- Main brokerage apps, together with Constancy, Schwab, Vanguard, and Robinhood skilled outages on an important buying and selling day.

- The outages coincided with a big market downturn fueled by recession fears and weak financial knowledge.

- Brokerages like E*TRADE and Interactive Brokers additionally confronted technical points, affecting hundreds of customers.

On Monday, on-line companies at main brokerages skilled vital outages, irritating traders making an attempt to commerce throughout a unstable market downturn. The outages got here on a day when Wall Avenue’s indexes plummeted, pushed by fears of a U.S. recession, weak financial knowledge, and lackluster second-quarter earnings from expertise giants.

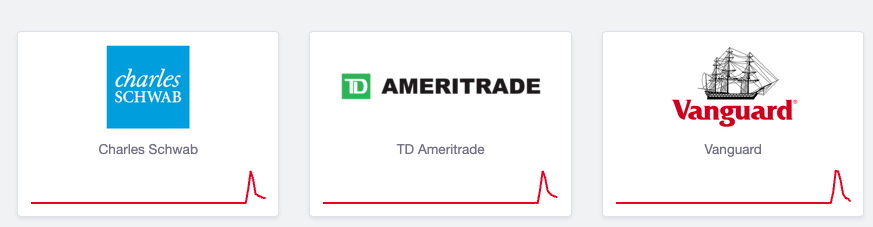

In response to outage monitoring web site Downdetector.com, many of the main brokerage corporations have been experiencing outages:

Downdetector tracks outages by aggregating standing experiences from a number of sources, together with customers.

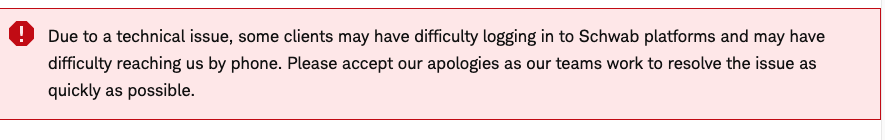

The technical points with Schwab and Constancy have been confirmed by the businesses, although they didn’t present particular particulars in regards to the causes. Bouts of maximum market volatility can generally overwhelm buying and selling platforms, resulting in technical disruptions. This raises questions in regards to the capability of brokerages to deal with excessive volumes throughout important buying and selling intervals.

Main Buying and selling Day

Wall Avenue’s response to the financial indicators was swift and extreme. Considerations a couple of recession have been compounded by weak financial knowledge and disappointing earnings from main expertise corporations. Geopolitical tensions additional dampened market sentiment, making traders jittery and prompting many to dump dangerous property, together with shares and cryptocurrencies.

Consequently, the market was down over 2% within the first minutes of buying and selling.

Along with Schwab, Constancy, and Vanguard, Robinhood, E*TRADE, and Interactive Brokers additionally confronted technical points.

Earlier within the day, Robinhood reported a pause in its in a single day buying and selling companies however later introduced the resumption of those companies. Robinhood permits customers to commerce choose shares and exchange-traded funds across the clock, making it a favourite amongst retail traders.

Schwab was nonetheless displaying a message warning customers as of 8:45am Pacific time:

The latest outages underscore the vulnerabilities within the system, particularly during times of excessive market stress.

Do not Miss These Different Tales: