TABLE OF CONTENTS

- Abstract

- Half I: Introduction to Asset Location

- Half II: After-Tax Return—Deep Dive

- Half III: Asset Location Myths

- Half IV: TCP Methodology

- Half V: Monte Carlo on the Amazon—Betterment’s Testing Framework

- Half VI: Outcomes

- Half VII: Particular Issues

- Addendum

Abstract

Asset location is broadly considered the closest factor there may be to a “free lunch” within the wealth administration trade.1 When investments are held in a minimum of two varieties of accounts (out of three doable sorts: taxable, tax-deferred and tax-exempt), asset location offers the flexibility to ship further after-tax return potential, whereas sustaining the identical stage of threat.

Typically talking, this profit is achieved by inserting the least tax-efficient property within the accounts taxed most favorably, and essentially the most tax-efficient property within the accounts taxed least favorably, all whereas sustaining the specified asset allocation within the mixture.

Half I: Introduction to Asset Location

Maximizing after-tax return on investments may be complicated. Nonetheless, most traders know that contributing to tax-advantaged (or “certified”) accounts is a comparatively easy method to pay much less tax on their retirement financial savings. Tens of millions of People wind up with some mixture of IRAs and 401(ok) accounts, each obtainable in two sorts: conventional or Roth. Many will solely save in a taxable account as soon as they’ve maxed out their contribution limits for the certified accounts. However whereas tax issues are paramount when selecting which account to fund, much less thought is given to the tax influence of which investments to then buy throughout all accounts.

The tax profiles of the three account sorts (taxable, conventional, and Roth) have implications for what to spend money on, as soon as the account has been funded. Selecting properly can considerably enhance the after-tax worth of 1’s financial savings, when multiple account is within the combine.

Virtually universally, such traders can profit from a correctly executed asset location technique. The concept behind asset location is pretty easy. Sure investments generate their returns in a extra tax-efficient method than others. Sure accounts shelter funding returns from tax higher than others. Inserting, or “finding” much less tax-efficient investments in tax-sheltered accounts might improve the after-tax worth of the general portfolio.

Allocate First, Find Second

Let’s begin with what asset location isn’t. All traders should choose a mixture of shares and bonds, discovering an applicable stability of threat and anticipated potential return, consistent with their objectives. One widespread purpose is retirement, during which case, the combination of property needs to be tailor-made to match the investor’s time horizon. This preliminary willpower is called “asset allocation,” and it comes first.

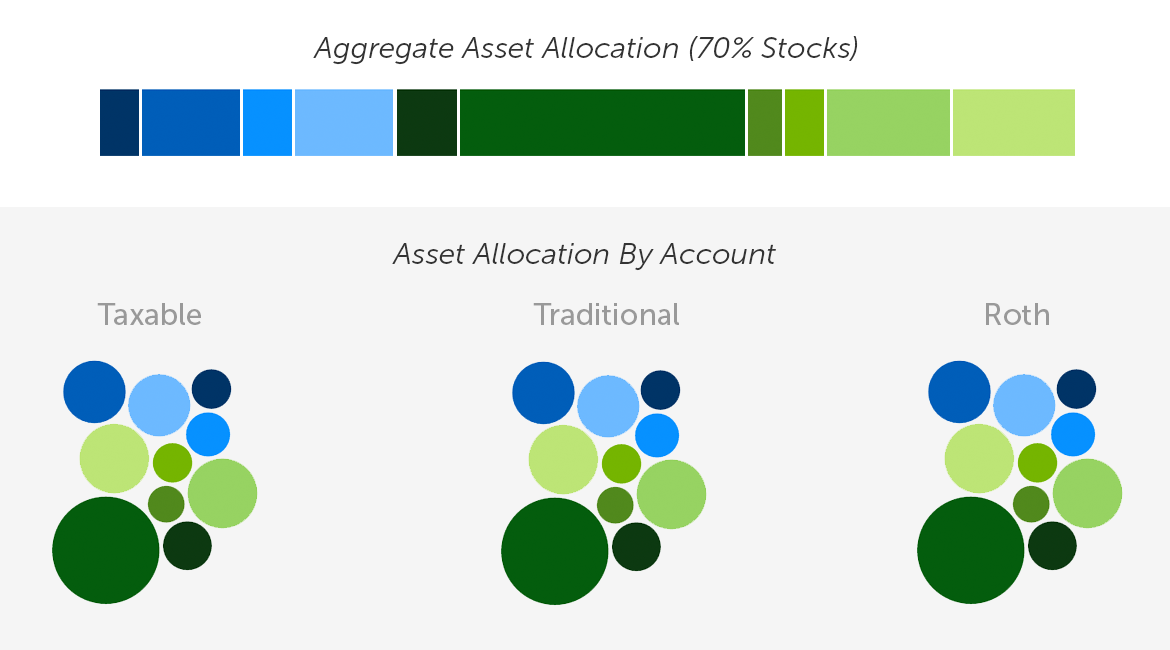

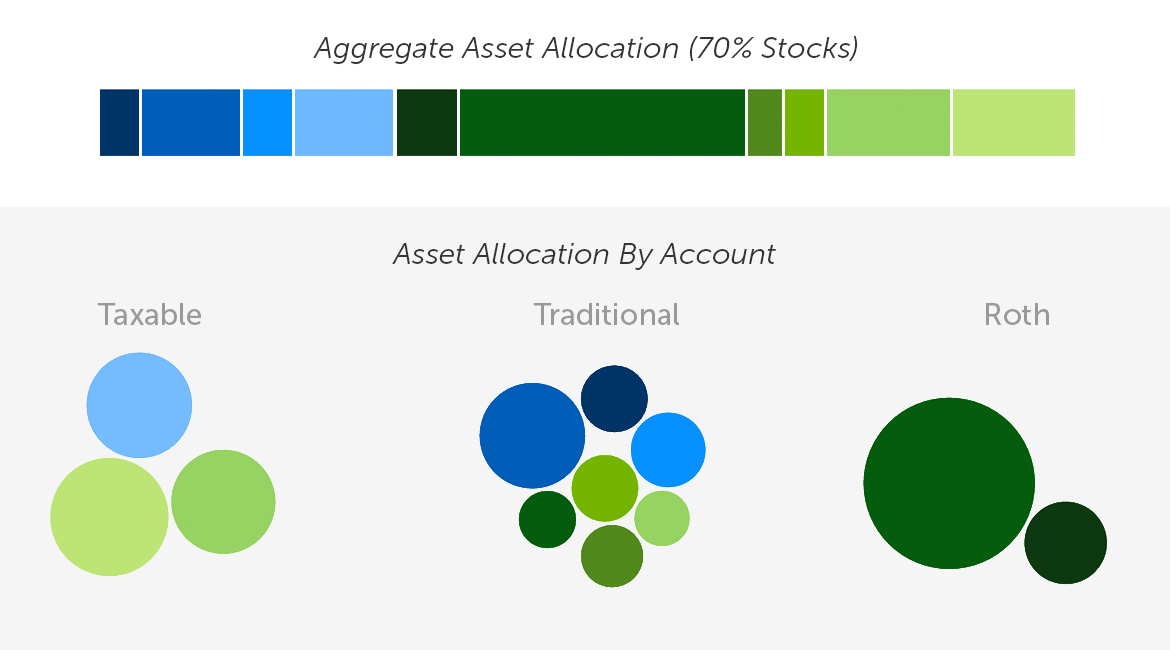

When investing in a number of accounts, it’s common for traders to easily recreate their desired asset allocation in every account. If every account, regardless of the dimensions, holds the identical property in the identical proportions, including up all of the holdings will even match the specified asset allocation. If all these funds, nevertheless scattered, are invested in the direction of the identical purpose, that is the best end result. The mixture portfolio is the one which issues, and it ought to observe the asset allocation chosen for the widespread purpose.

