Key Factors

- The U.S. Division of Schooling is suspending wage garnishments and tax refund offsets on defaulted federal pupil loans.

- The delay is supposed to provide debtors time to arrange for brand new reimbursement guidelines, together with the upcoming Reimbursement Help Plan (RAP).

- Debtors in default will now have extra time to rehabilitate their loans and get out of default.

The Division of Schooling formally introduced immediately that it’ll delay the beginning of involuntary assortment exercise on federal pupil loans, together with Administrative Wage Garnishment and tax refund seizures by means of the Treasury Offset Program. The transfer follows remarks by Schooling Secretary Linda McMahon at a press occasion and is framed as a transition interval forward of main adjustments to the federal reimbursement system.

Underneath present legislation, debtors who default on federal pupil loans can have wages garnished with out a courtroom order and see federal advantages or tax refunds withheld. The Division mentioned the non permanent pause will permit time to implement new reimbursement plans and provides debtors extra time to get out of pupil mortgage default.

Would you want to avoid wasting this?

Why Collections Are Being Delayed

Division officers mentioned involuntary collections would resume solely after the brand new system is in place, arguing that enforcement will work higher as soon as debtors have clearer and extra inexpensive reimbursement paths.

There may be at the moment no ETA on when collections will resume.

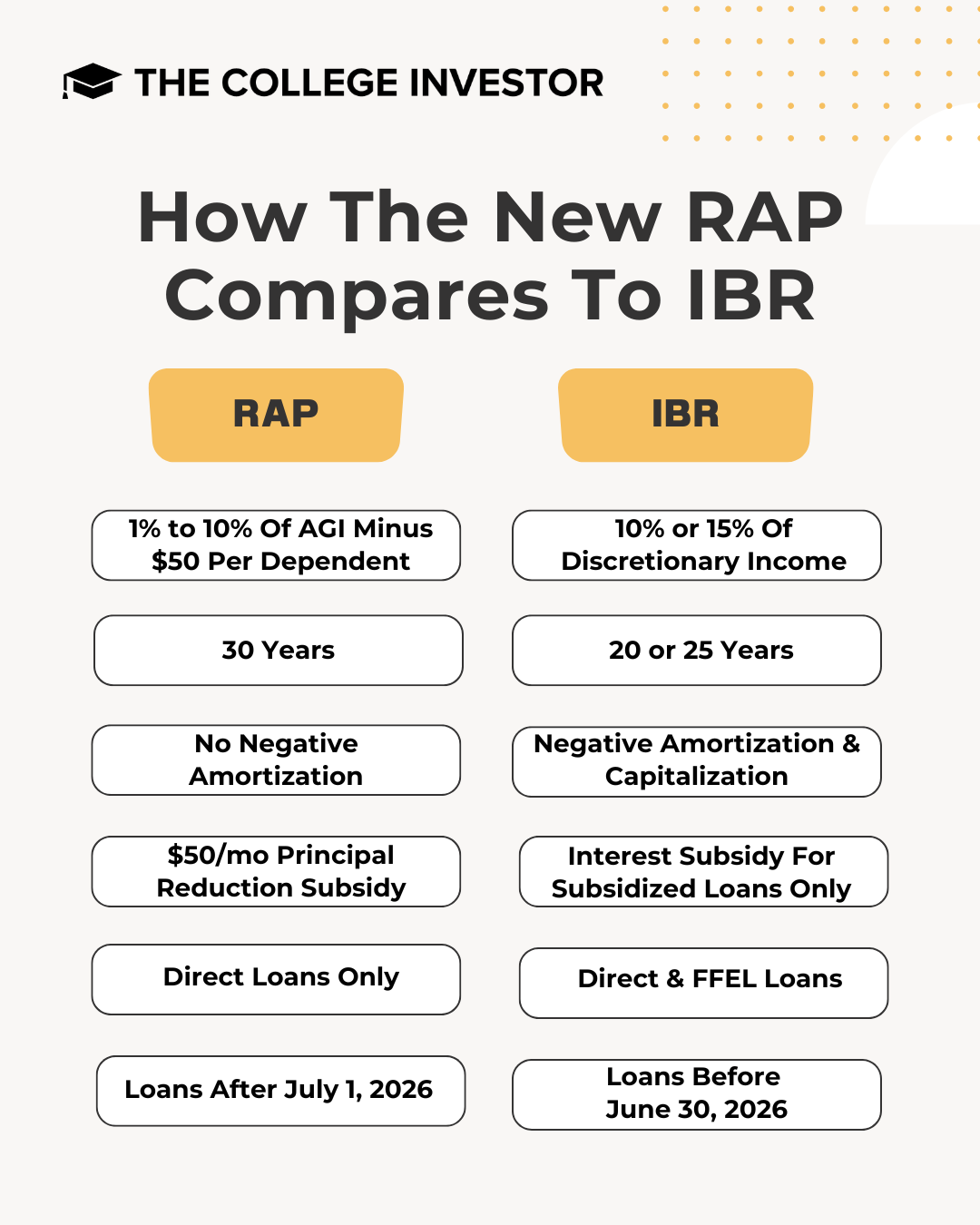

The One Large Stunning Invoice Act (OBBBA) considerably reduces the variety of federal reimbursement plans, changing what officers described as a complicated set of decisions with two major choices: a regular reimbursement plan and an income-driven reimbursement, or IDR, plan. The Division says simplifying the construction is supposed to scale back borrower errors and missed funds that may result in default.

The newly created Reimbursement Help Plan (RAP) is central to the adjustments. Starting July 1, 2026, the plan will waive unpaid curiosity for debtors who make on-time month-to-month funds which can be too small to cowl accruing curiosity. In sure instances, the Division can even make small matching funds so {that a} borrower’s principal steadiness nonetheless declines every month – as much as $50 per thirty days.

For debtors already in default, the Division mentioned delaying wage garnishments and tax offsets will give them time to consolidate loans or enter reimbursement preparations to allow them to qualify for these choices as soon as they turn into obtainable.

