China is going through a repeat of the tensions and uncertainty from the primary presidency of Donald Trump, solely with a weaker economic system that’s much more reliant on exports than it was through the first commerce conflict with the US.

Article content material

(Bloomberg) — China is going through a repeat of the tensions and uncertainty from the primary presidency of Donald Trump, solely with a weaker economic system that’s much more reliant on exports than it was through the first commerce conflict with the US.

Article content material

Article content material

China’s file commerce surplus of practically $1 trillion final yr was equal to greater than 5% of its gross home product, the best stage since 2015. The excess drove nearly a 3rd of the enlargement final yr, probably the most since 1997, in line with information launched final week.

Commercial 2

Article content material

That dependency on abroad markets provides to a large number of challenges going through President Xi Jinping: persistent deflation, lackluster shopper demand, an prolonged property hunch and a foreign money beneath strain. Bond yields are displaying that markets count on the world’s No. 2 economic system to weaken additional.

To counter these forces, Beijing will seemingly proceed to spice up authorities borrowing this yr to assist an bold financial progress goal. However rising protectionism within the US and different main buying and selling companions may threaten one among China’s most dependable progress drivers.

“The largest brilliant spot within the economic system final yr was exports,” stated Jacqueline Rong, chief China economist at BNP Paribas SA. “Meaning the largest drawback this yr can be US tariffs.”

BNP Paribas’ base case is that Trump will impose 10% tariffs on Chinese language items, Rong stated final week, though it’s nonetheless unclear whether or not the European Union and rising markets will observe swimsuit and lift commerce limitations focusing on China too.

After he gained election in November, Trump stated he would elevate tariffs on all US imports from China by 10% on high of levies already in place. At different occasions, he has floated hitting Chinese language items with even increased tariff charges after he takes workplace Monday.

Article content material

Commercial 3

Article content material

In response, corporations raced to replenish, boosting purchases from China within the ultimate months of final yr and probably pulling ahead demand from this yr. Chinese language companies exported nearly $50 billion value of products to the US in December, the best single month whole since mid-2022. A lull might come subsequent, with the Lunar New 12 months vacation falling later this month.

Some Commerce Diversification

US tariffs over the previous seven years have already pushed some corporations to maneuver their factories out of China or supply from elsewhere. American corporations now purchase lower than 15% of China’s shipments instantly, down from 19% on the finish of 2017.

Regardless of hopes that a few of that manufacturing would transfer again to the US, most of it went to markets similar to Vietnam, which is now taking file shipments of Chinese language digital elements to assemble into merchandise to ship to the US and elsewhere.

China’s exports to Vietnam soared to a file final yr, as did that nation’s shipments onto the US. Ranked by bilateral commerce balances, Vietnam’s commerce surplus with the US is the now the third-largest, after China and Mexico.

Commercial 4

Article content material

And though direct Chinese language exports to the US have shrunk a bit of in significance over the previous 4 years, the world’s largest economic system continues to be an important supply of ultimate demand for China, shopping for greater than half a trillion {dollars} value of products final yr, the equal of just about 3% of China’s GDP.

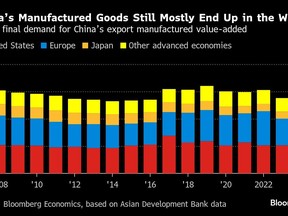

New analysis from Bloomberg Economics confirms that whereas each nations report having diversified their commerce from one another, the US continues to be the biggest single vacation spot for Chinese language manufacturing value-added.

Sanctions and Tariffs

If the US does impose new levies on China, Beijing can retaliate with its personal tariffs, because it did earlier than. The federal government has additionally constructed up new retaliatory instruments, as seen within the current ban on exports to the US of some metals and the sanctioning of greater than a dozen US protection companies within the final month.

“China’s efforts will turn into extra aggressive” on export controls, stated Alex Capri, creator of Techno-Nationalism: How It’s Reshaping Commerce, Geopolitics and Society. “The stable progress they noticed in 2024 regardless of US export controls may give them confidence to roll out extra of their very own export controls and constrictions on outbound exports in vital minerals, magnets, batteries and different items.”

Commercial 5

Article content material

China’s authorities has been making an attempt to purchase fewer commodities from the US and extra from Brazil, Russia and different friendlier nations, as a part of a years-long effort to diversify its buying and selling relationships, together with by signing commerce offers with South East Asian nations and creating the world’s largest tariff-free zone. That has diminished publicity to the US however might also make any retaliation by way of tariffs on US items even much less efficient than final time.

Chinese language corporations might attempt to redirect extra items to different markets to make up for misplaced gross sales within the US, however there’s no assure different nations gained’t impose their very own tariff limitations if imports immediately soar. International locations in South America have already positioned duties on Chinese language metal.

North American Tariffs

The return of Trump is spurring Mexico to behave, with President Claudia Sheinbaum imposing tariffs geared toward lowering reliance on Chinese language imports. She’s making an attempt to dissuade Trump from hitting items from Mexico with a 25% import tax.

Different nations are taking early defensive steps embrace Canada, which introduced new tariffs on Chinese language-made electrical automobiles and metals in September. The European Union and Turkey have hit Chinese language-made EVs with tariffs.

In the long run, the simplest instrument at Beijing’s disposal could also be a long-prescribed structural change: refocusing on the home economic system and boosting native consumption to exchange the demand misplaced to a brand new commerce conflict with the US.

“Fiscal measures, which have remained very conservative to date, could be probably the most wise, particularly stimulus funds to households to extend home consumption,” stated Martin Chorzempa, senior fellow on the Peterson Institute for Worldwide Economics in Washington.

—With help from Fran Wang and Yujing Liu.

Article content material