Portfolio Managed Individually in Every Account

Enter asset location, which might solely be utilized as soon as a desired asset allocation is chosen. Every asset’s after-tax return is taken into account within the context of each obtainable account. The property are then organized (unequally) throughout all coordinated accounts to assist maximize the after-tax efficiency of the general portfolio.

Identical Portfolio General—With Asset Location

To assist conceptualize asset location, take into account a staff of runners. Some runners compete higher on a observe than a cross-country dust path, as in comparison with their extra versatile teammates. Equally, sure asset courses can profit greater than others from the tax-efficient “terrain” of a professional account.

Asset allocation determines the composition of the staff, and the general portfolio’s after-tax return is a staff effort. Asset location then seeks to match up asset and surroundings in a method that maximizes the general end result over time, whereas preserving the composition of the staff intact.

TCP vs. TDF

The first enchantment of a target-date fund (TDF) is the “set it and neglect it” simplicity with which it permits traders to pick and keep a diversified asset allocation, by buying just one fund. That simplicity comes at a value—as a result of every TDF is a single, indivisible safety, it can’t erratically distribute its underlying property throughout a number of accounts, and thus can’t ship the extra after-tax returns of asset location.

Particularly, members who’re locked into 401(ok) plans with out automated administration could discover that an inexpensive TDF remains to be their finest “palms off” choice (plus, a TDF’s means to fulfill the Certified Default Funding Various (QDIA) requirement beneath ERISA ensures its baseline survival beneath present regulation).

Individuals in a Betterment at Work plan can already allow Betterment’s Tax-Coordinated Portfolio characteristic (“TCP”) to handle a single portfolio throughout their 401(ok), IRAs and taxable accounts they individually have with Betterment, designed to squeeze further after-tax returns from their mixture long-term financial savings.

Automated asset location (when built-in with automated asset allocation) replicates what makes a TDF so interesting, however successfully quantities to a “TDF 2.0″—a repeatedly managed portfolio, however one that may straddle a number of accounts for tax advantages.

Subsequent, we dive into the complicated dynamics that have to be thought of when searching for to optimize the after-tax return of a diversified portfolio.

Half II: After-Tax Return—Deep Dive

An excellent start line for a dialogue of funding taxation is the idea of “tax drag.” Tax drag is the portion of the return that’s misplaced to tax on an annual foundation. Particularly, funds pay dividends, that are taxed within the 12 months they’re acquired.

Nevertheless, there isn’t any annual tax in certified accounts, additionally typically generally known as “tax-sheltered accounts.” Due to this fact, inserting property that pay a considerable quantity of dividends into a professional account, fairly than a taxable account, “shelters” these dividends, and reduces tax drag. Decreasing the tax drag of the general portfolio is a method that asset location improves the portfolio’s potential after-tax return.

Importantly, investments are additionally topic to tax at liquidation, each within the taxable account, and in a conventional IRA (the place tax is deferred). Nevertheless, “tax drag”, as that time period is usually used, doesn’t embrace liquidation tax. So whereas the idea of “tax drag” is intuitive, and thus a very good place to begin, it can’t be the only focus when seeking to assist reduce taxes.

What’s “Tax Effectivity”

A carefully associated time period is “tax effectivity” and that is one that the majority discussions of asset location will inevitably concentrate on. A tax-efficient asset is one which has minimal “tax drag.” Prioritizing property on the idea of tax effectivity permits for asset location selections to be made following a easy, rule-based strategy.

Each “tax drag” and “tax effectivity” are ideas pertaining to taxation of returns in a taxable account. Due to this fact, we first take into account that account, the place the principles are most elaborate. With an understanding of those guidelines, we will layer on the influence of the 2 varieties of certified accounts.

Returns in a Taxable Account

There are two varieties of funding revenue, and two varieties of relevant tax charges.

Two varieties of funding tax charges. All funding revenue in a taxable brokerage account is topic to one in all two fee classes (with materials exceptions famous). For simplicity, and to maintain the evaluation common, this part solely addresses federal tax (state tax is taken into account when testing for efficiency).

- Strange fee: For many, this fee mirrors the marginal tax bracket relevant to earned revenue (primarily wages reported on a W-2).

- Preferential fee: This extra favorable fee ranges from 15% to twenty% for many traders.

For particularly excessive earners, each charges are topic to a further tax of three.8%.

Two varieties of funding returns. Investments generate returns in two methods: by appreciating in worth, and by making money distributions.

- Capital beneficial properties: When an funding is offered, the distinction between the proceeds and the tax foundation (typically, the acquisition value) is taxed as capital beneficial properties. If held for longer than a 12 months, this achieve is handled as long-term capital beneficial properties (LTCG) and taxed on the preferential fee. If held for a 12 months or much less, the achieve is handled as short-term capital beneficial properties (STCG), and taxed on the strange fee. Barring unexpected circumstances, passive traders ought to be capable to keep away from STCG totally. Betterment’s automated account administration seeks to keep away from STCG when doable,4 and the remainder of this paper assumes solely LTCG on liquidation of property.

- Dividends: Bonds pay curiosity, which is taxed on the strange fee, whereas shares pay dividends, that are taxed on the preferential fee (each topic to the exceptions beneath). An exchange-traded fund (ETF) swimming pools the money generated by its underlying investments, and makes funds which can be referred to as dividends, even when some or the entire supply was curiosity. These dividends inherit the tax remedy of the supply funds. Because of this, typically, a dividend paid by a bond ETF is taxed on the strange fee, and a dividend paid by a inventory ETF is taxed on the preferential fee.

- Certified Dividend Earnings (QDI): There may be an exception to the overall rule for inventory dividends. Inventory dividends take pleasure in preferential charges provided that they meet the necessities of certified dividend revenue (QDI). Key amongst these necessities is that the corporate issuing the dividend have to be a U.S. company (or a professional overseas company). A fund swimming pools dividends from many corporations, solely a few of which can qualify for QDI. To account for this, the fund assigns itself a QDI share every year, which the custodian makes use of to find out the portion of the fund’s dividends which can be eligible for the preferential fee. For inventory funds monitoring a U.S. index, the QDI share is often 100%. Nevertheless, funds monitoring a overseas inventory index can have a decrease QDI share, typically considerably. For instance, VWO, Vanguard’s Rising Markets Inventory ETF, had a QDI share of 38% in 2015, which implies that 38% of its dividends for the 12 months had been taxed on the preferential fee, and 62% had been taxed on the strange fee.

- Tax-exempt curiosity: There may be additionally an exception to the overall rule for bonds. Sure bonds pay curiosity that’s exempt from federal tax. Primarily, these are municipal bonds, issued by state and native governments. Because of this an ETF which holds municipal bonds pays a dividend that’s topic to 0% federal tax—even higher than the preferential fee.

The desk beneath summarizes these interactions. Word that this part doesn’t take into account tax remedy for these in a marginal tax bracket of 15% and beneath. These taxpayers are addressed in “Particular Issues.”

