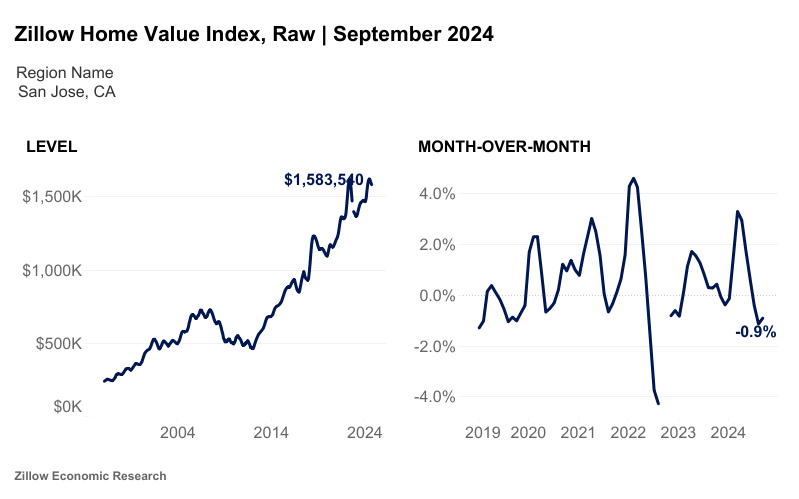

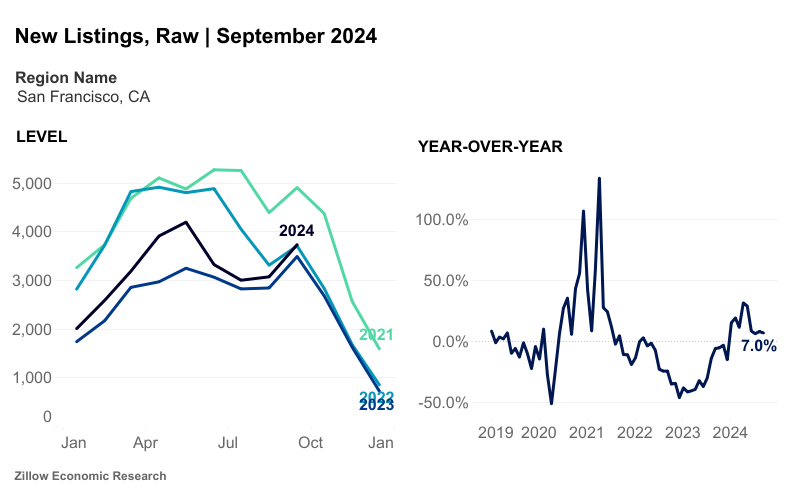

Regardless of mortgage fee unpredictability, the actual property market is rising in a number of the nation’s priciest cities. In accordance with the most recent Zillow knowledge, listings and houses going underneath contract have elevated markedly in September. Cities on the prime finish of the market, similar to Seattle, Los Angeles, and San Jose, confirmed the best positive factors.

“Usually, new listings and gross sales moved nearer to pre-pandemic norms in September,” stated Kara Ng, a housing economist at Zillow, informed Yahoo! Finance. “That’s nonetheless a protracted method to go in phrases of normalizing provide.”

Fee-Locked Consumers Come Off the Sidelines

The highest finish of the market had been stagnant amid the post-pandemic rate of interest enhance, with owners rate-locked and unwilling to surrender sub-4% rates of interest for 7% and better. The latest motion on the excessive finish might mirror optimism about future rate of interest cuts and a need to leap into the market earlier than costs climb. It might additionally sign a pent-up want to maneuver, which had been stalled amid rate of interest and market uncertainty.

Regardless of a slight softening total, with round 940,000 houses on the market nationwide in September, the market remains to be 23% beneath the extent it was on the identical time in 2019. Nonetheless, based on Realtor.com knowledge, listings had been nonetheless up by 25% or extra over the earlier 12 months in top-end cities and areas similar to Seattle, Silicon Valley, Denver, and Washington, D.C.

Silicon Valley Has Helped Ease California’s Excessive-Finish Market

The housing market on the West Coast has been a specific trigger for concern in recent times, with 28% of the nation’s homeless being in California. Nonetheless, on the excessive finish, a surge in tax income, notably with high-flying Silicon Valley firms, might have additionally helped loosen the actual property market in some rate-locked areas, with workers selecting to money out shares for actual property.

Equally, wealthier owners flush with money wouldn’t be as affected by the fluctuations in mortgage charges as different patrons who have to borrow extra.

California Housing Development Speaks for Pricier Properties Nationwide

The concept that the actual property market is more and more polarized between the prosperous and center class is mirrored in stats all year long. Redfin’s first-quarter report confirmed that total actual property gross sales fell 4% nationwide. Nonetheless, luxurious actual property gross sales elevated greater than 2%, posting their finest year-over-year positive factors in three years.

