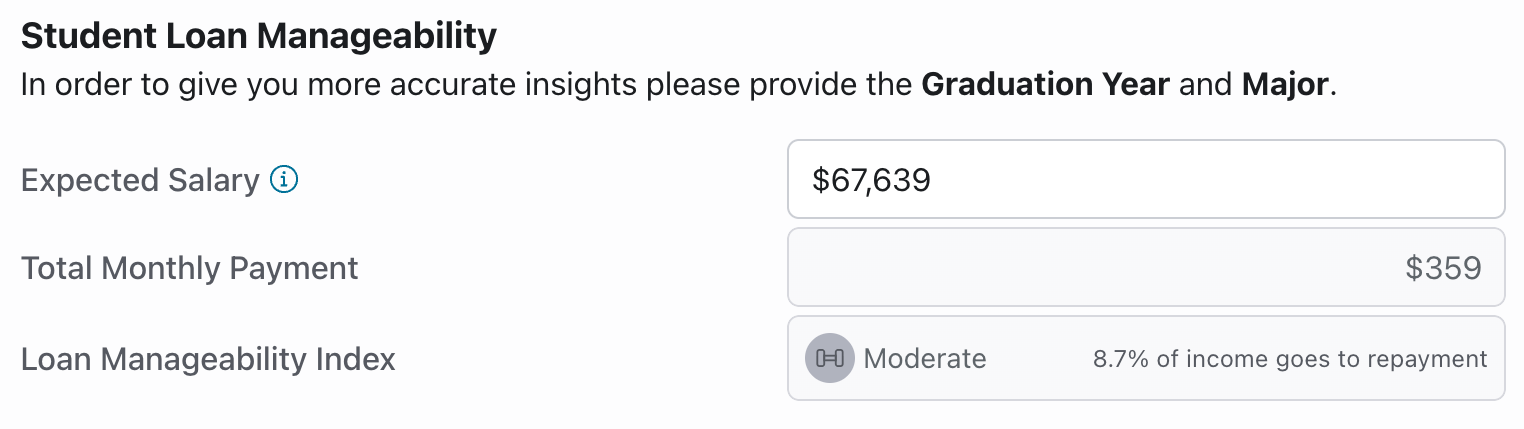

The software goes past easy mortgage estimates by linking borrowing quantities to projected earnings after commencement, based mostly on the scholar’s main. By inputting commencement yr, program size, and discipline of examine, college students and oldsters obtain tailor-made insights into whether or not their debt load will likely be manageable in contrast with anticipated salaries.

For instance, a pupil majoring in finance and graduating in 2029 might anticipate a mean beginning wage of about $72,800, in keeping with federal labor knowledge. If that pupil borrowed $27,000 in federal loans, the projected month-to-month fee can be $359. That quantities to roughly 8% of month-to-month revenue – inside the “reasonable” vary of reimbursement burden.

Would you want to avoid wasting this?

How A lot Pupil Mortgage Debt Can You Afford Calculator

Enter your estimated pupil mortgage and main info beneath to calculate what pupil mortgage reimbursement will seem like for you after commencement. It ought to take lower than 5 minutes to finish.

How To Use This Calculator

This calculator has three tabs:

- Pupil Federal Loans

- Guardian PLUS and Personal Loans

- Abstract Of All Loans

On the backside of each the Pupil Part and Guardian/Personal Mortgage Part, you possibly can see your Pupil Mortgage Manageability Index.