The influence of charges is clear: The upper the speed, the upper the tax drag. Equally necessary is timing. The important thing distinction between dividends and capital beneficial properties is that the previous are taxed yearly, contributing to tax drag, whereas tax on the latter is deferred.

Tax deferral is a strong driver of after-tax return, for the easy purpose that the financial savings, although momentary, may be reinvested within the meantime, and compounded. The longer the deferral, the extra useful it’s.

Placing this all collectively, we arrive on the foundational piece of typical knowledge, the place essentially the most fundamental strategy to asset location begins and ends:

- Bond funds are anticipated to generate their return totally via dividends, taxed on the strange fee. This return advantages neither from the preferential fee, nor from tax deferral, making bonds the traditional tax-inefficient asset class. These go in your certified account.

- Inventory funds are anticipated to generate their return primarily via capital beneficial properties. This return advantages each from the preferential fee, and from tax deferral. Shares are due to this fact the extra tax-efficient asset class. These go in your taxable account.

Tax-Environment friendly Standing: It’s Difficult

Actuality will get messy fairly shortly, nevertheless. Over the long run, shares are anticipated to develop quicker than bonds, inflicting the portfolio to float from the specified asset allocation. Rebalancing could periodically notice some capital beneficial properties, so we can’t anticipate full tax deferral on these returns (though if money flows exist, investing them intelligently can probably scale back the necessity to rebalance by way of promoting).

Moreover, shares do generate some return by way of dividends. The anticipated dividend yield varies with extra granularity. Small cap shares pay comparatively little (these are development corporations that are inclined to reinvest any earnings again into the enterprise) whereas giant cap shares pay extra (as these are mature corporations that are inclined to distribute earnings). Relying on the rate of interest surroundings, inventory dividends can exceed these paid by bonds.

Worldwide shares pay dividends too, and complicating issues additional, a few of these dividends won’t qualify as QDI, and will probably be taxed on the strange fee, like bond dividends (particularly rising markets inventory dividends).

Returns in a Tax-Deferred Account (TDA)

In comparison with a taxable account, a TDA is ruled by easy guidelines. Nevertheless, incomes the identical return in a TDA entails trade-offs which aren’t intuitive. Making use of a unique time horizon to the identical asset can swing our choice between a taxable account and a TDA.Understanding these dynamics is essential to appreciating why an optimum asset location methodology can’t ignore liquidation tax, time horizon, and the precise composition of every asset’s anticipated return.Though development in a conventional IRA or conventional 401(ok) isn’t taxed yearly, it’s topic to a liquidation tax. All of the complexity of a taxable account described above is diminished to 2 guidelines. First, all tax is deferred till distributions are produced from the account, which ought to start solely in retirement. Second, all distributions are taxed on the similar fee, regardless of the supply of the return.

The speed utilized to all distributions is the upper strange fee, besides that the extra 3.8% tax won’t apply to these whose tax bracket in retirement would in any other case be excessive sufficient.2

First, we take into account revenue that might be taxed yearly on the strange fee (i.e. bond dividends and non-QDI inventory dividends). The advantage of shifting these returns to a TDA is evident. In a TDA, these returns will ultimately be taxed on the similar fee, assuming the identical tax bracket in retirement. However that tax won’t be utilized till the top, and compounding as a consequence of deferral can solely have a constructive influence on the after-tax return, as in comparison with the identical revenue paid in a taxable account.3

Particularly, the danger is that LTCG (which we anticipate loads of from inventory funds) will probably be taxed like strange revenue. Underneath the fundamental assumption that in a taxable account, capital beneficial properties tax is already deferred till liquidation, favoring a TDA for an asset whose solely supply of return is LTCG is plainly dangerous. There isn’t any profit from deferral, which you’d have gotten anyway, and solely hurt from the next tax fee. This logic helps the standard knowledge that shares belong within the taxable account. First, as already mentioned, shares do generate some return by way of dividends, and that portion of the return will profit from tax deferral. That is clearly true for non-QDI dividends, already taxed as strange revenue, however QDI can profit too. If the deferral interval is lengthy sufficient, the worth of compounding will offset the hit from the upper fee at liquidation.

Second, it’s not correct to imagine that each one capital beneficial properties tax will probably be deferred till liquidation in a taxable account. Rebalancing could notice some capital beneficial properties “prematurely” and this portion of the return might additionally profit from tax deferral.

Inserting shares in a TDA is a trade-off—one which should weigh the potential hurt from unfavorable fee arbitrage towards the advantage of tax deferral. Valuing the latter means making assumptions about dividend yield and turnover. On prime of that, the longer the funding interval, the extra tax deferral is price. Kitces demonstrates {that a} dividend yield representing 25% of whole return (at 100% QDI), and an annual turnover of 10%, might swing the calculus in favor of holding the shares in a TDA, assuming a 30-year horizon.4 For overseas shares with lower than good QDI, we might anticipate the tipping level to come back sooner.

Returns in a Tax-Exempt Account (TEA)

Investments in a Roth IRA or Roth 401(ok) develop tax free, and are additionally not taxed upon liquidation. Because it eliminates all doable tax, a TEA presents a very useful alternative for maximizing after-tax return. The trade-off right here is managing alternative value—each asset does higher in a TEA, so how finest to make use of its treasured capability?

Clearly, a TEA is essentially the most favorably taxed account. Typical knowledge thus means that if a TEA is out there, we use it to first place the least tax-efficient property. However that strategy is fallacious.

Every thing Counts in Giant Quantities—Why Anticipated Return Issues

The highly effective but easy benefit of a TEA helps illustrate the limitation of focusing solely on tax effectivity when making location selections. Returns in a TEA escape all tax, regardless of the fee or timing would have been, which implies that an asset’s anticipated after-tax return equals its anticipated whole return.

When each a taxable account and a TEA can be found, it could be price placing a high-growth, low-dividend inventory fund into the TEA, as a substitute of a bond fund, despite the fact that the inventory fund is vastly extra tax-efficient. Related reasoning can apply to placement in a TDA as effectively, so long as the tax-efficient asset has a big sufficient anticipated return, and presents some alternative for tax deferral (i.e., some portion of the return comes from dividends).

Half III: Asset Location Myths

City Legend 1: Asset location is a one-time course of. Simply set it and neglect it.

Whereas an preliminary location could add some worth, doing it correctly is a steady course of, and would require changes in response to altering situations. Word that overlaying asset location isn’t a deviation from a passive investing philosophy, as a result of optimizing for location doesn’t imply altering the general asset allocation (the identical goes for tax loss harvesting).

Different issues that can change, all of which ought to issue into an optimum methodology: anticipated returns (each the risk-free fee, and the surplus return), dividend yields, QDI percentages, and most significantly, relative account balances. Contributions, rollovers, and conversions can improve certified property relative to taxable property, repeatedly offering extra room for extra optimization.

City Legend 2: Profiting from asset location means it’s best to contribute extra to a selected certified account than you in any other case would.

Positively not! Asset location ought to play no function in deciding which accounts to fund. It optimizes round account balances because it finds them, and isn’t involved with which accounts needs to be funded within the first place. Simply because the presence of a TEA makes asset location extra useful, doesn’t imply it’s best to contribute to a TEA, versus a TDA. That call is primarily a wager on how your tax fee at this time will evaluate to your tax fee in retirement. To hedge, some could discover it optimum to contribute to each a TDA and TEA (that is referred to as “tax diversification”). Whereas these selections are out of scope for this paper, Betterment’s retirement planning instruments may also help shoppers with these selections.