What This Means For Scholar Mortgage Debtors

Aissa Canchola Bañez, Coverage Director at Defend Debtors, says, “After months of stress and numerous horror tales from debtors, the Trump Administration says it has deserted plans to grab working folks’s hard-earned cash immediately from their paychecks and tax refunds merely for falling behind on their pupil loans. Amidst the rising affordability disaster, the Administration’s plans would have been economically reckless and would have risked pushing practically 9 million defaulted debtors even additional into debt. Earlier this month, a coalition of companions despatched an pressing letter to ED urging them to do exactly this. We’re happy to see they’ve heeded our calls.“

Nevertheless, the pause doesn’t erase pupil mortgage debt or cease curiosity from accruing on defaulted loans. The Division emphasised that defaulted loans will nonetheless be reported to credit score bureaus, which may hurt debtors’ credit score scores and have an effect on entry to housing, employment, or different loans.

Debtors in default are being inspired to contact the federal default mortgage servicer to assessment their choices, together with consolidation, reimbursement agreements, or rehabilitation. Taking motion in the course of the delay might assist debtors keep away from collections as soon as they resume and place them to profit from the brand new reimbursement framework.

For debtors who are usually not in default, the announcement doesn’t change present fee obligations. Common month-to-month funds stay due, and present income-driven reimbursement plans keep in place till the brand new IDR possibility turns into obtainable in 2026.

What Occurs Subsequent

Debtors in default ought to use this window to assessment their pupil mortgage data, verify eligibility for rehabilitation, and monitor bulletins in regards to the new IDR plan. Consolidating to rehabilitating your pupil loans now can prevent pointless prices down the highway.

It is necessary to do not forget that being in a reimbursement plan is all the time cheaper than being in default.

The approaching months will probably carry extra steering from the Division because it prepares to roll out the brand new system and decide when garnishments and offsets will resume.

Do not Miss These Different Tales:

The publish Division of Schooling Delays Scholar Mortgage Collections appeared first on The School Investor.