The overall worth of the housing market has soared within the months since charges had been first reduce.

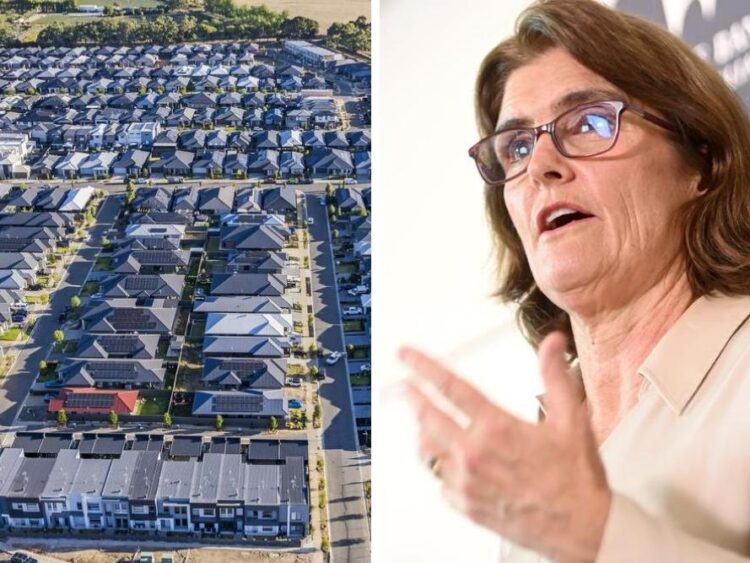

Australia’s housing market has turn into value 5 instances the annual output of the economic system after whole property values soared $213 billion within the months following the primary rate of interest reduce this yr.

ABS Figures launched Tuesday confirmed the full worth of the nation’s residential dwellings rose to $11.6 trillion within the June quarter, up from $11.35 trillion in March.

Australia’s nominal GDP is estimated to succeed in about A$2.58 trillion to $2.7 trillion over 2025, in accordance with present projections.

It comes as property consultants reveal housing demand has soared throughout many areas of the nation for the reason that Reserve Financial institution introduced the primary of three rate of interest cuts this yr in February.

MORE: Shock photos will terrify residence patrons

This has pushed robust value will increase, particularly in medium-sized cities corresponding to Brisbane, Adelaide and Perth, the place dwelling costs are near 10 per cent increased than a yr in the past, PropTrack information confirmed.

Sydney progress has been extra measured at 3.66 per cent, whereas Melbourne residence values had been up a mean of two.1 per cent in comparison with August 2024.

The quantity of wealth now locked up within the housing market dwarfs the worth of a number of the nation’s largest firms.

The $11.6 trillion whole worth of residential dwellings was increased than the mixed market capitalisation of the highest 50 firms listed on the ASX, together with firms corresponding to CBA, BHP and NAB.

MORE: 12 months when $3.5m Sydney houses can be norm

The overall worth of Aussie residential dwellings exceeds the market cap of our huge 4 banks.

It’s a marked shift from 5 years in the past when the mixed worth of residential dwellings throughout the nation was $7.25 trillion, in accordance with the ABS.

ABS head of finance statistics Dr Mish Tan mentioned residence values had been rising throughout the nation.

“June quarter’s progress within the worth of dwellings adopted a 0.3 per cent rise within the March quarter, with rises throughout all states and territories,” she mentioned.

Dr Tan added that the full worth of dwellings was 5.1 per cent increased than a yr in the past.

ABS lending information launched in August revealed a lot of the elevated spending within the housing market was coming from traders.

The variety of new loans being issued to traders rose 3.5 per cent over the June quarter, whereas new proprietor occupier loans rose by slightly below 1 per cent.

Dr Tan described lending exercise as being at “comparatively excessive ranges”.

Mortgage Alternative dealer James Algar mentioned purchaser demand was anticipated to extend considerably as soon as the federal authorities expands its Residence Assure Scheme in October.

The scheme permits eligible first-home patrons to buy properties with 5 per cent deposits and keep away from paying expensive lender’s mortgage insurance coverage.

The October adjustments will take away earlier wage limits for the scheme and increase the earlier value caps.