City Legend 3: Asset location has little or no worth if one in all your accounts is comparatively small.

It relies upon. Asset location won’t do a lot for traders with a really small taxable stability and a comparatively giant stability in just one kind of certified account, as a result of a lot of the general property are already sheltered. Nevertheless, a big taxable stability and a small certified account stability (particularly a TEA stability) presents a greater alternative. Underneath these circumstances, there could also be room for less than the least tax-efficient, highest-return property within the certified account. Sheltering a small portion of the general portfolio can ship a disproportionate quantity of worth.

City Legend 4: Asset location has no worth if you’re investing in each varieties of certified accounts, however not in a taxable account.

A TEA provides vital benefits over a TDA. Zero tax is best than a tax deferred till liquidation. Whereas tax effectivity (i.e. annual tax drag) performs no function in these location selections, anticipated returns and liquidation tax do. The property we anticipate to develop essentially the most needs to be positioned in a TEA, and doing so will plainly improve the general after-tax return. There may be a further profit as effectively. Required minimal distributions (RMDs) apply to TDAs however not TEAs. Shifting anticipated development into the TEA, on the expense of the TDA, will imply decrease RMDs, giving the investor extra flexibility to manage taxable revenue down the street. In different phrases, a decrease stability within the TDA can imply decrease tax charges in retirement, if greater RMDs would have pushed the retiree into the next bracket. This potential profit isn’t captured in our outcomes.

City Legend 5: Bonds at all times go within the IRA.

Presumably, however not essentially. This generally asserted rule is a simplification, and won’t be optimum beneath all circumstances. It’s mentioned at extra size beneath.

Present Approaches to Asset Location: Benefits and Limitations

Optimizing for After-Tax Return Whereas Sustaining Separate Portfolios

One strategy to growing after-tax return on retirement financial savings is to keep up a separate, standalone portfolio in every account with roughly the identical stage of risk-adjusted return, however tailoring every portfolio considerably to reap the benefits of the tax profile of the account. Successfully, which means that every account individually maintains the specified publicity to shares, whereas substituting sure asset courses for others.

Typically talking, managing a completely diversified portfolio in every account implies that there isn’t any method to keep away from inserting some property with the best anticipated return within the taxable account.

This strategy does embrace a useful tactic, which is to distinguish the high-quality bonds element of the allocation, relying on the account they’re held in. The allocation to the element is identical in every account, however in a taxable account, it’s represented by municipal bonds that are exempt from federal tax , and in a professional account, by taxable funding grade bonds .

This variation is efficient as a result of it takes benefit of the truth that these two asset courses have very related traits (anticipated returns, covariance and threat exposures) permitting them to play roughly the identical function from an asset allocation perspective. Municipal bonds are extremely tax-efficient as a consequence of their federal tax-exempt curiosity revenue, making them significantly compelling for a taxable account. Taxable funding grade bonds have vital tax drag, and work finest in a professional account. Betterment has utilized this substitution since 2014.