The actual property knowledge and itemizing firm’s second-quarter report confirmed that investor residence purchases had been up virtually 30% in dear West Coast markets similar to San Jose and Las Vegas, adopted by Sacramento, Los Angeles, and San Francisco. San Jose additionally noticed the most important achieve in total residence purchases, which rose 15.2% 12 months over 12 months within the second quarter. San Francisco got here in second place.

Many of the investor exercise was within the single-family residence sector. Craig Pellegrini, an actual property agent in San Jose, stated on the time of the report’s launch in August:

“San Jose has lots of abroad traders shopping for sight-unseen, and lots of residence flippers who’re buying dilapidated houses, placing some lipstick on them, and promoting them for a revenue. I’m additionally seeing mother and father purchase second houses that they plan to hire out for some time after which go on to their children, a few of whom simply graduated school and might’t afford to purchase themselves.”

Zillow’s value index report for September (beforehand talked about) echoes the market development. On the higher finish, rates of interest are much less of a priority for cash-rich patrons, who’re making strikes now earlier than costs enhance amid additional fee cuts.

The Outlook for the California Housing Market in 2025

The trajectory for elevated exercise within the higher finish of the market is mirrored within the outlook for the California market in 2025, based on the California Affiliation of Realtors. CAR president Melanie Barker, a Yosemite Realtor, stated in a press launch:

“A rise in houses on the market, together with decrease borrowing prices, is predicted to entice extra patrons and sellers to enter the market in 2025. Demand will develop as we begin the 12 months with the bottom rates of interest in additional than two years, notably for first-time patrons. In the meantime, would-be residence sellers, held again by the ‘lock-in impact,’ could have extra flexibility to pursue a house that higher fits their wants as mortgage charges proceed to say no.”

CAR senior vice chairman and chief economist Jordan Levine added:

“Stock is predicted to loosen as charges ease; demand may even enhance with decrease mortgage charges and restricted housing provide, which can push residence costs greater subsequent 12 months. Worth progress is predicted to be slower, however the housing scarcity will preserve the market aggressive outdoors of massive financial shocks, so costs will nonetheless rise.”

How Buyers Can Capitalize on Elevated Liquidity within the Prime-Finish Markets

All this sounds nice. However how do you profit from it as an investor? Listed here are some methods.

Goal rising markets positioned round pricier ones

Shopping for on the border of some costly actual property markets is a trusted technique when predicting the place to take a position, as there’ll all the time be individuals priced out of costly cities. Whether or not traders flip houses or hire, there’s more likely to be excessive demand for housing right here. Study the rising markets for funding round these cities, and also you’ll be on safe footing.

Flip houses

The dangers and rewards are each excessive when flipping houses in costly cities. Nonetheless, if you happen to’re a well-funded home flipper, flipping right here is smart as a result of the demand for housing will all the time be there. Assuming you purchase proper, there’s loads of scope for top income, even in case you are tearing down an older residence, constructing a brand new one, or just doing a beauty improve.

Workforce up with wealthier residents to do offers

Many residents of costly cities are flush with money however don’t have the time outdoors their main jobs to spend money on actual property. That’s the place a educated, well-organized investor is available in.

Borrowing giant sums of cash or teaming up with a well-heeled silent companion requires a extremely competent flipper with an excellent monitor report who can ship on their targets and has a stable contingency plan for any potential downsides, the place the investor is protected as a lot as attainable.

Wholesale offers for top income

In costly markets, wholesalers have to be credible and cling strictly to native actual property pointers. If meaning closing offers earlier than promoting, they may want the money to soak up the bills. Nonetheless, the potential income may very well be excessive due to the value factors.

Buy long-term leases for fairness appreciation and money stream

One benefit of shopping for offers in costly cities is that ultimately, the market corrects many errors as a result of properties proceed to rise in value. Conservative traders can construct their web price just by holding on to a property that pays for itself with rental revenue however accrues appreciation. Over time, with rental will increase and mortgage paydown, these pricier belongings will begin money flowing, too.

Closing Ideas

Timing rising markets is the place the gold is in actual property, however it’s additionally a dangerous endeavor, because it might imply being saddled with houses that don’t flip the nook as shortly as hoped.

If you happen to can afford it, shopping for in already-established markets is a protected transfer with few downsides, so long as you don’t over-leverage. Given the market cycle, shopping for now because the market rises as charges ultimately drop may very well be an excellent transfer.

Nonetheless, with an election and a brand new president, many traders have put shopping for plans on maintain, whatever the consequence. This would possibly signify a niche available in the market for bullish, well-funded patrons to make a transfer.

Discover the Hottest Markets of 2024!

Effortlessly uncover your subsequent funding hotspot with the model new BiggerPockets Market Finder, that includes detailed metrics and insights for all U.S. markets.

Notice By BiggerPockets: These are opinions written by the creator and don’t essentially signify the opinions of BiggerPockets.