Pupil Federal Loans

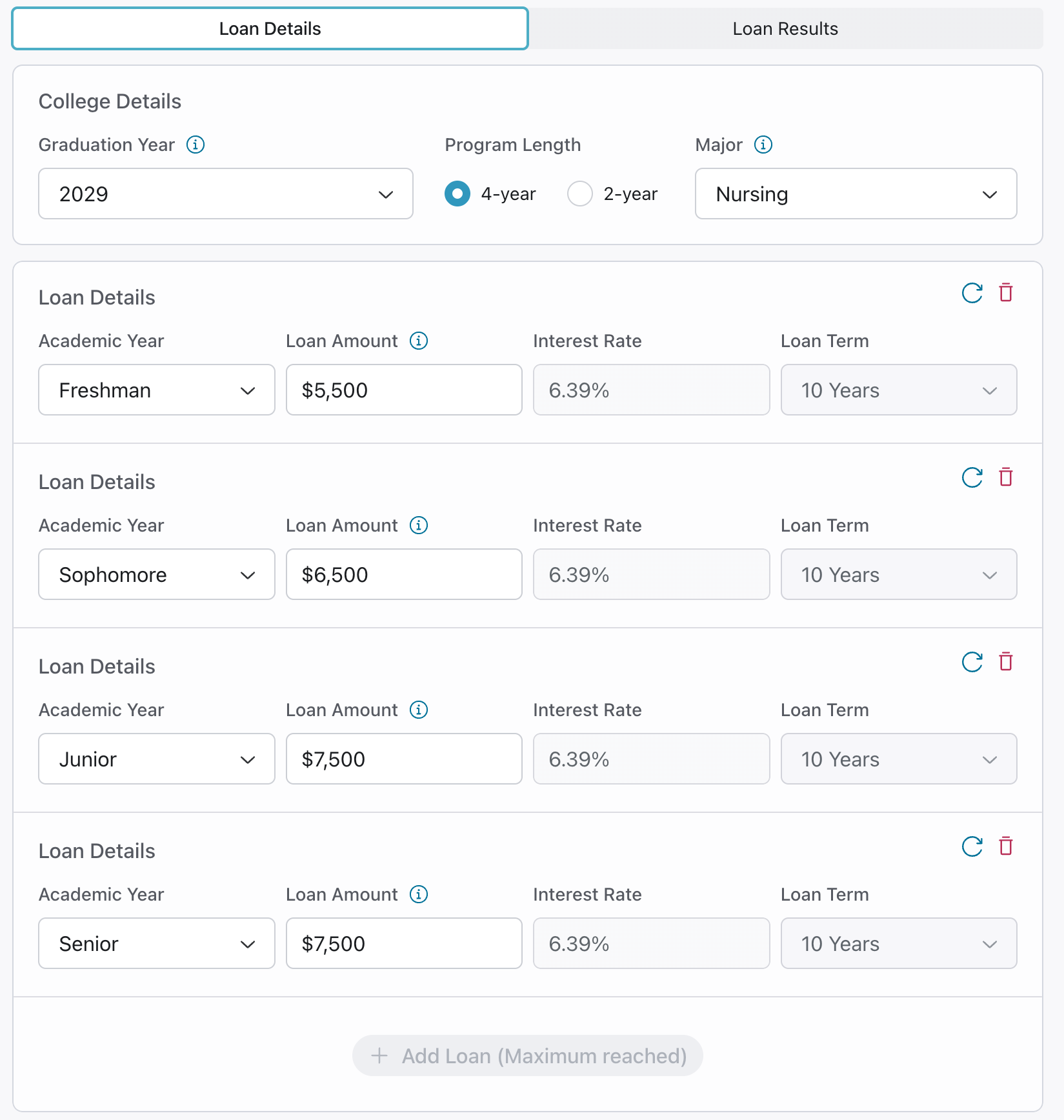

The calculator organizes debt by educational yr, giving households an opportunity to see how loans construct over time. Federal pupil mortgage borrowing limits for dependent college students are sometimes $5,500 for freshmen, $6,500 for sophomores, and $7,500 every for junior and senior years.

You additionally have to enter your commencement yr, program size, and main.

