ezTaxReturn takes the ache out of tax submitting…for some filers. Nevertheless, some might discover they will’t use the software program as a result of its limitations. Whereas we recommend you’re seemingly higher off elsewhere, we’ll go into the main points about how ezTaxReturn works for these contemplating it for his or her subsequent tax submitting.

For many who can use ezTaxReturn and do not qualify for the free tier, the pricing is not aggressive in comparison with comparable tax return software program applications. You could find higher choices at no cost and significantly better consumer experiences at the same value.

On this ezTaxReturn.com evaluation, we’ll discover how the app compares to different prime tax software program choices.

ezTaxReturn – Is It Free?

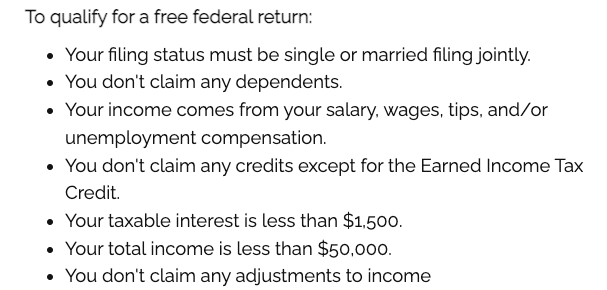

ezTaxReturn advertises a free tax return for “easy filers,” however those that qualify are extraordinarily restricted. Additional, you continue to must pay $24.99 for a state return, so except you reside in a state with no state revenue tax return requirement, you’ll must pay to make use of ezTaxReturn irrespective of the way you file.

ezTaxReturn is kind of strict about who qualifies at no cost federal returns. You will need to meet the next standards:

- Earn lower than $50,000 per 12 months

- Don’t have any dependents

- Have taxable curiosity revenue underneath $1,500

The one credit score customers can declare with the free tier is the Earned Earnings Tax Credit score (EITC). The free choice additionally solely helps W-2 revenue and unemployment revenue. Extra 1099 kinds and people with HSA contributions should improve to the paid model. As a result of these many restrictions, most individuals received’t qualify to file at no cost.

You’ll be able to see our picks for the greatest free tax software program right here.

What’s New In 2025?

Probably the most vital updates for 2025 centered on adjustments to the tax code from the IRS. The federal government applied new brackets and limits for a lot of deductions and credit, and ezTaxReturn made the mandatory adjustments to maintain up. You’ll additionally see updates for brand spanking new 1099-Okay necessities for on-line sellers.

The app expanded to help a bigger record of states, making it an choice for extra households. However state submitting costs additionally went up this 12 months, with the price of state returns rising by about $5 per state.

You could discover a most refund and accuracy assure on this and different tax software program. These are {industry} requirements, as your tax outcomes must be practically equivalent irrespective of the way you file so long as you enter your tax particulars accurately.

Does ezTaxReturn Actually Make Tax Submitting Straightforward In 2025?

If you happen to fall into the tier of customers who can file their federal return at no cost, you will see that a comparatively easy expertise. ezTaxReturn has an intuitive consumer expertise that makes submitting straightforward for tax filers with easy conditions. Nevertheless, it doesn’t supply imports in your tax kinds or W-2 knowledge.

ezTaxReturn is not preferrred for extra advanced tax submitting eventualities, together with anybody with funding accounts. It additionally doesn’t have built-in depletion or depreciation calculators, so actual property traders should do calculations elsewhere. Due to this shortcoming, we recommend actual property traders look to extra strong choices like TurboTax, H&R Block, and different premium tax preparation corporations.

Self-employed retirement plans are additionally not properly supported. ezTaxReturn doesn’t enable customers to say contributions to sure self-employed retirement plans, reminiscent of Keogh or SEP accounts.

ezTaxReturn Options

Though ezTaxReturn doesn’t help all tax conditions, it has just a few optimistic options making it value consideration.