The Primary Precedence Record

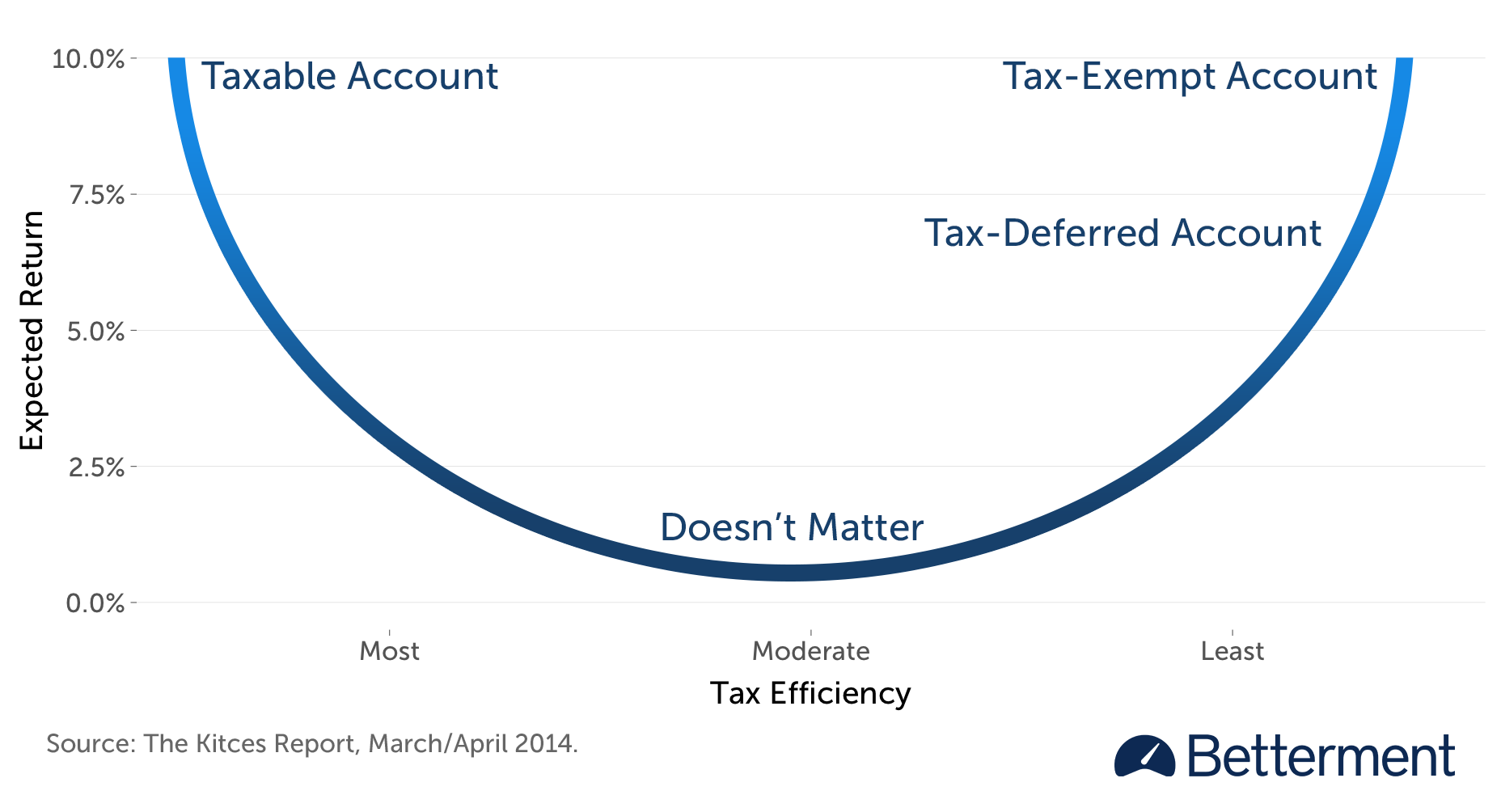

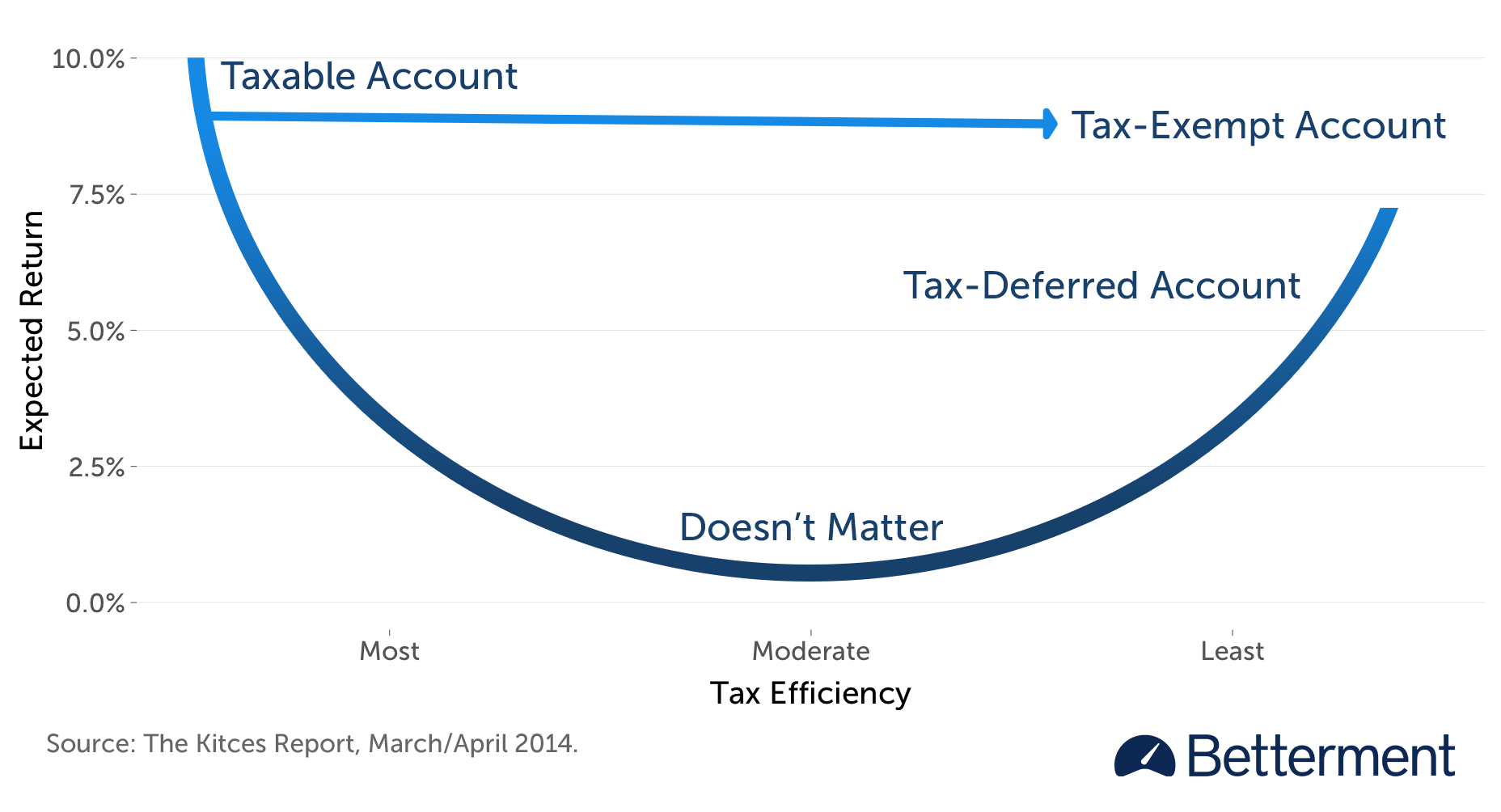

Gobind Daryanani and Chris Cordaro sought to stability issues round tax effectivity and anticipated return, and illustrated that when each are very low, location selections with respect to these property have very restricted influence.5 That research impressed Michael Kitces, who leverages its insights right into a extra refined strategy to constructing a precedence listing.6 To visually seize the connection between the 2 issues, Kitces bends the one-dimensional listing right into a “smile.”

Asset Location Precedence Record

Belongings with a excessive anticipated return which can be additionally very tax-efficient go within the taxable account. Belongings with a excessive anticipated return which can be additionally very tax-inefficient go within the certified accounts, beginning with the TEA. The “smile” guides us in filling the accounts from each ends concurrently, and by the point we get to the center, no matter selections we make with respect to these property simply “don’t matter” a lot.

Nevertheless, Kitces augments the graph briefly order, recognizing that the fundamental “smile” doesn’t seize a 3rd key consideration—the influence of liquidation tax. As a result of capital beneficial properties will ultimately be realized in a taxable account, however not in a TEA, even a extremely tax-efficient asset is likely to be higher off in a TEA, if its anticipated return is excessive sufficient. The subsequent iteration of the “smile” illustrates this choice.

Asset Location Precedence Record with Restricted Excessive Return Inefficient Belongings

Half IV: TCP Methodology

There isn’t any one-size-fits-all asset location for each set of inputs. Some circumstances apply to all traders, however shift via time—the anticipated return of every asset class (which mixes separate assumptions for the risk-free fee and the surplus return), in addition to dividend yields, QDI percentages, and tax legal guidelines. Different circumstances are private—which accounts the shopper has, the relative stability of every account, and the shopper’s time horizon.

Fixing for a number of variables whereas respecting outlined constraints is an issue that may be successfully solved by linear optimization. This technique is used to maximise some worth, which is represented by a formulation referred to as an “goal perform.” What we search to maximise is the after-tax worth of the general portfolio on the finish of the time horizon.

We get this quantity by including collectively the anticipated after-tax worth of each asset within the portfolio, however as a result of every asset may be held in multiple account, every portion have to be thought of individually, by making use of the tax guidelines of that account. We should due to this fact derive an account-specific anticipated after-tax return for every asset.

Deriving Account-Particular After-Tax Return

To outline the anticipated after-tax return of an asset, we first want its whole return (i.e., earlier than any tax is utilized). The full return is the sum of the risk-free fee (similar for each asset) and the surplus return (distinctive to each asset). Betterment derives extra returns utilizing the Black-Litterman mannequin as a place to begin. This widespread trade technique entails analyzing the worldwide portfolio of investable property and their proportions, and utilizing them to generate forward-looking anticipated returns for every asset class.

Subsequent, we should scale back every whole return into an after-tax return.7 The speedy downside is that for every asset class, the after-tax return may be totally different, relying on the account, and for a way lengthy it’s held.

- In a TEA, the reply is straightforward—the after-tax return equals the whole return—no calculation needed.

- In a TDA, we mission development of the asset by compounding the whole return yearly. At liquidation, we apply the strange fee to the entire development.8 We use what’s left of the expansion after taxes to derive an annualized return, which is our after-tax return.

- In a taxable account, we have to take into account the dividend and capital achieve element of the whole return individually, with respect to each fee and timing. We mission development of the asset by taxing the dividend element yearly on the strange fee (or the preferential fee, to the extent that it qualifies as QDI) and including again the after-tax dividend (i.e., we reinvest it). Capital beneficial properties are deferred, and the LTCG is absolutely taxed on the preferential fee on the finish of the interval. We then derive the annualized return based mostly on the after-tax worth of the asset.9

Word that for each the TDA and taxable calculations, time horizon issues. Extra time means extra worth from deferral, so the identical whole return can lead to the next annualized after-tax return. Moreover, the risk-free fee element of the whole return will even rely upon the time horizon, which impacts all three accounts.

