In the event you’re simply beginning your authorized profession, chances are you’ll assume {that a} authorized malpractice declare may by no means occur to you.

Whereas that’s hopefully the case, the truth is that almost all of attorneys will face a malpractice declare in some unspecified time in the future of their profession.

In keeping with the American Bar Affiliation (ABA), 4 out of 5 attorneys will get sued for malpractice at the least as soon as. And 70% of malpractice claims are filed towards corporations with one to 5 attorneys.

Authorized malpractice lawsuits are on the rise, with multimillion-dollar insurance coverage payouts rising 12 months over 12 months, in keeping with a 2023 report by insurance coverage dealer and guide Ames & Gough. A part of this has been attributed to shoppers being much less hesitant to sue their attorneys resulting from market pressures, financial turmoil, and the widespread data that almost all attorneys have authorized malpractice insurance coverage.

Simply have a look at the 2021 lawsuit that TerraForm Energy introduced towards its regulation corporations as a result of “consumers” as an alternative of “purchaser” was utilized in a purchase order settlement. The corporate claimed $300 million in damages.

Whereas sure areas of follow comparable to trusts and estates, enterprise transactions, and company and securities usually expertise essentially the most malpractice claims, any lawyer in any follow space is prone to a malpractice lawsuit.

Need to study extra about authorized malpractice and defend your agency? You’ve come to the suitable place.

What’s Authorized Malpractice?

Identical to everybody, attorneys could make errors. However what if these errors jeopardize their potential to offer correct illustration?

Within the U.S., attorneys should observe the Guidelines of Skilled Conduct established by the ABA. Authorized malpractice claims come up when a lawyer is alleged to have didn’t carry out their duties in keeping with these requirements {of professional} and moral conduct.

For instance, if a lawyer fails to file paperwork on time, communicates poorly, or breaches consumer confidentiality, they might be answerable for authorized malpractice.

Even when there isn’t a breach {of professional} requirements, some shoppers might understand an unfavorable authorized outcome as sufficient motive to deliver a malpractice declare towards your agency.

Sadly, for even essentially the most diligent attorneys, the chance of expensive claims comes as a part of the job.

What Are Frequent Forms of Authorized Malpractice Claims?

George Bernard Shaw as soon as mentioned, “A life spent making errors will not be solely extra honorable, however extra helpful than a life spent doing nothing.”

However strive telling that to a lawyer who’s been hit with a malpractice declare. Whereas authorized malpractice claims usually contain an error made by an legal professional, even the notion of a possible mistake can put attorneys prone to a lawsuit.

A few of the widespread errors that attorneys might make that result in authorized malpractice claims embody:

Misuse of funds: If an legal professional places a consumer’s retainer of their private account, that’s thought-about a misuse of funds. A extra excessive instance can be a lawyer stealing funds from a consumer.

Missed deadlines: Authorized proceedings are filled with deadlines, and lacking a deadline can have critical penalties. If an legal professional misses a deadline for submitting paperwork or anything related to a case, they might be answerable for authorized malpractice.

Conflicts of curiosity: If an legal professional places their very own pursuits forward of a consumer’s, that may represent a battle. Representing a number of shoppers with competing pursuits and having a private relationship with a member of the opposing social gathering (consumer or legal professional) are additionally thought-about conflicts of curiosity.

Failure to use the regulation: Legal professionals are anticipated to know the areas of regulation they follow and know apply the regulation correctly. If an legal professional doesn’t accurately perceive the legal guidelines affecting a selected case, or fails to maintain up with legal guidelines and laws, they might breach the authorized skilled commonplace of care.

Communication errors: Poor communication is a number one explanation for attorneys being sued by their shoppers. Whereas shoppers might get upset about not having their calls and emails returned promptly, a extra pertinent motive for malpractice claims is when an legal professional fails to offer a consumer with data related to their case.

Lack of consent: Legal professionals are employed to symbolize shoppers in authorized proceedings, however that doesn’t imply they’ve all of the say in making authorized choices. Legal professionals should have their consumer’s knowledgeable consent earlier than taking any authorized motion.

Fraud: If an legal professional deceives their consumer or anybody else concerned in a authorized continuing to acquire an illegal acquire, they probably dedicated fraud, which may result in a malpractice declare.

What Are the Penalties of Authorized Malpractice Claims?

Authorized malpractice allegations can have critical penalties for regulation corporations that don’t have protections in place.

Authorized protection charges, settlements or judgments, and different bills can add up shortly. Relying on the scenario, a authorized malpractice lawsuit may additionally lead to fines, lack of earnings from follow restrictions and reputational harm, and even suspension or disbarment.

A current instance includes a South Carolina legislator who had his regulation license suspended indefinitely after a former consumer sued him for malpractice for allegedly forging the consumer’s signature on settlement paperwork (that the consumer says he didn’t even find out about).

Nevertheless, even meritless claims can simply take up quite a lot of money and time, which impacts your follow, with a lot of your power going into coping with the declare slightly than representing shoppers.

The excellent news is that authorized malpractice insurance coverage protects attorneys within the occasion of a malpractice declare by protecting the prices of authorized illustration and any potential damages.

What Can Legal professionals Do to Defend Towards Authorized Malpractice Claims?

Each lawyer should defend and symbolize the most effective pursuits of their shoppers. But it surely’s additionally essential for attorneys to recollect to guard themselves by taking a proactive method to threat administration.

Beneath are some ways in which attorneys can mitigate the possibilities of being sued for malpractice whereas additionally defending their follow.