Guided Navigation

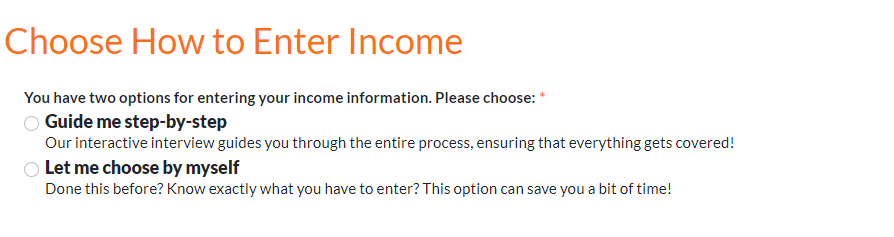

ezTaxReturn makes use of questions and solutions to information customers by the software program. The wording of the questions makes it straightforward for filers to reply accurately.

Strong Error Detection

ezTaxReturn has built-in error detection to stop customers from coming into info within the incorrect field or coming into the incorrect worth. The error detection ensures you possibly can’t transfer ahead with out first checking on a difficulty. Error messages are descriptive sufficient to assist customers clear up the issue.

ezTaxReturn Drawbacks

Regardless of ezTaxReturn’s easy consumer interface, the software program has a number of shortcomings.

Restrictive Free Tier

ezTaxReturn’s free tier helps only a few tax filers. And those that qualify will nonetheless must pay for state submitting. If you happen to earn greater than $50,000 per 12 months, have dependents, or have any revenue past your W-2 job and checking account curiosity, you received’t qualify.

No Depreciation Calculators

ezTaxReturn doesn’t have depreciation or depletion calculators. So landlords and self-employed folks with depreciable property can’t declare this reliable tax deduction by the software program.

Limitations On Submitting

The ezTaxReturn software program solely helps one rental property per return. Landlords with a number of properties can’t use the software program. It additionally doesn’t help choices buying and selling or wash gross sales.

As talked about above, there aren’t any depreciation calculators accessible, so folks with “sophisticated” tax submitting conditions might discover that the software program merely will not work for them.

EzTaxReturn additionally has limitations on state submitting. Unsupported states embody Indiana, Montana, North Dakota, Oregon, Rhode Island, Vermont, and West Virginia.

ezTaxReturn Plans And Pricing

Since ezTaxReturn has a restrictive Free tier – most filers might want to pay. State submitting prices $24.99 no matter which plan you employ. The corporate affords a Federal + State submitting mixture with a bundle value of $39.95.

Customers ought to affirm whether or not ezTaxReturn helps tax returns of their state earlier than signing up for the software program.

|

No dependents, W-2 or unemployment, earn lower than $50,000, no credit or deductions. |

||

How Does ezTaxReturn Evaluate?

ezTaxReturn costs itself close to the center of the pack. Even with its annual enhancements, the software program should not be definitely worth the value.

Money App Taxes and TaxHawk help extra advanced submitting at a lower cost. This is a better have a look at how ezTaxReturn compares:

|

Header |

|

|

|

|---|---|---|---|

|

Unemployment Earnings (1099-G) |

|||

|

Solely Returns Ready By EzTaxReturn |

|||

|

Retirement Earnings (SS, Pension, and so on.) |

|||

|

Paid (No wash gross sales or choices) |

|||

|

Paid (no depreciation, just one property supported) |

|||

|

Paid (no depreciation or depletion supported) |

|||

|

Small Enterprise Proprietor (Over $5k In Bills) |

Paid (no depreciation or depletion supported) |

||

|

$0 Fed & |

|||

|

All kinds and deductions can be found on the Free tier, however customers can improve to Deluxe ($6.99) or Professional ($44.99) to entry Audit Help or recommendation from tax professionals. |

|||

|

Cell |

Is It Protected And Safe?

ezTaxReturn makes use of industry-standard encryption know-how to maintain consumer info protected. It has sturdy password necessities, and customers should use a second type of authentication to log in.

By combining encryption and multifactor authentication, ezTaxReturn affords sturdy protections to stop knowledge breaches or hacks. The corporate hasn’t suffered main knowledge breaches and has traditionally acquired accolades for its safety protocols.

