China’s record-breaking run of aluminum output is more likely to lengthen by the remainder of the yr as provide dangers dissipate at a key manufacturing base within the south of the nation.

Article content

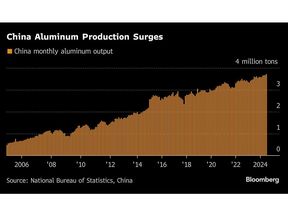

(Bloomberg) — China’s record-breaking run of aluminum output is likely to extend through the rest of the year as supply risks dissipate at a key production base in the south of the country.

National output is expected to rise 3% in the fourth quarter from a year ago to 11 million tons, according to Shanghai Metals Market. The forecast assumes that smelters in Yunnan will escape production cuts for the first time in four years due to abundant electricity supplies.

Advertisement 2

Article content material

China’s smelters, which account for about half of the world’s aluminum, churned out a report 3.69 million tons in August, based on the analysis agency, whose figures differ barely from official knowledge. September is more likely to present a little bit of a dip earlier than positive aspects resume, culminating in 3.72 million tons in December, SMM mentioned.

Demand has been wholesome regardless of a slowing financial system as a result of light-weight steel’s burgeoning functions in clear power and energy transmission. However producing aluminum is notoriously electricity-thirsty. In Yunnan, the province that accounts for about 12% of China’s provide, smelters depend on hydropower, which has been pinched in recent times by drought.

However this yr, an more and more fickle local weather has delivered heavy rains that ought to hold reservoirs full over the drier winter months. Hydro technology within the first eight months of the yr surged 22% to 882 billion kilowatt hours. China has additionally constructed monumental stockpiles of coal, its mainstay gasoline, which mitigates the chance of outages at smelters elsewhere.

The federal government’s planning company mentioned final week that China has sufficient coal to make sure sufficient heating provides over the colder months. In Yunnan, the native authorities gained’t limit energy provides to aluminum smelters over the winter and spring on account of ample provides of hydropower and coal, the official Xinhua Information Company reported on the finish of final month, citing the area’s grid firm.

Article content material

Commercial 3

Article content material

Nonetheless, China will probably be glad for the additional steel. The marketplace for aluminum will stay tight on account of rising consumption from electrical automobiles and solar energy, in addition to the impression of the federal government’s latest barrage of financial stimulus, mentioned SMM analyst Li Jiahui.

That’ll hold costs, which hit a two-year excessive in Might, at an elevated stage, she mentioned. Inventories, in the meantime, have slumped greater than 20% from their peak in March to 656,000 tons, based on SMM.

On the Wire

China has pledged to “halt the declines” within the housing market and can probably give attention to transactions, based on Bloomberg Economics. China’s third-quarter GDP and September exercise knowledge will in all probability present the slowdown deepening — underlining the necessity for policymakers to maneuver swiftly in executing their highly effective stimulus package deal, BE mentioned.

Vale SA churned out extra iron ore than anticipated at a time when considerations round oversupply and weak demand have depressed costs. Rio Tinto Group mentioned third-quarter iron ore shipments edged up 1% from the yr earlier than, as demand from China continued to melt amid an financial slowdown and ongoing property disaster.

Commercial 4

Article content material

China’s housing minister will maintain a press briefing on Thursday, probably offering extra particulars of measures to assist the nation’s slumping property sector and bolster financial progress.

This Week’s Diary

(All instances Beijing until famous.)

Wednesday, Oct. 16:

- China Wind Energy convention in Beijing, day 1

- SMM Metallic Trade convention in Xining, Qinghai, day 1

- CCTD’s weekly on-line briefing on Chinese language coal, 15:00

Thursday, Oct. 17:

- China’s housing minister holds briefing in Beijing, 10:00

- Chongqing gasoline change holds discussion board in Beijing, day 1

- China Wind Energy convention in Beijing, day 2

- SMM Metallic Trade convention in Xining, Qinghai, day 2

Friday, Oct. 18:

- China house costs for September, 09:30

- China industrial output for Sept., together with metal & aluminum; coal, gasoline & energy technology; and crude oil & refining. 10:00

- Retail gross sales, fastened belongings funding, property funding, residential gross sales, jobless charge

- 3Q GDP

- 3Q pork output and stock

- Retail gross sales, fastened belongings funding, property funding, residential gross sales, jobless charge

- China’s 2nd batch of Sept. commerce knowledge, together with agricultural imports; LNG & pipeline gasoline imports; oil merchandise commerce breakdown; alumina, copper and rare-earth product exports; bauxite, metal & aluminum product imports

- China’s weekly iron ore port stockpiles

- Shanghai change weekly commodities stock, ~15:00

- Worldwide Petroleum and Pure Fuel Enterprises Convention in Zhoushan, Zhejiang

- Chongqing gasoline change holds discussion board in Beijing, day 2

- China Wind Energy convention in Beijing, day 3

- SMM Metallic Trade convention in Xining, Qinghai, day 3

- EARNINGS: Zijin Mining, CATL, Huayou Cobalt

Article content material