Guardian PLUS and Personal Loans

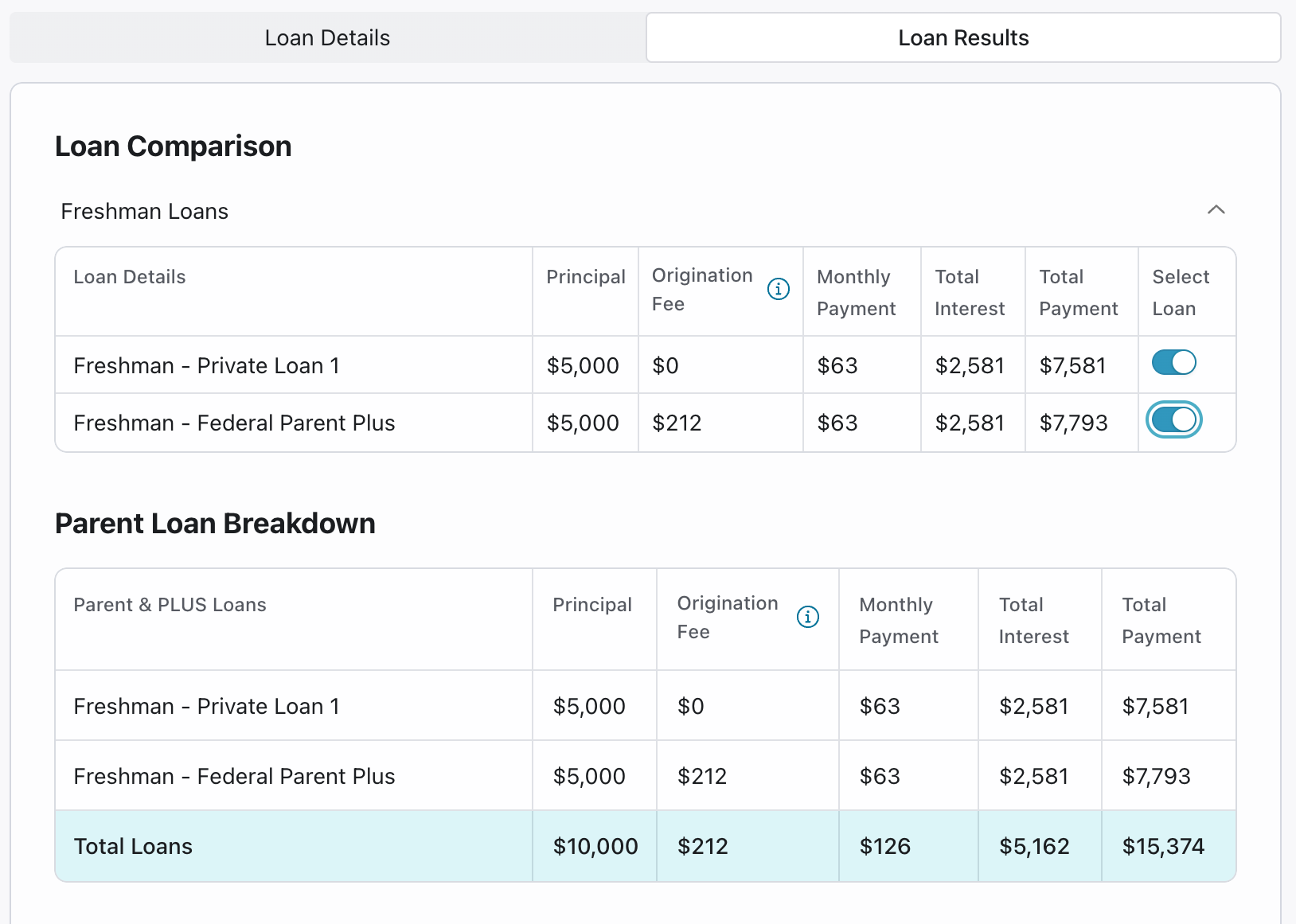

Federal pupil mortgage limits usually depart many households in need of masking the total price of attendance. That hole is usually stuffed with Guardian PLUS loans or non-public loans. The calculator’s second tab permits customers so as to add these loans individually, specifying the mortgage kind, quantity, rate of interest, and reimbursement time period.

For Guardian PLUS loans, origination charges are factored in routinely.

You may also add multiple mortgage per yr. This will likely matter as a result of new Guardian PLUS borrowing limits going into impact.

It is necessary to mode this as a result of Guardian PLUS loans carry larger rates of interest and charges than undergraduate federal loans, whereas non-public loans differ extensively relying on creditworthiness. By inputting the total quantities of loans, households can get an actual sense of affordability.