Contact

ezTaxReturn boasts that its software program is “really easy, it is unlikely you may want customer support.” It additionally says that solely about 10% of its prospects attain out for assist. However if you happen to want help, your choices are way more restricted than competing tax software program corporations.

Proper now, they solely have e-mail help (with a one-business-day turnaround time) and an FAQ on their web site. They usually have a telephone quantity you possibly can name throughout tax season, however this is not accessible as of the time of writing.

There isn’t a choice to contact a tax professional. The one approach to contact the corporate’s help group is to submit an e-mail inquiry.

Who Is This For And Is It Price It?

ezTaxReturn continues to extend its usability however nonetheless has a number of limitations. It isn’t preferrred for landlords nor these with self-employment revenue. Options are additionally removed from preferrred for many traders.

Filers with simpler tax conditions may gain advantage from ezTaxReturn. Nevertheless, the software program’s value continues to be too excessive for what it affords except you qualify at no cost federal submitting.

Customers on the lookout for a greater expertise, coupled with mid-range pricing, ought to think about Money App Taxes or FreeTaxUSA. These looking for a extra strong expertise ought to think about TurboTax, H&R Block, or TaxSlayer.

Undecided which software program meets your wants? We’ve bought you lined with suggestions for software program based mostly in your submitting state of affairs.

Why Ought to You Belief Us?

The School Investor group has spent years reviewing all the prime tax submitting choices, and our group has private expertise with nearly all of tax software program instruments. I personally have been the lead tax software program reviewer since 2022, and have in contrast many of the main corporations on {the marketplace}.

Our editor-in-chief Robert Farrington has been making an attempt and testing tax software program instruments since 2011, and has examined and tried nearly each tax submitting product. Moreover, our group has created critiques and video walk-throughs of all the main tax preparation corporations which you could find on our YouTube channel.

We’re tax DIYers and desire a whole lot, similar to you. We work onerous to supply knowledgeable and trustworthy opinions on each product we check.

How Was This Product Examined?

In our authentic exams, we went by ezTaxReturn and accomplished a real-life tax return that included W2 revenue, self-employment revenue, rental property revenue, and funding revenue. We tried to enter every bit of information and use each function accessible. We then in contrast the end result to all the opposite merchandise we have examined, in addition to a tax return ready by a tax skilled.

This 12 months, we went again by and re-checked all of the options we initially examined and any new options. We additionally validated the pricing choices.

Frequent Questions

Let’s reply just a few of the commonest questions that filers ask about ezTaxReturn:

Can ezTaxReturn assist me file my crypto investments?

ezTaxReturn technically helps submitting taxes for crypto investments. Nevertheless, this isn’t made straightforward. Customers should convert all their trades to USD and manually enter every into ezTaxReturn. This can be a cumbersome job that most individuals will need to keep away from.

Most customers with crypto investments will need to use a crypto tax software program that integrates with TurboTax.

Can ezTaxReturn assist me with state submitting in a number of states?

EzTaxReturn helps multi-state submitting, nevertheless it doesn’t help each state. States that aren’t supported embody the next: Connecticut, Delaware, Hawaii, Kansas, Maine, Nebraska, New Mexico, Utah, Idaho, Indiana, Iowa, Kentucky, Minnesota, Montana, North Dakota, Oklahoma, Oregon, Rhode Island, Vermont, and West Virginia.

Does ezTaxReturn supply refund advance loans?

No, ezTaxReturn isn’t providing refund advance loans in 2025. You’ll be able to pay your software program charge utilizing your refund for an additional $29.95, which is certainly not worthwhile.

Options

|

Accessible as a $39.99 add-on |

|

|

Import Tax Return From Different Suppliers |

|

|

Import Prior-12 months Return For Returning Clients |

|

|

Import W-2 With A Image |

|

|

Inventory Brokerage Integrations |

|

|

Crypto Change Integrations |

|

|

Sure (however (no depreciation and depletion isn’t supported) |

|

|

Sure, however just one property could be added per return |

|

|

Refund Anticipation Loans |

|

|

Buyer Service Cellphone Quantity |

|