As a result of we’re accounting for the potential of a TEA, as effectively, we even have three distinct after-tax returns, and thus every asset successfully turns into three property, for any given time horizon (which is restricted to every Betterment buyer).

The Goal Perform

To see how this comes collectively, we first take into account an especially simplified instance. Let’s assume we have now a taxable account, each a conventional and Roth account, with $50,000 in each, and a 30-year horizon. Our allocation calls for less than two property: 70% equities (shares) and 30% mounted revenue (bonds). With a complete portfolio worth of $150,000, we want $105,000 of shares and $45,000 of bonds.

1. These are constants whose worth we already know (as derived above).

req,tax is the after-tax return of shares within the taxable account, over 30 years

req,trad is the after-tax return of shares within the conventional account, over 30 years

req,roth is the after-tax return of shares within the Roth account, over 30 years

rfi,tax is the after-tax return of bonds within the taxable account, over 30 years

rfi,trad is the after-tax return of bonds within the conventional account, over 30 years

rfi,roth is the after-tax return of bonds within the Roth account, over 30 years

2. These are the values we are attempting to unravel for (referred to as “resolution variables”).

xeq,tax is the quantity of shares we’ll place within the taxable account

xeq,trad is the quantity of shares we’ll place within the conventional account

xeq,roth is the quantity of shares we’ll place within the Roth account

xfi,tax is the quantity of bonds we’ll place within the taxable account

xfi,trad is the quantity of bonds we’ll place within the conventional account

xfi,roth is the quantity of bonds we’ll place within the Roth account

3. These are the constraints which have to be revered. All positions for every asset should add as much as what we have now allotted to the asset general. All positions in every account should add as much as the obtainable stability in every account.

xeq,tax + xeq,trad + xeq,roth = 105,000

xfi,tax + xfi,trad + xfi,roth = 45,000

xeq,tax + xfi,tax = 50,000

xeq,trad + xfi,trad = 50,000

xeq,roth + xfi,roth = 50,000

4. That is the target perform, which makes use of the constants and resolution variables to precise the after-tax worth of the complete portfolio, represented by the sum of six phrases (the after-tax worth of every asset in every of the three accounts).

maxx req,taxxeq,tax + req,tradxeq,trad + req,rothxeq,roth + rfi,taxxfi,tax + rfi,tradxfi,trad + rfi,rothxfi,roth

Linear optimization turns the entire above into a posh geometric illustration, and mathematically closes in on the optimum answer. It assigns values for all resolution variables in a method that maximizes the worth of the target perform, whereas respecting the constraints. Accordingly, every resolution variable is a exact instruction for a way a lot of which asset to place in every account. If a variable comes out as zero, then that individual account will comprise none of that individual asset.

An precise Betterment portfolio can probably have twelve asset courses,15 relying on the allocation. Meaning TCP should successfully deal with as much as 36 “property,” every with its personal after-tax return. Nevertheless, the total complexity behind TCP goes effectively past growing property from two to 12.

Up to date constants and constraints will set off one other a part of the optimization, which determines what TCP is allowed to promote, with a view to transfer an already coordinated portfolio towards the newly optimum asset location, whereas minimizing taxes. Reshuffling property in a TDA or TEA is “free” within the sense that no capital beneficial properties will probably be realized.10 Within the taxable account, nevertheless, TCP will try to maneuver as shut as doable in the direction of the optimum asset location with out realizing capital beneficial properties.

Anticipated returns will periodically be up to date, both as a result of the risk-free fee has been adjusted, or as a result of new extra returns have been derived by way of Black-Litterman.

Future money flows could also be much more materials. Extra funds in a number of of the accounts might considerably alter the constraints which outline the dimensions of every account, and the goal greenback allocation to every asset class. Such occasions (together with dividend funds, topic to a de minimis threshold) will set off a recalculation, and probably a reshuffling of the property.

Money flows, specifically, generally is a problem for these managing their asset location manually. Inflows to only one account (or to a number of accounts in unequal proportions) create a stress between optimizing asset location and sustaining asset allocation, which is tough to resolve with out mathematical precision.

To take care of the general asset allocation, every place within the portfolio have to be elevated pro-rata. Nevertheless, a few of the further property we have to purchase “belong” in different accounts from an asset location perspective, despite the fact that new money isn’t obtainable in these accounts. If the taxable account can solely be partially reshuffled as a consequence of built-in beneficial properties, we should select both to maneuver farther away from the goal allocation, or the goal location.11

With linear optimization, our preferences may be expressed via further constraints, weaving these issues into the general downside. When fixing for brand new money flows, TCP penalizes allocation drift greater than it does location drift.

Towards this background, you will need to be aware that anticipated returns (the important thing enter into TCP, and portfolio administration typically) are educated guesses at finest. Regardless of how hermetic the maths, cheap individuals will disagree on the “appropriate” method to derive them, and the long run could not cooperate, particularly within the short-term. There isn’t any assure that any explicit asset location will add essentially the most worth, and even any worth in any respect. However given a long time, the probability of this end result grows.

Half V: Monte Carlo—Betterment’s Testing Framework

To check the output of the linear optimization technique, we turned to a Monte Carlo testing framework,12 constructed totally in-house by Betterment’s specialists. The forward-looking simulations mannequin the conduct of the TCP technique right down to the particular person lot stage. We simulate the paths of those heaps, accounting for dividend reinvestment, rebalancing, and taxation.

The simulations utilized Betterment’s rebalancing methodology, which corrects drift from the goal asset allocation in extra of three% as soon as the account stability meets or exceeds the required threshold, however stops in need of realizing STCG, when doable.

Betterment’s administration charges had been assessed in all accounts, and ongoing taxes had been paid yearly from the taxable account. All taxable gross sales first realized obtainable losses earlier than touching LTCG.

The simulations assume no extra money flows apart from dividends. This isn’t as a result of we don’t anticipate them to occur. Moderately, it’s as a result of making assumptions round these very private circumstances does nothing to isolate the advantage of TCP particularly. Asset location is pushed by the relative sizes of the accounts, and money flows will change these ratios, however the timing and quantity is very particular to the person.19 Avoiding the necessity to make particular assumptions right here helps maintain the evaluation extra common. We used equal beginning balances for a similar purpose.13

For each set of assumptions, we ran every market situation whereas managing every account as a standalone (uncoordinated) Betterment portfolio because the benchmark.14 We then ran the identical market eventualities with TCP enabled. In each circumstances, we calculated the after-tax worth of the mixture portfolio after full liquidation on the finish of the interval.15 Then, for every market situation, we calculated the after-tax annualized inner charges of return (IRR) and subtracted the benchmark IRR from the TCP IRR. That delta represents the incremental tax alpha of TCP for that situation. The median of these deltas throughout all market eventualities is the estimated tax alpha we current beneath for every set of assumptions.

Half VI: Outcomes

Extra Bonds, Extra Alpha

A better allocation to bonds results in a dramatically greater profit throughout the board. This is sensible—the heavier your allocation to tax-inefficient property, the extra asset location can do for you. To be extraordinarily clear: this isn’t a purpose to pick a decrease allocation to shares! Over the long-term, we anticipate the next inventory allocation to return extra (as a result of it’s riskier), each earlier than, and after tax. These are measurements of the extra return as a consequence of TCP, which say nothing concerning the absolute return of the asset allocation itself.