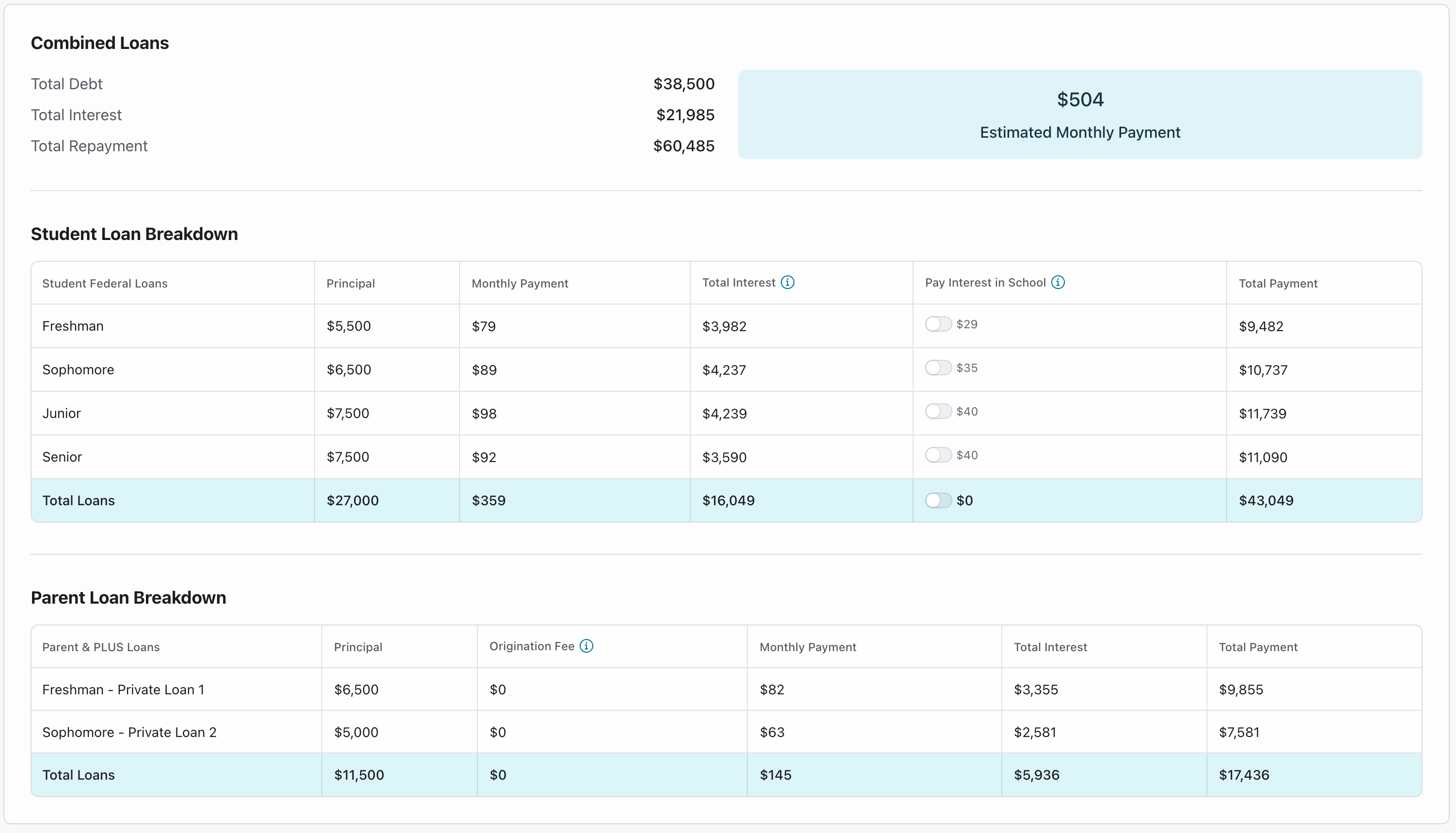

Abstract Of All Loans And Fee Due

The abstract tab consolidates all borrowing: pupil federal loans, Guardian PLUS, and personal loans, right into a single view. Households can immediately see the overall quantity borrowed, the month-to-month fee due after commencement, and the long-term price with curiosity included.

Pupil Mortgage Manageability Index

Our favourite characteristic is the Pupil Mortgage Manageability index that the calculator supplies for College students and Dad and mom. You’ll be able to examine that to your month-to-month wage, and see how reasonably priced your month-to-month pupil mortgage reimbursement plan will likely be.

If the quantity is excessive, you may wish to rethink your path. If the quantity is low, kudos!

Why This Issues For Households

One of the widespread errors households make is borrowing with no sensible plan for reimbursement.

Nationally, 43 million Individuals maintain federal pupil debt, with the common steadiness at about $37,000. Guardian PLUS debtors face even larger averages, with balances usually exceeding $50,000.

Instruments like The School Investor’s “How A lot Pupil Mortgage Debt Can You Afford Calculator” may also help households make borrowing selections based mostly not solely on want, but in addition on the scholar’s possible incomes potential.

That context is vital: borrowing $40,000 could also be manageable for a finance or engineering main, however it could possibly be much more burdensome for graduates in fields with decrease beginning salaries. It is important to be sure you’re getting an ROI on school!

Key Takeaways for College students and Dad and mom

- Hyperlink borrowing to profession outlook. Use the major-based wage knowledge to guage whether or not future funds will likely be manageable.

- Monitor loans yr by yr. Perceive how borrowing provides up over time, and contemplate paying curiosity whereas in class to restrict whole prices.

- Evaluate mortgage sorts. Guardian PLUS and personal loans differ when it comes to price and reimbursement flexibility—mannequin them each earlier than deciding.

- Goal for affordability. A standard rule of thumb is to maintain month-to-month pupil mortgage funds beneath 10 % of projected month-to-month revenue.

By making reimbursement extra clear earlier than the loans are signed, The School Investor’s “How A lot Pupil Mortgage Debt Can I Afford” Calculator provides households a clearer view of the trade-offs concerned and a greater likelihood of maintaining school debt beneath management.

Do not Miss These Different Tales:

The submit How A lot Pupil Mortgage Debt Can You Afford Calculator appeared first on The School Investor.