-

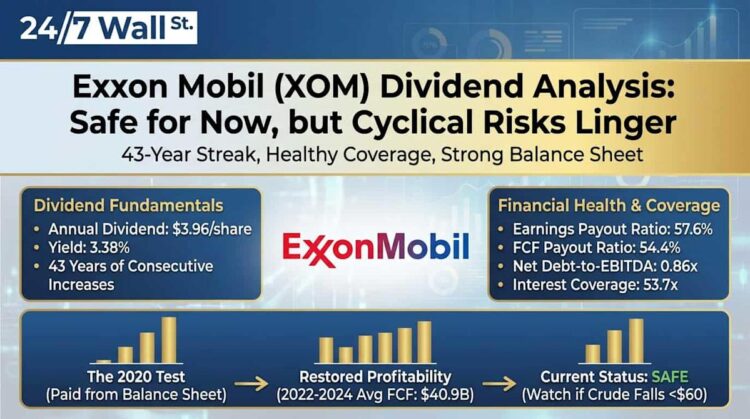

Exxon Mobil (XOM) pays $3.96 yearly per share with a 3.38% yield. Exxon has raised its dividend for 43 consecutive years.

-

Exxon’s payout ratios stand at 57.6% on earnings and 54.4% on free money stream. Each metrics present snug protection.

-

Internet earnings fell from $55.7B in 2022 to $33.7B in 2024. The dividend stays safe resulting from sturdy stability sheet power.

-

When you’re desirous about retiring or know somebody who’s, there are three fast questions inflicting many Individuals to comprehend they will retire sooner than anticipated. take 5 minutes to be taught extra right here

Exxon Mobil (NYSE: XOM) pays an annual dividend of $3.96 per share, yielding 3.38%. The corporate has raised its dividend for 43 consecutive years, sustaining that streak via the 2020 oil worth collapse. The query is whether or not this dividend stays sustainable as earnings decline from latest peaks.

|

Metric |

Worth |

|---|---|

|

Annual Dividend |

$3.96 per share |

|

Dividend Yield |

3.38% |

|

Consecutive Years of Will increase |

43 years |

|

Most Latest Cost |

December 10, 2025 |

|

Dividend Aristocrat Standing |

Sure |

XOM’s earnings payout ratio stands at 57.6%, calculated from TTM diluted EPS of $6.88 in opposition to the $3.96 annual dividend. This leaves substantial room even when earnings soften additional.

The free money stream image is tighter however wholesome. In 2024, XOM generated $30.7 billion in free money stream (working money stream of $55.0 billion minus capex of $24.3 billion) and paid $16.7 billion in dividends. That produces an FCF payout ratio of 54.4%.

|

Metric |

TTM Worth |

Evaluation |

|---|---|---|

|

Earnings Payout Ratio |

57.6% |

Wholesome |

|

FCF Payout Ratio |

54.4% |

Wholesome |

|

Working Money Stream Protection |

3.3x |

Sturdy |

The priority is the development. Internet earnings fell from $55.7 billion in 2022 to $33.7 billion in 2024. Q3 2025 earnings dropped 12.3% 12 months over 12 months. If this decline continues, payout ratios will rise.

XOM’s stability sheet is exceptionally sturdy. Internet debt of $53.3 billion in opposition to EBITDA of $61.7 billion produces a internet debt-to-EBITDA ratio of 0.86x. Curiosity protection stands at 53.7x, that means debt service barely registers in opposition to working earnings.

|

Metric |

Worth |

Evaluation |

|---|---|---|

|

Debt-to-Fairness |

0.26 |

Conservative |

|

Internet Debt-to-EBITDA |

0.86x |

Low |

|

Curiosity Protection |

53.7x |

Sturdy |

|

Money on Hand |

$13.9B |

Strong Buffer |

This monetary power proved vital in 2020, when XOM posted a $22.4 billion loss however maintained the $14.9 billion dividend by drawing on its stability sheet.

XOM’s 43-year dividend progress streak survived the 2020 pandemic, however required paying dividends from the stability sheet when free money stream turned damaging. The corporate paid $14.9 billion in dividends in opposition to damaging $2.6 billion in FCF that 12 months.