Conversely, a really excessive allocation to shares reveals a smaller (although nonetheless actual) profit. Nevertheless, youthful clients invested this aggressively ought to progressively scale back threat as they get nearer to retirement (to one thing extra like 50% shares). Seeking to a 70% inventory allocation is due to this fact an imperfect however cheap method to generalize the worth of the technique over a 30-year interval.

Extra Roth, Extra Alpha

One other sample is that the presence of a Roth makes the technique extra useful. This additionally is sensible—a taxable account and a TEA are on reverse ends of the “favorably taxed” spectrum, and having each presents the most important alternative for TCP’s “account arbitrage.” However once more, this profit shouldn’t be interpreted as a purpose to contribute to a TEA over a TDA, or to shift the stability between the 2 by way of a Roth conversion. These selections are pushed by different issues. TCP’s job is to optimize the relative balances because it finds them.

Enabling TCP On Present Taxable Accounts

TCP needs to be enabled earlier than the taxable account is funded, which means that the preliminary location may be optimized with out the necessity to promote probably appreciated property. A Betterment buyer with an present taxable account who permits TCP shouldn’t anticipate the total incremental profit, to the extent that property with built-in capital beneficial properties have to be offered to realize the optimum location.

It’s because TCP conservatively prioritizes avoiding a sure tax at this time, over probably decreasing tax sooner or later. Nevertheless, the optimization is carried out each time there’s a deposit (or dividend) to any account. With future money flows, the portfolio will transfer nearer to regardless of the optimum location is set to be on the time of the deposit.

Half VII: Particular Issues

Low Bracket Taxpayers: Beware

Taxation of funding revenue is considerably totally different for individuals who qualify for a marginal tax bracket of 15% or beneath. For example, we have now modified the chart from Half II to use to such low bracket taxpayers.

TCP isn’t designed for these traders. Optimizing round this tax profile would reverse many assumptions behind TCP’s methodology. Municipal bonds now not have a bonus over different bond funds. The arbitrage alternative between the strange and preferential fee is gone. In truth, there’s barely tax of any variety. It’s fairly probably that such traders wouldn’t profit a lot from TCP, and will even scale back their general after-tax return.

If the low tax bracket is momentary, TCP over the long-term should still make sense. Additionally be aware that some combos of account balances can, in sure circumstances, nonetheless add tax alpha for traders in low tax brackets. One instance is when an investor solely has conventional and Roth IRA accounts, and no taxable accounts being tax coordinated. Low bracket traders ought to very rigorously take into account whether or not TCP is appropriate for them. As a basic rule, we don’t suggest it.

Potential Issues with Coordinating Accounts Meant for Completely different Time Horizons

We started with the premise that asset location is smart solely with respect to accounts which can be typically supposed for a similar goal. That is essential, as a result of erratically distributing property will end in asset allocations in every account that aren’t tailor-made in the direction of the general purpose (or any purpose in any respect). That is nice, so long as we anticipate that each one coordinated accounts will probably be obtainable for withdrawals at roughly the identical time (e.g. at retirement). Solely the mixture portfolio issues in getting there.

Nevertheless, uneven distributions are much less diversified. Short-term drawdowns (e.g., the 2008 monetary disaster) can imply {that a} single account could drop considerably greater than the general coordinated portfolio. If that account is meant for a short-term purpose, it could not have an opportunity to get well by the point you want the cash. Likewise, if you don’t plan on depleting an account throughout your retirement, and as a substitute plan on leaving it to be inherited for future generations, arguably this account has an extended time horizon than the others and may thus be invested extra aggressively. In both case, we don’t suggest managing accounts with materially totally different time horizons as a single portfolio.

For the same purpose, it’s best to keep away from making use of asset location to an account that you simply anticipate will probably be long-term, however one that you could be look to for emergency withdrawals. For instance, a Security Web Purpose ought to by no means be managed by TCP.

Giant Upcoming Transfers/Withdrawals

If you may be making giant transfers in or out of your tax-coordinated accounts, it’s possible you’ll need to delay enabling our tax coordination device till after these transfers have occurred.

It’s because giant modifications within the balances of the underlying accounts can necessitate rebalancing, and thus could trigger taxes. With incoming deposits, we will intelligently rebalance your accounts by buying asset courses which can be underweight. However when giant withdrawals or transfers out are made, regardless of Betterment’s clever administration of executing trades, some taxes may be unavoidable when rebalancing to your general goal allocation.

The one exception to this rule is that if the big deposit will probably be in your taxable account as a substitute of your IRAs. In that case, it’s best to allow tax-coordination earlier than depositing cash into the taxable account. That is so our system is aware of to tax-coordinate you instantly.

The purpose of tax coordination is to cut back the drag taxes have in your investments, not trigger further taxes. So if an upcoming withdrawal or outbound switch might trigger rebalancing, and thus taxes, it could be prudent to delay enabling tax coordination till you may have accomplished these transfers.

Mitigating Behavioral Challenges Via Design

There’s a broader situation that stems from finding property with totally different volatility profiles on the account stage, however it’s behavioral. Uncoordinated portfolios with the identical allocation transfer collectively. Asset location, then again, will trigger one account to dip greater than one other, testing an investor’s abdomen for volatility. Those that allow TCP throughout their accounts needs to be ready for such differentiated actions. Rationally, we should always ignore this—in any case, the general allocation is identical—however that’s simpler stated than finished.

How TCP Interacts with Tax Loss Harvesting+

TCP and TLH work in tandem, searching for to reduce tax influence. As described in additional element beneath, the exact interplay between the 2 methods is very depending on private circumstances. Whereas it’s doable that enabling a TCP could scale back harvest alternatives, each TLH and TCP derive their profit with out disturbing the specified asset allocation.

Operational Interplay

TLH+ was designed round a “tertiary ticker” system, which ensures that no buy in an IRA or 401(ok) managed by Betterment will intrude with a harvested loss in a Betterment taxable account.

A sale in a taxable account, and a subsequent repurchase of the identical asset class in a professional account can be incidental for accounts managed as separate portfolios. Underneath TCP, nevertheless, we anticipate this to often occur by design. When “relocating” property, both throughout preliminary setup, or as a part of ongoing optimization, TCP will promote an asset class in a single account, and instantly repurchase it in one other. The tertiary ticker system permits this reshuffling to occur seamlessly, whereas making an attempt to guard any tax losses which can be realized within the course of.

Conceptualizing Blended Efficiency

TCP will have an effect on the composition of the taxable account in methods which can be exhausting to foretell, as a result of its selections will probably be pushed by modifications in relative balances among the many accounts. In the meantime, the load of particular asset courses within the taxable account is a cloth predictor of the potential worth of TLH (extra unstable property ought to provide extra harvesting alternatives). The exact interplay between the 2 methods is way extra depending on private circumstances, resembling at this time’s account stability ratios and future money stream patterns, than on typically relevant inputs like asset class return profiles and tax guidelines.

These dynamics are finest understood as a hierarchy. Asset allocation comes first, and determines what mixture of asset courses we should always stick with general. Asset location comes second, and repeatedly generates tax alpha throughout all coordinated accounts, throughout the constraints of the general portfolio. Tax loss harvesting comes third, and appears for alternatives to generate tax alpha from the taxable account solely, throughout the constraints of the asset combine dictated by asset location for that account.

TLH is often only within the first a number of years after an preliminary deposit to a taxable account. Over a long time, nevertheless, we anticipate it to generate worth solely from subsequent deposits and dividend reinvestments. Finally, even a considerable dip is unlikely to carry the market value beneath the acquisition value of the older tax heaps. In the meantime, TCP goals to ship tax alpha over the complete stability of all three accounts for the complete holding interval.

