Half social media, half private finance, Frich is a brand new social finance app that blends each collectively. It depends on user-generated survey information to generate stories about how younger individuals spend and earn cash.

Have you ever ever puzzled how a lot your neighbor is paying for lease? Are you curious to know what a “regular” grocery price range appears like? If that’s the case, Frich is on a mission to reply all of your burning cash questions. Do you have to obtain Frich? Right here’s what we predict.

What Is Frich?

Launched in 2021 by two former fashions who wished to higher perceive their very own funds, Frich is a social finance app geared at serving to Gen Z set up aware spending habits. Customers share particulars of their spending and take part in challenges to carry each other accountable to reaching their monetary targets.

Frich permits customers to share intimate particulars about their funds anonymously. The purpose is to make sure cash subjects much less taboo by rising transparency and dialog round them.

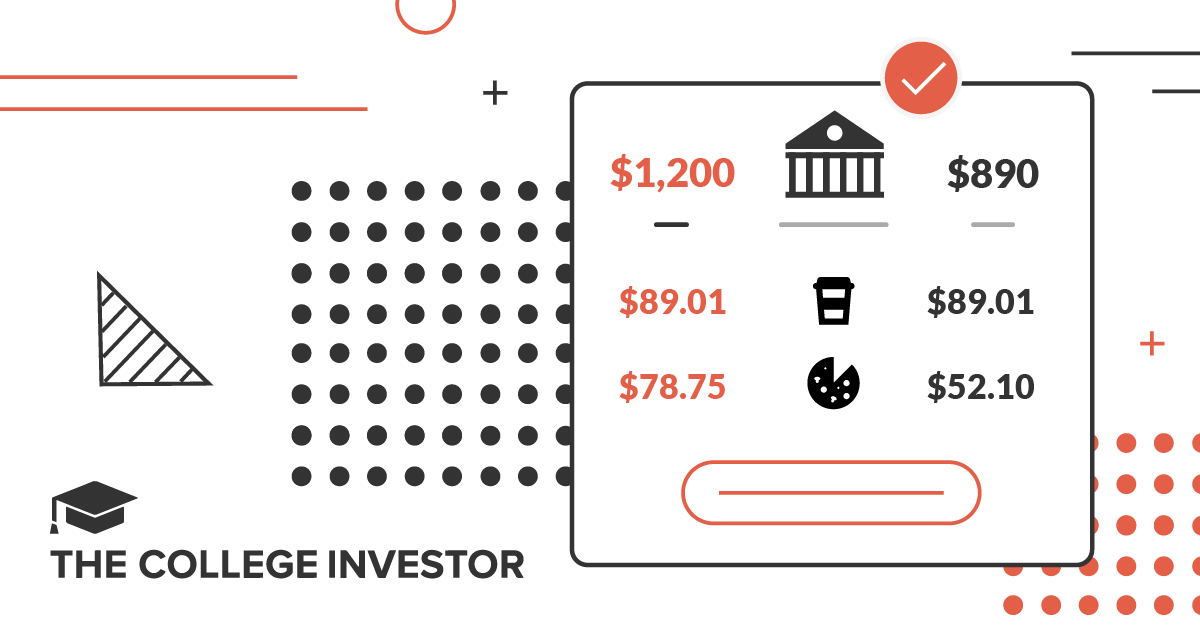

The app breaks down day-to-day residing bills, helps customers evaluate their revenue to different customers, and begins vital conversations just like the position of cash within the residence.

What Does It Supply?

Frich is completely different than most cash administration apps you’re doubtless conversant in. Here is a better have a look at the apps principal options.

Query of the Day

The Query of the Day is Frich’s core characteristic. Every day, the app polls customers about sure monetary subjects. Frich compiles the info and breaks it right down to reveal patterns and tendencies amongst its consumer base.

That is an instance of a query customers is perhaps requested:

Have you learnt how a lot you sibling(s) makes?

Based mostly on respondents solutions, Frich offered the next evaluation:

Let’s begin simple. We all know that a lot of you look as much as your siblings & take their recommendation to coronary heart. However are you aware how a lot your siblings make? Ought to ??

The consensus is that there isn’t a consensus. You guys have been just about 50/50 on this one (47% sure, 53% no). However subsequent time you ask your sibling for cash recommendation, possibly it would be good context to know the way a lot they make to evaluate whether or not their recommendation actually suits your state of affairs.

In keeping with Frich’s web site, answering questions unlocks instruments. The extra questions you reply, the extra alternatives you’ll should construct your monetary savvy on the platform.

Sources

The Useful resource hub gives insights centered on 5 key areas:

Similar to the Query of the Day, customers can reply questions and evaluate themselves amongst different customers in these classes.

This Sources part of the app is designed to offer customers with tips about methods to enhance their funds. By answering questions and reviewing the outcomes, Frich hopes to inspire customers to enhance their funds.

Perks

Perks are instruments and sources picked by the Frich staff to assist customers make smarter selections about their cash. Software suggestions are customized and tailor-made to a person consumer’s targets and wishes.

How Does Frich Work?

Are There Any Charges?

Frich is free to hitch. The corporate generates income from affiliate merchandise it recommends and insights it generates from user-provided information.

How Does Frich Examine?

Frich is a social comparability software that may show you how to contextualize your funds but it surely received’t show you how to handle your cash. Listed below are related apps you should utilize to handle your funds whereas additionally connecting with associates about cash.

YNAB

YNAB is a well-liked budgeting app that helps you set each greenback in your paycheck to work. The app has a cult-like following with a big neighborhood of customers. There are boards devoted to answering questions and customers are inspired to assist each other get higher at budgeting. YNAB is $99 a yr however comes with a free 34-day trial.

eToro

Identified for providing cryptocurrency, eToro is a social investing platform. Customers are inspired to share their trades and methods with each other and duplicate them. Other than crypto, the platform additionally provides exchange-traded funds (ETFs) and shares. It requires a minimal $10 funding and shares and ETFs may be traded without cost.

How Do I Use Frich?

To make use of Frich, create an account and start answering questions. The extra questions you reply, the extra insights you’ll get on methods to handle your funds.

Is It Secure And Safe?

Frich doesn’t seem to require a connection to a checking account or monetary establishment. All survey questions are generated by responses from particular person customers.

Responses are anonymized on the platform to keep up consumer safety. Full particulars relating to how information is collected and used are mentioned in Frich’s privateness coverage.

How Do I Contact Frich?

You possibly can contact Frich by sending an electronic mail to: hi there@getfrich.com. Alternatively, Frich maintains social media accounts on Instagram, X, TikTok, and LinkedIn. You possibly can ship a DM to any of these accounts.

Is It Value It?

Frich is for younger adults who’re concerned about evaluating their funds with different younger adults. It is perhaps helpful in case you stay in a big metropolis and are concerned about understanding the way you rank in comparison with your friends in different giant cities.

Frich is free so there isn’t a price to make use of the platform. That being stated, all the information collected by Frich is user-generated. It’s solely reflective of the customers offering the info, not all younger individuals. This might skew the outcomes, main you to attract incorrect conclusions round your personal monetary well-being. Frich is a brand new app so it’s too quickly to say what the long-term penalties of social monetary comparability might be, if any.

Fritch Options

|

Cell App Availability |

|