Don’t take each case: This tip is often known as “take heed to your intestine.” If a selected case or consumer appears problematic or dangerous, don’t be afraid to politely decline or refer the matter to a different agency higher suited to take it on. Turning down circumstances that aren’t a very good match to your regulation agency will do considerably much less harm in the long term than taking up each case that comes your manner.

At all times have a contract: This one is apparent, however attorneys ought to solely present companies to a consumer in the event that they put in writing what these companies will contain. The contract ought to encompass the phrases of companies, the retainer, and an in depth definition of what the legal professional should do below the retainer.

Set real looking expectations: In the case of threat administration for regulation corporations, setting expectations with shoppers early on is a big a part of the method. Trustworthy and open communication with shoppers is significant when strategizing a case to keep away from overpromising and underdelivering.

Doc all the things: And we imply all the things. Retaining detailed and time-stamped notes, documenting particular undertakings for each case, recording conversations, and backing up emails will assist defend you from potential rumour. Ensure that to maintain authorized paperwork safe to stop delicate data from being leaked in a information breach.

Persevering with authorized training: Most states have persevering with authorized training (CLE) necessities to make sure that attorneys keep up to date on present legal guidelines and ethics. Even in states with out CLE necessities, it’s nonetheless a good suggestion for attorneys to proceed with training to maintain up with authorized traits and modifications.

Have insurance coverage: Even essentially the most meticulous and skilled attorneys can’t absolutely keep away from the chance of a authorized malpractice declare. That’s why each lawyer and regulation agency wants skilled malpractice insurance coverage as safety from having to cowl prices related to a declare.

What Are the Advantages of Skilled Legal responsibility Insurance coverage for Regulation Corporations?

Regardless of your finest efforts, you’ll inevitably have sad shoppers in some unspecified time in the future. And each authorized malpractice declare stems from disgruntled shoppers.

Let’s say {that a} remaining ruling leads to losses for the consumer. That consumer believes you dropped the ball professionally and opts to recoup their losses by submitting a malpractice lawsuit towards you. As talked about earlier, even baseless claims will be expensive and time-consuming.

That’s the place the good thing about a authorized malpractice insurance coverage coverage is available in.

Authorized malpractice insurance coverage, often known as attorneys skilled legal responsibility insurance coverage, covers each a regulation agency and particular person attorneys, so that you received’t have to fret about protection bills from a malpractice go well with or damages that your follow could also be required to pay.

Whereas skilled legal responsibility insurance coverage is a further expense to your regulation agency, given the prevalence of authorized malpractice claims, having the suitable protection is a worthwhile funding.

The results of “going naked” — the time period for a lawyer who practices with out skilled legal responsibility insurance coverage — will be devastating. Those that determine to avoid wasting just a few {dollars} and go with out malpractice insurance coverage are taking part in a dangerous sport of likelihood because the monetary fallout from a lawsuit will far outweigh the price of an insurance coverage coverage.

What’s extra, skilled legal responsibility insurance coverage is usually considered as a key issue for individuals to contemplate when selecting a possible legal professional. Which means not having authorized skilled legal responsibility insurance coverage may hinder your agency’s development by making it troublesome to draw new shoppers.

The Significance of Threat Administration for Regulation Corporations

Each enterprise faces threat. And that’s very true for regulation corporations, that are significantly susceptible to cyberattacks and allegations of negligence.

Utilizing threat administration finest practices is important for regulation corporations to face up to threats that would probably jeopardize their follow. Recognizing dangers and having procedures and protocols to cope with them could make all of the distinction in defending your agency from authorized malpractice claims.

Each regulation agency ought to have a threat administration course of to establish malpractice dangers and consider risk ranges and incidence likelihood. As soon as dangers have been assessed and evaluated, you’ll be able to determine cope with them. Which will contain avoidance methods, threat discount methods, or threat switch utilizing insurance coverage.

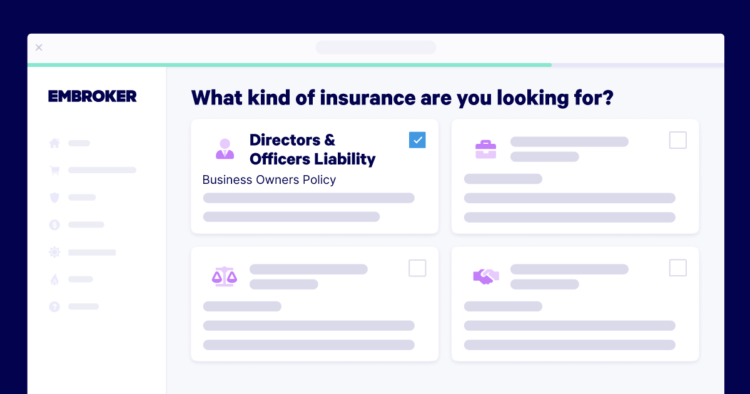

With insurance coverage, you’ll be able to switch a lot of the monetary threat to a 3rd social gathering — your insurer. Whereas we’ve already touched on the advantages of authorized skilled legal responsibility insurance coverage, different enterprise insurance coverage choices, together with cyber insurance coverage and administrators and officers insurance coverage, may additionally assist defend your agency towards expensive claims

It’s vital to do not forget that as your regulation agency grows, the dangers that it faces will change. However even when your regulation agency stays comparatively unchanged over time, new dangers are continually rising, comparable to synthetic intelligence. With the suitable insurance coverage, you’ll be able to relaxation assured that expensive claims received’t blindside your regulation agency.

Need to study extra about defend your regulation agency from the monetary repercussions of authorized malpractice claims?

Take a look at Embroker’s authorized malpractice protection choices, or contact a member of our knowledgeable authorized insurance coverage crew to debate your regulation agency’s insurance coverage wants.