***

Betterment doesn’t symbolize in any method that TCP will end in any explicit tax consequence or that particular advantages will probably be obtained for any particular person investor. The TCP service isn’t supposed as tax recommendation. Please seek the advice of your private tax advisor with any questions as as to if TCP is an acceptable technique for you in mild of your particular person tax circumstances. Please see our Tax-Coordinated Portfolio Disclosures for extra info.

Addendum

As of Might 2020, for patrons who point out that they’re planning on utilizing a Well being Financial savings Account (HSA) for long-term financial savings, we permit the inclusion of their HSA of their Tax-Coordinated Portfolio.

If an HSA is included in a Tax-Coordinated Portfolio, we deal with it primarily the identical as a further Roth account. It’s because funds inside an HSA develop revenue tax-free, and withdrawals may be made revenue tax-free for medical functions. With this assumption, we additionally implicitly assume that the HSA will probably be absolutely used to cowl long-term medical care spending.

The tax alpha numbers offered above haven’t been up to date to mirror the inclusion of HSAs, however stay our best-effort point-in-time estimate of the worth of TCP on the launch of the characteristic. Because the inclusion of HSAs permits even additional tax-advantaged contributions, we contend that the inclusion of HSAs is almost certainly to moreover profit clients who allow TCP.

1“Increase Your After-Tax Funding Returns.” Susan B. Garland. Kiplinger.com, April 2014.

2However see “How IRA Withdrawals In The Crossover Zone Can Set off The three.8% Medicare Surtax,” Michael Kitces, July 23, 2014.

3It’s price emphasizing that asset location optimizes round account balances because it finds them, and has nothing to say about which account to fund within the first place. Asset location considers which account is finest for holding a specified greenback quantity of a selected asset. Nevertheless, contributions to a TDA are tax-deductible, whereas getting a greenback right into a taxable account requires greater than a greenback of revenue.

4Pg. 5, The Kitces Report. January/February 2014.

5Daryanani, Gobind, and Chris Cordaro. 2005. “Asset Location: A Generic Framework for Maximizing After-Tax Wealth.” Journal of Monetary Planning (18) 1: 44–54.

6The Kitces Report, March/April 2014.

7Whereas the importance of strange versus preferential tax remedy of revenue has been made clear, the influence of a person’s particular tax bracket has not but been addressed. Does it matter which strange fee, and which preferential fee is relevant, when finding property? In any case, calculating the after-tax return of every asset means making use of a particular fee. It’s definitely true that totally different charges ought to end in totally different after-tax returns. Nevertheless, we discovered that whereas the particular fee used to derive the after-tax return can and does have an effect on the extent of ensuing returns for various asset courses, it makes a negligible distinction on ensuing location selections. The one exception is when contemplating utilizing very low charges as inputs (the implication of which is mentioned beneath “Particular Issues”). This could really feel intuitive: As a result of the optimization is pushed primarily by the relative measurement of the after-tax returns of various asset courses, transferring between brackets strikes all charges in the identical course, typically sustaining these relationships monotonically. The particular charges do matter rather a lot in terms of estimating the advantage of the asset location chosen, so fee assumptions are specified by the “Outcomes” part. In different phrases, if one taxpayer is in a average tax bracket, and one other in a excessive bracket, their optimum asset location will probably be very related and sometimes similar, however the excessive bracket investor could profit extra from the identical location.

8In actuality, the strange fee is utilized to the complete worth of the TDA, each the principal (i.e., the deductible contributions) and the expansion. Nevertheless, this may occur to the principal whether or not we use asset location or not. Due to this fact, we’re measuring right here solely that which we will optimize.

9TCP at this time doesn’t account for the potential advantage of a overseas tax credit score (FTC). The FTC is meant to mitigate the potential for double taxation with respect to revenue that has already been taxed out of the country. The scope of the profit is tough to quantify and its applicability will depend on private circumstances. All else being equal, we might anticipate that incorporating the FTC could considerably improve the after-tax return of sure asset courses in a taxable account—specifically developed and rising markets shares. If maximizing your obtainable FTC is necessary to your tax planning, it’s best to rigorously take into account whether or not TCP is the optimum technique for you.

10Commonplace market bid-ask unfold prices will nonetheless apply. These are comparatively low, as Betterment considers liquidity as a think about its funding choice course of. Betterment clients don’t pay for trades.

11Moreover, within the curiosity of constructing interplay with the device maximally responsive, sure computationally demanding facets of the methodology had been simplified for functions of the device solely. This might end in a deviation from the goal asset location imposed by the TCP service in an precise Betterment account.

12One other method to take a look at efficiency is with a backtest on precise market information. One benefit of this strategy is that it exams the technique on what really occurred. Conversely, a ahead projection permits us to check 1000’s of eventualities as a substitute of 1, and the long run is unlikely to appear to be the previous. One other limitation of a backtest on this context—sufficiently granular information for the complete Betterment portfolio is barely obtainable for the final 15 years. As a result of asset location is basically a long-term technique, we felt it was necessary to check it over 30 years, which was solely doable with Monte Carlo. Moreover, Monte Carlo really permits us to check tweaks to the algorithm with some confidence, whereas adjusting the algorithm based mostly on how it could have carried out prior to now is successfully a sort of “information snooping”.

13That stated, the technique is anticipated to alter the relative balances dramatically over the course of the interval, as a consequence of unequal allocations. We anticipate a Roth stability specifically to ultimately outpace the others, because the optimization will favor property with the best anticipated return for the TEA. That is precisely what we need to occur.

14For the uncoordinated taxable portfolio, we assume an allocation to municipal bonds (MUB) for the high-quality bonds element, however use funding grade taxable bonds (AGG) within the uncoordinated portfolio for the certified accounts. Whereas TCP makes use of this substitution, Betterment has supplied it since 2014, and we need to isolate the extra tax alpha of TCP particularly, with out conflating the advantages.

15Full liquidation of a taxable or TDA portfolio that has been rising for 30 years will notice revenue that’s assured to push the taxpayer into the next tax bracket. We assume this doesn’t occur, as a result of in actuality, a taxpayer in retirement will make withdrawals progressively. The methods round timing and sequencing decumulation from a number of account sorts in a tax-efficient method are out of scope for this paper.

Extra References

Berkin. A. “A State of affairs Primarily based Method to After-Tax Asset Allocation.” 2013. Journal of Monetary Planning.

Jaconetti, Colleen M., CPA, CFP®. Asset Location for Taxable Buyers, 2007. https://private.vanguard.com/pdf/s556.pdf.

Poterba, James, John Shoven, and Clemens Sialm. “Asset Location for Retirement Savers.” November 2000. https://college.mccombs.utexas.edu/Clemens.Sialm/PSSChap10.pdf.

Reed, Chris. “Rethinking Asset Location – Between Tax-Deferred, Tax-Exempt and Taxable Accounts.” Accessed 2015. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2317970.

Reichenstein, William, and William Meyer. “The Asset Location Determination Revisited.” 2013. Journal of Monetary Planning 26 (11): 48–55.

Reichenstein, William. 2007. “Calculating After-Tax Asset Allocation is Key to Figuring out Threat, Returns, and Asset Location.” Journal of Monetary Planning (20) 7: 44–53.